D 101a Form 1 ES Instructions Estimated Income Tax for 2022

What is the D 101a Form 1 ES Instructions Estimated Income Tax For

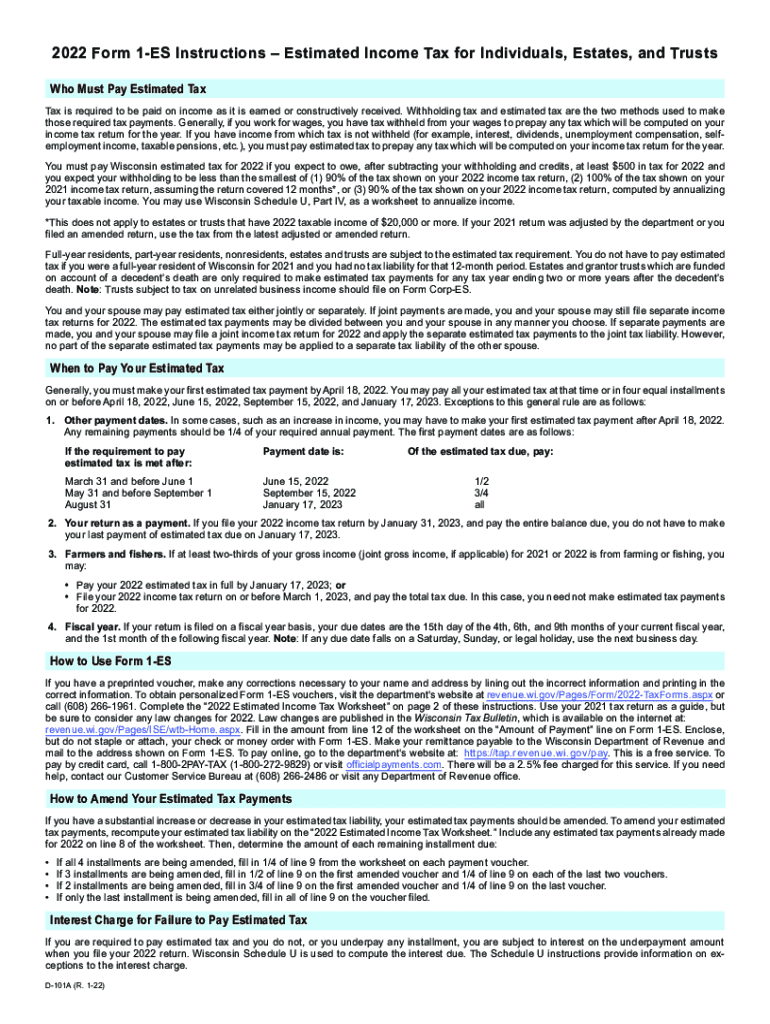

The D 101a Form 1 ES is designed for individuals in Wisconsin to report and pay estimated income tax. This form is essential for taxpayers who expect to owe tax of $500 or more when filing their annual return. It helps in managing tax liabilities throughout the year, ensuring that individuals do not face a large tax bill at the end of the year. By using this form, taxpayers can make quarterly payments based on their expected income, which can lead to better financial planning and cash flow management.

How to use the D 101a Form 1 ES Instructions Estimated Income Tax For

Using the D 101a Form 1 ES involves understanding the estimated income tax process. Taxpayers begin by calculating their expected income for the year, including wages, self-employment income, and other sources. Once the expected income is determined, individuals can estimate their tax liability using the current tax rates. The form provides specific instructions on how to complete the calculations and where to submit the payments. It's important to follow the guidelines closely to ensure compliance and avoid penalties.

Steps to complete the D 101a Form 1 ES Instructions Estimated Income Tax For

Completing the D 101a Form 1 ES requires several key steps:

- Gather all necessary financial documents, including income statements and previous tax returns.

- Calculate your expected income for the year and determine your estimated tax liability.

- Fill out the form with your personal information and estimated tax figures.

- Review the form for accuracy, ensuring all calculations are correct.

- Submit the form and make your estimated tax payment by the due dates specified in the instructions.

Filing Deadlines / Important Dates

Filing deadlines for the D 101a Form 1 ES are crucial for avoiding penalties. Typically, estimated tax payments are due quarterly, with specific dates set by the Wisconsin Department of Revenue. These dates usually fall in April, June, September, and January of the following year. Taxpayers should mark these dates on their calendars to ensure timely submissions and payments, as late payments can incur interest and penalties.

Legal use of the D 101a Form 1 ES Instructions Estimated Income Tax For

The D 101a Form 1 ES is legally recognized for the payment of estimated income taxes in Wisconsin. To ensure its legal validity, taxpayers must adhere to the instructions provided and submit the form by the specified deadlines. Compliance with these regulations is essential to avoid legal issues and maintain good standing with the Wisconsin Department of Revenue. The form serves as a formal declaration of expected income and tax liability, making it an important document for tax compliance.

Required Documents

To complete the D 101a Form 1 ES, taxpayers need several documents:

- Previous year’s tax return for reference.

- Income statements, such as W-2s or 1099s.

- Records of any deductions or credits that may apply.

- Any additional documentation that supports income estimates.

Having these documents ready will facilitate the accurate completion of the form and help ensure that estimated tax payments are calculated correctly.

Quick guide on how to complete 2022 d 101a form 1 es instructions estimated income tax for

Complete D 101a Form 1 ES Instructions Estimated Income Tax For effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents promptly and without hassle. Handle D 101a Form 1 ES Instructions Estimated Income Tax For on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign D 101a Form 1 ES Instructions Estimated Income Tax For effortlessly

- Locate D 101a Form 1 ES Instructions Estimated Income Tax For and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign tool, which only takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Put aside concerns about lost or misplaced documents, tedious form hunting, or mistakes that require reprinting new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign D 101a Form 1 ES Instructions Estimated Income Tax For and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 d 101a form 1 es instructions estimated income tax for

Create this form in 5 minutes!

How to create an eSignature for the 2022 d 101a form 1 es instructions estimated income tax for

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2019 Wisconsin form income tax?

The 2019 Wisconsin form income tax is a state tax form used by residents of Wisconsin to report their income for the year 2019. This form is essential for calculating the amount of state tax owed based on various income sources, deductions, and credits. Accurate completion of this form ensures compliance with state tax laws and helps avoid penalties.

-

How can airSlate SignNow help with the 2019 Wisconsin form income tax?

airSlate SignNow streamlines the process of preparing and eSigning the 2019 Wisconsin form income tax. With our easy-to-use platform, users can quickly fill out necessary tax forms, collect digital signatures, and send them securely. This eliminates the hassle of printing, signing, and mailing, making tax filing more efficient.

-

Is there a cost associated with using airSlate SignNow for the 2019 Wisconsin form income tax?

Yes, airSlate SignNow offers various pricing plans tailored to meet different needs, including features needed for handling the 2019 Wisconsin form income tax. While there is a subscription cost, the platform provides cost-effective solutions that can save you time and money in managing documents and signatures. Users can choose a plan that best fits their budget and requirements.

-

What are the features of airSlate SignNow that can assist with tax forms?

airSlate SignNow includes features such as template creation, automated workflows, and the ability to collect eSignatures, all of which are beneficial when handling the 2019 Wisconsin form income tax. These features help users streamline their documentation process, ensuring that all required signatures are obtained promptly and efficiently. Additionally, our platform provides document storage for easy access and retrieval.

-

Can I integrate airSlate SignNow with other applications for my taxes?

Yes, airSlate SignNow supports integrations with a variety of applications that can assist you in managing your 2019 Wisconsin form income tax. This includes accounting software and tax preparation tools, which help consolidate information and simplify the filing process. Such integrations enhance your workflow and ensure all data is organized and easily manageable.

-

What are the benefits of using airSlate SignNow for my 2019 Wisconsin form income tax?

Using airSlate SignNow for the 2019 Wisconsin form income tax offers several benefits, including enhanced efficiency and reduced paperwork. The platform allows for quick access to necessary forms, enabling faster completion and submission. Furthermore, with secure eSigning, you can be assured that your documents are legally compliant and protected.

-

How secure is airSlate SignNow when handling sensitive tax documents?

airSlate SignNow prioritizes security, employing top-notch encryption and security protocols to protect sensitive tax documents like the 2019 Wisconsin form income tax. Our platform is designed to ensure that all data is transmitted securely, keeping your personal and financial information safe throughout the process. Users can have peace of mind when using our solution for their important documents.

Get more for D 101a Form 1 ES Instructions Estimated Income Tax For

- Mutual wills package with last wills and testaments for married couple with adult and minor children tennessee form

- Tennessee widow form

- Legal last will and testament form for widow or widower with minor children tennessee

- Form widower 497327135

- Legal last will and testament form for a widow or widower with adult and minor children tennessee

- Legal last will and testament form for divorced and remarried person with mine yours and ours children tennessee

- Legal last will and testament form with all property to trust called a pour over will tennessee

- Written revocation of will tennessee form

Find out other D 101a Form 1 ES Instructions Estimated Income Tax For

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast