TRUST ESTATE Ohio Department of Taxation State of Ohio Form

Understanding the TRUST ESTATE Ohio Department of Taxation

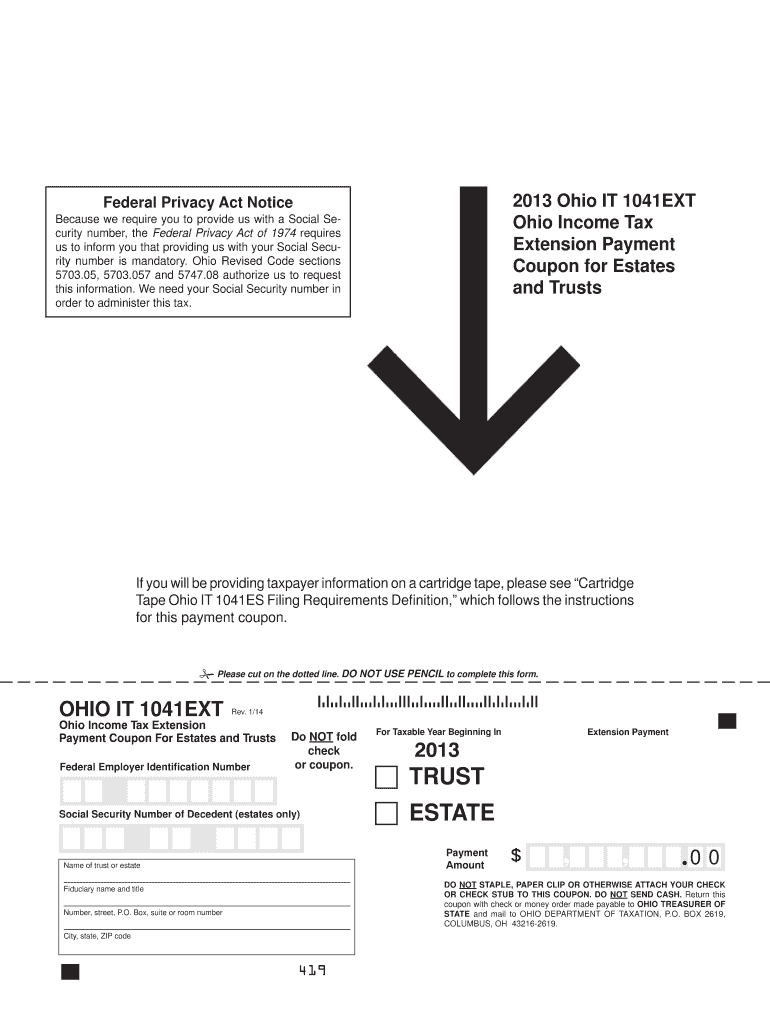

The TRUST ESTATE form from the Ohio Department of Taxation is essential for managing estate-related tax obligations in Ohio. This form is designed to ensure that estates comply with state tax laws during the process of settling an estate. Understanding its purpose helps individuals navigate the complexities of estate management and tax compliance.

Steps to Complete the TRUST ESTATE Ohio Department of Taxation

Completing the TRUST ESTATE form involves several key steps. First, gather all necessary documentation, including the decedent's financial records and details about the estate's assets. Next, accurately fill out the form, ensuring that all information is complete and correct. After completing the form, review it for any errors and ensure that all required signatures are in place. Finally, submit the form to the appropriate department, either online or by mail, following the submission guidelines provided by the Ohio Department of Taxation.

Required Documents for the TRUST ESTATE Ohio Department of Taxation

When preparing to submit the TRUST ESTATE form, certain documents are typically required. These may include:

- The decedent's will or trust documents

- Death certificate

- Financial statements and tax returns from the previous year

- Asset valuations and property deeds

- Any relevant court documents

Having these documents ready can facilitate a smoother filing process and ensure compliance with state regulations.

Legal Use of the TRUST ESTATE Ohio Department of Taxation

The legal use of the TRUST ESTATE form is crucial for the proper handling of an estate's tax responsibilities. This form serves as a formal declaration to the state regarding the estate's assets and liabilities. It is legally binding and must be completed accurately to avoid potential penalties or legal issues. Understanding the legal implications of this form is vital for executors and beneficiaries involved in estate management.

