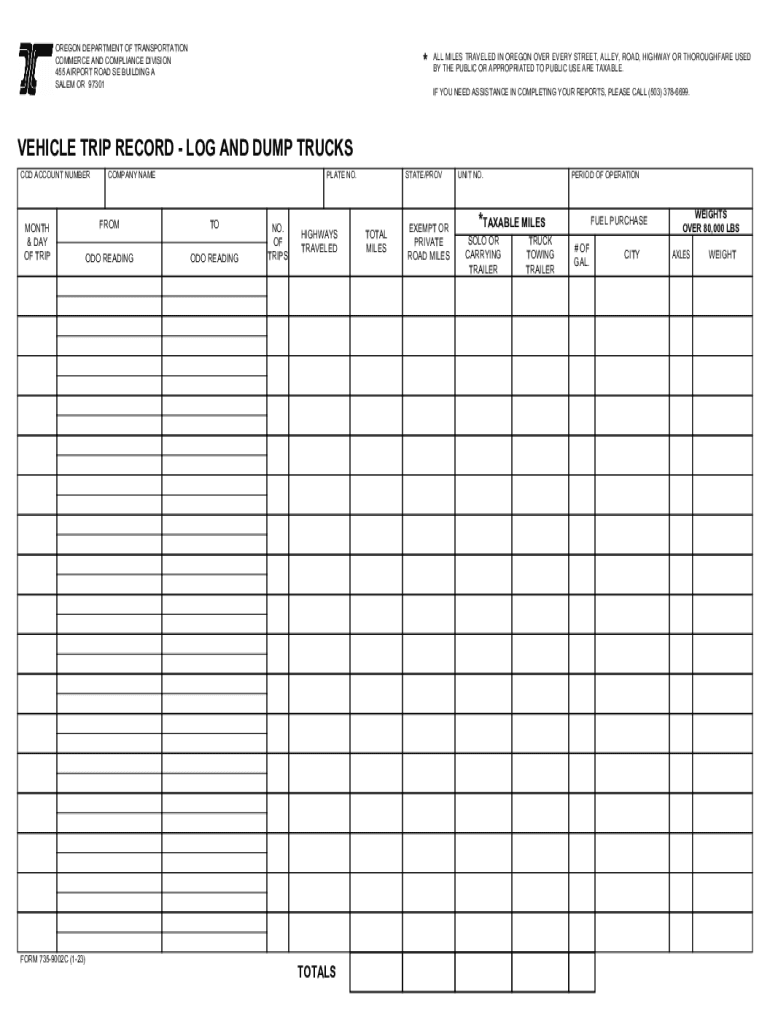

Oregon Department of Transportation Report Your Taxes Form

Understanding the vehicle trip record

A vehicle trip record is a crucial document for businesses and individuals who need to track vehicle usage for various purposes, including tax reporting, expense management, and compliance with regulations. This form typically captures essential details such as the date of the trip, starting and ending locations, purpose of the trip, and mileage. Accurate record-keeping helps ensure compliance with tax laws and can provide valuable insights for business operations.

Key elements of a vehicle trip record

When filling out a vehicle trip record, certain key elements must be included to ensure completeness and accuracy. These elements typically encompass:

- Date: The specific date when the trip occurred.

- Starting location: The address or location where the trip began.

- Ending location: The address or location where the trip concluded.

- Purpose of the trip: A brief description of why the trip was made, such as business meetings or client visits.

- Mileage: The total distance traveled during the trip, usually recorded in miles.

How to complete a vehicle trip record

Completing a vehicle trip record involves several straightforward steps. Begin by gathering all necessary information related to the trip. Follow these steps for accurate completion:

- Enter the date of the trip in the designated field.

- Document the starting and ending locations clearly.

- Provide a concise explanation of the trip's purpose.

- Calculate and input the total mileage traveled.

- Review the completed form for accuracy before submission.

Legal use of the vehicle trip record

The vehicle trip record serves a legal purpose, especially for businesses that need to substantiate vehicle-related expenses for tax deductions. To ensure its legal standing, the record must be accurate and complete. Compliance with IRS guidelines is essential, as inaccuracies can lead to penalties or audits. Keeping a well-maintained trip record demonstrates due diligence and can protect against potential legal issues.

Form submission methods

Once the vehicle trip record is completed, it can be submitted through various methods depending on the requirements of the organization or agency requesting it. Common submission methods include:

- Online: Many organizations allow for electronic submissions through secure portals.

- Mail: Physical copies can be sent via postal service to the appropriate address.

- In-person: Submitting the form directly to the relevant office or department may be required in some cases.

Examples of using the vehicle trip record

Vehicle trip records are utilized in various scenarios, including:

- Businesses tracking employee travel for reimbursement or tax purposes.

- Freelancers documenting mileage for tax deductions.

- Non-profits maintaining records for grant compliance.

These examples highlight the versatility of the vehicle trip record in different contexts, emphasizing its importance in financial and operational management.

Quick guide on how to complete oregon department of transportation report your taxes

Prepare Oregon Department Of Transportation Report Your Taxes effortlessly on any gadget

Online document management has gained traction among enterprises and individuals alike. It offers an excellent environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the correct form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without any delays. Handle Oregon Department Of Transportation Report Your Taxes on any device using airSlate SignNow's Android or iOS applications and simplify your document-centric tasks today.

The simplest way to modify and eSign Oregon Department Of Transportation Report Your Taxes with ease

- Locate Oregon Department Of Transportation Report Your Taxes and click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize signNow sections of the documents or obscure sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Revise and eSign Oregon Department Of Transportation Report Your Taxes and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the oregon department of transportation report your taxes

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a vehicle trip record?

A vehicle trip record is a detailed log that tracks the mileage, destinations, and purposes of trips made by a vehicle. This record is essential for businesses to maintain compliance with transportation regulations and optimize their fleet management. Utilizing airSlate SignNow can streamline the process of documenting these trips through easy eSigning and storage.

-

How does airSlate SignNow help with managing vehicle trip records?

airSlate SignNow simplifies the management of vehicle trip records by providing an intuitive platform for creating, sending, and eSigning documents. Businesses can easily store all trip records in one place, ensuring easy access and organization. This enhances efficiency and reduces the risk of errors associated with manual documentation.

-

Are there any costs associated with using airSlate SignNow for vehicle trip records?

Yes, airSlate SignNow offers flexible pricing plans tailored to meet different business needs. The cost varies based on the features you select, but it is designed to be cost-effective for companies looking to improve their vehicle trip record management. You can start with a free trial to explore the capabilities before committing.

-

What features does airSlate SignNow offer for vehicle trip record documentation?

The platform provides features like customizable templates, automated workflows, and eSigning capabilities that are specifically beneficial for vehicle trip records. These tools enable businesses to streamline the documentation process, ensuring accuracy and compliance. Additionally, real-time tracking and notifications keep all team members informed.

-

Can airSlate SignNow integrate with other tools I use for vehicle management?

Yes, airSlate SignNow offers integration capabilities with various other tools and software commonly used in vehicle management. This allows for seamless data transfer and enhances the overall effectiveness of your vehicle trip record system. Explore integrations that work best for your existing workflows.

-

What are the benefits of using airSlate SignNow for vehicle trip records?

Using airSlate SignNow for vehicle trip records enhances efficiency, accuracy, and compliance in documenting trips. The platform signNowly reduces the time spent on paper-based processes, allowing your team to focus on core activities. Furthermore, the ability to eSign documents remotely ensures that trip records are completed swiftly, regardless of location.

-

Is it easy to access and manage vehicle trip records on airSlate SignNow?

Absolutely! airSlate SignNow provides a user-friendly interface that makes accessing and managing vehicle trip records simple. You can easily search for and retrieve any document, ensuring that you have quick access to important trip information when needed. The cloud-based platform also allows for secure storage and easy sharing.

Get more for Oregon Department Of Transportation Report Your Taxes

Find out other Oregon Department Of Transportation Report Your Taxes

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF