IiviVv L20 1 Ii ,ii*i I ,i ILiiiLiviVi * *iiLV* 2023-2026

Understanding the DC Schedule H 2024

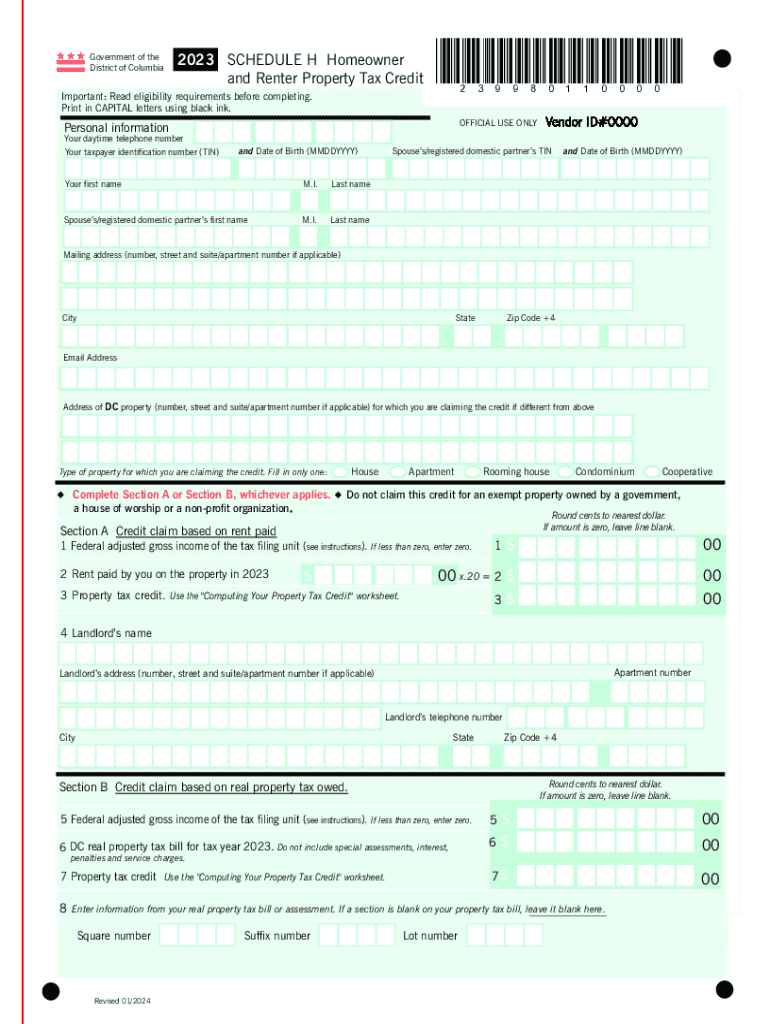

The DC Schedule H 2024 is a tax form used by individuals and businesses in the District of Columbia to report and pay their unincorporated business franchise tax. This form is essential for those who operate as sole proprietors, partnerships, or limited liability companies (LLCs) that do not elect to be treated as corporations. It ensures compliance with local tax laws and helps in accurately calculating the tax owed based on gross receipts.

Steps to Complete the DC Schedule H 2024

Completing the DC Schedule H 2024 involves several key steps:

- Gather necessary financial information, including total gross receipts for the tax year.

- Fill out the form with accurate data, ensuring that all sections are completed.

- Calculate the unincorporated business franchise tax based on the provided gross receipts.

- Review the completed form for any errors or omissions.

- Submit the form by the designated deadline, either electronically or via mail.

Filing Deadlines for the DC Schedule H 2024

It is crucial to adhere to the filing deadlines for the DC Schedule H 2024 to avoid penalties. Typically, the deadline coincides with the federal tax filing deadline, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. Always verify the specific date for the current tax year.

Required Documents for Filing

To successfully file the DC Schedule H 2024, you will need the following documents:

- Financial statements detailing your business income and expenses.

- Previous year's tax returns for reference.

- Any supporting documentation that verifies your gross receipts.

Form Submission Methods

The DC Schedule H 2024 can be submitted through various methods to accommodate different preferences:

- Online submission via the District of Columbia's Office of Tax and Revenue website.

- Mailing a printed copy of the completed form to the appropriate tax office.

- In-person submission at designated tax offices within the District.

Penalties for Non-Compliance

Failure to file the DC Schedule H 2024 on time or inaccuracies in reporting can lead to significant penalties. These may include:

- Late filing fees, which can accumulate over time.

- Interest on any unpaid tax amounts.

- Potential legal action for continued non-compliance.

Create this form in 5 minutes or less

Find and fill out the correct iivivv l20 1 ii iii iiiliiilivivi iilv

Create this form in 5 minutes!

How to create an eSignature for the iivivv l20 1 ii iii iiiliiilivivi iilv

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the dc schedule h 2024 and how does it relate to airSlate SignNow?

The dc schedule h 2024 refers to the specific timeline and requirements for document submissions in Washington, D.C. By using airSlate SignNow, businesses can efficiently manage their document workflows in accordance with the dc schedule h 2024, ensuring compliance and timely submissions.

-

How can airSlate SignNow help me meet the dc schedule h 2024 deadlines?

airSlate SignNow provides tools that streamline the eSigning process, allowing you to send, sign, and manage documents quickly. This efficiency is crucial for meeting the dc schedule h 2024 deadlines, as it reduces turnaround time and helps you stay organized.

-

What are the pricing options for airSlate SignNow in relation to the dc schedule h 2024?

airSlate SignNow offers various pricing plans that cater to different business needs. These plans are designed to provide cost-effective solutions for managing documents related to the dc schedule h 2024, ensuring you get the best value for your investment.

-

What features does airSlate SignNow offer to support the dc schedule h 2024?

Key features of airSlate SignNow include customizable templates, automated workflows, and real-time tracking. These features are particularly beneficial for businesses needing to comply with the dc schedule h 2024, as they enhance efficiency and accuracy in document handling.

-

Can airSlate SignNow integrate with other tools to assist with the dc schedule h 2024?

Yes, airSlate SignNow integrates seamlessly with various applications such as CRM systems and cloud storage services. This integration capability is essential for businesses looking to streamline their processes in line with the dc schedule h 2024.

-

What are the benefits of using airSlate SignNow for the dc schedule h 2024?

Using airSlate SignNow for the dc schedule h 2024 offers numerous benefits, including improved efficiency, reduced paper usage, and enhanced security. These advantages help businesses stay compliant while also promoting a more sustainable approach to document management.

-

Is airSlate SignNow user-friendly for managing the dc schedule h 2024?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to navigate and utilize its features. This user-friendliness is particularly important for managing the dc schedule h 2024, as it allows teams to focus on their tasks without technical distractions.

Get more for IiviVv L20 1 Ii ,ii*i I ,i iLiiiLiviVi * *iiLV*

Find out other IiviVv L20 1 Ii ,ii*i I ,i iLiiiLiviVi * *iiLV*

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple

- Electronic signature Indiana Business Operations Limited Power Of Attorney Online

- Electronic signature Iowa Business Operations Resignation Letter Online

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple