F1099r PDF Attention Copy a of This Form is Provided for

Understanding Form 5498

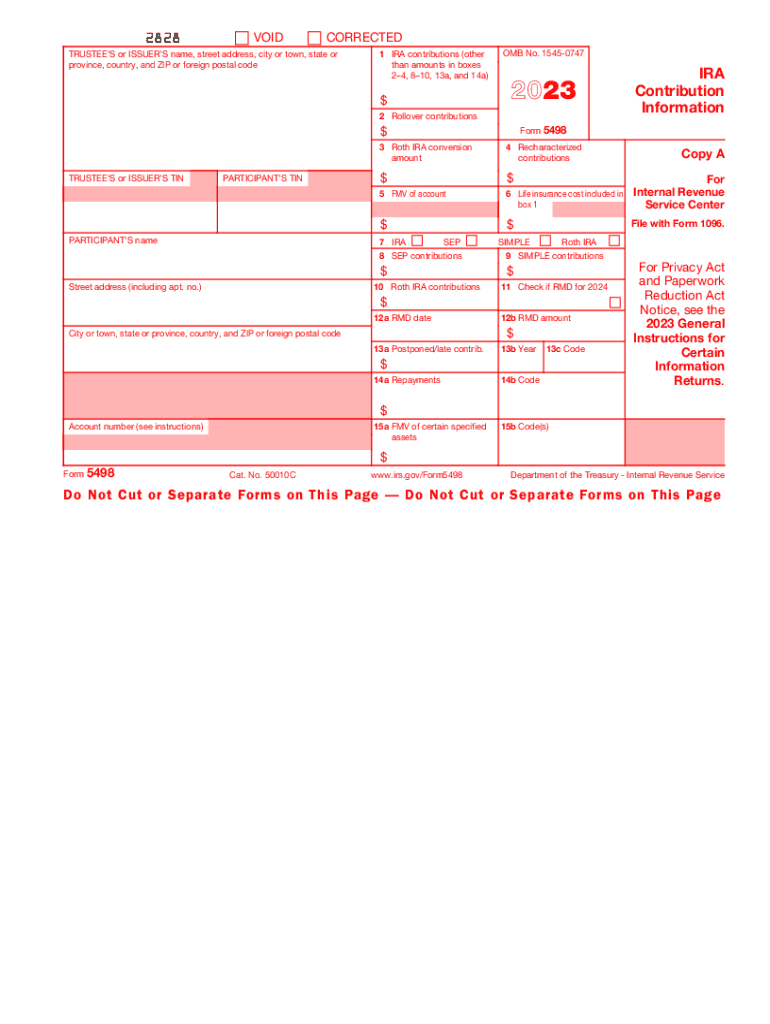

Form 5498 is an important tax document used to report contributions to individual retirement accounts (IRAs). It is issued by financial institutions to the Internal Revenue Service (IRS) and provides details about contributions, rollovers, conversions, and the fair market value of the account. This form is essential for taxpayers to accurately report their IRA contributions on their tax returns.

Key Elements of Form 5498

The form includes several critical pieces of information:

- Account Holder Information: Name, address, and Social Security number of the account holder.

- Type of IRA: Indicates whether the account is a traditional IRA, Roth IRA, SEP IRA, or SIMPLE IRA.

- Contribution Amounts: Details of contributions made during the tax year, including rollover amounts.

- Fair Market Value: The value of the account as of December 31 of the tax year.

- Required Minimum Distributions (RMDs): Information regarding any RMDs that may be applicable.

Filing Deadlines for Form 5498

Form 5498 must be filed by the financial institution by May 31 of the year following the tax year. This deadline allows taxpayers to receive the necessary information in time to complete their tax returns. It is important to note that contributions made for the previous tax year can be reported until the tax filing deadline, which is typically April 15.

IRS Guidelines for Form 5498

The IRS provides specific guidelines regarding the completion and submission of Form 5498. Taxpayers should ensure that all information is accurate and complete to avoid potential issues with their tax filings. The IRS also emphasizes the importance of retaining a copy of this form for personal records, as it may be needed for future reference or audits.

Digital vs. Paper Version of Form 5498

Form 5498 can be filed electronically or submitted in paper format. Digital filing is often more efficient and can help reduce errors. Financial institutions typically offer electronic versions that can be easily accessed and stored. However, if a paper form is preferred, it can be printed, filled out, and mailed to the IRS.

Who Issues Form 5498?

Form 5498 is issued by the financial institutions that manage the IRA accounts. This includes banks, brokerage firms, and other entities that offer retirement accounts. It is their responsibility to provide accurate information regarding contributions and account values to both the IRS and the account holders.

Penalties for Non-Compliance with Form 5498

Failure to file Form 5498 or inaccuracies in reporting can lead to penalties imposed by the IRS. These penalties may include fines for the financial institution responsible for filing the form. Additionally, taxpayers may face complications with their tax returns if the information reported on Form 5498 does not match their filings.

Quick guide on how to complete f1099rpdf attention copy a of this form is provided for

Complete F1099r pdf Attention Copy A Of This Form Is Provided For effortlessly on any device

The management of online documents has gained traction among businesses and individuals alike. It offers a superb environmentally friendly option to traditional printed and signed paperwork, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to generate, modify, and electronically sign your documents quickly without delays. Manage F1099r pdf Attention Copy A Of This Form Is Provided For on any device using airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

The simplest way to alter and electronically sign F1099r pdf Attention Copy A Of This Form Is Provided For with ease

- Obtain F1099r pdf Attention Copy A Of This Form Is Provided For and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Indicate important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to finalize your changes.

- Choose your preferred method to submit your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, or errors that necessitate reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your preference. Modify and electronically sign F1099r pdf Attention Copy A Of This Form Is Provided For and guarantee smooth communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the f1099rpdf attention copy a of this form is provided for

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 5498?

Form 5498 is a tax form that reports contributions to individual retirement arrangements (IRAs). It is crucial for both the IRS and individuals to track retirement savings. Understanding Form 5498 is essential for accurate tax reporting and financial planning.

-

How does airSlate SignNow help with Form 5498?

airSlate SignNow simplifies the process of preparing and eSigning Form 5498. Our platform allows users to create, fill out, and securely send Form 5498 electronically, ensuring compliance and ease of access. This streamlines your tax documentation process, making it more efficient.

-

Is airSlate SignNow affordable for small businesses handling Form 5498?

Yes, airSlate SignNow offers competitive pricing plans that cater to small businesses needing to manage Form 5498. With cost-effective solutions, small enterprises can ensure they remain compliant without breaking the bank. Our services provide great value while simplifying document management.

-

Can I integrate airSlate SignNow with my accounting software for Form 5498?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, allowing you to handle Form 5498 efficiently. You can sync data and manage documents without switching between platforms, enhancing productivity and reducing errors.

-

What are the main features of airSlate SignNow for processing Form 5498?

Key features include document templates, secure eSignature options, and real-time collaboration for Form 5498. These tools ensure that your forms are completed accurately and shared securely with stakeholders. Our user-friendly interface makes it easy for anyone to navigate.

-

Is my data secure when using airSlate SignNow for Form 5498?

Yes, data security is a top priority at airSlate SignNow. We use advanced encryption technologies and compliance measures to ensure that your information related to Form 5498 is protected. You can confidently manage sensitive tax documents without worrying about bsignNowes.

-

Can airSlate SignNow help me stay compliant with IRS regulations for Form 5498?

Certainly! airSlate SignNow provides tools that ensure your Form 5498 meets IRS requirements. By using our platform, you can reduce the risk of errors and ensure timely submissions, keeping you compliant with current tax regulations.

Get more for F1099r pdf Attention Copy A Of This Form Is Provided For

- Letter clients sample form

- Sample letter employer form

- Terminate corporation form

- Insurance contract form

- Release of claims for future accidental personal injuries or death by individual participating in parachute instruction form

- Billboards advertising form

- Release for diverting water in favor of governmental agency form

- Lease agreement rental 497328598 form

Find out other F1099r pdf Attention Copy A Of This Form Is Provided For

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors