1019, Notice of Assessment, Taxable Valuation, and Property 2022-2026

Understanding the 1019, Notice of Assessment, Taxable Valuation, and Property

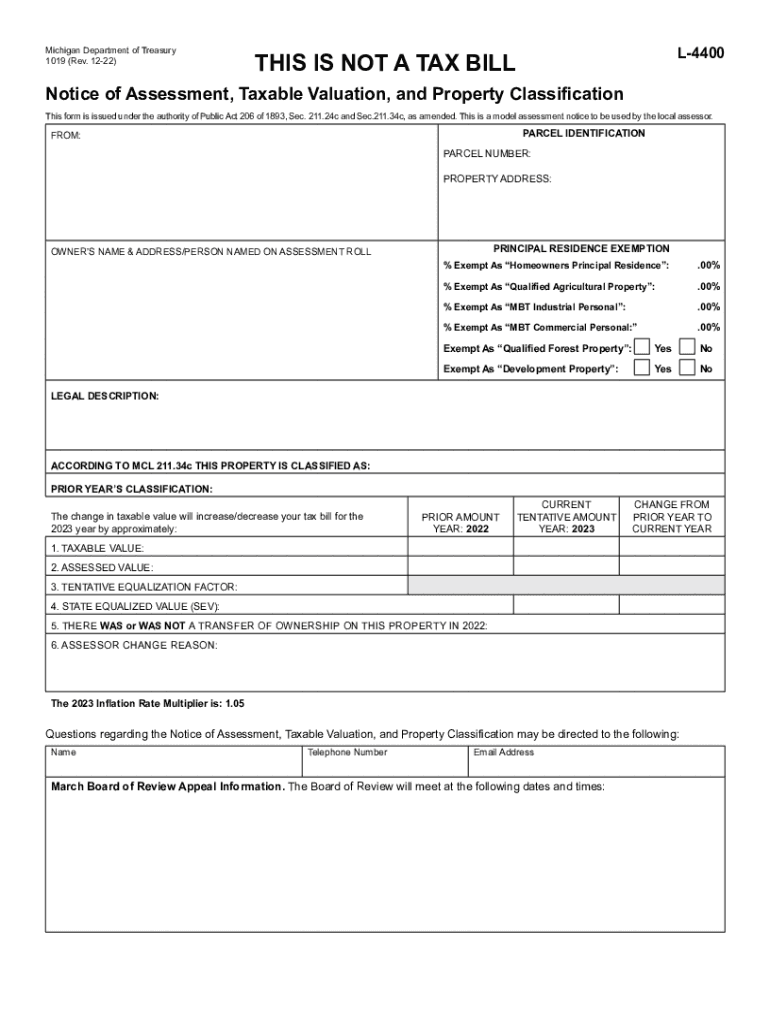

The 1019 form, commonly known as the Notice of Assessment, is a crucial document in the property assessment process in Michigan. It provides property owners with information regarding the taxable valuation of their property. This valuation is essential for determining property taxes owed to local governments. The notice outlines the assessed value, which reflects the estimated market value of the property as determined by the local assessor. Understanding this document is vital for property owners to ensure their assessments are accurate and fair.

Steps to Complete the 1019, Notice of Assessment, Taxable Valuation, and Property

Completing the 1019 form requires careful attention to detail. Here are the key steps involved:

- Review the assessed value listed on the form to ensure it aligns with your understanding of your property's market value.

- Check for any exemptions or deductions that may apply to your property, such as the Homestead Exemption.

- Gather any supporting documentation that may be necessary to contest the assessment if you believe it is inaccurate.

- Complete any required fields on the form, ensuring all information is accurate and up to date.

- Submit the completed form to the appropriate local government office by the specified deadline.

Legal Use of the 1019, Notice of Assessment, Taxable Valuation, and Property

The 1019 form serves as a legally binding document that communicates the assessed value of a property to its owner. It is essential for property owners to understand that this notice has legal implications, especially if they choose to appeal the assessment. The form must be filed correctly and on time to ensure compliance with local regulations. Failure to respond to the notice or contest the assessment may result in the loss of the right to appeal, making it crucial for property owners to act promptly.

Key Elements of the 1019, Notice of Assessment, Taxable Valuation, and Property

Several key elements are included in the 1019 form that property owners should be aware of:

- Assessed Value: This is the value determined by the local assessor, which is used to calculate property taxes.

- Taxable Value: This value often differs from the assessed value and is used for tax calculations.

- Exemptions: Any exemptions that may apply to the property, such as the Homestead Exemption, will be noted.

- Appeal Information: Instructions on how to contest the assessment if the property owner believes it is incorrect.

How to Obtain the 1019, Notice of Assessment, Taxable Valuation, and Property

Property owners can obtain the 1019 form through several methods. Typically, the form is mailed to property owners by the local assessor's office. However, it can also be accessed online through the local government’s website. If a property owner does not receive the notice, they should contact their local assessor’s office directly to request a copy. It is important to keep track of this document, as it contains critical information regarding property taxes.

Filing Deadlines and Important Dates for the 1019, Notice of Assessment, Taxable Valuation, and Property

Timeliness is crucial when dealing with the 1019 form. Property owners should be aware of the following deadlines:

- The 1019 form is typically mailed out in the spring, with specific dates varying by locality.

- Property owners usually have a limited time frame to appeal the assessment, often within 30 days of receiving the notice.

- It is essential to check with the local assessor’s office for exact dates and deadlines to ensure compliance.

Quick guide on how to complete 1019 notice of assessment taxable valuation and property

Complete 1019, Notice Of Assessment, Taxable Valuation, And Property effortlessly on any device

Managing documents online has become increasingly favored by companies and individuals alike. It serves as a perfect eco-friendly alternative to conventional printed and signed materials, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage 1019, Notice Of Assessment, Taxable Valuation, And Property on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven task today.

How to modify and electronically sign 1019, Notice Of Assessment, Taxable Valuation, And Property with ease

- Locate 1019, Notice Of Assessment, Taxable Valuation, And Property and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review all the information and then click the Done button to save your modifications.

- Choose how you'd like to send your form, whether by email, text message (SMS), an invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that necessitate printing extra document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign 1019, Notice Of Assessment, Taxable Valuation, And Property and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1019 notice of assessment taxable valuation and property

Create this form in 5 minutes!

How to create an eSignature for the 1019 notice of assessment taxable valuation and property

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is mi taxable valuation?

Mi taxable valuation refers to the assessed value of property in Michigan used to calculate property taxes. It is essential for property owners to understand this valuation to ensure accurate taxation. Knowing your mi taxable valuation can help you make informed decisions regarding property ownership and potential appeals.

-

How does airSlate SignNow simplify documents related to mi taxable valuation?

AirSlate SignNow enables users to easily create, send, and eSign documents related to mi taxable valuation. This can include appeals, assessments, and other related forms, streamlining the entire process. The platform’s user-friendly interface and secure eSigning capabilities make it an ideal solution for property owners.

-

Is there a cost associated with using airSlate SignNow for mi taxable valuation documents?

Yes, airSlate SignNow offers various pricing plans tailored to fit different business needs, including those focused on mi taxable valuation. Each plan includes features that ensure efficient document management and eSigning. You can review the pricing options on our website to find the best fit for your needs.

-

What features does airSlate SignNow offer for managing mi taxable valuation documents?

AirSlate SignNow provides features essential for managing mi taxable valuation documents, such as customizable templates, secure storage, and real-time tracking of document status. These features help users efficiently handle the documentation process while ensuring compliance and security in handling sensitive information.

-

How does eSigning benefit the process of mi taxable valuation?

ESigning via airSlate SignNow simplifies the mi taxable valuation process by allowing stakeholders to sign documents electronically, reducing turnaround time. This convenience ensures that all necessary paperwork is handled quickly and efficiently. Additionally, it enhances the security and traceability of documents related to property assessments.

-

Can airSlate SignNow integrate with other tools for handling mi taxable valuation?

Absolutely! AirSlate SignNow offers integrations with various tools and software that can assist in managing mi taxable valuation processes, such as CRM systems and project management applications. These integrations allow for seamless workflows and enhanced efficiency in managing property documentation.

-

How secure is airSlate SignNow for handling documents related to mi taxable valuation?

Security is a top priority at airSlate SignNow. The platform employs advanced encryption and complies with industry standards to ensure that documents related to mi taxable valuation are protected. You can trust that your sensitive information will remain confidential and secure during the entire document management process.

Get more for 1019, Notice Of Assessment, Taxable Valuation, And Property

- Tennessee affidavit form

- Tennessee survivorship form

- Quitclaim deed three grantors to two grantees tennessee form

- Tennessee quitclaim deed 497326677 form

- Tennessee notice lien form

- Quitclaim deed from individual to two individuals in joint tenancy tennessee form

- Tennessee property bond form

- Owners notice of transfer individual tennessee form

Find out other 1019, Notice Of Assessment, Taxable Valuation, And Property

- Sign Indiana Real estate document Free

- How To Sign Wisconsin Real estate document

- Sign Montana Real estate investment proposal template Later

- How Do I Sign Washington Real estate investment proposal template

- Can I Sign Washington Real estate investment proposal template

- Sign Wisconsin Real estate investment proposal template Simple

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe

- Sign Maryland Consulting Agreement Template Fast

- Sign California Distributor Agreement Template Myself

- How Do I Sign Louisiana Startup Business Plan Template

- Can I Sign Nevada Startup Business Plan Template

- Sign Rhode Island Startup Business Plan Template Now

- How Can I Sign Connecticut Business Letter Template

- Sign Georgia Business Letter Template Easy