DO NOT FILE THIS DRAFT FORM Cloudfront Net 2022

Understanding the Massachusetts Income Tax Payment Voucher

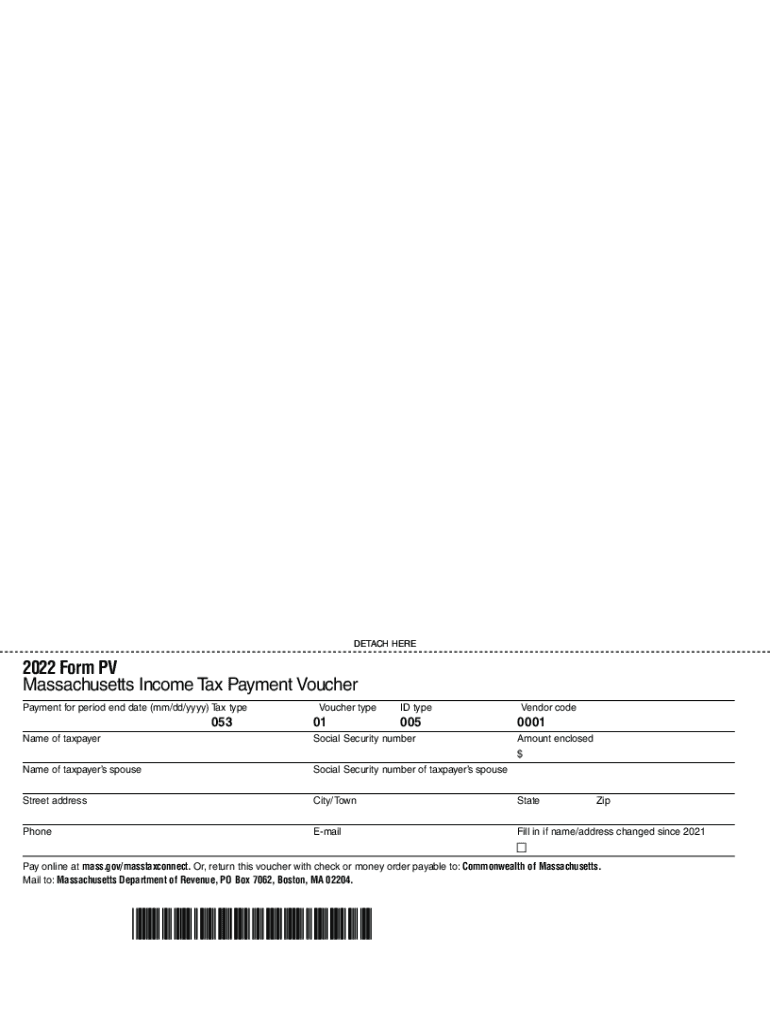

The Massachusetts income tax payment voucher, commonly referred to as the MA PV, is a crucial form for individuals who need to make tax payments directly to the state. This voucher is typically used when taxpayers owe additional taxes beyond what has been withheld from their income. It is important to fill out this form accurately to ensure that your payment is properly credited to your account.

Steps to Complete the Massachusetts Income Tax Payment Voucher

To successfully complete the Massachusetts tax payment voucher, follow these steps:

- Obtain the correct version of the MA PV form, ensuring it corresponds to the tax year you are filing for.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate the amount you are paying, ensuring it matches your tax liability.

- Sign and date the form to validate your submission.

- Submit the voucher along with your payment, either by mail or electronically, depending on your preference.

Filing Deadlines for Massachusetts Income Tax Payments

It is essential to be aware of the filing deadlines for your Massachusetts income tax payments. Generally, the deadline for filing personal income tax returns and making payments is April fifteenth. If this date falls on a weekend or holiday, the deadline is extended to the next business day. Late payments may incur penalties and interest, so timely submission is crucial.

Form Submission Methods for the Massachusetts Tax Payment Voucher

The Massachusetts income tax payment voucher can be submitted in several ways:

- By Mail: Send the completed MA PV form along with your payment to the address specified on the form.

- Online: Use the Massachusetts Department of Revenue's online portal to submit your payment electronically.

- In-Person: Deliver your payment and voucher directly to your local Department of Revenue office.

Key Elements of the Massachusetts Income Tax Payment Voucher

The MA PV form includes several key elements that must be completed to ensure proper processing:

- Taxpayer Information: Name, address, and Social Security number.

- Payment Amount: The total amount being submitted for payment.

- Tax Year: Indicate the tax year for which the payment is being made.

- Signature: The taxpayer must sign and date the form to validate the submission.

Penalties for Non-Compliance with Massachusetts Tax Payments

Failure to submit your Massachusetts income tax payment voucher on time can result in penalties. The state may impose a late payment penalty, which is typically a percentage of the unpaid tax amount. Additionally, interest may accrue on any unpaid balance, increasing the total amount owed. To avoid these penalties, it is advisable to file and pay on time.

Quick guide on how to complete do not file this draft form cloudfrontnet

Effortlessly Prepare DO NOT FILE THIS DRAFT FORM Cloudfront net on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can locate the appropriate form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Manage DO NOT FILE THIS DRAFT FORM Cloudfront net on any device using the airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

How to Modify and Electrically Sign DO NOT FILE THIS DRAFT FORM Cloudfront net with Ease

- Locate DO NOT FILE THIS DRAFT FORM Cloudfront net and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose how you prefer to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you select. Modify and electronically sign DO NOT FILE THIS DRAFT FORM Cloudfront net and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct do not file this draft form cloudfrontnet

Create this form in 5 minutes!

How to create an eSignature for the do not file this draft form cloudfrontnet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for making a Massachusetts income tax payment using airSlate SignNow?

Using airSlate SignNow, you can easily create, sign, and send documents related to your Massachusetts income tax payment. Simply upload your tax form, send it for eSignature, and ensure it's submitted on time. Our platform streamlines the entire process, making it more efficient for your financial obligations.

-

Are there any fees associated with Massachusetts income tax payment through airSlate SignNow?

airSlate SignNow offers competitive pricing plans that are cost-effective for handling your Massachusetts income tax payment documentation. Each plan includes features that facilitate document management and eSigning. No hidden fees apply, ensuring you know exactly what you'll pay to manage your tax documents efficiently.

-

Can I track my Massachusetts income tax payment status with airSlate SignNow?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your documents associated with your Massachusetts income tax payment. You'll receive notifications when your documents are signed and completed, ensuring you have all the information in real-time. This transparency keeps you informed throughout the process.

-

What features does airSlate SignNow offer for managing Massachusetts income tax payment documents?

airSlate SignNow offers a robust set of features designed for managing your Massachusetts income tax payment documents. These include customizable templates, secure eSigning, automatic reminders, and document storage. These tools help streamline your tax paperwork and enhance productivity.

-

How can airSlate SignNow benefit businesses handling multiple Massachusetts income tax payments?

airSlate SignNow is particularly beneficial for businesses handling multiple Massachusetts income tax payments due to its efficiency and ease of use. By allowing for bulk processing of documents, built-in compliance features, and collaborative signing, you can manage all your tax-related paperwork in one secure platform. This saves time and reduces errors in your submissions.

-

Is airSlate SignNow compliant with Massachusetts income tax regulations?

Yes, airSlate SignNow is designed to comply with Massachusetts income tax regulations, ensuring your documents meet legal standards. Our platform follows strict security protocols and eSignature laws, helping you adhere to regulations while efficiently processing your tax payments. Compliance is a top priority for us, so you can use our service confidently.

-

What integrations does airSlate SignNow offer for managing Massachusetts income tax payments?

airSlate SignNow offers various integrations with popular business applications that can assist in managing your Massachusetts income tax payment processes. You can connect our platform with tools like CRM systems, accounting software, and document management services to streamline your workflow further. These integrations enhance the overall efficiency of your tax document management.

Get more for DO NOT FILE THIS DRAFT FORM Cloudfront net

Find out other DO NOT FILE THIS DRAFT FORM Cloudfront net

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement