Obtain a Federal Tax ID Number from the IRS Maryland 2023-2026

Obtaining a Federal Tax ID Number from the IRS in Maryland

In Maryland, obtaining a Federal Tax ID Number, also known as an Employer Identification Number (EIN), is essential for businesses and certain individuals. This unique nine-digit number is issued by the IRS and is used for various tax purposes, including filing tax returns and opening business bank accounts.

Steps to Complete the Application for a Federal Tax ID Number

The process of applying for a Federal Tax ID Number in Maryland can be completed online, by mail, or by fax. Here are the steps to follow:

- Determine your eligibility: Ensure that you need an EIN based on your business structure and activities.

- Complete the application: Use IRS Form SS-4, which can be filled out online or downloaded for mailing.

- Submit your application: If applying online, complete the process on the IRS website. For mail or fax, send the completed form to the appropriate IRS office.

- Receive your EIN: Upon approval, you will receive your EIN immediately if applied online, or within a few weeks if submitted by mail.

Required Documents for EIN Application

When applying for a Federal Tax ID Number in Maryland, you will need to provide specific information. This includes:

- The legal name of the business or individual applying.

- The business structure (e.g., LLC, corporation, partnership).

- The reason for applying for an EIN.

- The business address and contact information.

- The name and Social Security Number (SSN) of the responsible party.

Filing Deadlines and Important Dates

It is crucial to be aware of filing deadlines related to the Maryland income tax and federal tax obligations. Generally, businesses must file their income tax returns by April 15 for individuals and March 15 for corporations. However, if you are applying for an EIN, there are no specific deadlines, but timely application is recommended to ensure compliance with tax requirements.

Penalties for Non-Compliance

Failure to obtain a Federal Tax ID Number when required can lead to significant penalties. Businesses may face fines from the IRS, which can accumulate over time. Furthermore, not having an EIN can hinder your ability to open a business bank account, hire employees, or apply for business licenses and permits.

Eligibility Criteria for EIN Application

To qualify for a Federal Tax ID Number in Maryland, applicants must meet specific criteria, including:

- Being a business entity such as a corporation, partnership, or LLC.

- Being a sole proprietor with employees or needing to file certain tax returns.

- Having a principal place of business in the United States or its territories.

Quick guide on how to complete obtain a federal tax id number from the irs maryland

Prepare Obtain A Federal Tax ID Number From The IRS Maryland effortlessly on any device

Digital document management has become widely adopted by organizations and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can locate the necessary form and securely keep it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents quickly without delays. Handle Obtain A Federal Tax ID Number From The IRS Maryland on any device using airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to edit and eSign Obtain A Federal Tax ID Number From The IRS Maryland with ease

- Obtain Obtain A Federal Tax ID Number From The IRS Maryland and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Formulate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choice. Edit and eSign Obtain A Federal Tax ID Number From The IRS Maryland and guarantee outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct obtain a federal tax id number from the irs maryland

Create this form in 5 minutes!

How to create an eSignature for the obtain a federal tax id number from the irs maryland

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

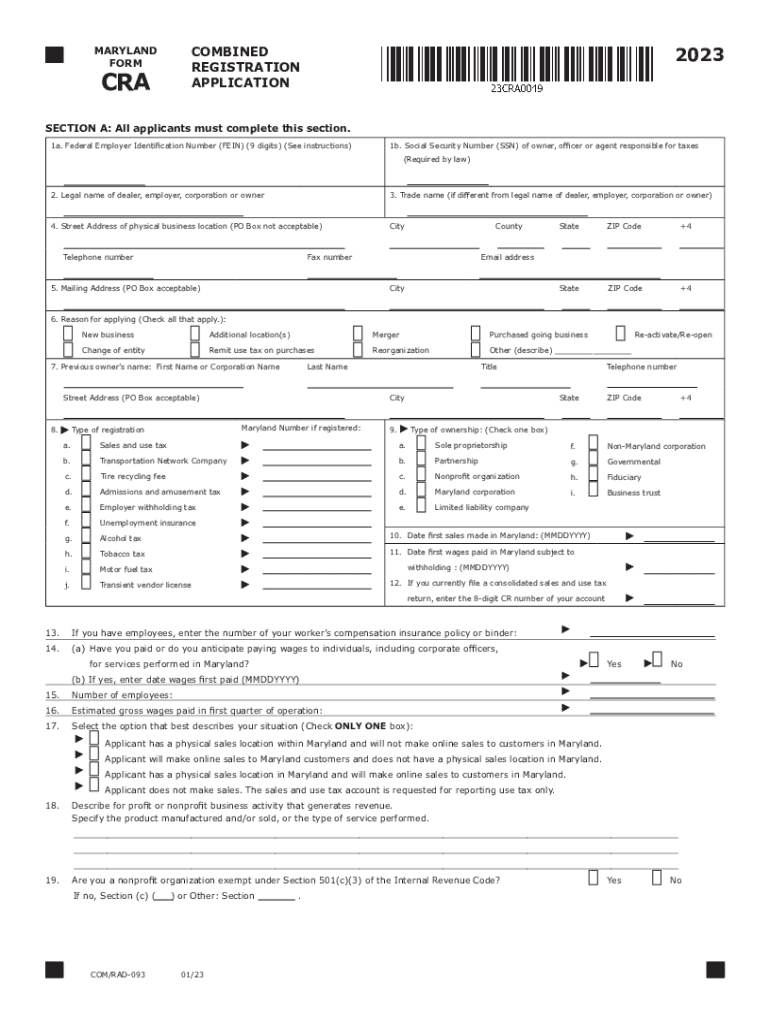

What is the combined registration application in Maryland?

The combined registration application in Maryland is a streamlined process for businesses to register for various state requirements. This simplifies the paperwork needed for licenses, permits, and tax registrations, making it easier for entrepreneurs to start and operate their businesses efficiently.

-

How can airSlate SignNow assist with the combined registration application in Maryland?

airSlate SignNow provides a platform that allows users to easily eSign documents required for the combined registration application in Maryland. This feature enhances the submission process, ensuring businesses can complete their registration quickly and securely from any device.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers a variety of pricing plans to cater to different business needs, starting from a basic plan to comprehensive solutions. Each plan provides essential features to assist users in managing their documents, including those related to the combined registration application in Maryland, at a competitive rate.

-

Are there any benefits to using airSlate SignNow for document management?

Yes, using airSlate SignNow for document management offers numerous benefits, including enhanced efficiency and time savings. With its user-friendly interface and features tailored for documents like the combined registration application in Maryland, users can streamline their workflows and improve collaboration among teams.

-

What integrations are available with airSlate SignNow?

airSlate SignNow integrates seamlessly with various third-party applications, enhancing its functionality for users. These integrations support businesses in managing their processes more efficiently, especially for handling documents related to the combined registration application in Maryland.

-

Is airSlate SignNow secure for handling sensitive documents?

Absolutely, airSlate SignNow prioritizes security with advanced encryption protocols that safeguard your documents. This ensures that all forms, including the combined registration application in Maryland, are protected during the signing and submission process.

-

Can airSlate SignNow help expedite the registration process in Maryland?

Yes, airSlate SignNow can signNowly expedite the registration process in Maryland by allowing users to quickly eSign and manage necessary documents. This efficiency is crucial for businesses looking to complete their combined registration application in Maryland without unnecessary delays.

Get more for Obtain A Federal Tax ID Number From The IRS Maryland

Find out other Obtain A Federal Tax ID Number From The IRS Maryland

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word