Michigan 1019 2018

What is the Michigan 1019?

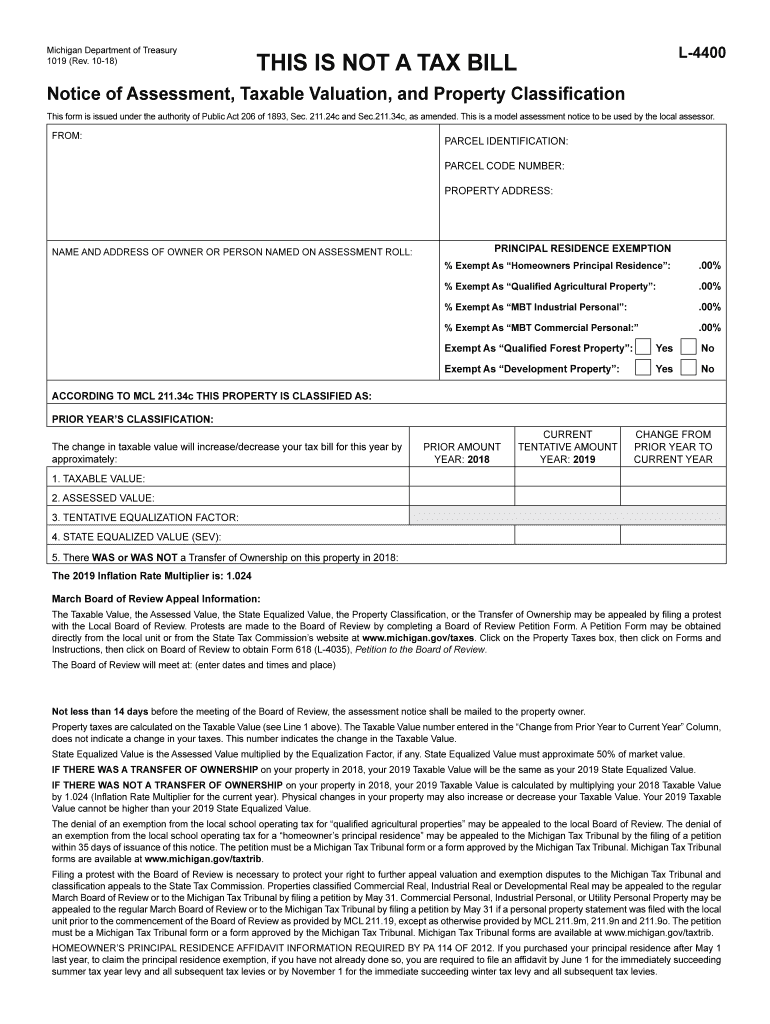

The Michigan 1019 form, officially known as the Notice of Assessment Taxable Valuation, is a critical document used in the property assessment process in Michigan. This form provides property owners with essential information regarding the assessed value of their property, which is used to calculate property taxes. Understanding this form is vital for homeowners, as it outlines the taxable value determined by the local assessing officer and informs them of any changes in valuation from the previous year.

How to use the Michigan 1019

Using the Michigan 1019 form effectively involves reviewing the information presented on it. Property owners should carefully examine the assessed value listed, as it directly impacts their property tax obligations. If discrepancies are found, homeowners have the right to appeal the assessment. The form also provides instructions on how to proceed with any appeals, ensuring that property owners are aware of their rights and options regarding their property valuation.

Steps to complete the Michigan 1019

Completing the Michigan 1019 form involves several steps. First, property owners should gather their property details, including the address and any previous assessment notices. Next, they should review the current assessed value and compare it to past valuations. If they believe the assessment is inaccurate, they can fill out the appropriate sections of the form to contest the valuation. It is important to submit any appeals within the timeframe specified on the form to ensure consideration.

Legal use of the Michigan 1019

The legal use of the Michigan 1019 is governed by state property tax laws. This form serves as an official notification from the local assessor to the property owner, making it a legally binding document regarding property valuation. When filled out correctly and submitted in accordance with the state’s regulations, it can be used in legal proceedings if disputes arise concerning property assessments. Understanding the legal implications of this form is crucial for property owners to protect their rights.

Filing Deadlines / Important Dates

Filing deadlines for the Michigan 1019 are critical for property owners. Typically, the notice is mailed to property owners in February, and any appeals must be filed within a specific period, often by the first Monday in March. Staying aware of these important dates ensures that property owners do not miss the opportunity to contest their assessments. It is advisable to mark these deadlines on a calendar to facilitate timely responses.

Who Issues the Form

The Michigan 1019 form is issued by the local assessing office in each municipality. Assessors are responsible for determining property values and ensuring that assessments are fair and equitable. Property owners can contact their local assessor's office for any questions regarding the form, its contents, or the assessment process. Understanding who issues the form helps property owners know where to seek assistance and clarification.

Quick guide on how to complete 1019 notice of assessment taxable valuation state of michigan

Effortlessly Complete Michigan 1019 on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents quickly and without interruptions. Manage Michigan 1019 on any device using the airSlate SignNow apps for Android or iOS, and enhance your document-oriented processes today.

The easiest method to modify and electronically sign Michigan 1019 without hassle

- Find Michigan 1019 and click Get Form to begin.

- Use the tools we offer to complete your form.

- Highlight important sections of your documents or obscure confidential information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all details and then click the Done button to save your modifications.

- Choose how you wish to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Michigan 1019 and guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1019 notice of assessment taxable valuation state of michigan

Create this form in 5 minutes!

How to create an eSignature for the 1019 notice of assessment taxable valuation state of michigan

How to generate an eSignature for the 1019 Notice Of Assessment Taxable Valuation State Of Michigan online

How to generate an eSignature for the 1019 Notice Of Assessment Taxable Valuation State Of Michigan in Chrome

How to generate an eSignature for putting it on the 1019 Notice Of Assessment Taxable Valuation State Of Michigan in Gmail

How to generate an electronic signature for the 1019 Notice Of Assessment Taxable Valuation State Of Michigan straight from your smartphone

How to create an eSignature for the 1019 Notice Of Assessment Taxable Valuation State Of Michigan on iOS devices

How to make an electronic signature for the 1019 Notice Of Assessment Taxable Valuation State Of Michigan on Android OS

People also ask

-

What is Michigan 1019 and how does it relate to airSlate SignNow?

Michigan 1019 refers to the specific version of airSlate SignNow that caters to businesses operating within Michigan. This version offers tailored features and compliance with state regulations, ensuring that users can eSign documents legally and efficiently.

-

How much does airSlate SignNow cost for Michigan businesses?

The pricing for airSlate SignNow varies depending on the plan you choose, but it is designed to be cost-effective for Michigan businesses. With different tiers available, you can find a plan that suits your budget and provides the necessary features for your document management needs.

-

What features does airSlate SignNow offer for Michigan 1019 users?

airSlate SignNow offers an array of features such as legally binding eSignatures, document templates, and integration with other software. For Michigan 1019 users, these features are specifically designed to streamline the signing process while ensuring compliance with local regulations.

-

Can I integrate airSlate SignNow with other applications for Michigan 1019?

Yes, airSlate SignNow supports numerous integrations with popular applications which enhance workflow efficiency for Michigan 1019 users. These integrations allow businesses to connect tools seamlessly, making document management and eSigning more convenient.

-

What are the benefits of using airSlate SignNow for Michigan businesses?

Using airSlate SignNow provides Michigan businesses with a fast, secure, and cost-effective way to manage documents. The benefits include reduced paper usage, quicker turnaround times, and flexibility to sign documents from anywhere, which are critical for maintaining competitive advantage.

-

Is airSlate SignNow compliant with Michigan eSignature laws?

Yes, airSlate SignNow is fully compliant with Michigan's eSignature laws as outlined in the Michigan Electronic Transactions Act. This ensures that document signing within Michigan 1019 is legally binding, giving users peace of mind about their electronic transactions.

-

What support is available for Michigan 1019 users of airSlate SignNow?

Michigan 1019 users can access a dedicated support team through various channels including email, live chat, and comprehensive help resources. The goal is to ensure that users have all the assistance they need to leverage the full potential of airSlate SignNow.

Get more for Michigan 1019

- Sample invoice for individual sign language interpretingdoc form

- Motlow transcript form

- Intent to graduate motlow state form

- Form hhs 745 ors ors od nih

- Fill fourm schedule collage form

- Franklin county odjfs form

- Fcdjfs forms

- City of peoria fire department fire hydrant flow test request peoriaaz form

Find out other Michigan 1019

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form

- Help Me With eSign Hawaii Business Operations Presentation

- How Do I eSign Idaho Car Dealer Document

- How Do I eSign Indiana Car Dealer Document

- How To eSign Michigan Car Dealer Document

- Can I eSign Michigan Car Dealer PPT

- How Can I eSign Michigan Car Dealer Form