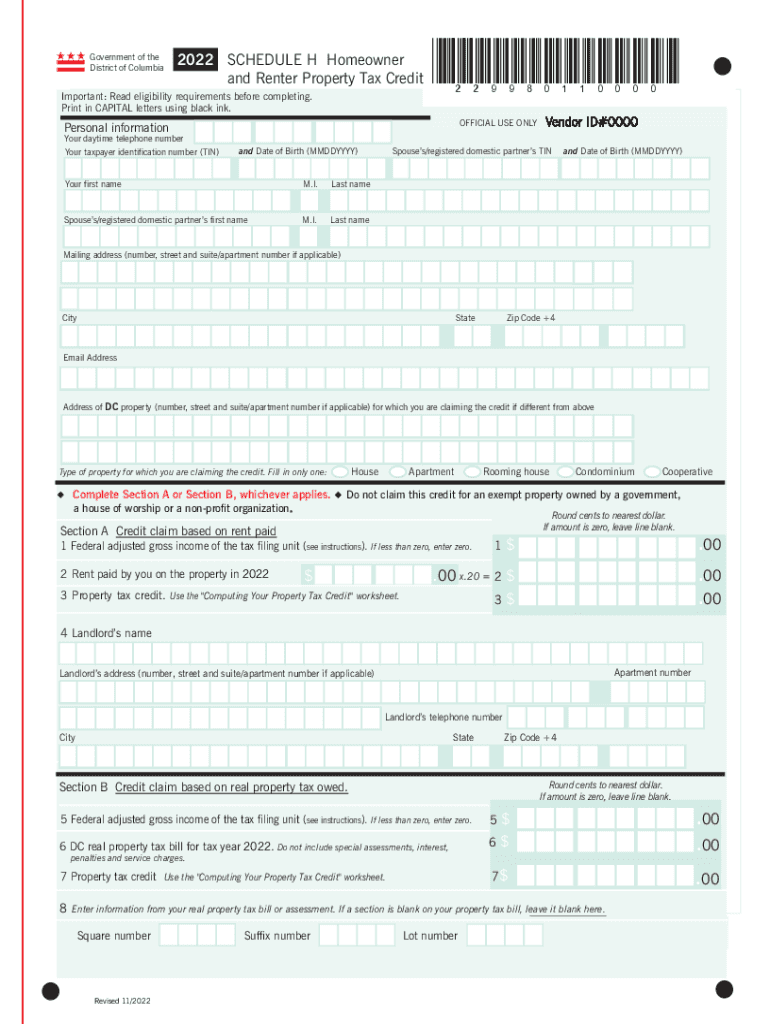

Schedule H DC Office of Tax and Revenue 2022

What is the Schedule H DC Office of Tax and Revenue?

The Schedule H is a tax form used by the DC Office of Tax and Revenue to provide property tax relief to eligible homeowners in Washington, D.C. This form allows residents to claim a property tax credit based on their income and the assessed value of their property. The Schedule H is specifically designed to support low-income homeowners, ensuring they receive financial assistance to help manage their property tax obligations.

Steps to Complete the Schedule H DC Office of Tax and Revenue

Completing the Schedule H involves several key steps:

- Gather Required Information: Collect necessary documents such as proof of income, property tax bills, and identification.

- Fill Out the Form: Accurately complete all sections of the Schedule H, ensuring that all information is correct and up to date.

- Calculate Your Credit: Follow the instructions to determine the amount of property tax credit you are eligible for based on your income and property value.

- Review the Form: Double-check all entries for accuracy to avoid delays in processing.

- Submit the Form: Send the completed Schedule H to the DC Office of Tax and Revenue through the appropriate submission method.

Eligibility Criteria for the Schedule H DC Office of Tax and Revenue

To qualify for the Schedule H property tax credit, applicants must meet specific eligibility criteria:

- Must be a homeowner in Washington, D.C.

- Must meet income limits set by the DC Office of Tax and Revenue.

- Must have occupied the property as their primary residence for at least half of the year.

- Must not have received a similar tax credit for the same property during the same tax year.

Legal Use of the Schedule H DC Office of Tax and Revenue

The Schedule H is legally recognized as a valid document for claiming property tax credits in Washington, D.C. To ensure its legal standing, it must be completed accurately and submitted by the designated deadline. Compliance with all local tax regulations is essential for the credit to be honored by the DC Office of Tax and Revenue.

