Form 12c Download

What is the Form 12c Download

The Form 12c is a crucial document used in the United States for income tax purposes. It serves as a declaration for claiming deductions on certain income, particularly for individuals seeking to report their income accurately. The form is often utilized by taxpayers who wish to provide necessary information regarding their income sources, thereby ensuring compliance with the Internal Revenue Service (IRS) regulations. The digital version of the form, available for download, allows for easier completion and submission, streamlining the tax filing process.

How to Obtain the Form 12c Download

Obtaining the Form 12c is straightforward. Taxpayers can download the form directly from the IRS website or authorized tax preparation platforms. The digital format ensures that users have access to the most current version of the form, which is essential for accurate filing. It is advisable to check for any updates or changes to the form before downloading to ensure compliance with the latest tax regulations.

Steps to Complete the Form 12c Download

Completing the Form 12c involves several key steps to ensure accuracy and compliance. First, download the form from a reliable source. Next, gather all necessary documentation, including income statements and any relevant tax records. Fill out the form carefully, ensuring that all information is accurate and complete. After completing the form, review it for any errors before submitting it to the appropriate tax authority. If filing electronically, follow the specific instructions provided by the platform used for submission.

Legal Use of the Form 12c Download

The legal use of the Form 12c is governed by IRS regulations. To be considered valid, the form must be completed accurately and submitted within the designated filing period. Additionally, it is essential to ensure that all claims made on the form are substantiated by appropriate documentation. Using a secure platform for electronic submission can enhance the legal standing of the form, as it provides a digital certificate and maintains compliance with eSignature laws.

Key Elements of the Form 12c Download

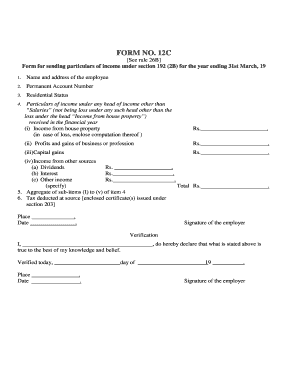

Key elements of the Form 12c include personal identification information, details of income sources, and specific deductions being claimed. Each section of the form is designed to capture essential information that the IRS requires for processing tax returns. It is important to pay close attention to each field, as inaccuracies can lead to delays or penalties. Understanding these elements can aid taxpayers in completing the form efficiently and accurately.

Filing Deadlines / Important Dates

Filing deadlines for the Form 12c are critical for compliance with tax regulations. Generally, taxpayers must submit their forms by April 15 of the tax year. However, extensions may be available under certain circumstances. It is crucial to stay informed about any changes to these deadlines, as late submissions can result in penalties or interest on unpaid taxes. Keeping a calendar of important dates can help ensure timely filing.

Required Documents

When completing the Form 12c, certain documents are required to support the information provided. These may include W-2 forms, 1099 forms, and any other income statements that reflect earnings for the tax year. Additionally, documentation for deductions claimed, such as receipts or statements, should be organized and readily available. Having these documents on hand can facilitate a smoother completion process and ensure compliance with IRS requirements.

Quick guide on how to complete form 12c download

Effortlessly Complete Form 12c Download on Any Device

Digital document management has become increasingly popular among organizations and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage Form 12c Download on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Easiest Way to Edit and eSign Form 12c Download Without Effort

- Obtain Form 12c Download and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method for sharing your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors necessitating new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 12c Download and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 12c download

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process to form 12c download pdf in hindi?

To form 12c download pdf in hindi, you can visit the official website, navigate to the download section, and select the Hindi version of the form. Once you find the correct form, click the download button, and it will be saved as a PDF. Ensure you have adequate software to view and print the PDF for your records.

-

Is there a cost associated with form 12c download pdf in hindi?

The form 12c download pdf in hindi is generally available for free on official websites. However, if you use additional services for guidance or submission, there may be associated fees. It's recommended to check the specific website offering the download for any potential charges.

-

What features does airSlate SignNow offer for handling forms like the 12c?

airSlate SignNow provides various features that simplify the management of forms like the 12c, including eSignature capabilities, collaboration tools, and secure document storage. These features help streamline the process of filling out and submitting the form 12c download pdf in hindi. Utilizing these tools can signNowly enhance productivity and reduce errors.

-

What are the benefits of using airSlate SignNow for forms like 12c?

Using airSlate SignNow for forms like the 12c allows businesses to save time and money through streamlined workflows. The platform supports efficient document signing and management, reducing administrative burdens. Additionally, it enhances security and compliance when handling sensitive documents, such as form 12c download pdf in hindi.

-

Can I integrate airSlate SignNow with other applications for managing forms like 12c?

Yes, airSlate SignNow offers integration capabilities with various applications, which can enhance your workflow for managing forms like the 12c. You can connect it with services like Google Drive, Dropbox, and CRM systems. These integrations make it easier to access and manage your form 12c download pdf in hindi alongside other important documents.

-

How does airSlate SignNow ensure the security of downloaded forms like 12c?

airSlate SignNow prioritizes the security of your documents, including forms like the 12c. The platform employs encryption, secure servers, and compliance with industry standards to protect sensitive information. As you form 12c download pdf in hindi, you can trust that your data is secure at all times.

-

Is airSlate SignNow user-friendly for those unfamiliar with digital forms?

Absolutely! airSlate SignNow is designed to be user-friendly, making it accessible for individuals unfamiliar with digital forms. The intuitive interface guides users seamlessly through processes like the form 12c download pdf in hindi. With helpful resources and support, users can easily navigate and complete their forms.

Get more for Form 12c Download

- This wyoming commercial lease agreement agreement made on form

- Free bill of sale forms pdf template form downloadfree texas bill of sale forms pdf word eformsfree bill of sale forms word pdf

- Tennessee residential rental application form

- Make typemodel form

- Buyers name quotbuyerquot with a mailing address of form

- South carolina general personal property bill of sale form

- Free south carolina bill of sale form pdf template

- Kansas general bill of sale form

Find out other Form 12c Download

- Electronic signature Kentucky Car Dealer LLC Operating Agreement Safe

- Electronic signature Louisiana Car Dealer Lease Template Now

- Electronic signature Maine Car Dealer Promissory Note Template Later

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free

- How Do I Electronic signature Hawaii Business Operations Forbearance Agreement

- Electronic signature Massachusetts Car Dealer Operating Agreement Free

- How To Electronic signature Minnesota Car Dealer Credit Memo

- Electronic signature Mississippi Car Dealer IOU Now

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple

- Electronic signature Indiana Business Operations Limited Power Of Attorney Online

- Electronic signature Iowa Business Operations Resignation Letter Online

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself