Form Gst Reg 30 in Excel

What is the Form GST Reg 30 in Excel

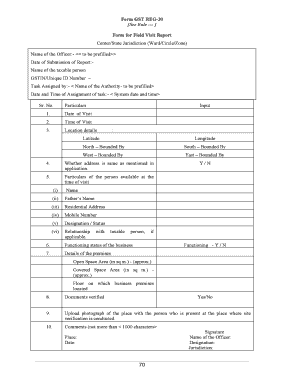

The Form GST Reg 30 is a crucial document used for the registration of goods and services tax in the United States. This form is specifically designed to help businesses comply with tax regulations by providing essential information about their operations. The Excel version of the form allows users to fill out the necessary details in a structured format, making it easier to manage and submit. This digital format enhances accessibility and efficiency, enabling users to calculate totals automatically and reduce the risk of errors that can occur with manual entry.

How to Use the Form GST Reg 30 in Excel

Using the Form GST Reg 30 in Excel is straightforward. First, download the form from a reliable source. Open the document in Excel, where you will find designated fields for entering your business information, tax details, and any other required data. It is essential to follow the instructions provided within the form to ensure that all necessary sections are completed accurately. Once you have filled in the required fields, review the information for accuracy before saving the document for submission.

Steps to Complete the Form GST Reg 30 in Excel

Completing the Form GST Reg 30 in Excel involves several key steps:

- Download the Form GST Reg 30 in Excel format.

- Open the form and familiarize yourself with the layout and required fields.

- Enter your business name, address, and contact information in the appropriate sections.

- Provide details regarding your tax obligations, including the types of goods and services offered.

- Double-check all entries for accuracy and completeness.

- Save the completed form in a secure location for future reference.

Legal Use of the Form GST Reg 30 in Excel

The Form GST Reg 30 in Excel is legally recognized as a valid document for tax registration purposes, provided it is completed accurately and submitted according to the relevant regulations. It is essential to ensure that all information is truthful and compliant with local tax laws to avoid any legal repercussions. Using a digital format like Excel can help maintain compliance by providing built-in calculations and error-checking features, which enhance the reliability of the submitted information.

Filing Deadlines / Important Dates

Filing deadlines for the Form GST Reg 30 can vary based on state regulations and specific business circumstances. It is crucial to be aware of these deadlines to avoid penalties and ensure compliance. Typically, businesses are required to submit their registration forms within a specific timeframe after commencing operations or when there are significant changes in their business structure. Always check with local tax authorities for the most accurate and up-to-date information regarding filing deadlines.

Form Submission Methods (Online / Mail / In-Person)

The Form GST Reg 30 can be submitted through various methods, depending on the requirements set by the local tax authority. Common submission methods include:

- Online submission through the tax authority's official portal.

- Mailing a printed copy of the completed form to the designated address.

- In-person submission at local tax offices, if applicable.

It is advisable to confirm the preferred submission method with the relevant tax authority to ensure compliance with their guidelines.

Quick guide on how to complete form gst reg 30 in excel

Effortlessly Prepare Form Gst Reg 30 In Excel on Any Device

Digital document management has soared in popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, enabling you to locate the correct form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents promptly without any holdups. Manage Form Gst Reg 30 In Excel on any device with airSlate SignNow mobile applications for Android or iOS and streamline any document-related procedure today.

Simple Steps to Edit and eSign Form Gst Reg 30 In Excel with Ease

- Obtain Form Gst Reg 30 In Excel and click on Get Form to commence.

- Make use of the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose your preferred method of delivering your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, unwieldy form searching, or mistakes that necessitate printing fresh copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Form Gst Reg 30 In Excel to ensure clear communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form gst reg 30 in excel

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form gst reg 30 in excel used for?

The form gst reg 30 in excel is primarily used for businesses to apply for GST registration in India. This form helps streamline the application process, ensuring all necessary information is included accurately. Utilizing a digital format like excel simplifies data entry and reduces errors.

-

How can airSlate SignNow assist with submitting the form gst reg 30 in excel?

airSlate SignNow provides features that allow users to securely eSign and send the form gst reg 30 in excel seamlessly. With our solution, you can easily upload your excel file, apply signatures, and send it to relevant stakeholders directly. This simplifies the submission process, saving time and ensuring compliance.

-

Is there a cost associated with using airSlate SignNow for the form gst reg 30 in excel?

Yes, airSlate SignNow offers various pricing plans tailored to suit different business needs. While there is a fee for premium features, users can take advantage of a free trial to explore functionalities related to the form gst reg 30 in excel. This allows businesses to assess the value before committing to a subscription.

-

Can I integrate airSlate SignNow with other software while handling the form gst reg 30 in excel?

Absolutely! airSlate SignNow integrates with numerous software applications, enhancing your workflow while managing the form gst reg 30 in excel. Whether you use CRM systems or project management tools, our integrations ensure that data is synchronized and processes are streamlined, improving overall efficiency.

-

What are the benefits of using airSlate SignNow for eSigning the form gst reg 30 in excel?

Using airSlate SignNow for eSigning the form gst reg 30 in excel offers numerous benefits, including enhanced security, reduced turnaround time, and increased efficiency. Our platform ensures that documents remain confidential and tamper-proof, while the eSigning process is faster compared to traditional methods, facilitating quicker approvals.

-

Is it easy to create the form gst reg 30 in excel with airSlate SignNow?

Yes, creating the form gst reg 30 in excel is straightforward with airSlate SignNow. Our user-friendly interface allows users to easily input data, customize the form, and generate an excel file. This convenience is especially beneficial for businesses looking to quickly adapt their GST registration process.

-

How secure is airSlate SignNow when handling the form gst reg 30 in excel?

airSlate SignNow prioritizes security, employing advanced encryption and compliance with industry standards. When handling the form gst reg 30 in excel, users can trust that their sensitive information is protected throughout the signing and submission process. Our platform also maintains an audit trail for added transparency.

Get more for Form Gst Reg 30 In Excel

- Ama university form

- Pdf medvantx pharmacy services po box 5736 sioux falls sd form

- Eye care servicesocli vision form

- Pdf william and mary boookstore college of william and form

- Community based supplier registration form city of cape town

- Electricity and energy business unit form

- Inventory form across australia removals

- Broker loan submission coversheet form

Find out other Form Gst Reg 30 In Excel

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online

- eSignature New York Web Hosting Agreement Mobile

- eSignature North Carolina Web Hosting Agreement Secure

- How Do I eSignature Utah Web Hosting Agreement

- eSignature Connecticut Joint Venture Agreement Template Myself

- eSignature Georgia Joint Venture Agreement Template Simple

- eSignature Alaska Debt Settlement Agreement Template Safe

- eSignature New Jersey Debt Settlement Agreement Template Simple

- eSignature New Mexico Debt Settlement Agreement Template Free

- eSignature Tennessee Debt Settlement Agreement Template Secure

- eSignature Wisconsin Debt Settlement Agreement Template Safe

- Can I eSignature Missouri Share Transfer Agreement Template

- eSignature Michigan Stock Purchase Agreement Template Computer

- eSignature California Indemnity Agreement Template Online

- eSignature New Mexico Promissory Note Template Now