Form Submission Methods for the TRUST ESTATE Ohio Department of Taxation

Submitting the TRUST ESTATE form can be done through various methods. Individuals may choose to file online via the Ohio Department of Taxation's website, which often provides a more efficient process. Alternatively, forms can be mailed directly to the department or submitted in person at designated offices. Each method has its own set of guidelines and timelines, so it is important to follow the instructions carefully to ensure timely processing.

Penalties for Non-Compliance with the TRUST ESTATE Ohio Department of Taxation

Failing to comply with the requirements of the TRUST ESTATE form can lead to significant penalties. These may include fines, interest on unpaid taxes, and potential legal action against the estate or its representatives. It is crucial for those managing an estate to understand these risks and ensure that all filings are completed accurately and on time to avoid complications.

Quick guide on how to complete signtrust

Effortlessly manage signtrust on any gadget

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed forms, allowing you to locate the appropriate template and securely keep it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Manage ohio department of real estate forms on any gadget using airSlate SignNow Android or iOS applications and enhance any document-related operation today.

Simple steps to modify and electronically sign ohio department of taxation with ease

- Locate ohio department taxation and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive information with the tools that airSlate SignNow supplies specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes only a few seconds and carries the same legal standing as a regular ink signature.

- Review the details and click on the Done button to preserve your changes.

- Choose how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or mistakes requiring new document copies to be printed. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Modify and electronically sign ohio sales tax form pdf and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs ohio department of taxation

-

How much would it cost to fill a 30-lb tank of propane in Ohio?

lets see, a 30 lb tank holds 7 gals at around $3.98 a gallon (average price right now) would come to $27.86

-

Did TCU try to back out of playing Ohio State this weekend because they knew they would lose?

No, they didn’t try to back out of this game, but they should have.Heisman candidate, pro-style QB, Dwayne Haskins is the real deal.The Buckeyes are a 14 point favorite. They are returning to the AT&T Stadium nine months after dissecting USC at this venue.One of the major issues the TCU QB will be facing is an SEC style defensive line. The Buckeyes rotate eight guys, each one bigger, faster, and meaner than the last. Mr. Robinson may I introduce Messrs Bosa, Young and Jones.The first time I really saw this type of defensive line in action was when Meyer’s Florida Gators met up with the Buckeyes in the January 2007 BCS National Championship Game. Dual threat QB, Heisman winner, Troy Smith, completed just four of 14 passes for 35 yards along with an interception, a fumble, and he was sacked five times.This is going to be an ugly evening for the Big 12. (OK, it turned out to be an ugly 3rd quarter.)PSMuch is being made of the absence of Meyer from the sideline, and the advantage this gives The Frogs. I have bad news, Froggy. The Ohio State tradition is “Next Man Up.” This is the program that won a National Championship with their THIRD string quarterback. Day and Schiano are up to the task.The Buckeyes love this stadium. I was there in January 2015 when they crushed the Ducks for the championship. Frogs are much more fragile than Ducks.Go Bucks!

-

How do I obtain a new registration for my out of state vehicle in Cuyahoga Falls Ohio?

You can only obtain vehicle registration from the DMV offices of your state of residency. Period.

-

What type of crime would a person have to commit for the state of Ohio to force you to move out of state (not related to divorce or custody)?

States can’t force you to move out. They can make staying unpleasant, especially in connection with a criminal conviction (sex offender registries, felon disenfranchisement, &c), but you’re allowed to live in any state.States can force you to _stay_ to complete probation. Usually there’s a process to transfer probation to another state, and I don’t know whether you could ever force either state to agree to such a transfer, but since that’s not the question I won’t worry about it.

Related searches to ohio department taxation

Create this form in 5 minutes!

How to create an eSignature for the ohio sales tax form pdf

How to generate an eSignature for the Trust Estate Ohio Department Of Taxation State Of Ohio online

How to generate an eSignature for your Trust Estate Ohio Department Of Taxation State Of Ohio in Chrome

How to generate an eSignature for putting it on the Trust Estate Ohio Department Of Taxation State Of Ohio in Gmail

How to create an electronic signature for the Trust Estate Ohio Department Of Taxation State Of Ohio from your mobile device

How to create an electronic signature for the Trust Estate Ohio Department Of Taxation State Of Ohio on iOS

How to make an electronic signature for the Trust Estate Ohio Department Of Taxation State Of Ohio on Android

People also ask state of ohio department of taxation

-

What are Ohio Department of Real Estate forms?

Ohio Department of Real Estate forms are official documents required for various real estate transactions in Ohio. These forms ensure compliance with state regulations and help streamline the process for real estate professionals and consumers. By utilizing airSlate SignNow, users can easily access and eSign these forms, making the whole process more efficient.

-

How can airSlate SignNow help with Ohio Department of Real Estate forms?

airSlate SignNow simplifies the process of handling Ohio Department of Real Estate forms. With our platform, you can effortlessly send, sign, and manage these documents digitally. This not only speeds up the transaction process but also reduces paper waste and improves document security.

-

What features does airSlate SignNow offer for managing Ohio Department of Real Estate forms?

Our platform includes features like customizable templates, real-time tracking, and automated reminders specifically for Ohio Department of Real Estate forms. Users can also integrate advanced security measures such as two-factor authentication to safeguard sensitive information. These features make managing real estate forms straightforward and reliable.

-

What is the pricing structure for using airSlate SignNow for Ohio Department of Real Estate forms?

airSlate SignNow offers competitive pricing plans that cater to various business sizes, allowing you to effectively manage Ohio Department of Real Estate forms without breaking the bank. You can choose from monthly or annual subscriptions, with discounts available for longer commitments. Explore our website to find the best plan that meets your needs.

-

Can airSlate SignNow be integrated with other tools for Ohio Department of Real Estate forms?

Yes, airSlate SignNow can be seamlessly integrated with various tools and platforms, making it easier to manage Ohio Department of Real Estate forms. Whether you use CRM systems, email clients, or project management tools, our integrations enhance your workflow efficiency. This allows for a smooth transition of data and signatures across different applications.

-

What benefits do I get from using airSlate SignNow for Ohio Department of Real Estate forms?

Using airSlate SignNow for Ohio Department of Real Estate forms provides numerous benefits including faster processing times, improved collaboration, and increased compliance. Our user-friendly interface allows users to sign documents from any device, ensuring convenience. Additionally, the document tracking feature keeps you informed about the status of each form you send.

-

Is airSlate SignNow secure for handling Ohio Department of Real Estate forms?

Absolutely! airSlate SignNow employs advanced security measures to protect your Ohio Department of Real Estate forms. With features like encryption, secure storage, and compliance with legal standards, you can trust that your documents and sensitive information are safeguarded against unauthorized access.

Get more for ohio department of real estate forms

Find out other ohio department of taxation

- How Can I Sign California Rental house lease agreement

- How To Sign Nebraska Rental house lease agreement

- How To Sign North Dakota Rental house lease agreement

- Sign Vermont Rental house lease agreement Now

- How Can I Sign Colorado Rental lease agreement forms

- Can I Sign Connecticut Rental lease agreement forms

- Sign Florida Rental lease agreement template Free

- Help Me With Sign Idaho Rental lease agreement template

- Sign Indiana Rental lease agreement forms Fast

- Help Me With Sign Kansas Rental lease agreement forms

- Can I Sign Oregon Rental lease agreement template

- Can I Sign Michigan Rental lease agreement forms

- Sign Alaska Rental property lease agreement Simple

- Help Me With Sign North Carolina Rental lease agreement forms

- Sign Missouri Rental property lease agreement Mobile

- Sign Missouri Rental property lease agreement Safe

- Sign West Virginia Rental lease agreement forms Safe

- Sign Tennessee Rental property lease agreement Free

- Sign West Virginia Rental property lease agreement Computer

- How Can I Sign Montana Rental lease contract