Form Submission Methods for the Schedule H DC Office of Tax and Revenue

There are several methods available for submitting the Schedule H:

- Online Submission: Use the DC Office of Tax and Revenue's online portal for a quick and efficient submission process.

- Mail Submission: Send the completed form via postal mail to the designated address provided by the tax office.

- In-Person Submission: Visit the DC Office of Tax and Revenue to submit the form directly.

Filing Deadlines for the Schedule H DC Office of Tax and Revenue

It is crucial to be aware of the filing deadlines for the Schedule H to avoid penalties. Typically, the deadline coincides with the annual property tax filing date. Homeowners should check the DC Office of Tax and Revenue's official announcements for any updates or changes to these deadlines.

Quick guide on how to complete 2021 schedule h dc office of tax and revenue

Effortlessly Prepare Schedule H DC Office Of Tax And Revenue on Any Device

The management of documents online has gained popularity among businesses and individuals alike. It offers a fantastic eco-friendly substitute for traditional printed and signed paperwork, as you can access the necessary forms and securely keep them online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents quickly and without delays. Manage Schedule H DC Office Of Tax And Revenue on any device using the airSlate SignNow apps for Android or iOS, and simplify any document-related task today.

The Easiest Way to Modify and eSign Schedule H DC Office Of Tax And Revenue Effortlessly

- Locate Schedule H DC Office Of Tax And Revenue and click on Get Form to begin.

- Make use of the tools we provide to complete your document.

- Select important sections of the documents or obscure confidential information with the tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to preserve your changes.

- Choose your preferred method for sharing your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Modify and eSign Schedule H DC Office Of Tax And Revenue while ensuring seamless communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 schedule h dc office of tax and revenue

Create this form in 5 minutes!

How to create an eSignature for the 2021 schedule h dc office of tax and revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the dc schedule h 2024, and how does it relate to airSlate SignNow?

The dc schedule h 2024 refers to the proposed scheduling format used by businesses in Washington D.C. for varying operational needs. airSlate SignNow streamlines document management and e-signatures, making it easier to handle schedules and compliance related to the dc schedule h 2024. With our platform, you can sign and send important documents seamlessly.

-

How does airSlate SignNow assist with the dc schedule h 2024 implementation?

airSlate SignNow provides tools to simplify and accelerate the implementation of the dc schedule h 2024. Our e-signature features allow businesses to get necessary approvals faster, ensuring that all schedules and documents are compliant and up to date. You can also save time and reduce delays in your operations.

-

What are the pricing options available for airSlate SignNow related to dc schedule h 2024?

airSlate SignNow offers flexible pricing plans that cater to various business sizes and their needs regarding the dc schedule h 2024. Our pricing is designed to be cost-effective while providing comprehensive features for document signing and management. You can choose from different tiers based on your specific requirements.

-

Can I integrate airSlate SignNow with other applications for handling the dc schedule h 2024?

Yes, airSlate SignNow can integrate with a variety of applications essential for managing the dc schedule h 2024. Whether you use CRM systems, cloud storage solutions, or workflow management tools, our platform can connect seamlessly to enhance your document processes. This integration ensures that your scheduling and signing tasks are efficient and organized.

-

What are the key features of airSlate SignNow that support the dc schedule h 2024?

airSlate SignNow includes essential features such as custom workflows, advanced e-signature capabilities, and real-time tracking, which all support efficient management of the dc schedule h 2024. These features allow you to automate your document workflow, ensuring that all necessary signatures are collected promptly. Additionally, our user-friendly interface simplifies navigation.

-

How can businesses benefit from using airSlate SignNow for the dc schedule h 2024?

Businesses can signNowly benefit from using airSlate SignNow for the dc schedule h 2024 by saving time, reducing paperwork, and improving compliance. With our e-signature solutions, the speed of transaction execution increases, allowing for better operational efficiency. Additionally, our platform ensures that all documents are securely signed and stored.

-

Is airSlate SignNow secure for handling documents related to the dc schedule h 2024?

Absolutely! airSlate SignNow prioritizes security, implementing robust encryption and compliance measures to protect documents associated with the dc schedule h 2024. We take the security of your data seriously, ensuring that all e-signatures and documents are not only secure but also comply with necessary regulations.

Get more for Schedule H DC Office Of Tax And Revenue

Find out other Schedule H DC Office Of Tax And Revenue

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy