Form 8821 Rev March Tax Information Authorization Irs

Understanding the IRS Form 8821 Tax Information Authorization

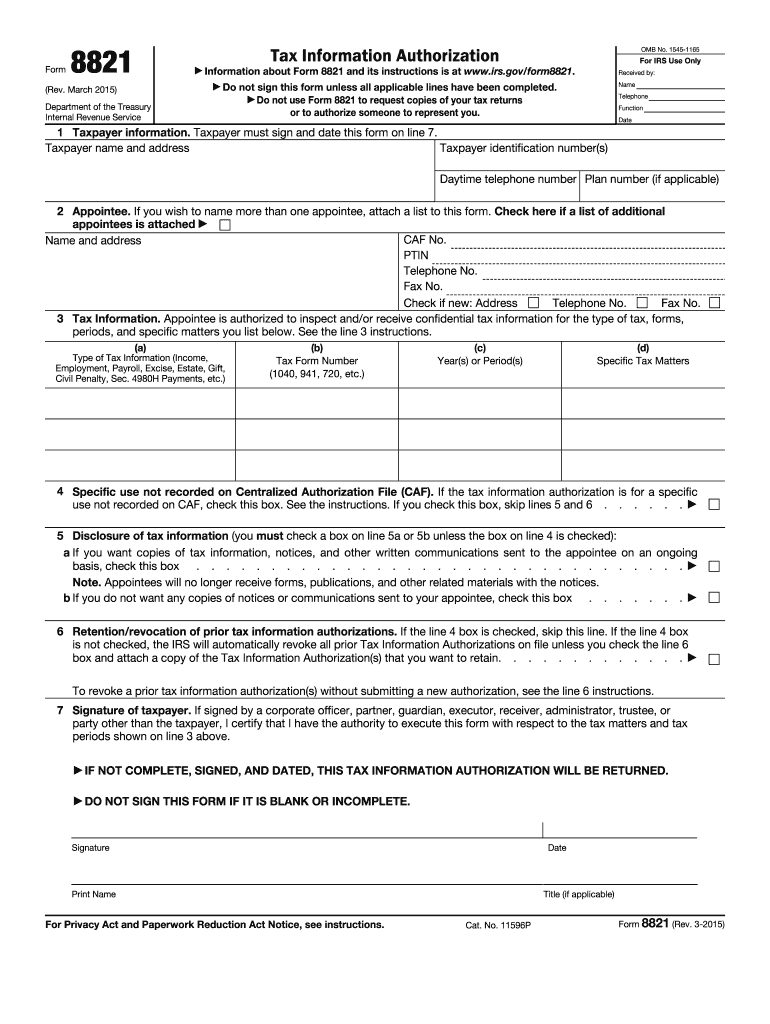

The IRS Form 8821, officially known as the Tax Information Authorization, allows taxpayers to authorize an individual or organization to receive and inspect their tax information. This form is particularly useful for those who want to ensure that their tax representatives, such as accountants or tax preparers, can access necessary information directly from the IRS. By completing this form, taxpayers can streamline communication and facilitate the tax preparation process.

Steps to Complete the IRS Form 8821

Filling out the IRS Form 8821 involves several key steps to ensure accuracy and compliance:

- Obtain the Form: Download the IRS Form 8821 from the IRS website or request a physical copy.

- Provide Taxpayer Information: Fill in your name, address, and Social Security number or Employer Identification Number (EIN).

- Designate the Appointee: Clearly state the name and contact information of the individual or organization you are authorizing.

- Specify the Tax Information: Indicate the specific tax information you are allowing the appointee to access, such as income tax, payroll tax, or other relevant categories.

- Sign and Date: Ensure that you sign and date the form to validate your authorization.

After completing these steps, the form can be submitted to the IRS for processing.

Obtaining the IRS Form 8821

The IRS Form 8821 can be obtained in a few simple ways:

- Visit the official IRS website to download a PDF version of the form.

- Request a physical copy by calling the IRS directly.

- Access tax preparation software that includes the form as part of its offerings.

Having the correct version of the form is essential for ensuring that your tax information authorization is processed without delays.

Legal Use of the IRS Form 8821

The IRS Form 8821 is legally binding once it is properly completed and signed by the taxpayer. This form complies with federal regulations governing tax information disclosure. It is important to note that the form does not grant the appointee the authority to make decisions on behalf of the taxpayer; it solely allows access to tax information. To ensure the form's legality, it must be filled out accurately, and the taxpayer's signature must be included.

Examples of Using the IRS Form 8821

There are various scenarios in which the IRS Form 8821 can be beneficial:

- A taxpayer may want to authorize their accountant to access their tax records to prepare their annual tax return.

- A business owner might use the form to allow their tax advisor to obtain information needed for payroll tax filings.

- Individuals who are unable to manage their tax affairs due to health reasons may authorize a family member to handle their tax information.

These examples illustrate how the form can facilitate tax-related processes for different individuals and situations.

Filing Methods for the IRS Form 8821

The IRS Form 8821 can be submitted through various methods, ensuring flexibility for taxpayers:

- Online Submission: Some tax software allows for electronic filing of the form.

- Mail Submission: The completed form can be mailed to the appropriate IRS address, which can be found in the form instructions.

- In-Person Submission: Taxpayers may also choose to deliver the form in person at their local IRS office.

Choosing the right submission method can help ensure timely processing of the authorization.

Quick guide on how to complete form 8821 rev march 2015 tax information authorization irs

Complete Form 8821 Rev March Tax Information Authorization Irs effortlessly on any device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers an excellent environmentally friendly substitute for conventional printed and signed documents since you can acquire the correct form and securely keep it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents quickly without delays. Handle Form 8821 Rev March Tax Information Authorization Irs on any platform using airSlate SignNow's Android or iOS applications and optimize any document-centric procedure today.

How to modify and electronically sign Form 8821 Rev March Tax Information Authorization Irs with ease

- Obtain Form 8821 Rev March Tax Information Authorization Irs and select Get Form to begin.

- Leverage the tools we offer to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information using the tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, time-consuming form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Form 8821 Rev March Tax Information Authorization Irs and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How can I deduct on my Federal income taxes massage therapy for my chronic migraines? Is there some form to fill out to the IRS for permission?

As long as your doctor prescribed this, it is tax deductible under the category for medical expenses. There is no IRS form for permission.

Create this form in 5 minutes!

How to create an eSignature for the form 8821 rev march 2015 tax information authorization irs

How to make an eSignature for your Form 8821 Rev March 2015 Tax Information Authorization Irs in the online mode

How to make an electronic signature for your Form 8821 Rev March 2015 Tax Information Authorization Irs in Google Chrome

How to create an electronic signature for putting it on the Form 8821 Rev March 2015 Tax Information Authorization Irs in Gmail

How to create an eSignature for the Form 8821 Rev March 2015 Tax Information Authorization Irs straight from your mobile device

How to generate an eSignature for the Form 8821 Rev March 2015 Tax Information Authorization Irs on iOS devices

How to generate an eSignature for the Form 8821 Rev March 2015 Tax Information Authorization Irs on Android devices

People also ask

-

What is an IRS authorization form and why do I need it?

An IRS authorization form allows individuals or businesses to grant permission for someone else to handle their tax matters. This form is essential for ensuring that your tax information is shared securely and efficiently. Using airSlate SignNow, you can easily create and eSign this form, streamlining the process.

-

How can I create an IRS authorization form using airSlate SignNow?

Creating an IRS authorization form with airSlate SignNow is simple. You can start by selecting a template from our library, fill in the necessary details, and then eSign it electronically. This not only saves time but also ensures compliance with IRS requirements.

-

Are there any costs associated with using airSlate SignNow for IRS authorization forms?

airSlate SignNow offers a cost-effective solution for handling IRS authorization forms. Our pricing plans are designed to fit various business needs, and you can choose a plan based on the number of users and documents. This flexibility allows you to manage expenses effectively while accessing essential features.

-

What features does airSlate SignNow offer for IRS authorization forms?

airSlate SignNow provides a variety of features for managing IRS authorization forms. These include customizable templates, electronic signatures, secure storage, and automated tracking for completed documents. These features enhance your efficiency and ensure that your forms are processed smoothly.

-

Can I integrate airSlate SignNow with other applications for IRS authorization forms?

Yes, airSlate SignNow integrates seamlessly with multiple applications, making it easy to manage your IRS authorization forms alongside your existing tools. Whether you use CRM systems, document management platforms, or accounting software, our integrations enhance your workflow and productivity.

-

How does eSigning an IRS authorization form work with airSlate SignNow?

eSigning an IRS authorization form using airSlate SignNow is straightforward. After preparing your form, you can send it to signers directly from the platform. Once they eSign the document, you receive a notification, and all signed documents are securely stored and accessible.

-

Is airSlate SignNow compliant with IRS regulations for authorization forms?

Absolutely! airSlate SignNow is designed to comply with IRS regulations concerning authorization forms. Our platform ensures that all signature processes meet legal standards, providing you with peace of mind when handling sensitive tax information.

Get more for Form 8821 Rev March Tax Information Authorization Irs

- Quitclaim deed from corporation to two individuals south carolina form

- Warranty deed from corporation to two individuals south carolina form

- Warranty deed from individual to a trust south carolina form

- Warranty deed from husband and wife to a trust south carolina form

- Warranty deed from husband to himself and wife south carolina form

- Sc husband wife form

- Quitclaim deed from husband and wife to husband and wife south carolina form

- Sc husband wife 497325557 form

Find out other Form 8821 Rev March Tax Information Authorization Irs

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form