Form 121A ES "Urban Redevelopment Estimated Excise

What is the Form 121A Urban Redevelopment Estimated Excise?

The Form 121A Urban Redevelopment Estimated Excise is a tax document used in Massachusetts to report the estimated excise tax associated with urban redevelopment projects. This form is essential for developers and property owners engaged in urban renewal initiatives, as it helps calculate the tax obligations arising from such projects. The excise tax is typically based on the value of the redevelopment and is aimed at funding local infrastructure and community services.

Steps to Complete the Form 121A Urban Redevelopment Estimated Excise

Completing the Form 121A requires careful attention to detail. Here are the steps to ensure accurate completion:

- Gather necessary information, including project details, estimated costs, and property valuations.

- Fill out the form with accurate data, ensuring all sections are completed to avoid delays.

- Review the form for any errors or omissions before submission.

- Submit the form by the specified deadline to avoid penalties.

Legal Use of the Form 121A Urban Redevelopment Estimated Excise

The legal use of Form 121A is governed by Massachusetts tax laws. It is crucial for the form to be filled out correctly to ensure compliance with state regulations. The form serves as an official declaration of tax liability, and accurate reporting is essential to avoid legal repercussions. Additionally, the form must be signed by the appropriate parties to validate its contents.

Filing Deadlines / Important Dates

Timely filing of the Form 121A is critical. The deadlines for submission can vary based on the specific project and local regulations. Generally, forms must be submitted annually, with specific due dates set by the Massachusetts Department of Revenue. It is advisable to check for any updates or changes to these deadlines to ensure compliance and avoid late fees.

Form Submission Methods

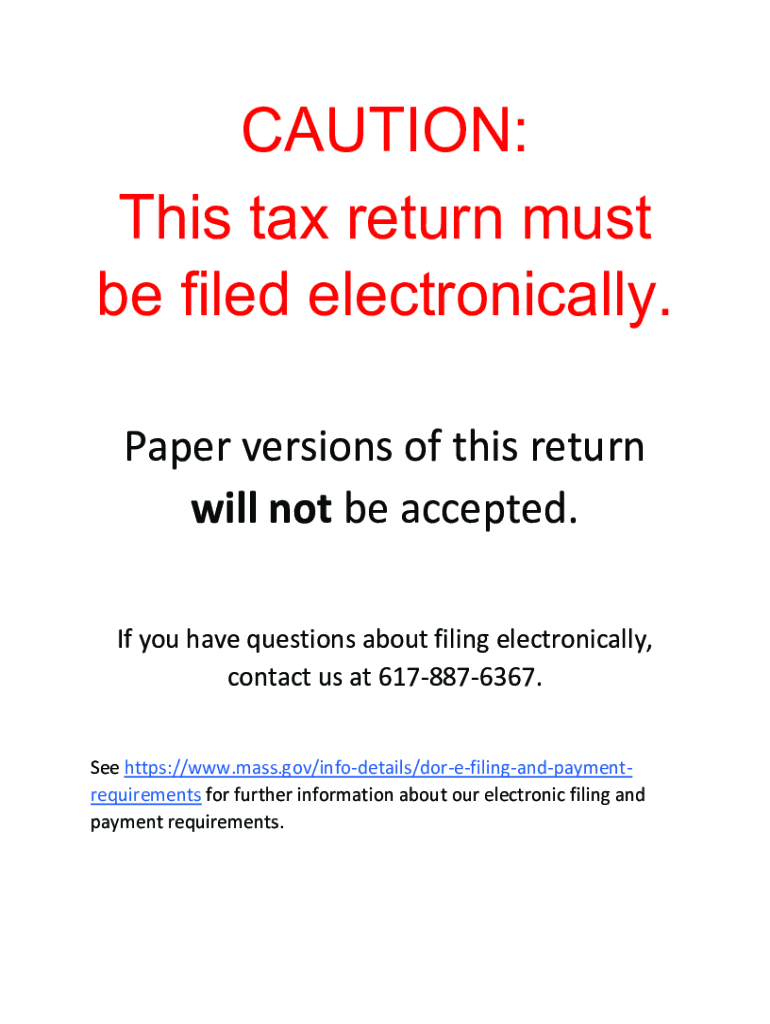

The Form 121A can be submitted through various methods, including:

- Online submission via the Massachusetts Department of Revenue website.

- Mailing a printed copy of the completed form to the designated address.

- In-person submission at local tax offices, where available.

Key Elements of the Form 121A Urban Redevelopment Estimated Excise

Understanding the key elements of the Form 121A is essential for accurate completion. Key components include:

- Property identification details, including address and parcel number.

- Estimated redevelopment costs and project descriptions.

- Calculation of the excise tax based on the assessed value of the redevelopment.

- Signature of the responsible party, confirming the accuracy of the information provided.

Quick guide on how to complete form 121a es ampquoturban redevelopment estimated excise

Prepare Form 121A ES "Urban Redevelopment Estimated Excise easily on any device

Online document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your files rapidly without delays. Manage Form 121A ES "Urban Redevelopment Estimated Excise on any device with airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

How to modify and eSign Form 121A ES "Urban Redevelopment Estimated Excise effortlessly

- Obtain Form 121A ES "Urban Redevelopment Estimated Excise and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes moments and carries the same legal validity as a traditional handwritten signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your preference. Edit and eSign Form 121A ES "Urban Redevelopment Estimated Excise and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 121a es ampquoturban redevelopment estimated excise

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 121a urban redevelopment excise?

The 121a urban redevelopment excise is a financial tool designed to help municipalities and developers fund urban redevelopment projects. It allows for the investment in infrastructure and public amenities, ultimately leading to revived urban areas. Understanding this excise can help businesses leverage it effectively in their redevelopment plans.

-

How can airSlate SignNow assist with managing 121a urban redevelopment excise documentation?

airSlate SignNow streamlines the document management process for the 121a urban redevelopment excise. Our platform allows you to create, send, and eSign documents effortlessly, ensuring that all relevant paperwork is handled efficiently. This helps in avoiding delays and enhances compliance with legal requirements related to the excise.

-

What are the pricing options for airSlate SignNow when dealing with 121a urban redevelopment excise projects?

AirSlate SignNow offers flexible pricing plans tailored for businesses involved in 121a urban redevelopment excise projects. Depending on your needs, you can choose from individual, business, or enterprise plans that provide a range of features. Each plan is designed to be cost-effective while ensuring you have the tools needed for efficient document management.

-

What features does airSlate SignNow offer for handling 121a urban redevelopment excises?

Our platform includes features such as customizable templates, secure eSigning, automated workflows, and real-time tracking, which are essential for managing 121a urban redevelopment excises. These features enhance collaboration and ensure that all parties involved have access to necessary documents when needed. With airSlate SignNow, you can manage the full lifecycle of your redevelopment documents effortlessly.

-

How does airSlate SignNow enhance collaboration on 121a urban redevelopment excise projects?

AirSlate SignNow fosters collaboration on 121a urban redevelopment excise projects through real-time editing and commenting features. This allows all stakeholders, including developers and municipal authorities, to interact directly on documents. Effective collaboration ensures that projects remain on track and compliant with all regulations related to the excise.

-

Can airSlate SignNow integrate with other tools for 121a urban redevelopment excise management?

Yes, airSlate SignNow seamlessly integrates with various tools commonly used in the management of 121a urban redevelopment excise projects. This includes project management software, CRM systems, and cloud storage solutions, which facilitate a smooth workflow and data sharing. This integration capability ensures that you have a comprehensive solution for all your redevelopment needs.

-

What are the benefits of using airSlate SignNow for 121a urban redevelopment excises?

Utilizing airSlate SignNow for managing 121a urban redevelopment excises can lead to signNow time and cost savings. The platform simplifies the eSigning process and provides a user-friendly experience, making it accessible to all team members. Moreover, improved document security and compliance help mitigate risks involved in urban redevelopment projects.

Get more for Form 121A ES "Urban Redevelopment Estimated Excise

- Plaintiffs response to second amended motion to dismiss and for sanctions mississippi form

- Mississippi burial form

- Mississippi interpleader form

- Mississippi motion dismiss 497314203 form

- Support dismiss form

- Motion arbitration form

- Checklist for the outdoor exhibition of fireworks codes ohio form

- Aikenco op form

Find out other Form 121A ES "Urban Redevelopment Estimated Excise

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now