Form BT 191 Change of Officer, Member or Partner Notification 2022-2026

What is the Form BT 191 Change Of Officer, Member Or Partner Notification

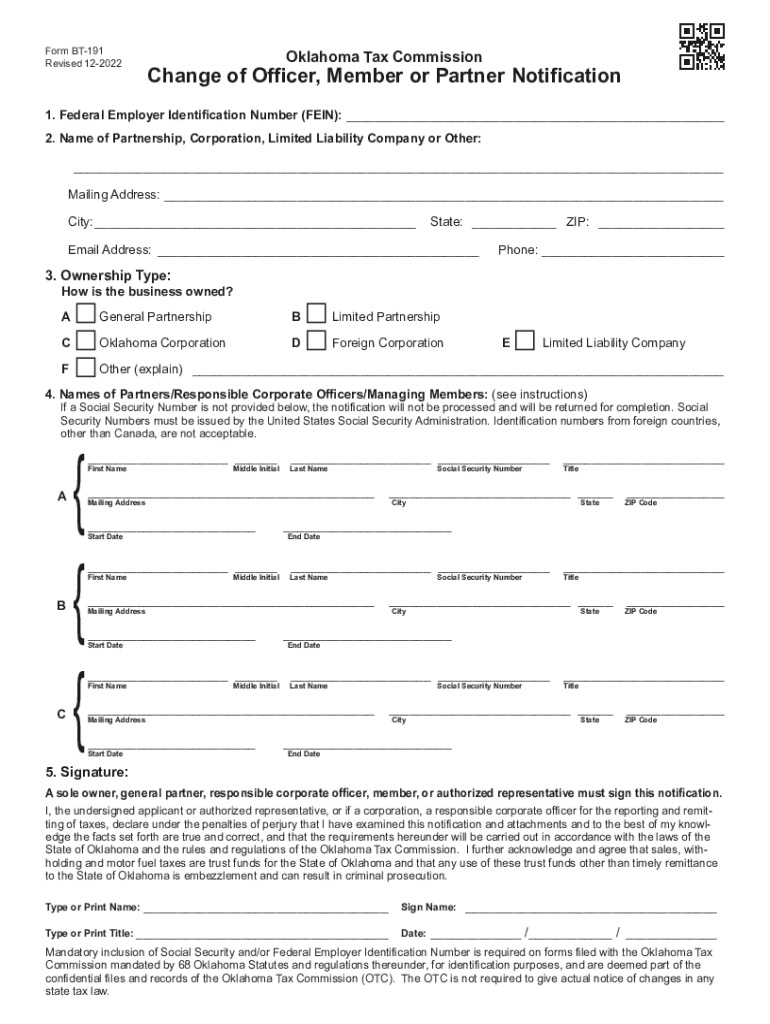

The Form BT 191 is a crucial document used to notify the appropriate authorities about changes in the officers, members, or partners of a business entity. This form is particularly relevant for limited liability companies (LLCs), corporations, and partnerships that need to maintain accurate records with state agencies. The notification ensures that the state has up-to-date information regarding the management and structure of the business, which is essential for legal compliance and transparency.

How to use the Form BT 191 Change Of Officer, Member Or Partner Notification

Using the Form BT 191 involves several straightforward steps. First, obtain the form from the relevant state agency's website or office. Next, fill out the required sections, which typically include details about the business and the specific changes in personnel. After completing the form, it must be submitted to the appropriate state office, either online or via mail, depending on state regulations. It is important to keep a copy of the submitted form for your records.

Steps to complete the Form BT 191 Change Of Officer, Member Or Partner Notification

Completing the Form BT 191 requires careful attention to detail. Here are the steps to follow:

- Download the Form BT 191 from the official state website.

- Provide the business name, address, and identification number.

- List the names and titles of the individuals being added or removed.

- Include the effective date of the changes.

- Sign and date the form, ensuring that all required signatures are obtained.

- Submit the form according to your state’s guidelines.

Legal use of the Form BT 191 Change Of Officer, Member Or Partner Notification

The legal use of the Form BT 191 is essential for maintaining compliance with state laws governing business entities. Filing this form correctly ensures that the business remains in good standing and avoids potential penalties. It is legally binding once submitted, as it reflects the official record of the business's management structure. Failure to file the form in a timely manner can lead to legal complications, including fines or loss of business privileges.

Key elements of the Form BT 191 Change Of Officer, Member Or Partner Notification

Several key elements must be included in the Form BT 191 to ensure its validity:

- Business Information: Full name, address, and identification number of the business.

- Details of Changes: Names and titles of new or departing officers, members, or partners.

- Effective Date: The date when the changes take effect.

- Signatures: Required signatures from authorized individuals within the business.

Form Submission Methods (Online / Mail / In-Person)

The submission methods for the Form BT 191 vary by state. Generally, businesses can submit the form online through the state’s business portal, which is often the fastest method. Alternatively, the form can be mailed to the appropriate state office or delivered in person. It is advisable to check the specific submission guidelines for your state to ensure compliance and timely processing.

Quick guide on how to complete form bt 191 change of officer member or partner notification

Accomplish Form BT 191 Change Of Officer, Member Or Partner Notification effortlessly on any device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the features required to create, modify, and electronically sign your documents swiftly without delays. Handle Form BT 191 Change Of Officer, Member Or Partner Notification on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-centric process today.

How to modify and electronically sign Form BT 191 Change Of Officer, Member Or Partner Notification effortlessly

- Obtain Form BT 191 Change Of Officer, Member Or Partner Notification and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with features that airSlate SignNow supplies specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you wish to submit your form, either via email, text message (SMS), invitation link, or download it to your PC.

Put aside concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Form BT 191 Change Of Officer, Member Or Partner Notification and ensure smooth communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form bt 191 change of officer member or partner notification

Create this form in 5 minutes!

How to create an eSignature for the form bt 191 change of officer member or partner notification

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is bt 191 and how does it relate to airSlate SignNow?

The bt 191 is a specific document type that can be easily managed and signed using airSlate SignNow. With our user-friendly platform, businesses can eSign bt 191 documents efficiently without the hassle of traditional paperwork.

-

How much does airSlate SignNow cost for handling bt 191 documents?

airSlate SignNow offers competitive pricing plans that suit different business needs, including those requiring management of bt 191 documents. By subscribing to our flexible plans, you can efficiently send and eSign bt 191 documents at a cost-effective rate.

-

What features are available for bt 191 document handling on airSlate SignNow?

With airSlate SignNow, you can enjoy robust features for managing bt 191 documents, such as customizable templates, secure cloud storage, and real-time tracking. These features help streamline your document workflows and enhance efficiency.

-

Can airSlate SignNow integrate with other tools for bt 191 document management?

Yes, airSlate SignNow offers seamless integrations with various applications, making it easy to manage bt 191 documents alongside your current business processes. You can connect with CRM systems, cloud storage services, and more.

-

What are the benefits of using airSlate SignNow for bt 191 documents?

Using airSlate SignNow for your bt 191 documents simplifies the eSigning process, reduces turnaround time, and enhances security. Our platform provides a reliable way to ensure your documents are signed quickly and securely.

-

Is there a trial version of airSlate SignNow for bt 191?

Yes, airSlate SignNow offers a free trial that allows users to explore the platform's capabilities for managing bt 191 documents. This gives you the opportunity to see how our features can cater to your specific business needs before making a commitment.

-

How secure is airSlate SignNow when handling bt 191 documents?

airSlate SignNow takes security seriously, employing advanced encryption and compliance measures to protect your bt 191 documents. This ensures that sensitive information remains safe during the eSigning process.

Get more for Form BT 191 Change Of Officer, Member Or Partner Notification

- Title transfer sheet form

- Complaint habeas form

- Recorded surveillance form

- Writ corpus form

- Waiver release liability form

- Judgment conviction 497329211 form

- Agreement between self employed independent contractor and owner of mobile tire repair service to drive the mobile tire repair form

- Judgments circuit court form

Find out other Form BT 191 Change Of Officer, Member Or Partner Notification

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will