E92 08302 a 45 W Ftschool 2008

What is the E92 08302 A 45 W Ftschool

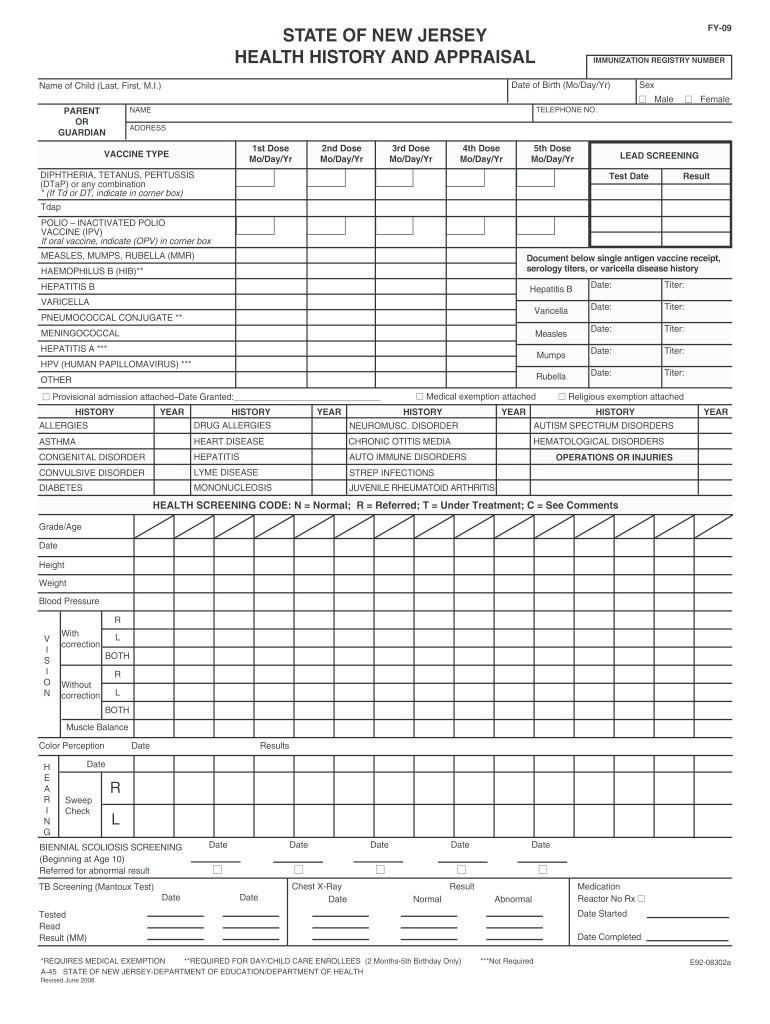

The E92 08302 A 45 W Ftschool is a specific form used for educational or administrative purposes within certain institutions. This form is typically required for students or applicants seeking enrollment or participation in specific programs. Understanding its purpose is crucial for ensuring compliance and fulfilling requirements set by the institution.

How to use the E92 08302 A 45 W Ftschool

Using the E92 08302 A 45 W Ftschool involves several steps to ensure accurate completion. First, gather all necessary information, including personal details and any required documentation. Next, fill out the form carefully, ensuring all fields are completed as per the guidelines provided. Once completed, review the form for accuracy before submission. Depending on the institution's requirements, the form may need to be submitted online, by mail, or in person.

Steps to complete the E92 08302 A 45 W Ftschool

Completing the E92 08302 A 45 W Ftschool involves a systematic approach:

- Collect all necessary information and documents required for the form.

- Access the form through the appropriate channel, whether online or a physical copy.

- Carefully fill out each section of the form, ensuring all information is accurate and complete.

- Review the form for any errors or omissions before finalizing it.

- Submit the form according to the instructions provided, ensuring you keep a copy for your records.

Legal use of the E92 08302 A 45 W Ftschool

The legal use of the E92 08302 A 45 W Ftschool is governed by the policies of the institution requiring the form. It is essential to ensure that the information provided is truthful and accurate, as any discrepancies may lead to legal implications or denial of the application. Familiarizing oneself with the specific legal requirements related to this form is advisable to ensure compliance.

Key elements of the E92 08302 A 45 W Ftschool

Key elements of the E92 08302 A 45 W Ftschool typically include:

- Personal identification information, such as name and contact details.

- Details regarding the program or course of interest.

- Supporting documentation, which may include transcripts or letters of recommendation.

- Signature and date to validate the information provided.

Who Issues the Form

The E92 08302 A 45 W Ftschool is generally issued by educational institutions or specific administrative bodies that oversee student enrollment and program participation. It is important to obtain the form directly from the relevant institution to ensure that you are using the most current version and meeting all necessary requirements.

Quick guide on how to complete e92 08302 a 45 w ftschool

Explore the simpler approach to handle your E92 08302 A 45 W Ftschool

The traditional techniques for finalizing and validating documents consume an excessively long duration compared to contemporary papers management options. Previously, you would look for suitable social forms, print them, fill in all the information, and send them via postal service. Now, you can obtain, fill out, and endorse your E92 08302 A 45 W Ftschool in a single web browser tab with airSlate SignNow. Preparing your E92 08302 A 45 W Ftschool has never been easier.

Steps to finalize your E92 08302 A 45 W Ftschool with airSlate SignNow

- Access the category page you require and find your state-specific E92 08302 A 45 W Ftschool. Alternatively, utilize the search option.

- Verify that the form version is accurate by viewing it.

- Select Get form and enter editing mode.

- Fill in your document with the necessary information using the editing tools.

- Examine the included details and click the Sign feature to confirm your form.

- Select the most convenient method to create your signature: generate it, draw your signature, or upload its image.

- Click DONE to apply changes.

- Download the file onto your device or proceed to Sharing settings to send it digitally.

Efficient online tools like airSlate SignNow streamline the process of completing and submitting your forms. Try it to discover exactly how long document management and approval processes are meant to take. You will conserve considerable time.

Create this form in 5 minutes or less

Find and fill out the correct e92 08302 a 45 w ftschool

FAQs

-

When do I have to learn how to fill out a W-2 form?

Form W-2 is an obligatory form to be completed by every employer. Form W-2 doesn’t have to be filled out by the employee. It is given to inform the employee about the amount of his annual income and taxes withheld from it.You can find a lot of information here: http://bit.ly/2NjjlJi

-

How do I fill out a W-4 form?

The main thing you need to put on your W-4 besides your name, address and social security number is whether you are married or single and the number of exemptions you wish to take to lower the amount of money with held for taxes from your paycheck. The number of exemptions refers to how many people you support, i. e. children. Say you are single and have 3 children, you can put down 4 exemptions, 1 for your self and 1 for each child. This means you will have more pay to take home because you aren’t having it with held from your paycheck. If you are single and have no children, you can either take 1 or 0 exemptions. If you make decent money, take 0 deductions, if you are barely making it you could probably take 1 exemption. Just realize that if you take exemptions, and not enough money is taken out of your check to pay your taxes, you will be liable for it come April 15th.If you are married and have no children and you make decent money, take 0 deductions. If you have children, only one spouse should take them as exemptions and it should be the one who makes the most money. For example, say your spouse is the major bread winner and you have 2 children, your spouse could take 4 exemptions (one for each member of the family) and then you would take 0 exemptions.Usually, it’s best to err on the side of caution and take the smaller amount of deductions so that you won’t owe a lot of money come tax time. If you’ve had too much with held it will come back to you as a refund.

-

Why did my employer give me a W-9 Form to fill out instead of a W-4 Form?

I wrote about the independent-contractor-vs-employee issue last year, see http://nctaxpro.wordpress.com/20...Broadly speaking, you are an employee when someone else - AKA the employer - has control over when and where you work and the processes by which you perform the work that you do for that individual. A DJ or bartender under some circumstances, I suppose, might qualify as an independent contractor at a restaurant, but the waitstaff, bus help, hosts, kitchen aides, etc. almost certainly would not.There's always risk in confronting an employer when faced with a situation like yours - my experience is that most employers know full well that they are violating the law when they treat employees as independent contractors, and for that reason they don't tolerate questions about that policy very well - so you definitely should tread cautiously if you want to keep this position. Nonetheless, I think you owe it to yourself to ask whether or not the restaurant intends to withhold federal taxes from your checks - if for no other reason than you don't want to get caught short when it comes to filing your own return, even if you don't intend to challenge the policy.

-

How do I fill a W-9 Tax Form out?

Download a blank Form W-9To get started, download the latest Form W-9 from the IRS website at https://www.irs.gov/pub/irs-pdf/.... Check the date in the top left corner of the form as it is updated occasionally by the IRS. The current revision should read (Rev. December 2014). Click anywhere on the form and a menu appears at the top that will allow you to either print or save the document. If the browser you are using doesn’t allow you to type directly into the W-9 then save the form to your desktop and reopen using signNow Reader.General purposeThe general purpose of Form W-9 is to provide your correct taxpayer identification number (TIN) to an individual or entity (typically a company) that is required to submit an “information return” to the IRS to report an amount paid to you, or other reportable amount.U.S. personForm W-9 should only be completed by what the IRS calls a “U.S. person”. Some examples of U.S. persons include an individual who is a U.S. citizen or a U.S. resident alien. Partnerships, corporations, companies, or associations created or organized in the United States or under the laws of the United States are also U.S. persons.If you are not a U.S. person you should not use this form. You will likely need to provide Form W-8.Enter your informationLine 1 – Name: This line should match the name on your income tax return.Line 2 – Business name: This line is optional and would include your business name, trade name, DBA name, or disregarded entity name if you have any of these. You only need to complete this line if your name here is different from the name on line 1. See our related blog, What is a disregarded entity?Line 3 – Federal tax classification: Check ONE box for your U.S. federal tax classification. This should be the tax classification of the person or entity name that is entered on line 1. See our related blog, What is the difference between an individual and a sole proprietor?Limited Liability Company (LLC). If the name on line 1 is an LLC treated as a partnership for U.S. federal tax purposes, check the “Limited liability company” box and enter “P” in the space provided. If the LLC has filed Form 8832 or 2553 to be taxed as a corporation, check the “Limited liability company” box and in the space provided enter “C” for C corporation or “S” for S corporation. If it is a single-member LLC that is a disregarded entity, do not check the “Limited liability company” box; instead check the first box in line 3 “Individual/sole proprietor or single-member LLC.” See our related blog, What tax classification should an LLC select?Other (see instructions) – This line should be used for classifications that are not listed such as nonprofits, governmental entities, etc.Line 4 – Exemptions: If you are exempt from backup withholding enter your exempt payee code in the first space. If you are exempt from FATCA reporting enter your exemption from FATCA reporting code in the second space. Generally, individuals (including sole proprietors) are not exempt from backup withholding. See the “Specific Instructions” for line 4 shown with Form W-9 for more detailed information on exemptions.Line 5 – Address: Enter your address (number, street, and apartment or suite number). This is where the requester of the Form W-9 will mail your information returns.Line 6 – City, state and ZIP: Enter your city, state and ZIP code.Line 7 – Account numbers: This is an optional field to list your account number(s) with the company requesting your W-9 such as a bank, brokerage or vendor. We recommend that you do not list any account numbers as you may have to provide additional W-9 forms for accounts you do not include.Requester’s name and address: This is an optional section you can use to record the requester’s name and address you sent your W-9 to.Part I – Taxpayer Identification Number (TIN): Enter in your taxpayer identification number here. This is typically a social security number for an individual or sole proprietor and an employer identification number for a company. See our blog, What is a TIN number?Part II – Certification: Sign and date your form.For additional information visit w9manager.com.

-

How do you fill out a W-2 form?

In general, the W-2 form is divided into two parts each with numerous fields to be completed carefully by an employer. The section on the left contains both the employer's and employee`s names and contact information as well social security number and identification number.You can find a lot of information here: http://bit.ly/2NjjlJi

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

Create this form in 5 minutes!

How to create an eSignature for the e92 08302 a 45 w ftschool

How to create an electronic signature for the E92 08302 A 45 W Ftschool in the online mode

How to generate an electronic signature for your E92 08302 A 45 W Ftschool in Chrome

How to make an electronic signature for signing the E92 08302 A 45 W Ftschool in Gmail

How to create an electronic signature for the E92 08302 A 45 W Ftschool straight from your smart phone

How to create an electronic signature for the E92 08302 A 45 W Ftschool on iOS

How to generate an electronic signature for the E92 08302 A 45 W Ftschool on Android

People also ask

-

What is the E92 08302 A 45 W Ftschool solution?

The E92 08302 A 45 W Ftschool is a comprehensive eSignature solution provided by airSlate SignNow, designed to streamline document sending and signing processes. It allows businesses to efficiently manage their paperwork digitally, ensuring a seamless experience for both senders and signers.

-

How does E92 08302 A 45 W Ftschool benefit my business?

By using the E92 08302 A 45 W Ftschool, businesses can enhance productivity by reducing the time spent on paperwork. This solution not only simplifies the signing process but also minimizes errors, leading to improved workflow and faster transaction times.

-

What are the key features of E92 08302 A 45 W Ftschool?

The E92 08302 A 45 W Ftschool offers a variety of features including customizable templates, real-time tracking, and cloud storage integration. These features help users to easily create, send, and manage documents while maintaining security and compliance.

-

Is E92 08302 A 45 W Ftschool affordable for small businesses?

Yes, E92 08302 A 45 W Ftschool is designed to be a cost-effective solution for businesses of all sizes, including small enterprises. With flexible pricing plans, you can choose the option that best fits your budget and needs, making it accessible for everyone.

-

Can E92 08302 A 45 W Ftschool integrate with existing software?

Absolutely! E92 08302 A 45 W Ftschool can easily integrate with a variety of existing software applications, allowing for a smooth transition and enhanced functionality. Whether you use CRM, project management tools, or cloud storage, it can connect seamlessly to improve your workflow.

-

How secure is the E92 08302 A 45 W Ftschool platform?

Security is a top priority for airSlate SignNow, and the E92 08302 A 45 W Ftschool platform employs advanced encryption and authentication measures. This ensures that all your documents and signatures are protected against unauthorized access, maintaining the confidentiality of your sensitive information.

-

What support options are available for E92 08302 A 45 W Ftschool users?

Users of E92 08302 A 45 W Ftschool have access to comprehensive support options, including live chat, email assistance, and extensive online resources. Whether you have a question about features or need technical support, our team is here to help you maximize your experience.

Get more for E92 08302 A 45 W Ftschool

Find out other E92 08302 A 45 W Ftschool

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later