Sa100 Form

What is the Sa100 Form

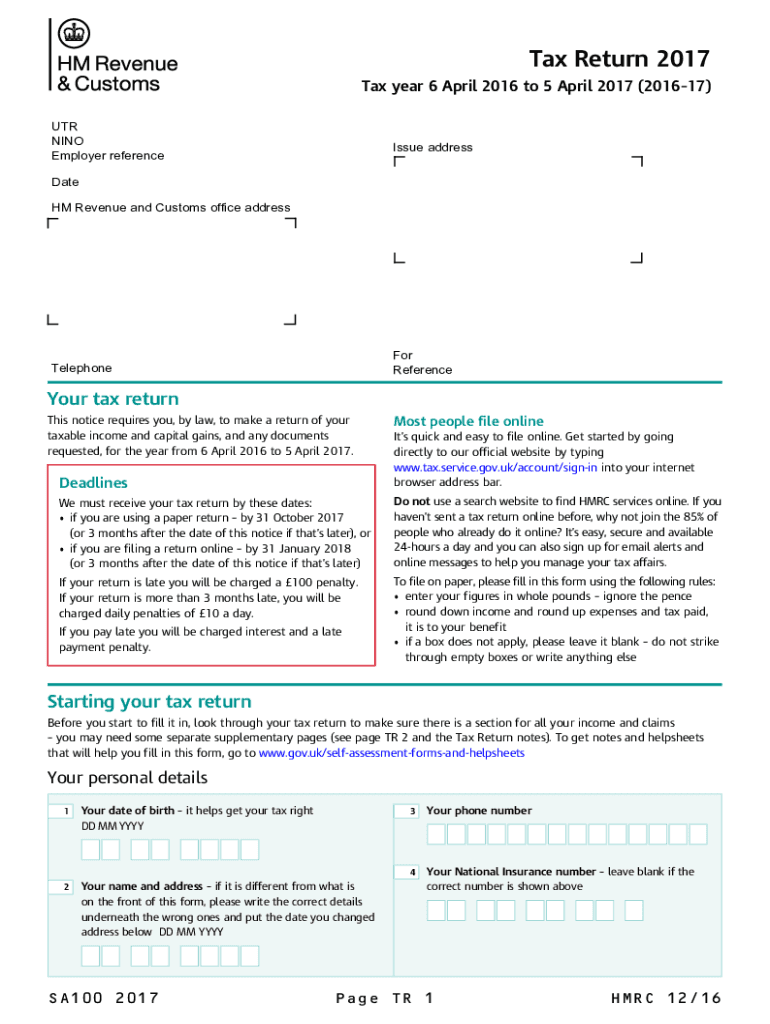

The Sa100 form is a self-assessment tax return used by individuals in the United Kingdom to report their income and capital gains to HM Revenue and Customs (HMRC). While primarily applicable in the UK, understanding its structure and purpose can benefit U.S. taxpayers who may have international interests or are involved in cross-border transactions. The form requires detailed information regarding various income sources, including employment, self-employment, and investment income.

How to use the Sa100 Form

To effectively use the Sa100 form, individuals should first gather all necessary financial documents, such as P60s, P45s, and records of income from self-employment or investments. Once the relevant information is collected, taxpayers can fill out the form either digitally or on paper. The form consists of several sections, each designed to capture specific types of income and deductions. After completing the form, it must be submitted to HMRC by the specified deadline to avoid penalties.

Steps to complete the Sa100 Form

Completing the Sa100 form involves several key steps:

- Gather all necessary financial documents, including income statements and receipts.

- Fill out personal information, including your name, address, and National Insurance number.

- Report all sources of income, such as employment, self-employment, and rental income.

- Claim any allowable expenses and deductions to reduce taxable income.

- Review the completed form for accuracy before submission.

Legal use of the Sa100 Form

The Sa100 form is legally binding when submitted to HMRC, provided it is completed accurately and honestly. Failing to report income or providing false information can result in penalties or legal repercussions. It is essential for taxpayers to ensure compliance with all relevant tax laws and regulations when using the form. Utilizing a reliable digital platform can enhance the legal validity of the submission through secure signing and storage options.

Filing Deadlines / Important Dates

Filing deadlines for the Sa100 form are crucial for compliance. Typically, the deadline for online submissions is January 31 of the year following the tax year. For paper submissions, the deadline is earlier, usually October 31. Taxpayers should be aware of these dates to avoid late filing penalties, which can accumulate quickly. Additionally, any tax owed must be paid by the same deadline to prevent interest charges.

Form Submission Methods (Online / Mail / In-Person)

The Sa100 form can be submitted through various methods, including online, by mail, or in person. Online submission is the most efficient and provides immediate confirmation of receipt. Paper submissions can be sent via postal service, but it is advisable to use recorded delivery to ensure it reaches HMRC. In-person submissions are less common but may be available at certain HMRC offices. Each method has its own processing times and requirements, so taxpayers should choose the one that best suits their needs.

Quick guide on how to complete sa100 form 2017

Complete Sa100 Form seamlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-conscious substitute for traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow provides you with all the essential tools to create, modify, and eSign your documents swiftly without delays. Manage Sa100 Form on any platform with the airSlate SignNow Android or iOS applications and enhance any document-based process today.

The easiest way to modify and eSign Sa100 Form effortlessly

- Obtain Sa100 Form and then click Get Form to begin.

- Utilize the tools at your disposal to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to preserve your modifications.

- Select how you wish to send your form, by email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, cumbersome form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Alter and eSign Sa100 Form and guarantee effective communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sa100 form 2017

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a fillable SA100 2017 PDF and why is it important?

A fillable SA100 2017 PDF is a digital form used for self-assessment tax returns in the UK for the 2017 tax year. It allows individuals and businesses to submit their financial information efficiently. Using a fillable version reduces errors and streamlines the submission process.

-

How can airSlate SignNow help with fillable SA100 2017 PDFs?

airSlate SignNow simplifies the management of fillable SA100 2017 PDFs by enabling users to easily fill out, sign, and send their documents electronically. This not only saves time but also ensures a secure and compliant submission process. Plus, the platform is user-friendly and accessible from any device.

-

Is there a cost associated with using airSlate SignNow for fillable SA100 2017 PDFs?

Yes, airSlate SignNow offers various pricing plans, making it cost-effective for businesses and individuals who need to manage fillable SA100 2017 PDFs. You can choose from different tiers based on your needs, ensuring you get the features that best suit your requirements without overspending.

-

Can I integrate airSlate SignNow with other applications to manage fillable SA100 2017 PDFs?

Absolutely! airSlate SignNow offers seamless integrations with various applications, such as Google Drive, Dropbox, and Microsoft Office. This allows users to import and export fillable SA100 2017 PDFs easily, facilitating a more efficient workflow.

-

What features does airSlate SignNow provide for signing fillable SA100 2017 PDFs?

airSlate SignNow includes several features designed for signing fillable SA100 2017 PDFs, such as electronic signatures, templating, and document tracking. Users can sign their documents securely and receive notifications when their fillable SA100 2017 PDFs are viewed or signed by recipients.

-

Can I send reminders for fillable SA100 2017 PDFs using airSlate SignNow?

Yes, airSlate SignNow allows you to set up automatic reminders for any fillable SA100 2017 PDFs you send out. This ensures that you and your recipients stay on track with deadlines, making it easier to complete the tax submission process on time.

-

Is airSlate SignNow secure for handling sensitive fillable SA100 2017 PDFs?

Yes, airSlate SignNow is designed with security in mind and uses advanced encryption to protect sensitive information in fillable SA100 2017 PDFs. Additionally, the platform complies with industry standards, ensuring your documents are safely stored and transmitted.

Get more for Sa100 Form

Find out other Sa100 Form

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy