D40P PAYMENT VOUCHER See Instructions on Back Detach at Perforation and Mail the Voucher, with Payment Attached, to the Office O 2019

What is the D40P Payment Voucher?

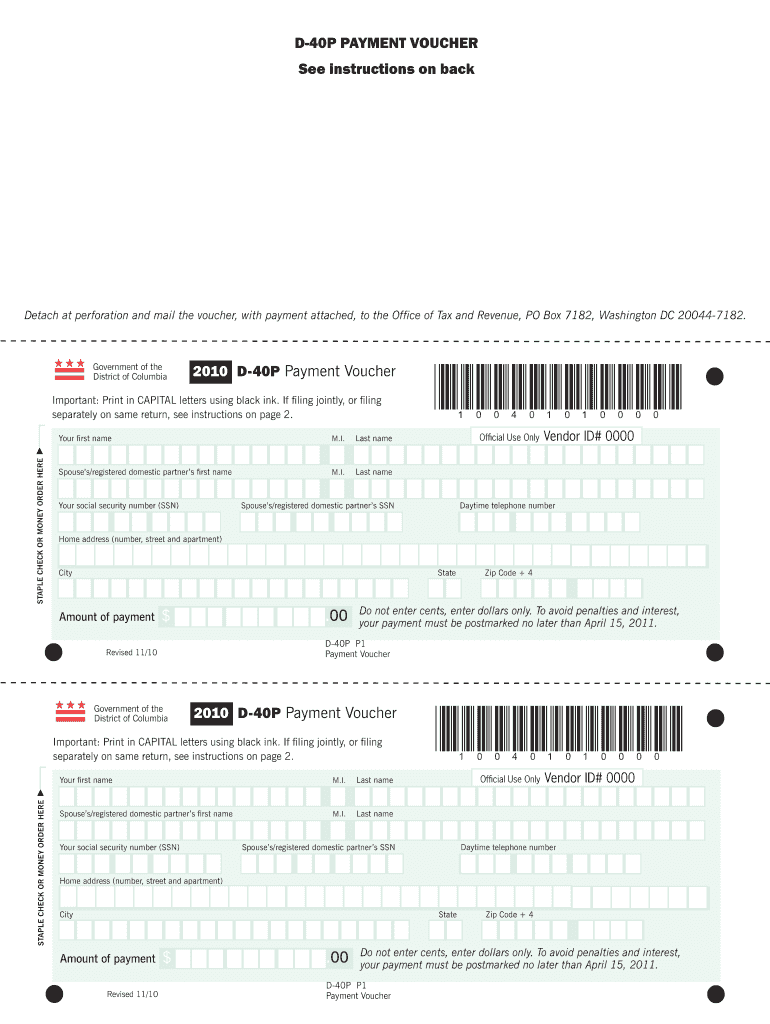

The D40P Payment Voucher is a document used by taxpayers in Washington, D.C., to submit payments for various tax obligations. This voucher is specifically designed for individuals or businesses that need to remit payments to the Office of Tax and Revenue. It includes essential information such as the taxpayer's identification details and the amount due. The voucher must be printed, filled out, and mailed to the designated address, ensuring timely processing of payments.

How to Use the D40P Payment Voucher

To use the D40P Payment Voucher, begin by obtaining the form from the appropriate source. After filling out the necessary information, detach the voucher at the perforation. Ensure that you attach your payment securely to the voucher before mailing it. It is crucial to send the completed voucher to the Office of Tax and Revenue at the specified address to avoid any delays in processing your payment.

Steps to Complete the D40P Payment Voucher

Completing the D40P Payment Voucher involves several straightforward steps:

- Obtain the D40P Payment Voucher form.

- Fill in your personal details, including your name, address, and taxpayer identification number.

- Indicate the payment amount and the tax year related to the payment.

- Detach the voucher at the perforation.

- Attach your payment securely to the voucher.

- Mail the completed voucher to the Office of Tax and Revenue at the provided address.

Legal Use of the D40P Payment Voucher

The D40P Payment Voucher is legally recognized as a valid method for submitting tax payments in Washington, D.C. It is essential to ensure that the voucher is filled out accurately and sent to the correct address. Failure to comply with the requirements may result in penalties or delays in processing your payment. Utilizing this voucher helps maintain compliance with local tax laws.

Filing Deadlines for the D40P Payment Voucher

Filing deadlines for the D40P Payment Voucher vary depending on the type of tax being paid. It is important to be aware of these deadlines to avoid late fees or penalties. Generally, payments should be submitted by the due date specified for the tax year. Keeping track of these dates ensures that taxpayers remain in good standing with the Office of Tax and Revenue.

Examples of Using the D40P Payment Voucher

There are various scenarios in which the D40P Payment Voucher may be utilized:

- Individuals paying their annual income tax obligations.

- Businesses remitting sales tax or other business-related taxes.

- Taxpayers making estimated tax payments throughout the year.

Each of these examples highlights the versatility of the D40P Payment Voucher in facilitating tax payments in Washington, D.C.

Quick guide on how to complete d40p payment voucher see instructions on back detach at perforation and mail the voucher with payment attached to the office of

Effortlessly manage D40P PAYMENT VOUCHER See Instructions On Back Detach At Perforation And Mail The Voucher, With Payment Attached, To The Office O on any device

Digital document management has become widely adopted by businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the right form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without delays. Handle D40P PAYMENT VOUCHER See Instructions On Back Detach At Perforation And Mail The Voucher, With Payment Attached, To The Office O on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign D40P PAYMENT VOUCHER See Instructions On Back Detach At Perforation And Mail The Voucher, With Payment Attached, To The Office O effortlessly

- Find D40P PAYMENT VOUCHER See Instructions On Back Detach At Perforation And Mail The Voucher, With Payment Attached, To The Office O and click on Get Form to begin.

- Use the tools available to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information with the tools that airSlate SignNow provides for that specific purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to confirm your changes.

- Choose how you want to send your form, either via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow simplifies your document management needs in just a few clicks from any device of your preference. Modify and eSign D40P PAYMENT VOUCHER See Instructions On Back Detach At Perforation And Mail The Voucher, With Payment Attached, To The Office O and maintain excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct d40p payment voucher see instructions on back detach at perforation and mail the voucher with payment attached to the office of

Create this form in 5 minutes!

How to create an eSignature for the d40p payment voucher see instructions on back detach at perforation and mail the voucher with payment attached to the office of

The best way to create an eSignature for your PDF online

The best way to create an eSignature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

How to make an eSignature right from your smartphone

The way to generate an electronic signature for a PDF on iOS

How to make an eSignature for a PDF on Android

People also ask

-

What is the D40P PAYMENT VOUCHER, and why do I need it?

The D40P PAYMENT VOUCHER is a tax payment form that allows individuals to submit payments to the Office of Tax and Revenue in Washington, DC. It is essential for ensuring your tax payments are handled correctly and on time. You can find instructions on the back, which include how to detach and mail the voucher with your payment attached.

-

How do I complete the D40P PAYMENT VOUCHER?

To complete the D40P PAYMENT VOUCHER, be sure to follow the instructions provided on the back of the form. Fill in the required personal information and payment details accurately. Once completed, detach the voucher at the perforation and mail it, along with your payment, to the specified address: Office of Tax and Revenue, PO Box 7182, Washington DC 20044-7182.

-

What payment methods are accepted with the D40P PAYMENT VOUCHER?

The D40P PAYMENT VOUCHER typically accepts checks or money orders as payment methods. Ensure that your payment is correctly made out to the Office of Tax and Revenue before mailing it along with the completed voucher. This ensures prompt processing of your payment.

-

Are there any deadlines associated with the D40P PAYMENT VOUCHER?

Yes, there are specific deadlines tied to the D40P PAYMENT VOUCHER submission. It is crucial to mail the voucher along with payment by the due date to avoid late fees or penalties. Check the official website or your tax documentation for the exact dates relevant to your tax obligations.

-

Can I track the status of my D40P PAYMENT VOUCHER submission?

Unfortunately, tracking the status of your D40P PAYMENT VOUCHER submission directly is not typically available. However, you can contact the Office of Tax and Revenue if you have concerns or need to confirm receipt of your payment. It's advisable to keep a copy of your submitted voucher and payment for your records.

-

Is the D40P PAYMENT VOUCHER form available online?

Yes, the D40P PAYMENT VOUCHER form is available online through the Office of Tax and Revenue's official website. This easy access allows you to print the form, fill it out at your convenience, and follow the instructions for mailing it with your payment. Ensure that you are using the latest version of the form for compliance.

-

What should I do if I made a mistake on my D40P PAYMENT VOUCHER?

If you notice a mistake on your D40P PAYMENT VOUCHER after it has been submitted, contact the Office of Tax and Revenue immediately for guidance. Depending on the nature of the error, they may advise you on how to correct it or if a resubmission is necessary. Timely communication can help resolve any issues promptly.

Get more for D40P PAYMENT VOUCHER See Instructions On Back Detach At Perforation And Mail The Voucher, With Payment Attached, To The Office O

- Critical incident report providers amerihealth caritas pennsylvania community healthchoices critical incident report form

- Durable power of attorney for health carelifespan form

- Dhec1129 form

- Sc 1613 form

- Substance abuse discharge note providers select health of form

- Race stroke scale pdf form

- Mandatory practitioner profile questionnaire tennessee 2009 form

- Instructions for form ct 183 and ct 184

Find out other D40P PAYMENT VOUCHER See Instructions On Back Detach At Perforation And Mail The Voucher, With Payment Attached, To The Office O

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format

- Sign Alabama House rental lease agreement Online

- Sign Arkansas House rental lease agreement Free

- Sign Alaska Land lease agreement Computer

- How Do I Sign Texas Land lease agreement

- Sign Vermont Land lease agreement Free

- Sign Texas House rental lease Now

- How Can I Sign Arizona Lease agreement contract

- Help Me With Sign New Hampshire lease agreement

- How To Sign Kentucky Lease agreement form

- Can I Sign Michigan Lease agreement sample

- How Do I Sign Oregon Lease agreement sample

- How Can I Sign Oregon Lease agreement sample

- Can I Sign Oregon Lease agreement sample

- How To Sign West Virginia Lease agreement contract

- How Do I Sign Colorado Lease agreement template

- Sign Iowa Lease agreement template Free