3800N Nebraska Department of Revenue 2022-2026

What is the 3800N Nebraska Department of Revenue

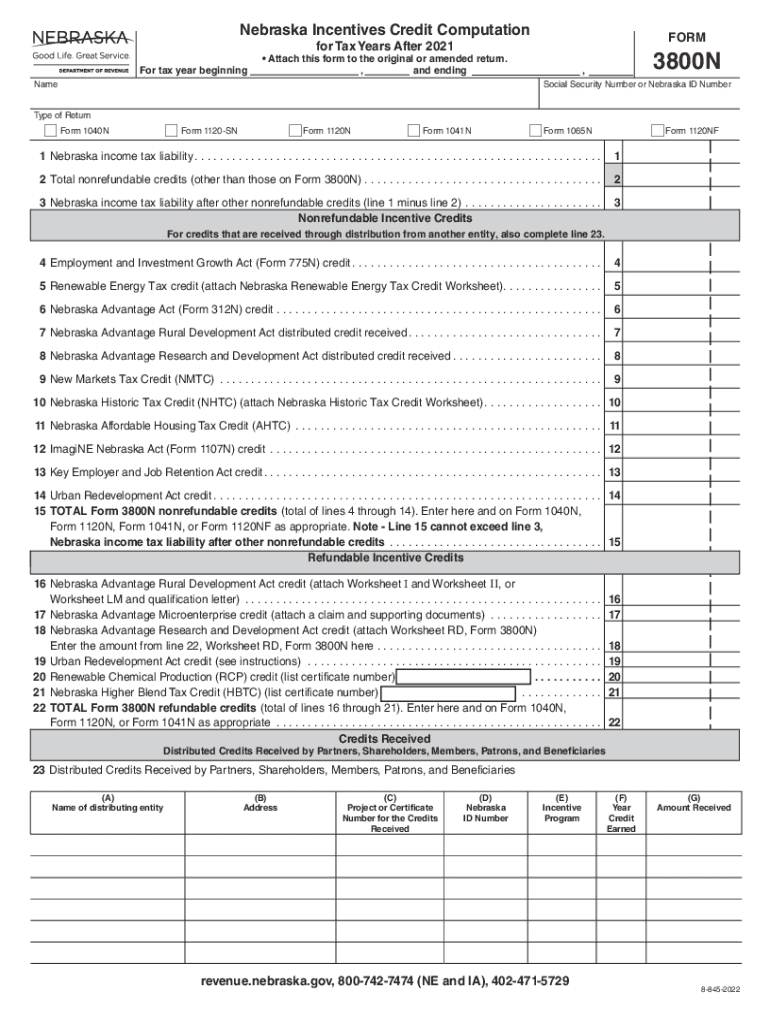

The 3800N form, issued by the Nebraska Department of Revenue, is a tax form used to claim the Nebraska Incentives Credit. This credit is designed to encourage businesses to invest in the state by providing tax relief for qualifying activities. The form is essential for taxpayers who wish to benefit from specific incentives offered by the state, making it a vital component of the Nebraska tax system.

How to use the 3800N Nebraska Department of Revenue

Using the 3800N form involves several steps to ensure that you correctly claim the incentives available. First, gather all necessary documentation that supports your eligibility for the credit. This may include proof of investments or activities that qualify under Nebraska's incentive programs. Next, complete the form accurately, ensuring that all required fields are filled out. Once completed, submit the form as directed by the Nebraska Department of Revenue, either electronically or via mail.

Steps to complete the 3800N Nebraska Department of Revenue

Completing the 3800N form requires attention to detail. Follow these steps:

- Review the eligibility criteria for the Nebraska Incentives Credit to confirm your qualification.

- Collect all necessary documentation, including financial records and proof of investment.

- Fill out the 3800N form, ensuring all sections are completed accurately.

- Double-check your entries for accuracy and completeness.

- Submit the form through the appropriate channels, whether online or by mail.

Legal use of the 3800N Nebraska Department of Revenue

The legal use of the 3800N form is governed by Nebraska state tax laws. To ensure compliance, taxpayers must adhere to the guidelines set forth by the Nebraska Department of Revenue. This includes using the form only for its intended purpose, accurately reporting all relevant information, and maintaining records that support the claims made on the form. Failure to comply with these legal requirements may result in penalties or denial of the credit.

Eligibility Criteria

To qualify for the Nebraska Incentives Credit claimed on the 3800N form, certain criteria must be met. Generally, businesses must demonstrate that they have made qualifying investments within the state. This may include expenditures on equipment, facilities, or other eligible activities as defined by Nebraska law. Additionally, businesses must be registered and in good standing with the Nebraska Department of Revenue to be eligible for the credit.

Form Submission Methods

The 3800N form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission through the Nebraska Department of Revenue's electronic filing system.

- Mailing a completed paper form to the designated address provided by the Department.

- In-person submission at local Department of Revenue offices, if applicable.

Quick guide on how to complete 3800n nebraska department of revenue

Complete 3800N Nebraska Department Of Revenue effortlessly on any gadget

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage 3800N Nebraska Department Of Revenue on any gadget using airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to adjust and eSign 3800N Nebraska Department Of Revenue without any hassle

- Obtain 3800N Nebraska Department Of Revenue and then click Get Form to initiate.

- Employ the tools we provide to finalize your form.

- Emphasize relevant parts of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and then click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from a device of your preference. Modify and eSign 3800N Nebraska Department Of Revenue and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 3800n nebraska department of revenue

Create this form in 5 minutes!

How to create an eSignature for the 3800n nebraska department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 3800n credit and how does it work with airSlate SignNow?

The 3800n credit refers to a specific credit option available within the airSlate SignNow platform that allows users to send and eSign documents efficiently. By leveraging this credit, businesses can streamline their document workflows, ensuring that important agreements are processed quickly and securely.

-

How much does it cost to purchase 3800n credit for airSlate SignNow?

The pricing for 3800n credit in airSlate SignNow varies depending on the specific package and features selected. Generally, purchasing credits can offer signNow savings over traditional pay-per-use models, making it a cost-effective choice for businesses looking to manage their document processes.

-

What features are included with the 3800n credit in airSlate SignNow?

When you utilize 3800n credit in airSlate SignNow, you gain access to powerful features such as customizable templates, bulk sending capabilities, and detailed tracking of document statuses. These features enhance overall workflow efficiency and enable users to manage multiple documents effortlessly.

-

What are the benefits of using 3800n credit with airSlate SignNow?

Using 3800n credit with airSlate SignNow provides businesses with enhanced flexibility in document management and signing. It not only saves time but also reduces operational costs by centralizing the document signing process, making it convenient for all parties involved.

-

Are there any integrations available for 3800n credit in airSlate SignNow?

Yes, airSlate SignNow with 3800n credit offers various integrations with popular business tools such as Salesforce, Google Drive, and Dropbox. These integrations facilitate seamless workflows, enabling users to manage documents from their favorite applications without hassle.

-

Can I track my document status when using 3800n credit?

Absolutely! airSlate SignNow allows users to track the status of their documents in real-time when using 3800n credit. You can easily see when a document is viewed, signed, or completed, ensuring that you remain updated throughout the signing process.

-

Is the 3800n credit refundable if I no longer need it?

The policy for refunding 3800n credit in airSlate SignNow may depend on the specific terms and conditions at the time of purchase. It is advisable to check the refund policy on the website or contact customer support for detailed information regarding refunds.

Get more for 3800N Nebraska Department Of Revenue

Find out other 3800N Nebraska Department Of Revenue

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template

- How To Electronic signature Kentucky Investment Contract

- Electronic signature Tennessee Consulting Agreement Template Fast

- How To Electronic signature California General Power of Attorney Template

- eSignature Alaska Bill of Sale Immovable Property Online

- Can I Electronic signature Delaware General Power of Attorney Template

- Can I Electronic signature Michigan General Power of Attorney Template

- Can I Electronic signature Minnesota General Power of Attorney Template

- How Do I Electronic signature California Distributor Agreement Template

- eSignature Michigan Escrow Agreement Simple

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement