D 40P PAYMENT VOUCHER DC Office of Tax and Revenue 2022

What is the D 40P Payment Voucher?

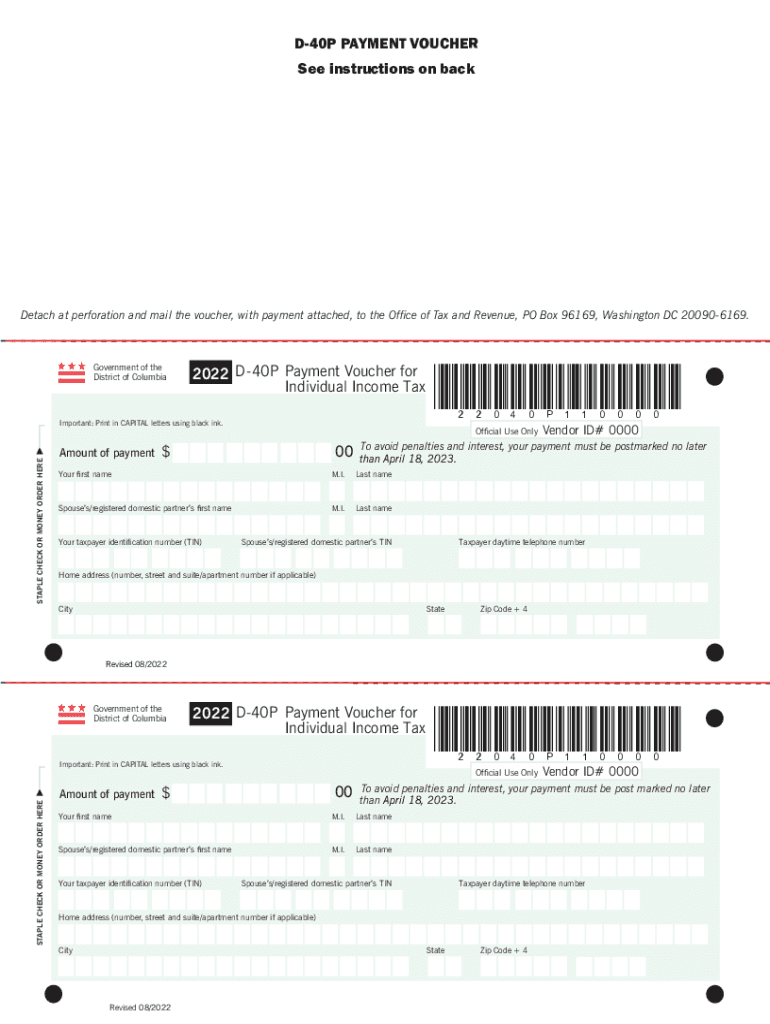

The D 40P Payment Voucher is a form issued by the DC Office of Tax and Revenue that allows taxpayers to make estimated tax payments for the current tax year. This voucher is specifically designed for individuals who need to submit payments for their District of Columbia income taxes. The form serves as a record of the payment made and is essential for maintaining accurate tax records. By using the D 40P, taxpayers can ensure they meet their tax obligations in a timely manner, thereby avoiding penalties and interest on late payments.

Steps to Complete the D 40P Payment Voucher

Completing the D 40P Payment Voucher involves several straightforward steps:

- Download the D 40P form from the DC Office of Tax and Revenue website or access it through a reliable digital platform.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate the amount you are paying and the tax year for which the payment is being made.

- Review the form for accuracy to ensure all information is correct.

- Sign and date the voucher to validate your payment.

- Submit the completed voucher along with your payment using your preferred method.

Legal Use of the D 40P Payment Voucher

The D 40P Payment Voucher is legally recognized as a valid method for making tax payments in the District of Columbia. To ensure compliance, it is essential that taxpayers follow the guidelines set forth by the DC Office of Tax and Revenue. This includes using the voucher for the correct tax year and ensuring that the payment is made by the specified deadlines. Proper use of the D 40P can help avoid penalties and ensure that taxpayers remain in good standing with tax authorities.

Filing Deadlines / Important Dates

Taxpayers must be aware of the key filing deadlines associated with the D 40P Payment Voucher. Generally, estimated tax payments are due on a quarterly basis. The specific dates for 2023 are as follows:

- First Quarter: April 15, 2023

- Second Quarter: June 15, 2023

- Third Quarter: September 15, 2023

- Fourth Quarter: January 15, 2024

It is crucial for taxpayers to submit their payments by these dates to avoid any late fees or penalties.

Form Submission Methods

Taxpayers have several options for submitting the D 40P Payment Voucher. These methods include:

- Online submission through the DC Office of Tax and Revenue's electronic payment system.

- Mailing the completed voucher along with the payment to the designated address provided on the form.

- In-person submission at the local tax office, where payments can be made directly.

Choosing the appropriate submission method can enhance convenience and ensure timely processing of payments.

Key Elements of the D 40P Payment Voucher

The D 40P Payment Voucher contains several key elements that must be completed accurately:

- Taxpayer Information: Name, address, and Social Security number.

- Payment Amount: The total amount being submitted for the estimated tax payment.

- Tax Year: The specific year for which the payment applies.

- Signature: A signature is required to validate the voucher.

Ensuring all elements are filled out correctly is vital for the form's acceptance and processing.

Quick guide on how to complete d 40p payment voucher dc office of tax and revenue

Prepare D 40P PAYMENT VOUCHER DC Office Of Tax And Revenue effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools you require to create, modify, and eSign your documents quickly without delays. Manage D 40P PAYMENT VOUCHER DC Office Of Tax And Revenue on any device with airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

How to modify and eSign D 40P PAYMENT VOUCHER DC Office Of Tax And Revenue with ease

- Find D 40P PAYMENT VOUCHER DC Office Of Tax And Revenue and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight relevant sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your preference. Modify and eSign D 40P PAYMENT VOUCHER DC Office Of Tax And Revenue and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct d 40p payment voucher dc office of tax and revenue

Create this form in 5 minutes!

How to create an eSignature for the d 40p payment voucher dc office of tax and revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a d 40p payment voucher 2023?

The d 40p payment voucher 2023 is a specific document used to manage payment transactions efficiently. It streamlines the process of issuing payments and ensures proper tracking and documentation for businesses. Understanding how to utilize this voucher can enhance your operational efficiency.

-

How can airSlate SignNow help with d 40p payment voucher 2023?

airSlate SignNow provides an intuitive platform for creating, sending, and electronically signing the d 40p payment voucher 2023. With its user-friendly interface, businesses can simplify their documentation processes while ensuring compliance and security. This helps in reducing errors and saves time.

-

What are the benefits of using the d 40p payment voucher 2023 with airSlate SignNow?

Utilizing the d 40p payment voucher 2023 with airSlate SignNow allows for seamless electronic signatures and cloud storage. It enhances collaboration by enabling multiple stakeholders to review and approve documents efficiently. Additionally, this helps in maintaining a robust audit trail for all transactions.

-

Is there a cost associated with the d 40p payment voucher 2023 feature?

While the d 40p payment voucher 2023 can be used at no additional charge within the airSlate SignNow platform, specific subscription plans may apply for full access to its features. Pricing details vary based on the chosen package, designed to fit different business needs. Visit our pricing page for more information.

-

Can I integrate the d 40p payment voucher 2023 with other applications?

Yes, airSlate SignNow allows for integration with various applications, making it simple to work with the d 40p payment voucher 2023 alongside your preferred tools. This includes CRM systems, project management apps, and payment gateways. Such integration streamlines your workflow and enhances productivity.

-

What types of businesses can benefit from the d 40p payment voucher 2023?

The d 40p payment voucher 2023 is beneficial for a wide range of businesses, from small startups to large enterprises. Any organization that regularly processes payments can leverage this tool to enhance efficiency and accuracy. It is particularly useful for finance departments seeking better payment tracking.

-

How secure is the d 40p payment voucher 2023 on airSlate SignNow?

Security is a priority at airSlate SignNow, especially for documents like the d 40p payment voucher 2023. The platform employs advanced encryption and robust security protocols to protect your data. This ensures that your payment information and signed documents remain confidential and secure.

Get more for D 40P PAYMENT VOUCHER DC Office Of Tax And Revenue

Find out other D 40P PAYMENT VOUCHER DC Office Of Tax And Revenue

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure