Principal 401k Cash Out Form

What is the Principal 401k Cash Out Form

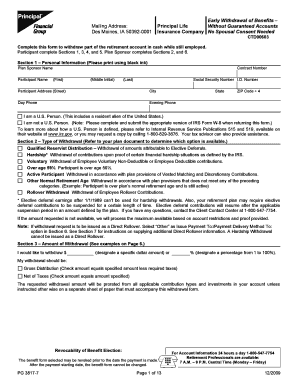

The Principal 401k cash out form is a document that allows individuals to withdraw funds from their 401k retirement account managed by Principal Financial Group. This form is essential for those who wish to access their retirement savings before reaching retirement age. It outlines the reasons for the withdrawal, the amount requested, and the method of payment, ensuring that the process complies with IRS regulations. Understanding the purpose of this form is crucial for making informed financial decisions regarding retirement savings.

How to Use the Principal 401k Cash Out Form

Using the Principal 401k cash out form involves several steps to ensure the withdrawal process is completed accurately. First, individuals must obtain the form, which can typically be found on the Principal Financial Group's website or requested from their customer service. Once in possession of the form, fill in personal information, including your account number, contact details, and the amount you wish to withdraw. It is important to specify the reason for the withdrawal, as this can impact the tax implications. After completing the form, review it for accuracy before submitting it according to the provided instructions.

Steps to Complete the Principal 401k Cash Out Form

Completing the Principal 401k cash out form requires attention to detail. Follow these steps:

- Obtain the form from the Principal website or customer service.

- Provide your personal information, including full name, address, and Social Security number.

- Enter your 401k account number accurately.

- Indicate the withdrawal amount and the reason for the cash out.

- Select your preferred payment method, such as direct deposit or check.

- Sign and date the form to validate your request.

Ensure that all information is correct to avoid delays in processing your request.

Required Documents

When submitting the Principal 401k cash out form, certain documents may be required to support your request. These documents can include:

- A copy of your identification, such as a driver’s license or passport.

- Proof of your current address, like a utility bill or bank statement.

- Any additional documentation that may be required based on the reason for the withdrawal, such as medical bills for hardship withdrawals.

Providing complete documentation can help expedite the processing of your withdrawal request.

Legal Use of the Principal 401k Cash Out Form

The legal use of the Principal 401k cash out form is governed by IRS regulations. Withdrawals from a 401k account may incur taxes and penalties, especially if taken before the age of fifty-nine and a half. It is essential to understand the implications of cashing out, including the potential for a ten percent early withdrawal penalty. Additionally, the form must be completed accurately and submitted in accordance with Principal's guidelines to ensure compliance with legal requirements.

Form Submission Methods

The Principal 401k cash out form can be submitted through various methods, depending on your preference and the options provided by Principal Financial Group. Common submission methods include:

- Online submission through the Principal website, where you can upload the completed form.

- Mailing the form to the designated address provided by Principal.

- Submitting the form in person at a local Principal office, if available.

Choosing the right submission method can help ensure that your request is processed in a timely manner.

Quick guide on how to complete principal 401k cash out form

Complete Principal 401k Cash Out Form effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers a suitable eco-friendly alternative to conventional printed and signed documents, allowing you to access the proper form and securely save it online. airSlate SignNow provides you with all the resources needed to create, modify, and eSign your documents quickly without delays. Manage Principal 401k Cash Out Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused task today.

The most efficient way to modify and eSign Principal 401k Cash Out Form effortlessly

- Obtain Principal 401k Cash Out Form and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Choose your preferred method of sending your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choosing. Modify and eSign Principal 401k Cash Out Form and ensure exceptional communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the principal 401k cash out form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the principal 401k withdrawal download form?

The principal 401k withdrawal download form is a document that allows you to request a distribution from your principal 401k account. This form is essential for accessing your retirement funds and provides the necessary information for the transaction.

-

How do I obtain the principal 401k withdrawal download form?

You can easily obtain the principal 401k withdrawal download form directly from the principal financial services website or through your retirement plan administrator. Ensure you have the correct account information handy to streamline the process.

-

What features does airSlate SignNow offer for signing the principal 401k withdrawal download form?

airSlate SignNow offers a secure and user-friendly platform for electronically signing the principal 401k withdrawal download form. Features include customizable templates, cloud storage integration, and multi-party signing capabilities, making it simple to complete your withdrawal request.

-

Is there a cost associated with using airSlate SignNow for the principal 401k withdrawal download form?

airSlate SignNow offers competitive pricing plans that cater to different business needs. You can seamlessly eSign the principal 401k withdrawal download form without hidden fees, ensuring an affordable solution for your document signing requirements.

-

Can I integrate airSlate SignNow with other applications for my principal 401k withdrawal download form?

Yes, airSlate SignNow supports various integrations with popular applications such as Google Drive, Salesforce, and Dropbox. This allows you to easily manage and store your principal 401k withdrawal download form alongside your other business documents.

-

What are the benefits of using airSlate SignNow for my withdrawal process?

Using airSlate SignNow offers numerous benefits for your withdrawal process, including speed, convenience, and enhanced security. You can instantly eSign the principal 401k withdrawal download form from anywhere, ensuring a hassle-free experience.

-

How does airSlate SignNow ensure the security of the principal 401k withdrawal download form?

airSlate SignNow prioritizes security by implementing industry-standard encryption protocols to protect your documents. When signing the principal 401k withdrawal download form, your data is safeguarded against unauthorized access and bsignNowes.

Get more for Principal 401k Cash Out Form

- Legal last will and testament form for married person with adult and minor children montana

- Mutual wills package with last wills and testaments for married couple with adult and minor children montana form

- Legal last will and testament form for a widow or widower with adult children montana

- Legal last will and testament form for widow or widower with minor children montana

- Legal last will form for a widow or widower with no children montana

- Legal last will and testament form for a widow or widower with adult and minor children montana

- Legal last will and testament form for divorced and remarried person with mine yours and ours children montana

- Legal last will and testament form with all property to trust called a pour over will montana

Find out other Principal 401k Cash Out Form

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple