Printable Nebraska Form 3800N Nebraska Incentives Credit Computation for All Tax Years 2019

Understanding the Nebraska 3800N Form for Incentives Credit Computation

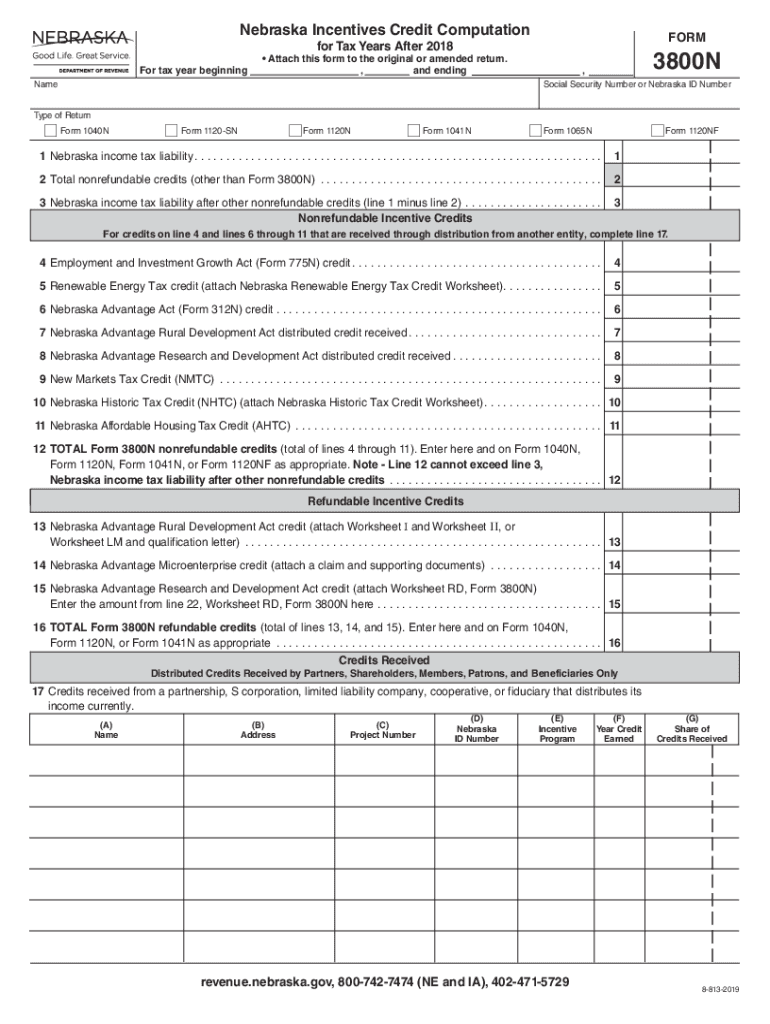

The Nebraska 3800N form is specifically designed for taxpayers seeking to claim the Nebraska incentives credit. This form is essential for those who have participated in qualifying activities that contribute to economic development within the state. The 3800N form allows individuals and businesses to compute their eligibility for the incentives credit, which can significantly reduce tax liabilities. It is important to understand the specific requirements and calculations involved in this form to ensure accurate submission and compliance with state regulations.

Steps to Complete the Nebraska 3800N Form

Completing the Nebraska 3800N form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documentation related to your eligibility for the incentives credit. This may include financial statements, proof of investment, and any relevant tax records. Next, carefully fill out the form, paying close attention to each section, including the computation of the credit based on your qualifying activities. After completing the form, review it for any errors or omissions before submitting it to the Nebraska Department of Revenue.

Eligibility Criteria for the Nebraska 3800N Incentives Credit

To qualify for the Nebraska incentives credit, certain eligibility criteria must be met. Taxpayers must demonstrate that they have engaged in activities that promote economic growth, such as investing in new facilities or creating jobs within the state. Additionally, the activities must align with the guidelines set forth by the Nebraska Department of Revenue. It is crucial to review these criteria thoroughly before completing the 3800N form to ensure compliance and maximize potential benefits.

Obtaining the Nebraska 3800N Form

The Nebraska 3800N form can be easily obtained through the Nebraska Department of Revenue's official website. It is available in a printable format, allowing taxpayers to fill it out by hand or electronically. For those who prefer a digital approach, the form can also be completed online using compatible software. Ensure that you have the most current version of the form, as updates may occur annually or as regulations change.

Legal Use of the Nebraska 3800N Form

The Nebraska 3800N form is legally binding when completed and submitted in accordance with state laws. To ensure that the form is recognized as valid, it must be filled out accurately, with all required signatures and supporting documentation included. Compliance with the guidelines established by the Nebraska Department of Revenue is essential for the form to be accepted and for the incentives credit to be granted. Understanding the legal implications of the form helps taxpayers navigate the process with confidence.

Important Filing Deadlines for the Nebraska 3800N Form

Filing deadlines for the Nebraska 3800N form are critical to ensure timely processing of your incentives credit claim. Typically, the form must be submitted by the tax filing deadline for the year in which the credit is being claimed. It is advisable to check the Nebraska Department of Revenue's announcements for any specific dates or changes to the filing schedule. Missing the deadline may result in the forfeiture of the credit, so timely submission is essential.

Quick guide on how to complete printable 2020 nebraska form 3800n nebraska incentives credit computation for all tax years

Prepare Printable Nebraska Form 3800N Nebraska Incentives Credit Computation For All Tax Years effortlessly on any device

Digital document management has gained traction among companies and individuals. It offers an ideal environmentally friendly alternative to conventional paper documents that require printing and signing, as you can obtain the correct format and securely archive it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents promptly and efficiently. Manage Printable Nebraska Form 3800N Nebraska Incentives Credit Computation For All Tax Years on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

The simplest way to alter and eSign Printable Nebraska Form 3800N Nebraska Incentives Credit Computation For All Tax Years with ease

- Find Printable Nebraska Form 3800N Nebraska Incentives Credit Computation For All Tax Years and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Generate your signature using the Sign feature, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign Printable Nebraska Form 3800N Nebraska Incentives Credit Computation For All Tax Years and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct printable 2020 nebraska form 3800n nebraska incentives credit computation for all tax years

Create this form in 5 minutes!

How to create an eSignature for the printable 2020 nebraska form 3800n nebraska incentives credit computation for all tax years

The way to generate an electronic signature for a PDF document in the online mode

The way to generate an electronic signature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

How to create an electronic signature right from your mobile device

The best way to make an eSignature for a PDF document on iOS devices

How to create an electronic signature for a PDF on Android devices

People also ask

-

What is the 3800n form used for?

The 3800n form is primarily used for electronically signing important documents in a secure manner. With airSlate SignNow, users can easily fill out, sign, and send the 3800n form, streamlining document workflows and enhancing efficiency.

-

How does airSlate SignNow help with the 3800n form?

airSlate SignNow simplifies the process of creating and managing the 3800n form. Our user-friendly platform allows you to upload, edit, and sign the form within minutes, making compliance and document management hassle-free.

-

Is there a free trial available for the 3800n form service?

Yes, airSlate SignNow offers a free trial that allows you to explore the features related to the 3800n form. You can experience how easy it is to eSign documents and utilize our full suite of tools before deciding on a subscription plan.

-

What pricing plans are available for using the 3800n form on airSlate SignNow?

airSlate SignNow provides various pricing plans tailored to meet the needs of different users. You can choose from individual, business, or enterprise plans, all designed to include features that facilitate the use of the 3800n form at an affordable cost.

-

Are there any integrations available for the 3800n form?

Absolutely! airSlate SignNow supports multiple integrations with popular applications, enhancing your workflow involving the 3800n form. You can easily connect with CRM systems, cloud storage services, and more for streamlined processes.

-

What are the security features when using the 3800n form with airSlate SignNow?

The security of your data when using the 3800n form is a top priority for airSlate SignNow. We utilize advanced encryption methods, multi-factor authentication, and secure data storage to ensure that all your documents remain confidential and protected.

-

Can I customize the 3800n form templates in airSlate SignNow?

Yes, airSlate SignNow allows you to customize the 3800n form templates to suit your specific requirements. You can add your branding, modify fields, and tailor the form design to align with your business needs.

Get more for Printable Nebraska Form 3800N Nebraska Incentives Credit Computation For All Tax Years

- Oklahoma uniform contract of sale of real estate residential sale

- Oklahoma standard residential lease agreement eforms

- Oklahoma property condition disclaimer statement form

- Nevada short sale addendum to purchase agreement form

- 524 comp consent to act form

- 40 free roommate agreement templates ampamp forms word pdf

- Free nevada lease agreement with option to purchase form

- New jersey department of community affairs njgov form

Find out other Printable Nebraska Form 3800N Nebraska Incentives Credit Computation For All Tax Years

- How Can I Electronic signature Texas Customer Return Report

- How Do I Electronic signature Florida Reseller Agreement

- Electronic signature Indiana Sponsorship Agreement Free

- Can I Electronic signature Vermont Bulk Sale Agreement

- Electronic signature Alaska Medical Records Release Mobile

- Electronic signature California Medical Records Release Myself

- Can I Electronic signature Massachusetts Medical Records Release

- How Do I Electronic signature Michigan Medical Records Release

- Electronic signature Indiana Membership Agreement Easy

- How Can I Electronic signature New Jersey Medical Records Release

- Electronic signature New Mexico Medical Records Release Easy

- How Can I Electronic signature Alabama Advance Healthcare Directive

- How Do I Electronic signature South Carolina Advance Healthcare Directive

- eSignature Kentucky Applicant Appraisal Form Evaluation Later

- Electronic signature Colorado Client and Developer Agreement Later

- Electronic signature Nevada Affiliate Program Agreement Secure

- Can I Electronic signature Pennsylvania Co-Branding Agreement

- Can I Electronic signature South Dakota Engineering Proposal Template

- How Do I Electronic signature Arizona Proforma Invoice Template

- Electronic signature California Proforma Invoice Template Now