Louisiana Individual Income Tax Form

What is the Louisiana Individual Income Tax

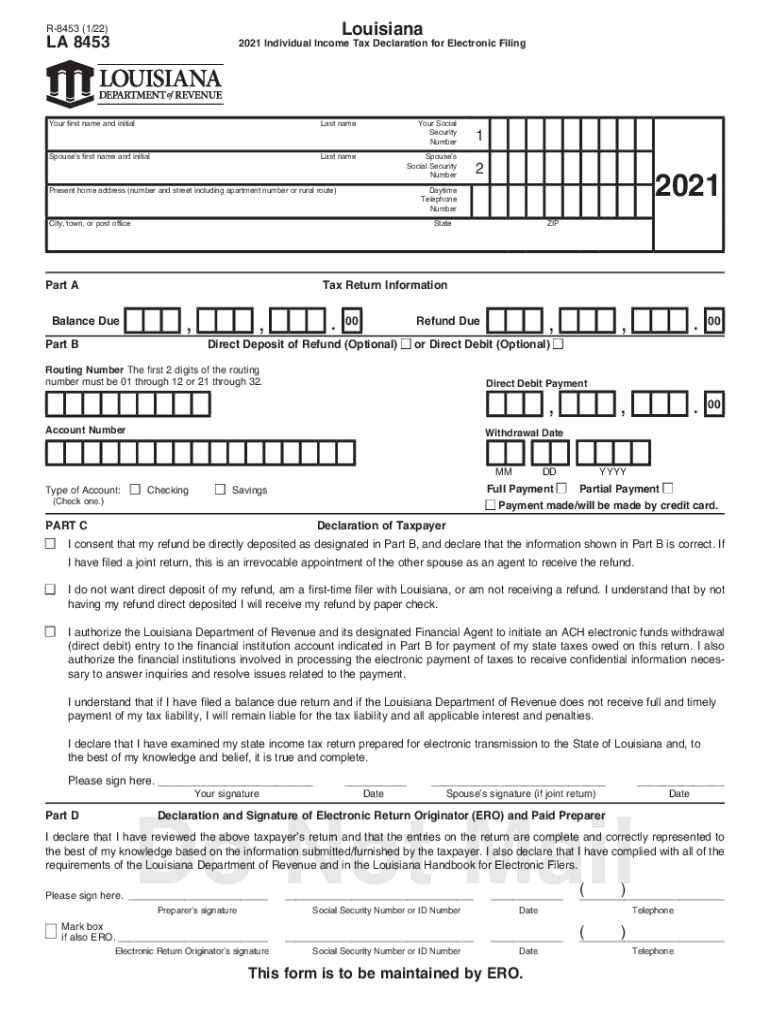

The Louisiana Individual Income Tax is a state tax levied on the income of residents and non-residents who earn income within Louisiana. This tax is calculated based on the taxpayer's taxable income, which includes wages, salaries, and other forms of compensation. The tax rates are progressive, meaning that as income increases, the rate of tax also increases. Understanding the structure of this tax is essential for compliance and accurate filing.

Steps to complete the Louisiana Individual Income Tax

Completing the Louisiana Individual Income Tax involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including W-2 forms, 1099 forms, and any other income statements. Next, determine your filing status, which can affect your tax rate and deductions. After that, calculate your total income and applicable deductions to arrive at your taxable income. Finally, fill out the appropriate tax forms, such as the 2021 Louisiana income tax form, ensuring all information is accurate before submission.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the Louisiana Individual Income Tax to avoid penalties. Typically, the deadline for filing is May fifteenth of the year following the tax year. For the 2021 revenue individual income tax, this means that returns must be filed by May 15, 2022. Extensions may be available, but they must be requested prior to the original deadline. Staying informed about these dates helps ensure timely compliance.

Required Documents

When preparing to file the Louisiana Individual Income Tax, certain documents are essential. These include:

- W-2 forms from employers

- 1099 forms for other income sources

- Documentation of deductions, such as mortgage interest statements

- Proof of any tax credits claimed

- Previous year’s tax return for reference

Having these documents ready can streamline the filing process and reduce the likelihood of errors.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers in Louisiana have several options for submitting their individual income tax forms. The most common methods include:

- Online filing through the Louisiana Department of Revenue’s website, which is often the quickest and most efficient method.

- Mailing a completed paper form to the appropriate address provided by the state.

- In-person submission at designated tax offices for those who prefer face-to-face assistance.

Each method has its advantages, and taxpayers should choose the one that best fits their needs.

Penalties for Non-Compliance

Failure to comply with Louisiana’s individual income tax requirements can result in significant penalties. These may include fines for late filing, interest on unpaid taxes, and potential legal action for severe cases of non-compliance. It is important to understand these consequences to avoid unnecessary financial burdens. Taxpayers should ensure timely and accurate filing to mitigate these risks.

Quick guide on how to complete louisiana individual income tax

Effortlessly Prepare Louisiana Individual Income Tax on Any Device

The management of documents online has gained traction among organizations and individuals alike. It offers an ideal eco-conscious alternative to traditional printed and signed documents, as you can easily find the needed form and securely store it digitally. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents quickly without delays. Manage Louisiana Individual Income Tax on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

Effortless Modification and Electronic Signing of Louisiana Individual Income Tax

- Obtain Louisiana Individual Income Tax and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information using the tools that airSlate SignNow offers specifically for this purpose.

- Create your electronic signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on Done to save your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or mislaid documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Alter and electronically sign Louisiana Individual Income Tax and ensure excellent communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the louisiana individual income tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the relationship between airSlate SignNow and the 2021 revenue individual income tax?

airSlate SignNow can streamline the process of preparing and submitting documents related to the 2021 revenue individual income tax. By enabling electronic signature capabilities on tax documents, it ensures compliance and efficiency, making it easier for individuals to manage their tax obligations.

-

How does airSlate SignNow assist with filing 2021 revenue individual income tax?

With airSlate SignNow, you can easily sign and send tax-related documents, such as forms and agreements, for the 2021 revenue individual income tax. This digital solution eliminates the hassle of physical paperwork, ensuring that your submissions are timely and secure.

-

Is airSlate SignNow cost-effective for managing 2021 revenue individual income tax documents?

Yes, airSlate SignNow offers a cost-effective solution for managing documents related to the 2021 revenue individual income tax. With various pricing plans, users can choose the option that best fits their budget while enjoying all the features necessary for efficient document handling.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow provides features such as document templates, electronic signing, and secure storage, which are essential for managing the 2021 revenue individual income tax documents. These tools enhance productivity and ensure that your files are organized and accessible when needed.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Yes, airSlate SignNow seamlessly integrates with various accounting and tax preparation software, making it easier to handle the 2021 revenue individual income tax. This integration allows users to pull in tax documents and prepare them for eSignature without leaving their preferred applications.

-

What are the benefits of using airSlate SignNow for tax filing?

Using airSlate SignNow for tax filing offers benefits such as reducing paper clutter, speeding up the signing process, and providing a secure method to store tax documents. This is particularly useful for the 2021 revenue individual income tax, as it helps ensure accuracy and compliance.

-

How secure is airSlate SignNow for handling sensitive tax information?

airSlate SignNow employs advanced security protocols to protect sensitive tax information, including documents related to the 2021 revenue individual income tax. Features like encryption and secure access help safeguard your data from unauthorized access.

Get more for Louisiana Individual Income Tax

Find out other Louisiana Individual Income Tax

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal