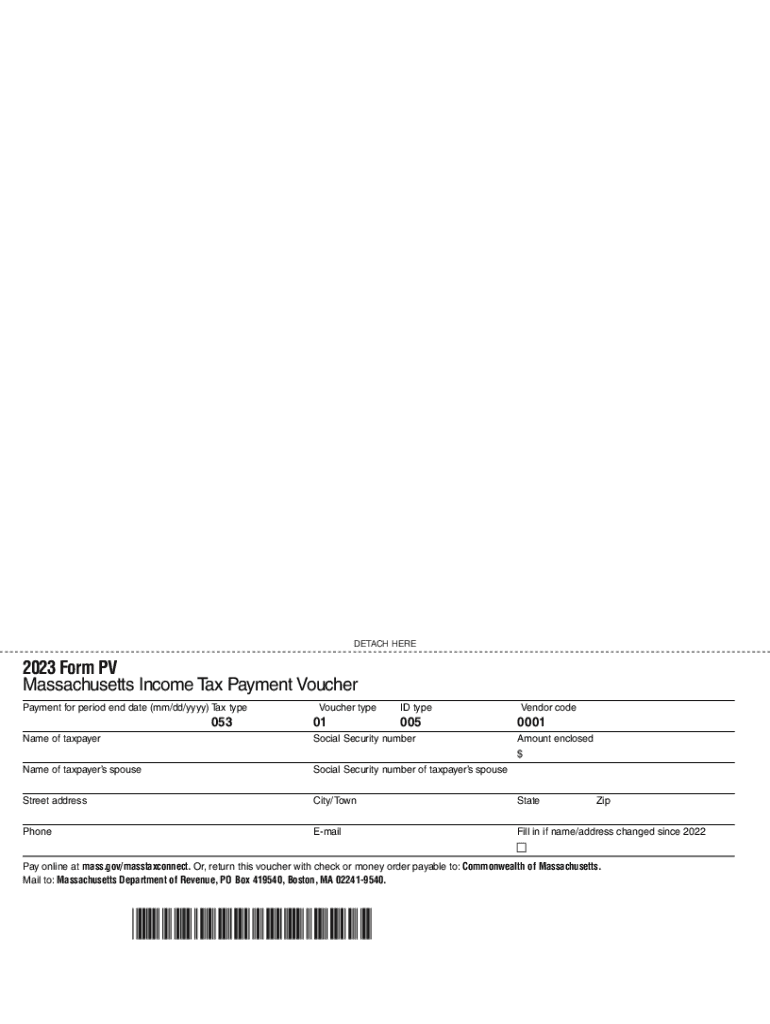

Massachusetts Form PV Income Tax Payment Voucher 2023

What is the Massachusetts Form PV Income Tax Payment Voucher

The Massachusetts Form PV, also known as the Massachusetts tax payment voucher, is a crucial document for individuals and businesses making estimated income tax payments to the state. It serves as a means for taxpayers to report and remit their estimated tax liabilities throughout the year, ensuring compliance with Massachusetts tax regulations. The form is specifically designed for those who expect to owe tax of more than a certain amount when filing their annual income tax return.

How to use the Massachusetts Form PV Income Tax Payment Voucher

Using the Massachusetts Form PV involves a few straightforward steps. First, taxpayers should accurately calculate their estimated tax liability for the year. This amount is then recorded on the form. After completing the form, individuals must submit it along with their payment to the Massachusetts Department of Revenue. It is essential to keep a copy of the completed voucher for personal records. The form can be used for both personal and business tax payments, making it versatile for various taxpayer scenarios.

Steps to complete the Massachusetts Form PV Income Tax Payment Voucher

Completing the Massachusetts Form PV requires careful attention to detail. Follow these steps:

- Obtain the latest version of the form from the Massachusetts Department of Revenue website.

- Fill in your personal information, including your name, address, and Social Security number or Employer Identification Number.

- Calculate your estimated tax liability for the year and enter the amount on the form.

- Choose the payment method, whether by check or electronic payment.

- Review the form for accuracy before submitting it.

Key elements of the Massachusetts Form PV Income Tax Payment Voucher

The Massachusetts Form PV contains several key elements that taxpayers must complete. These include:

- Taxpayer Information: Personal identification details such as name, address, and identification numbers.

- Estimated Tax Amount: The total estimated tax liability for the year.

- Payment Information: Details regarding the payment method and amount being submitted.

- Signature: The taxpayer's signature is required to validate the submission.

Form Submission Methods

Taxpayers have multiple options for submitting the Massachusetts Form PV. The form can be submitted in several ways:

- By Mail: Send the completed form and payment to the designated address provided on the form.

- Online: Use the Massachusetts Department of Revenue's online payment system to submit the form electronically.

- In-Person: Deliver the form and payment directly to a local Department of Revenue office.

Filing Deadlines / Important Dates

Timely submission of the Massachusetts Form PV is critical to avoid penalties. The filing deadlines typically align with quarterly estimated tax payment dates, which are usually:

- April fifteenth for the first quarter

- June fifteenth for the second quarter

- September fifteenth for the third quarter

- January fifteenth of the following year for the fourth quarter

Quick guide on how to complete massachusetts form pv income tax payment voucher

Complete Massachusetts Form PV Income Tax Payment Voucher seamlessly on any device

Digital document management has gained traction among companies and individuals alike. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Manage Massachusetts Form PV Income Tax Payment Voucher on any device using airSlate SignNow Android or iOS applications and enhance any document-centric procedure today.

The easiest way to modify and eSign Massachusetts Form PV Income Tax Payment Voucher with ease

- Obtain Massachusetts Form PV Income Tax Payment Voucher and click on Get Form to begin.

- Utilize the tools we provide to finalize your form.

- Mark important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tiring form searches, or mistakes that necessitate new document printouts. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you prefer. Modify and eSign Massachusetts Form PV Income Tax Payment Voucher to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct massachusetts form pv income tax payment voucher

Create this form in 5 minutes!

How to create an eSignature for the massachusetts form pv income tax payment voucher

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Massachusetts tax payment voucher?

A Massachusetts tax payment voucher is a form that taxpayers use to submit their payments for income taxes owed to the state. It ensures that your payment is correctly recorded and applied to your tax account. Using a Massachusetts tax payment voucher helps streamline the payment process, making it easier to manage your tax obligations.

-

How can airSlate SignNow help with Massachusetts tax payment vouchers?

airSlate SignNow provides an efficient platform for sending and eSigning your Massachusetts tax payment vouchers. With an easy-to-use interface, you can quickly prepare and securely sign your documents, ensuring timely submission. Utilizing airSlate SignNow simplifies the entire process, making it more convenient for taxpayers.

-

Is there a cost associated with using airSlate SignNow for Massachusetts tax payment vouchers?

Yes, while airSlate SignNow offers various pricing plans, it is generally a cost-effective solution for managing Massachusetts tax payment vouchers. The pricing depends on the features you select, but the platform aims to provide great value while helping you streamline your tax document management. Check our pricing page for specific details.

-

What features does airSlate SignNow offer for creating tax payment vouchers?

airSlate SignNow offers features like customizable templates, eSignature capabilities, and document tracking, all designed to enhance the experience of handling Massachusetts tax payment vouchers. You can easily create, send, and manage your vouchers, ensuring you have the tools needed to stay organized and compliant. These features signNowly reduce administrative burden and save time.

-

Can I integrate airSlate SignNow with my accounting software for tax payments?

Absolutely! airSlate SignNow provides integrations with a variety of accounting software, allowing you to seamlessly manage your Massachusetts tax payment vouchers. By integrating with tools like QuickBooks or Xero, you can streamline your financial processes and keep all your tax documents organized in one place. This integration simplifies tracking and reporting your tax obligations.

-

How does airSlate SignNow ensure the security of my Massachusetts tax payment vouchers?

Security is a top priority for airSlate SignNow. We implement advanced encryption and security protocols to protect your data when creating and storing Massachusetts tax payment vouchers. Our platform is compliant with industry standards, ensuring that your sensitive information remains safe and secure throughout the entire process.

-

What are the benefits of using airSlate SignNow for my business's tax payment process?

Using airSlate SignNow for your business's tax payment process provides numerous benefits, including increased efficiency, reduced paperwork, and faster processing. You can quickly prepare your Massachusetts tax payment vouchers and have them signed electronically, which accelerates the submission timeline. This streamlined approach saves time and reduces the risk of errors, ultimately benefiting your overall tax management.

Get more for Massachusetts Form PV Income Tax Payment Voucher

- Louisiana living wills laws state laws findlaw form

- Act of donation manual gift louisiana department form

- Control number la p025 pkg form

- Control number la p026 pkg form

- 10 steps to organize a senior widowed parents finances form

- Control number la p023 pkg form

- Control number la p031 pkg form

- Control number la p032 pkg form

Find out other Massachusetts Form PV Income Tax Payment Voucher

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online