Blank W9 Form

What is the Blank W-9 Form

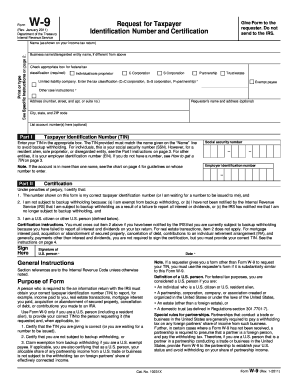

The Blank W-9 Form is an essential document used in the United States for tax purposes. It is primarily utilized by individuals and businesses to provide their taxpayer identification information to other entities. This form is crucial for those who are required to report income paid to independent contractors, freelancers, or other non-employees. By completing the W-9, the requester can accurately report payments to the Internal Revenue Service (IRS) and ensure compliance with tax regulations.

How to use the Blank W-9 Form

Using the Blank W-9 Form involves a straightforward process. First, the individual or business must fill out the form with their name, business name (if applicable), address, and taxpayer identification number (TIN). Once completed, the form should be submitted to the requester, who may be a client or employer needing the information for tax reporting purposes. It is important to ensure that the information provided is accurate to avoid any issues with the IRS.

Steps to complete the Blank W-9 Form

Completing the Blank W-9 Form requires attention to detail. Here are the steps to follow:

- Download the Blank W-9 Form from a reliable source.

- Enter your name as it appears on your tax return.

- If applicable, provide your business name.

- Fill in your address, including city, state, and ZIP code.

- Input your taxpayer identification number, which may be your Social Security number or Employer Identification Number.

- Sign and date the form to certify that the information is correct.

Legal use of the Blank W-9 Form

The Blank W-9 Form serves a legal purpose in the context of tax compliance. By providing accurate information, individuals and businesses fulfill their obligation to report income correctly. The form must be used in accordance with IRS guidelines, ensuring that the information is kept confidential and secure. Misuse of the W-9 can lead to penalties, so it is essential to understand its legal implications.

IRS Guidelines

The IRS has specific guidelines regarding the use of the Blank W-9 Form. It is important to ensure that the form is completed accurately and submitted to the appropriate parties. The IRS requires that the information provided on the W-9 be used solely for tax reporting purposes. Additionally, the form must be updated if there are any changes to the taxpayer's information, such as a change in name or address.

Form Submission Methods (Online / Mail / In-Person)

The Blank W-9 Form can be submitted through various methods, depending on the requester's preferences. Common submission methods include:

- Online submission via secure email or a document management system.

- Mailing a printed copy of the completed form to the requester.

- Delivering the form in person if required by the requester.

Penalties for Non-Compliance

Failing to provide a completed Blank W-9 Form can result in penalties from the IRS. If a business or individual does not submit the form when requested, they may face backup withholding on payments made to them. This means that the requester must withhold a percentage of the payment for tax purposes until the W-9 is provided. Additionally, inaccuracies or failure to report income can lead to further penalties, including fines and interest on unpaid taxes.

Quick guide on how to complete blank w9 form

Complete Blank W9 Form effortlessly on any gadget

Managing documents online has gained popularity among businesses and individuals. It offers an ideal environmentally-friendly alternative to conventional printed and signed documents, as you can obtain the proper form and securely store it on the internet. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Blank W9 Form on any gadget with airSlate SignNow Android or iOS apps and simplify any document-related procedure today.

The easiest method to modify and eSign Blank W9 Form without hassle

- Find Blank W9 Form and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure confidential information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you would like to send your form, by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Blank W9 Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the blank w9 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are W9 forms and why are they important?

W9 forms are tax documents used by businesses to request the Taxpayer Identification Number (TIN) of a payee. They are essential for ensuring that the correct tax information is reported to the IRS. Properly completed W9 forms help businesses comply with tax regulations and avoid potential penalties.

-

How does airSlate SignNow facilitate the signing of W9 forms?

airSlate SignNow provides a user-friendly platform that allows businesses to easily send, receive, and eSign W9 forms electronically. This streamlined process reduces paperwork and saves time, enabling faster turnaround for tax documentation. With secure electronic signatures, your W9 forms are not only easy to manage but also compliant with legal standards.

-

What are the pricing options for using airSlate SignNow for W9 forms?

airSlate SignNow offers flexible pricing plans to cater to various business needs, making it cost-effective for handling W9 forms. You can choose from different subscription tiers based on the volume of documents you need to sign. Sign up today to explore our competitive pricing that ensures you get great value while managing your W9 forms.

-

Can I integrate airSlate SignNow with other software for managing W9 forms?

Yes, airSlate SignNow integrates seamlessly with various business applications such as CRM systems, cloud storage, and productivity tools. This allows you to manage W9 forms alongside your existing workflows. By using our integrations, you enhance productivity and streamline document management for better efficiency.

-

Is it secure to use airSlate SignNow for W9 forms?

Absolutely. airSlate SignNow employs robust security measures to protect your W9 forms and sensitive information. Our platform utilizes encryption technology and complies with industry standards to ensure that all documents are securely managed while maintaining privacy and integrity.

-

Can I access my W9 forms from mobile devices using airSlate SignNow?

Yes, airSlate SignNow provides a mobile-friendly application that allows you to access and manage your W9 forms on the go. Whether you're at the office or remote, you can send, sign, and complete your W9 forms directly from your smartphone or tablet. This flexibility helps you stay productive, regardless of your location.

-

What features does airSlate SignNow offer for W9 forms?

airSlate SignNow provides a variety of features for managing W9 forms, including templates, automatic reminders, and real-time tracking of document status. These features simplify the process of sending and signing forms, making compliance effortless. With user-friendly tools, preparing and processing W9 forms has never been easier.

Get more for Blank W9 Form

- Praecipe form

- Warranty deed for husband and wife converting property from tenants in common to joint tenancy montana form

- Warranty deed for parents to child with reservation of life estate montana form

- Warranty deed for separate or joint property to joint tenancy montana form

- Warranty deed to separate property of one spouse to both spouses as joint tenants montana form

- Fiduciary deed for use by executors trustees trustors administrators and other fiduciaries montana form

- Warranty deed from limited partnership or llc is the grantor or grantee montana form

- Exhibit sheet montana form

Find out other Blank W9 Form

- How To eSign Indiana Legal Residential Lease Agreement

- eSign Iowa Legal Separation Agreement Easy

- How To eSign New Jersey Life Sciences LLC Operating Agreement

- eSign Tennessee Insurance Rental Lease Agreement Later

- eSign Texas Insurance Affidavit Of Heirship Myself

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now