CERT 135, Reduced Sales and Use Tax Rete for Motor CT Gov Form

What is the CERT 135?

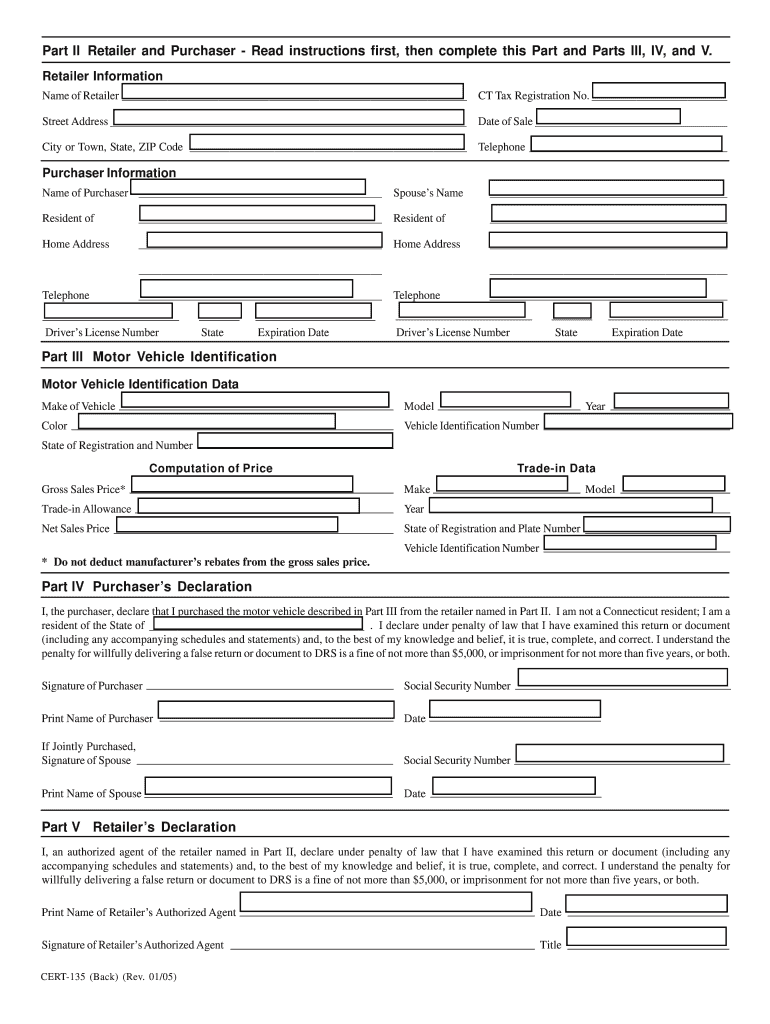

The CERT 135, also known as the Reduced Sales and Use Tax Certificate for Motor Vehicles, is a form used in Connecticut to claim a reduction in sales and use tax when purchasing certain motor vehicles. This certificate is essential for qualifying buyers who meet specific criteria, allowing them to benefit from tax savings during the purchase process. The form is particularly relevant for individuals and businesses looking to acquire vehicles at a reduced tax rate, thereby facilitating more affordable transactions.

How to use the CERT 135

To effectively use the CERT 135, buyers must complete the form accurately and present it to the seller during the vehicle purchase. This process involves filling out personal details, including the buyer's name, address, and the vehicle's information. It is crucial to ensure that all information is correct to avoid any complications. Once completed, the seller retains the form for their records, which helps in verifying the tax-exempt status of the transaction.

Steps to complete the CERT 135

Completing the CERT 135 involves several straightforward steps:

- Obtain the CERT 135 form, which can be downloaded as a PDF from the Connecticut government website.

- Fill in your personal information, including your name and address.

- Provide details about the vehicle, such as the make, model, and vehicle identification number (VIN).

- Sign and date the form to certify that the information provided is accurate.

- Present the completed form to the seller at the time of purchase.

Legal use of the CERT 135

The CERT 135 is legally binding when used correctly. It allows eligible buyers to claim a reduced sales and use tax rate on qualifying motor vehicle purchases. To ensure compliance with state laws, it is important to use the form only for eligible transactions and to keep accurate records. Sellers must also retain the completed forms to validate the tax-exempt status during audits or reviews by tax authorities.

Eligibility Criteria

To qualify for the reduced sales and use tax under the CERT 135, buyers must meet specific eligibility criteria set by the Connecticut Department of Revenue Services. Generally, this includes being a resident of Connecticut and purchasing a motor vehicle that qualifies for the reduced tax rate. Certain exemptions may apply, so it is advisable to review the latest guidelines or consult with a tax professional to ensure compliance.

Examples of using the CERT 135

The CERT 135 can be used in various scenarios, such as:

- A business purchasing a fleet of vehicles for commercial use, allowing them to save on taxes.

- An individual buying a new or used car that qualifies under the reduced tax program.

- A non-profit organization acquiring vehicles for charitable purposes, benefiting from tax reductions.

Quick guide on how to complete cert 135 reduced sales and use tax rete for motor ctgov

Prepare CERT 135, Reduced Sales And Use Tax Rete For Motor CT gov effortlessly on any device

Web-based document management has gained popularity among organizations and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Handle CERT 135, Reduced Sales And Use Tax Rete For Motor CT gov on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to edit and eSign CERT 135, Reduced Sales And Use Tax Rete For Motor CT gov with ease

- Obtain CERT 135, Reduced Sales And Use Tax Rete For Motor CT gov and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes moments and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Edit and eSign CERT 135, Reduced Sales And Use Tax Rete For Motor CT gov and ensure seamless communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cert 135 reduced sales and use tax rete for motor ctgov

How to generate an electronic signature for the Cert 135 Reduced Sales And Use Tax Rete For Motor Ctgov online

How to create an electronic signature for the Cert 135 Reduced Sales And Use Tax Rete For Motor Ctgov in Chrome

How to create an eSignature for signing the Cert 135 Reduced Sales And Use Tax Rete For Motor Ctgov in Gmail

How to make an eSignature for the Cert 135 Reduced Sales And Use Tax Rete For Motor Ctgov right from your smart phone

How to create an electronic signature for the Cert 135 Reduced Sales And Use Tax Rete For Motor Ctgov on iOS

How to create an eSignature for the Cert 135 Reduced Sales And Use Tax Rete For Motor Ctgov on Android OS

People also ask

-

What is a form 135 sample?

A form 135 sample is a template that businesses can use to produce standardized forms for various purposes. It provides a clear structure that ensures all necessary information is captured. Using an airSlate SignNow form 135 sample can greatly simplify the document creation process.

-

How can I access a form 135 sample using airSlate SignNow?

You can easily access a form 135 sample by signing up for an airSlate SignNow account. Our platform offers a variety of customizable templates, including the form 135 sample. Once logged in, you can edit, fill out, and send the form as needed.

-

What are the benefits of using airSlate SignNow for form 135 sample documents?

Using airSlate SignNow for your form 135 sample documents accelerates the signing process and enhances collaboration. Our platform is cost-effective and offers features such as e-signature, secure document storage, and real-time tracking. This improves efficiency and reduces turnaround time.

-

Are there any costs associated with using form 135 samples in airSlate SignNow?

AirSlate SignNow offers a range of pricing plans, including a free trial to explore the features available for form 135 samples. The subscription plans are designed to cater to different business needs, providing flexibility and value. Evaluate our pricing page for detailed options.

-

Can I integrate airSlate SignNow with other applications for managing form 135 samples?

Yes! AirSlate SignNow seamlessly integrates with popular applications such as Google Drive, Dropbox, and Salesforce, making it easy to manage your form 135 samples. These integrations allow for streamlined workflows and better data management, enhancing your overall experience.

-

Is it possible to edit a form 135 sample after sending it for signature?

Once a form 135 sample has been sent for signature using airSlate SignNow, it cannot be edited. However, you can cancel the current request and send a new version with the necessary changes. This ensures that all parties receive the correct information while maintaining document integrity.

-

How does airSlate SignNow ensure the security of my form 135 samples?

AirSlate SignNow employs robust security measures to protect your form 135 samples and sensitive information. We utilize encryption protocols, secure cloud storage, and compliance with industry standards. This ensures that your documents remain confidential and secure at all times.

Get more for CERT 135, Reduced Sales And Use Tax Rete For Motor CT gov

- Mutual wills package with last wills and testaments for married couple with adult children south carolina form

- Mutual wills package with last wills and testaments for married couple with no children south carolina form

- Mutual wills package with last wills and testaments for married couple with minor children south carolina form

- South carolina will 497326009 form

- Will no children form

- Legal last will and testament form for married person with minor children south carolina

- South carolina codicil form

- Legal last will and testament form for married person with adult and minor children from prior marriage south carolina

Find out other CERT 135, Reduced Sales And Use Tax Rete For Motor CT gov

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement