Exoapp Form

What is the Exoapp

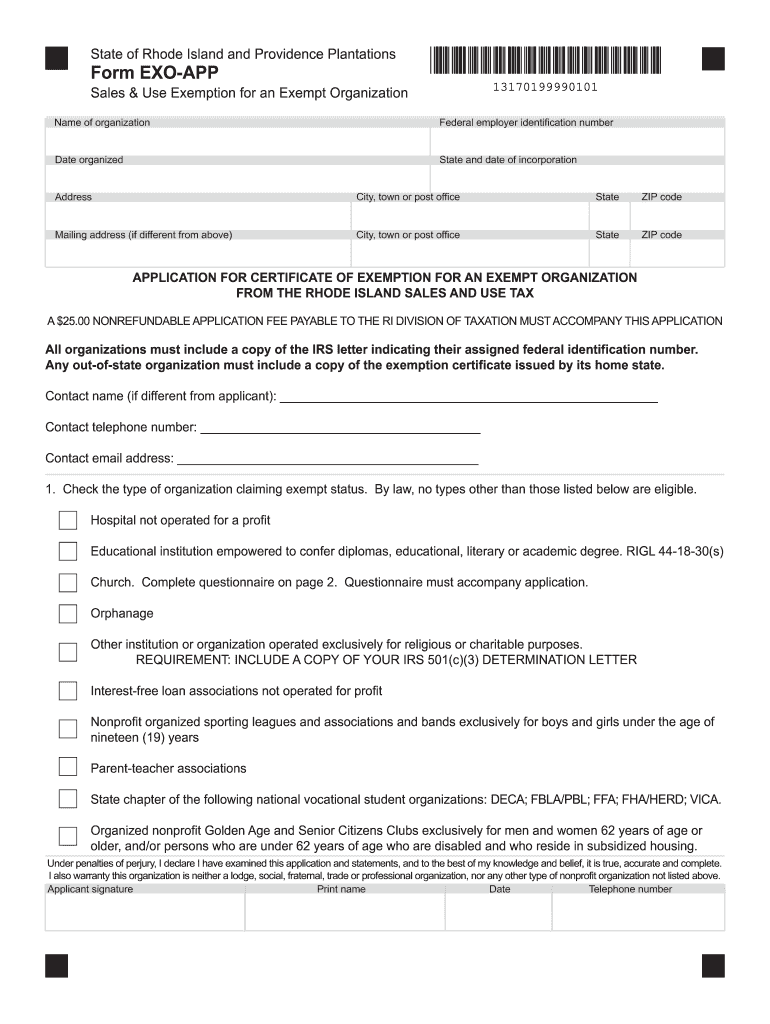

The Exoapp, officially known as the Rhode Island Exempt Organization Application, is a crucial form for organizations seeking tax-exempt status in the state of Rhode Island. This application allows eligible entities to apply for exemption from state income tax, sales tax, and other tax obligations. The Exoapp is designed to streamline the process for organizations that meet specific criteria, such as charitable, educational, or religious purposes. Understanding the purpose and requirements of the Exoapp is essential for organizations aiming to benefit from tax exemptions in Rhode Island.

Steps to Complete the Exoapp

Completing the Rhode Island Exempt Organization Application involves several key steps to ensure accuracy and compliance with state regulations. Begin by gathering all necessary documentation, including your organization’s formation documents, bylaws, and financial statements. Next, fill out the Exoapp form with detailed information about your organization, including its mission, activities, and how it meets the criteria for exemption. After completing the form, review it thoroughly for any errors or omissions. Finally, submit the application along with any required attachments to the Rhode Island Division of Taxation for processing.

Legal Use of the Exoapp

The legal use of the Exoapp is governed by the regulations set forth by the Rhode Island Division of Taxation. Organizations must ensure that they meet the eligibility criteria outlined in state law to qualify for tax-exempt status. This includes demonstrating that the organization operates exclusively for exempt purposes and does not engage in activities that benefit private interests. It is important for applicants to familiarize themselves with these legal requirements to avoid potential issues during the application process.

Eligibility Criteria

To qualify for tax-exempt status through the Exoapp, organizations must meet specific eligibility criteria established by the Rhode Island Division of Taxation. Generally, eligible organizations include those that are charitable, educational, religious, or scientific in nature. Additionally, the organization must be organized and operated exclusively for these purposes, with no part of its net earnings benefiting any private shareholder or individual. Understanding these criteria is vital for organizations to determine their eligibility before applying for the Exoapp.

Required Documents

When submitting the Rhode Island Exempt Organization Application, several documents are required to support the application. These typically include the organization’s articles of incorporation, bylaws, and a detailed description of its activities. Financial statements, including budgets and income statements, may also be necessary to demonstrate the organization’s operational status. Ensuring that all required documents are complete and accurate can significantly enhance the chances of a successful application.

Form Submission Methods

The Exoapp can be submitted through various methods, allowing organizations flexibility in their application process. Applicants may choose to file the form online through the Rhode Island Division of Taxation’s website, which often expedites processing times. Alternatively, organizations can submit the application via mail or in person at the Division of Taxation office. Each submission method has its own guidelines and requirements, so it is essential for organizations to follow the instructions carefully to ensure proper processing.

Quick guide on how to complete download rhode island division of taxation tax ri

Your assistance manual on how to prepare your Exoapp

If you’re curious about how to finalize and submit your Exoapp, here are a few brief guidelines on how to simplify tax filing.

To begin, you simply need to create your airSlate SignNow account to transform your digital document handling. airSlate SignNow is an extremely user-friendly and powerful document solution that allows you to modify, generate, and finish your tax forms with ease. With its editor, you can toggle between text, check boxes, and eSignatures and return to modify answers as necessary. Enhance your tax management with advanced PDF editing, eSigning, and easy sharing.

Follow the instructions below to finalize your Exoapp in minutes:

- Set up your account and start editing PDFs within moments.

- Utilize our directory to find any IRS tax form; browse through variants and schedules.

- Click Retrieve form to access your Exoapp in our editor.

- Complete the necessary fillable sections with your information (text, numbers, checkmarks).

- Employ the Signature Tool to add your legally-binding eSignature (if necessary).

- Review your document and amend any errors.

- Save changes, print your version, send it to your recipient, and download it to your device.

Use this manual to file your taxes online with airSlate SignNow. Keep in mind that filing on paper can lead to increased return errors and delayed refunds. Additionally, before e-filing your taxes, verify the IRS website for reporting regulations in your state.

Create this form in 5 minutes or less

FAQs

-

If one is employed to a company, why does one have to fill in a Tax form when taxation is taken out of one's pay cheque automatically every month?

TAX EVASION IS ILLEGAL, TAX AVOIDANCE IS NOT!!!!!!IRS's game IRS's rules. Get a good Personal Tax Practitioner who is available year round that you trust, so when making financial decisions you can call and see how it will effect you tax wise and know the best way to implement it.Income tax reporting is voluntary. The IRS years ago felt that the American people as a whole were not being as forth coming as they should with income information. At this point IRS changed the rules by pitting the burden of proof on employers to report how much money they paid to each employee. This also helped IRS to balance businesses deductions against the populations income reporting. W-2's, 1099, a, b, c, misc, 1098 etc. is IRS's way of getting advanced information on the major things that happen to everyone in regards moneys earned and paid that effect personal & business taxes. Taxes withheld are only a percentage of your income and may not necessarily match the amount of taxes owed.Never for get that while the government is the government it is still a business that has to make money to operate. It forecast its earnings each year based on average working age and salaries of the population.Did you ever ask yourself why it is a IRS rule that taxes have to be filed within 3 years of the due date? IRS pays 6% simple interest on any refund held in their possession after the end of the filing season for that year. Years ago people who knew they had a refund just would not file for years, thus costing the IRS a lot of money when they did file. Now if you do not file within the 3 year time limit and you have a refund, guess who gets it? Yes, the IRS gets it. They confiscate your money for not doing something that they tell you is voluntary in the first place.The key thing to remember in reporting taxes is 1. Are your earnings below the reporting line? (yes) then 2. Were any taxes withheld federal or state? (Yes). Then file all w-2's to insure you get refunded all of the taxes that were withheld.If (No) to the same questions above no need to file IRS will have the same information and know you were below the filing requirement.

-

The company I work for is taking taxes out of my paycheck but has not asked me to complete any paperwork or fill out any forms since day one. How are they paying taxes without my SSN?

WHOA! You may have a BIG problem. When you started, are you certain you did not fill in a W-4 form? Are you certain that your employer doesn’t have your SS#? If that’s the case, I would be alarmed. Do you have paycheck stubs showing how they calculated your withholding? ( BTW you are entitled to those under the law, and if you are not receiving them, I would demand them….)If your employer is just giving you random checks with no calculation of your wages and withholdings, you have a rogue employer. They probably aren’t payin in what they purport to withhold from you.

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

-

How much will a doctor with a physical disability and annual net income of around Rs. 2.8 lakhs pay in income tax? Which ITR form is to be filled out?

For disability a deduction of ₹75,000/- is available u/s 80U.Rebate u/s87AFor AY 17–18, rebate was ₹5,000/- or income tax which ever is lower for person with income less than ₹5,00,000/-For AY 18–19, rebate is ₹2,500/- or income tax whichever is lower for person with income less than 3,50,000/-So, for an income of 2.8 lakhs, taxable income after deduction u/s 80U will remain ₹2,05,000/- which is below the slab rate and hence will not be taxable for any of the above said AY.For ITR,If doctor is practicing himself i.e. He has a professional income than ITR 4 should be filedIf doctor is getting any salary than ITR 1 should be filed.:)

-

Why should it be so complicated just figuring out how much tax to pay? (record keeping, software, filling out forms . . . many times cost much more than the amount of taxes due) The cost of compliance makes the U.S. uncompetitive and costs jobs and lowers our standard of living.

Taxes can be viewed as having 4 uses (or purposes) in our (and most) governments:Revenue generation (to pay for public services).Fiscal policy control (e.g., If the government wishes to reduce the money supply in order to reduce the risk of inflation, they can raise interest rates, sell fewer bonds, burn money, or raise taxes. In the last case, this represents excess tax revenue over the actual spending needs of the government).Wealth re-distribution. One argument for this is that the earnings of a country can be perceived as belonging to all of its citizens since the we all have a stake in the resources of the country (natural resources, and intangibles such as culture, good citizenship, civic duties). Without some tax policy complexity, the free market alone does not re-distribute wealth according to this "shared" resources concept. However, this steps into the boundary of Purpose # 4...A way to implement Social Policy (and similar government mandated policies, such as environmental policy, health policy, savings and debt policy, etc.). As Government spending can be use to implement policies (e.g., spending money on public health care, environmental cleanup, education, etc.), it is equivalent to provide tax breaks (income deductions or tax credits) for the private sector to act in certain ways -- e.g., spend money on R&D, pay for their own education or health care, avoid spending money on polluting cars by having a higher sales tax on these cars or offering a credit for trade-ins [ref: Cash for Clunkers]).Uses # 1 & 2 are rather straight-forward, and do not require a complex tax code to implement. Flat income and/or consumption (sales) taxes can easily be manipulated up or down overall for these top 2 uses. Furthermore, there is clarity when these uses are invoked. For spending, we publish a budget. For fiscal policy manipulation, the official economic agency (The Fed) publishes their outlook and agenda.Use # 3 is controversial because there is no Constitutional definition for the appropriate level of wealth re-distribution, and the very concept of wealth re-distribution is considered by some to be inappropriate and unconstitutional. Thus, the goal of wealth re-distribution is pretty much hidden in with the actions and policies of Use #4 (social policy manipulation).Use # 4, however, is where the complexity enters the Taxation system. Policy implementation through taxation (or through spending) occurs via legislation. Legislation (law making) is inherently complex and subject to gross manipulation by special interests during formation and amendments. Legislation is subject to interpretation, is prone to errors (leading to loopholes) and both unintentional or intentional (criminal / fraudulent) avoidance.The record keeping and forms referred to in the question are partially due to the basic formula for calculating taxes (i.e., percentage of income, cost of property, amount of purchase for a sales tax, ...). However, it is the complexity (and associated opportunities for exploitation) of taxation legislation for Use # 4 (Social Policy implementation) that naturally leads to complexity in the reporting requirements for the tax system.

Create this form in 5 minutes!

How to create an eSignature for the download rhode island division of taxation tax ri

How to create an eSignature for the Download Rhode Island Division Of Taxation Tax Ri in the online mode

How to generate an electronic signature for your Download Rhode Island Division Of Taxation Tax Ri in Google Chrome

How to make an electronic signature for signing the Download Rhode Island Division Of Taxation Tax Ri in Gmail

How to create an eSignature for the Download Rhode Island Division Of Taxation Tax Ri right from your smart phone

How to generate an electronic signature for the Download Rhode Island Division Of Taxation Tax Ri on iOS

How to create an electronic signature for the Download Rhode Island Division Of Taxation Tax Ri on Android OS

People also ask

-

What is an RI application exemption?

An RI application exemption is a specific provision that allows businesses to bypass certain requirements when submitting applications. This exemption can streamline the process, making it easier for companies to get their documents processed without unnecessary delays, ultimately enhancing efficiency.

-

How can airSlate SignNow assist with the RI application exemption?

airSlate SignNow provides a seamless platform for businesses to manage their documentation related to the RI application exemption. With intuitive features for eSigning and document tracking, users can ensure compliance while saving time and resources in their application processes.

-

Is there a cost associated with using airSlate SignNow for RI application exemption documentation?

Yes, while airSlate SignNow offers a cost-effective solution for handling documentation, prices vary based on the plan selected. Evaluating the features linked to the RI application exemption will help you choose a plan that best fits your business needs without compromising on quality.

-

What features does airSlate SignNow offer for handling RI application exemptions?

airSlate SignNow includes features such as customizable templates, advanced eSigning options, and real-time notifications, all essential for managing RI application exemptions. These tools simplify the signing process and ensure that all documentation is kept organized and accessible.

-

Can I integrate airSlate SignNow with other software for RI application exemption processes?

Absolutely! airSlate SignNow integrates with various popular software solutions, which enhances workflows involving the RI application exemption. This ensures that you can efficiently manage your documents and automate processes across different platforms.

-

What benefits can I expect from using airSlate SignNow for RI application exemptions?

Using airSlate SignNow certainly optimizes the way you handle RI application exemptions. You can expect increased productivity, reduced processing times, and enhanced document security, which signNowly contributes to a smoother application experience.

-

How secure is airSlate SignNow when dealing with RI application exemption documents?

airSlate SignNow prioritizes security, employing encryption and secure access protocols to protect your RI application exemption documents. Your sensitive information remains confidential, giving you peace of mind as you manage your applications.

Get more for Exoapp

- South carolina tenant landlord form

- Sc tenant landlord form

- Letter tenant demand sample 497325644 form

- Sc tenant landlord form

- Letter from tenant to landlord with demand that landlord provide proper outdoor garbage receptacles south carolina form

- Letter from tenant to landlord about landlords failure to make repairs south carolina form

- Letter notice rent template form

- Letter from tenant to landlord about landlord using unlawful self help to gain possession south carolina form

Find out other Exoapp

- Sign Tennessee Joint Venture Agreement Template Free

- How Can I Sign South Dakota Budget Proposal Template

- Can I Sign West Virginia Budget Proposal Template

- Sign Alaska Debt Settlement Agreement Template Free

- Help Me With Sign Alaska Debt Settlement Agreement Template

- How Do I Sign Colorado Debt Settlement Agreement Template

- Can I Sign Connecticut Stock Purchase Agreement Template

- How Can I Sign North Dakota Share Transfer Agreement Template

- Sign Oklahoma Debt Settlement Agreement Template Online

- Can I Sign Oklahoma Debt Settlement Agreement Template

- Sign Pennsylvania Share Transfer Agreement Template Now

- Sign Nevada Stock Purchase Agreement Template Later

- Sign Arkansas Indemnity Agreement Template Easy

- Sign Oklahoma Stock Purchase Agreement Template Simple

- Sign South Carolina Stock Purchase Agreement Template Fast

- Sign California Stock Transfer Form Template Online

- How Do I Sign California Stock Transfer Form Template

- How Can I Sign North Carolina Indemnity Agreement Template

- How Do I Sign Delaware Stock Transfer Form Template

- Help Me With Sign Texas Stock Purchase Agreement Template