Form 850 Instructions 2022-2026

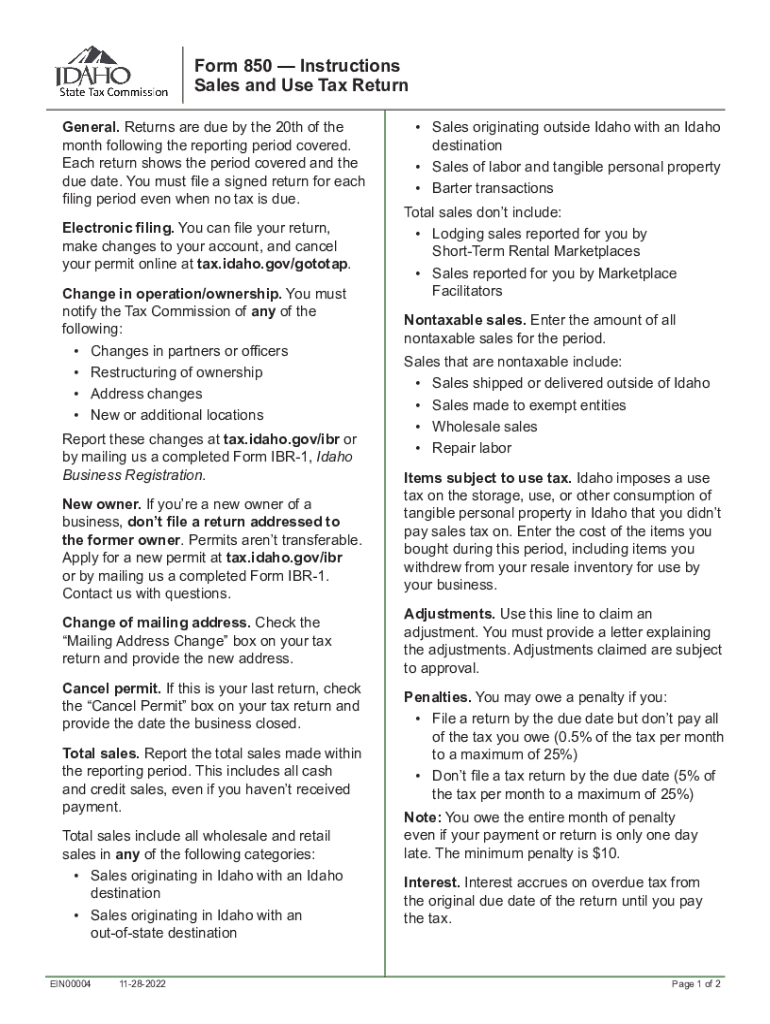

What is the Idaho Form 850?

The Idaho Form 850 is a sales tax form used by businesses in Idaho to report and remit sales tax collected from customers. This form is essential for compliance with state tax regulations and ensures that businesses fulfill their tax obligations accurately. The form provides a structured way for businesses to detail their sales transactions and calculate the total sales tax due to the state.

Steps to Complete the Idaho Form 850

Completing the Idaho Form 850 involves several key steps to ensure accuracy and compliance. Here’s a straightforward guide:

- Gather Required Information: Collect all sales records, including gross sales, exempt sales, and any deductions.

- Calculate Total Sales: Sum up all sales made during the reporting period to determine the total taxable sales.

- Determine Sales Tax Due: Apply the appropriate sales tax rate to the taxable sales amount to calculate the total sales tax owed.

- Complete the Form: Fill out the Idaho Form 850 with the calculated figures and any required details.

- Review and Submit: Double-check all entries for accuracy before submitting the form online, by mail, or in person.

Legal Use of the Idaho Form 850

The Idaho Form 850 is legally binding when completed and submitted according to state regulations. To ensure its validity, businesses must adhere to specific guidelines regarding the accuracy of information reported and the timely submission of the form. Proper electronic signatures and compliance with eSignature laws further enhance the legal standing of the submitted document.

How to Obtain the Idaho Form 850

The Idaho Form 850 can be easily obtained through the Idaho State Tax Commission’s website. It is available in a downloadable PDF format, allowing businesses to print and fill it out manually or complete it digitally. Additionally, businesses may request a physical copy from local tax offices if needed.

Filing Deadlines for the Idaho Form 850

Filing deadlines for the Idaho Form 850 vary based on the reporting frequency assigned to the business, which can be monthly, quarterly, or annually. It is crucial for businesses to be aware of their specific deadlines to avoid penalties. Generally, forms are due on the 20th of the month following the end of the reporting period.

Form Submission Methods for the Idaho Form 850

Businesses have multiple options for submitting the Idaho Form 850. The form can be filed online through the Idaho State Tax Commission’s e-filing system, mailed to the appropriate tax office, or submitted in person at local tax offices. Each method has its own processing times, so businesses should choose the one that best fits their needs.

Quick guide on how to complete form 850 instructions

Effortlessly Prepare Form 850 Instructions on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly without any holdups. Manage Form 850 Instructions on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Modify and Electronically Sign Form 850 Instructions with Ease

- Acquire Form 850 Instructions and click Get Form to begin.

- Make use of the tools we provide to fill in your form.

- Emphasize relevant sections of the documents or redact sensitive information with the tools specifically designed for that task by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details carefully and click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and electronically sign Form 850 Instructions to ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 850 instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Idaho form 850 PDF used for?

The Idaho form 850 PDF is primarily used for various tax purposes in the state of Idaho. It helps individuals and businesses report specific financial information to the Idaho State Tax Commission. Using airSlate SignNow, you can easily eSign and send the Idaho form 850 PDF securely.

-

How can I fill out the Idaho form 850 PDF?

Filling out the Idaho form 850 PDF can be done quickly using digital tools like airSlate SignNow. You can upload the PDF to our platform, fill in the required fields, and electronically sign it. This process saves time and minimizes paperwork.

-

Is there a cost associated with using airSlate SignNow for the Idaho form 850 PDF?

Yes, airSlate SignNow offers various pricing plans designed to fit different budgets and business needs. While the cost may vary based on your requirements, the platform is known for being a cost-effective solution for managing documents like the Idaho form 850 PDF.

-

What features does airSlate SignNow provide for the Idaho form 850 PDF?

airSlate SignNow offers a suite of features for the Idaho form 850 PDF, including document editing, eSigning, secure storage, and tracking capabilities. You can also integrate it with other applications for enhanced productivity. These features ensure a seamless experience when managing your form.

-

Can I integrate airSlate SignNow with other software for managing the Idaho form 850 PDF?

Absolutely! airSlate SignNow offers integration with various third-party software and tools, making it easy to manage your Idaho form 850 PDF alongside your existing systems. This flexibility allows for a more streamlined workflow and effective document management.

-

What are the benefits of using airSlate SignNow for eSigning the Idaho form 850 PDF?

Using airSlate SignNow to eSign the Idaho form 850 PDF offers numerous benefits, including improved efficiency, enhanced security, and reduced paper usage. You can sign documents from anywhere, ensuring timely submissions and better compliance with state regulations.

-

How do I ensure my Idaho form 850 PDF is secure when using airSlate SignNow?

airSlate SignNow employs advanced security measures to protect your documents, including end-to-end encryption and secure data storage. These safeguards ensure that when you upload and eSign the Idaho form 850 PDF, your information remains confidential and secure from unauthorized access.

Get more for Form 850 Instructions

- Letter from tenant to landlord about fair housing reduction or denial of services to family with children texas form

- Tx letter form

- Letter from tenant to landlord responding to notice to terminate for noncompliance noncompliant condition caused by landlords 497327505 form

- Assumed name certificate texas form

- Tx failure form

- Assumed name 497327508 form

- Tx codes form

- Texas note 497327510 form

Find out other Form 850 Instructions

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online

- eSign Hawaii Business Operations LLC Operating Agreement Mobile

- How Do I eSign Idaho Car Dealer Lease Termination Letter

- eSign Indiana Car Dealer Separation Agreement Simple

- eSign Iowa Car Dealer Agreement Free

- eSign Iowa Car Dealer Limited Power Of Attorney Free

- eSign Iowa Car Dealer Limited Power Of Attorney Fast

- eSign Iowa Car Dealer Limited Power Of Attorney Safe

- How Can I eSign Iowa Car Dealer Limited Power Of Attorney

- How To eSign Illinois Business Operations Stock Certificate

- Can I eSign Louisiana Car Dealer Quitclaim Deed

- eSign Michigan Car Dealer Operating Agreement Mobile

- Can I eSign Mississippi Car Dealer Resignation Letter