Indemnity Bond for Lost Fdr Bank of Baroda Form

What is the indemnity bond for lost FD Bank of Baroda?

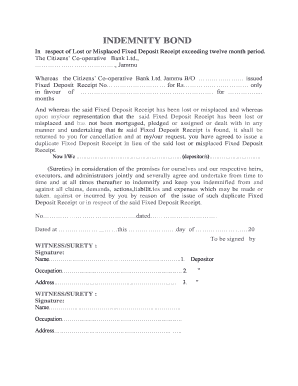

The indemnity bond for lost fixed deposit (FD) at Bank of Baroda is a legal document that protects both the bank and the depositor in the event that the original fixed deposit receipt is lost. This bond serves as a formal assurance that the bank will not be held liable for any claims related to the lost receipt, provided that the depositor adheres to the terms outlined in the bond. It is essential for ensuring that the depositor can still access their funds without the original documentation.

How to obtain the indemnity bond for lost FD Bank of Baroda

To obtain the indemnity bond for a lost fixed deposit receipt at Bank of Baroda, the depositor must visit their local branch. They will need to fill out a specific application form requesting the bond. It is advisable to bring identification documents and any relevant information regarding the lost FD, such as the account number and deposit details. The bank may require the depositor to sign the indemnity bond in the presence of a bank official to ensure its validity.

Steps to complete the indemnity bond for lost FD Bank of Baroda

Completing the indemnity bond involves several key steps:

- Visit the nearest Bank of Baroda branch.

- Request the indemnity bond application form from a bank representative.

- Fill out the form with accurate details, including personal information and FD specifics.

- Provide necessary identification and documentation as requested by the bank.

- Sign the indemnity bond in the presence of a bank official.

- Submit the completed form and await confirmation from the bank regarding the bond's acceptance.

Key elements of the indemnity bond for lost FD Bank of Baroda

The indemnity bond for a lost fixed deposit receipt typically includes several critical elements:

- Depositor's Information: Full name, address, and contact details.

- FD Details: Account number, amount, and maturity date of the fixed deposit.

- Indemnity Clause: A statement outlining the depositor's agreement to indemnify the bank against any claims related to the lost receipt.

- Signature: The depositor's signature, confirming their understanding and acceptance of the bond's terms.

Legal use of the indemnity bond for lost FD Bank of Baroda

The indemnity bond is legally binding and must comply with relevant laws governing financial transactions. It protects the bank from potential fraud or claims arising from the lost fixed deposit receipt. For the bond to be enforceable, it must be executed properly, including the necessary signatures and adherence to the bank's policies. This ensures that both the bank and the depositor are safeguarded in the event of any disputes.

Examples of using the indemnity bond for lost FD Bank of Baroda

There are various scenarios in which a depositor might need to use the indemnity bond for a lost FD:

- A depositor realizes that their fixed deposit receipt is missing and needs to access their funds.

- A family member of the depositor needs to claim the funds after the depositor's passing, but the receipt cannot be located.

- The depositor requires a loan against the fixed deposit but cannot present the original receipt.

Quick guide on how to complete indemnity bond for lost fdr bank of baroda

Effortlessly prepare Indemnity Bond For Lost Fdr Bank Of Baroda on any device

The management of online documents has gained traction among both organizations and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed papers, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, alter, and electronically sign your documents quickly and without hindrance. Manage Indemnity Bond For Lost Fdr Bank Of Baroda on any device using airSlate SignNow's Android or iOS applications and simplify your document-based tasks today.

How to alter and electronically sign Indemnity Bond For Lost Fdr Bank Of Baroda with ease

- Obtain Indemnity Bond For Lost Fdr Bank Of Baroda and click Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize pertinent sections of the documents or conceal sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Construct your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional hand-signed signature.

- Review all the details and click the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Alter and electronically sign Indemnity Bond For Lost Fdr Bank Of Baroda while ensuring excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the indemnity bond for lost fdr bank of baroda

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an indemnity bond for lost FD Bank of Baroda?

An indemnity bond for lost FD Bank of Baroda is a legal document that protects the bank from potential losses if a fixed deposit receipt is lost. It assures the bank that they can reimburse the amount only after verifying the claim. This bond is essential to allow customers to access their funds even when the original document is unavailable.

-

How can I create an indemnity bond for lost FD Bank of Baroda?

To create an indemnity bond for lost FD Bank of Baroda, you can use the airSlate SignNow platform, which simplifies document generation and eSigning. Simply fill in the required details on the platform, and you can generate the indemnity bond quickly. Once completed, you can send it for eSignature, streamlining the entire process.

-

What are the costs associated with an indemnity bond for lost FD Bank of Baroda?

The costs for an indemnity bond for lost FD Bank of Baroda may vary based on the bank’s policies and the amount of the fixed deposit. Additionally, using services like airSlate SignNow could incur a minimal fee for document creation and eSignatures. It’s best to check with the bank and the platform for detailed pricing.

-

What features does airSlate SignNow provide for creating an indemnity bond for lost FD Bank of Baroda?

airSlate SignNow offers features that allow users to create, edit, and sign an indemnity bond for lost FD Bank of Baroda easily. The platform provides templates, compliance assurance, and secure storage, making document management efficient. Moreover, users can send documents for signature directly through the platform.

-

How long does it take to process an indemnity bond for lost FD Bank of Baroda?

The processing time for an indemnity bond for loss of FD Bank of Baroda depends on the bank’s internal procedures. Generally, with airSlate SignNow, the creation and signing process can be completed in minutes. After submission, the bank may take a few additional days to review and approve the bond.

-

Can I eSign an indemnity bond for lost FD Bank of Baroda remotely?

Yes, you can eSign an indemnity bond for lost FD Bank of Baroda remotely using airSlate SignNow. The platform enables you to securely sign documents from anywhere at any time. This feature is particularly beneficial for customers who may not be able to visit the bank in person.

-

What are the benefits of using airSlate SignNow for an indemnity bond for lost FD Bank of Baroda?

Using airSlate SignNow for an indemnity bond for lost FD Bank of Baroda streamlines the process, reduces paperwork, and enhances security. The platform's user-friendly interface allows for quick document creation and easy eSigning. Additionally, it helps in tracking document status and ensuring compliance.

Get more for Indemnity Bond For Lost Fdr Bank Of Baroda

- Download the registration packet 88th annual rashid family form

- Progress payment customer authority form

- Gypsy moth checklist od household services form

- Fish hawk trails architectural control committee acc form

- General district court continuance form hanover county co hanover va

- Mail a donation bformb casey39s general store

- E92 08302 a 45 w ftschool form

- World coins pdf download form

Find out other Indemnity Bond For Lost Fdr Bank Of Baroda

- eSignature Michigan Internship Contract Computer

- Can I eSignature Nebraska Student Data Sheet

- How To eSignature Michigan Application for University

- eSignature North Carolina Weekly Class Evaluation Now

- eSignature Colorado Medical Power of Attorney Template Fast

- Help Me With eSignature Florida Medical Power of Attorney Template

- eSignature Iowa Medical Power of Attorney Template Safe

- eSignature Nevada Medical Power of Attorney Template Secure

- eSignature Arkansas Nanny Contract Template Secure

- eSignature Wyoming New Patient Registration Mobile

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template