2022

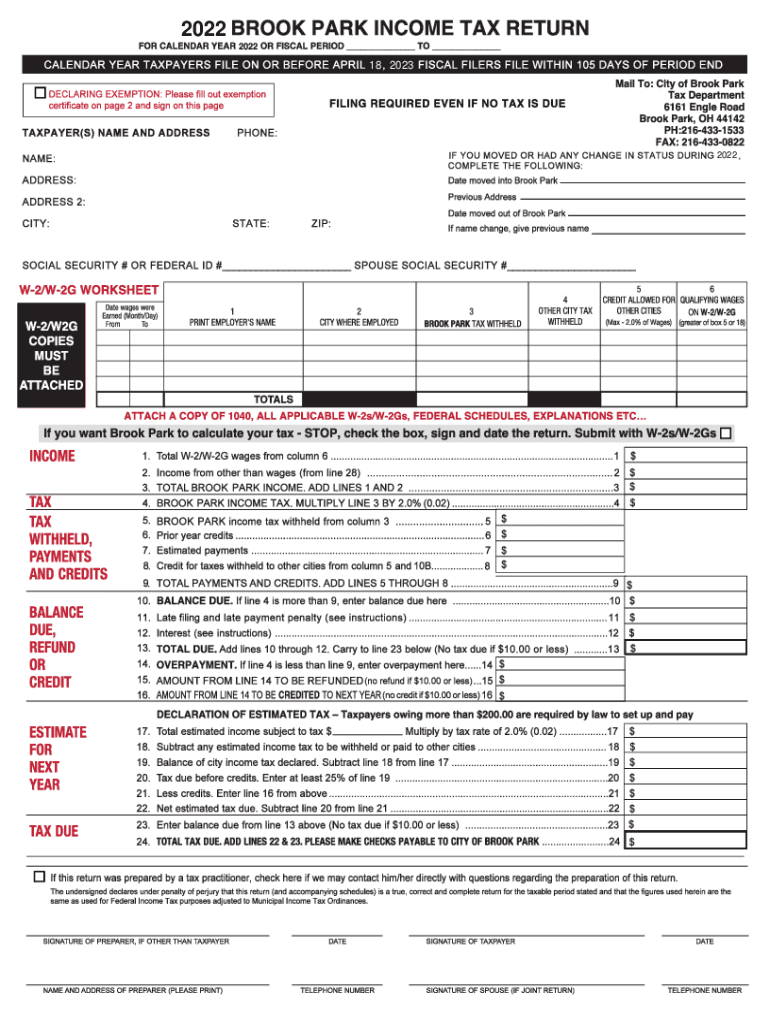

What is the Ohio income tax return form?

The Ohio income tax return form is a document that residents of Ohio use to report their income to the state for tax purposes. This form is essential for calculating the amount of state income tax owed or any potential refund due. The form typically requires information about various income sources, deductions, and credits applicable to the taxpayer's situation. Understanding this form is crucial for compliance with Ohio tax laws and for ensuring accurate tax filings.

Steps to complete the Ohio income tax return form

Completing the Ohio income tax return form involves several key steps:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Determine your filing status, which can affect your tax rate and eligibility for certain credits.

- Fill out the form with accurate income information and applicable deductions.

- Review the form for errors and ensure all required fields are completed.

- Sign and date the form, confirming the information is correct.

- Submit the completed form either electronically or via mail, according to your preference.

Legal use of the Ohio income tax return form

The Ohio income tax return form is legally binding when completed and submitted according to state regulations. To ensure its legal validity, taxpayers must provide accurate information and sign the form. Electronic signatures are accepted, provided they comply with the relevant eSignature laws, such as the ESIGN Act and UETA. This means that using a trusted digital platform for signing can enhance the legal standing of the submitted form.

Filing deadlines / Important dates

Taxpayers in Ohio should be aware of specific deadlines for filing their income tax return forms. Generally, the deadline for submitting the Ohio income tax return is April 15 of each year, aligning with the federal tax filing deadline. If this date falls on a weekend or holiday, the deadline may be extended. It is important to stay informed about any changes to these dates, as they can impact your tax obligations.

Form submission methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the Ohio income tax return form. The most common methods include:

- Online submission: Many taxpayers choose to file electronically using tax software or online services, which can streamline the process and reduce errors.

- Mail: Paper forms can be completed and mailed to the appropriate tax authority. Ensure that you use the correct address and include any necessary documentation.

- In-person: Some taxpayers may opt to file their forms in person at designated tax offices, where assistance may be available.

Required documents

When completing the Ohio income tax return form, certain documents are essential for accurate reporting. These typically include:

- W-2 forms from employers, detailing wages and withheld taxes.

- 1099 forms for any freelance or contract work.

- Documentation for deductions, such as receipts for charitable contributions or medical expenses.

- Any additional forms relevant to specific tax credits or situations, such as education credits.

IRS guidelines

While the Ohio income tax return form is specific to state requirements, it is important to align your state filing with IRS guidelines. This includes understanding how state income taxes interact with federal tax obligations. Taxpayers should ensure that any income reported on the Ohio form is consistent with what has been reported to the IRS to avoid discrepancies that could trigger audits or penalties.

Quick guide on how to complete 627571040

Complete effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the correct form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centered task today.

The simplest method to alter and electronically sign with ease

- Find and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal significance as a traditional wet ink signature.

- Review all the information and then click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign to ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 627571040

Create this form in 5 minutes!

How to create an eSignature for the 627571040

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Ohio income tax return form?

The Ohio income tax return form is a document that residents of Ohio must complete to report their income and calculate their tax liability. It is essential for ensuring compliance with state tax laws. Utilizing the right tools, like airSlate SignNow, makes completing and submitting your Ohio income tax return form easier and more efficient.

-

How can I access the Ohio income tax return form?

You can access the Ohio income tax return form online through the Ohio Department of Taxation's website or directly within the airSlate SignNow platform. Our solution streamlines the process, allowing you to fill out and eSign the form quickly. This ensures you have the most up-to-date version of the form.

-

What features does airSlate SignNow offer for filling out the Ohio income tax return form?

airSlate SignNow comes with user-friendly features that allow you to easily complete your Ohio income tax return form online. With templates and customizable fields, you can enter your information seamlessly. Additionally, our eSignature capabilities ensure you can sign the form without printing it.

-

Is there a cost to use airSlate SignNow for the Ohio income tax return form?

Yes, airSlate SignNow offers a variety of pricing plans to accommodate individuals and businesses. The cost depends on the features you need for managing documents, including the Ohio income tax return form. Our plans are designed to be cost-effective and provide excellent value for users.

-

Can I share my Ohio income tax return form with others using airSlate SignNow?

Absolutely! airSlate SignNow allows you to share your Ohio income tax return form securely with tax professionals or partners for review or signature. You can invite collaborators directly through the platform, ensuring that everyone has access to the same document.

-

What benefits does eSigning the Ohio income tax return form offer?

eSigning your Ohio income tax return form offers numerous benefits, including faster processing times and increased convenience. You no longer need to print, sign, and scan documents, as airSlate SignNow provides a secure and efficient way to sign forms electronically. This not only saves time but also reduces paper waste.

-

Is my information secure when using airSlate SignNow for the Ohio income tax return form?

Yes, security is a top priority at airSlate SignNow. All information entered into your Ohio income tax return form is encrypted and stored securely, ensuring your data remains private and protected. We comply with all industry standards to safeguard your sensitive information.

Get more for

Find out other

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF