Schedule PA 41 X Amended PA Fiduciary Income Tax Schedule PA 41 X FormsPublications 2022

Understanding the Pennsylvania 41X Amended Fiduciary Income Tax Form

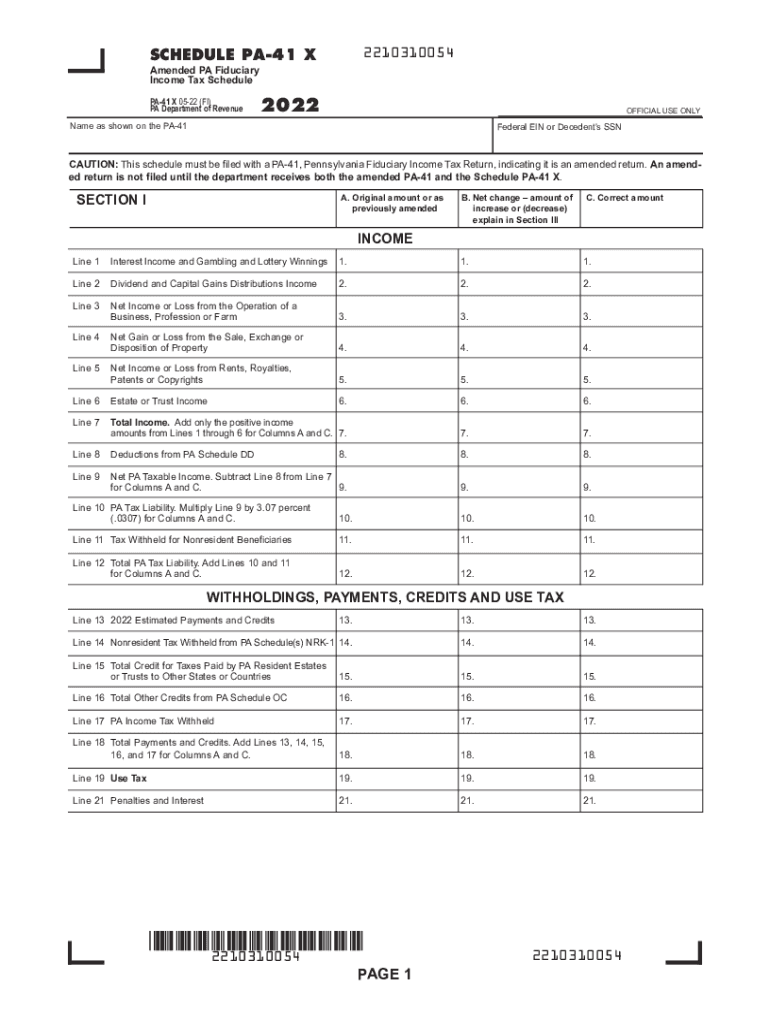

The Pennsylvania 41X form, commonly referred to as the amended PA fiduciary income tax schedule, is essential for fiduciaries who need to correct previously filed tax returns. This form allows fiduciaries to amend their income tax filings for estates or trusts in Pennsylvania. It is crucial to ensure that all information is accurate and up to date, as this can affect tax liabilities and compliance with state regulations.

Steps to Complete the Pennsylvania 41X Form

Completing the Pennsylvania 41X form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documentation related to the original filing, including prior tax returns and any supporting financial statements. Next, carefully review the instructions provided with the form to understand the specific changes being made. Fill out the form, ensuring that all entries are clear and legible. After completing the form, double-check for any errors or omissions before submitting it to the appropriate state tax authority.

Legal Use of the Pennsylvania 41X Form

The Pennsylvania 41X form is legally recognized for amending fiduciary income tax returns in the state. To ensure that the amended return is accepted, it is important to follow all legal guidelines set forth by the Pennsylvania Department of Revenue. This includes adhering to deadlines for filing amendments and providing accurate information about the changes being made. Utilizing a trusted eSignature solution like signNow can help ensure that your submission is secure and compliant with legal standards.

Filing Deadlines for the Pennsylvania 41X Form

Filing deadlines for the Pennsylvania 41X form are critical to avoid penalties and interest. Generally, the amended return must be filed within three years of the original due date of the return being amended. However, it is advisable to check for any specific deadlines that may apply to your situation, particularly if there are unique circumstances or extensions involved. Staying informed about these deadlines helps ensure that fiduciaries remain compliant with state tax regulations.

Required Documents for the Pennsylvania 41X Form

When preparing to file the Pennsylvania 41X form, certain documents are required to support the amendment. These typically include the original tax return being amended, any additional forms or schedules that were part of the original filing, and documentation that justifies the changes being made. This may encompass financial statements, receipts, or other relevant paperwork. Having these documents readily available can streamline the amendment process and facilitate accurate reporting.

Form Submission Methods for the Pennsylvania 41X

The Pennsylvania 41X form can be submitted through various methods, including online filing, mail, or in-person delivery. For online submissions, utilizing a secure eSignature platform can enhance the efficiency and security of the process. If opting to submit by mail, ensure that the form is sent to the correct address as specified by the Pennsylvania Department of Revenue. In-person submissions may be made at designated tax offices, providing an opportunity for immediate assistance if needed.

Examples of Using the Pennsylvania 41X Form

Practical examples of when to use the Pennsylvania 41X form include situations where a fiduciary discovers errors in income reporting, changes in deductions, or adjustments due to audits. For instance, if a trust initially reported income incorrectly, filing a 41X form allows the fiduciary to amend the return and correct the tax liability. These amendments are vital for maintaining compliance and ensuring that the fiduciary meets all tax obligations accurately.

Quick guide on how to complete 2022 schedule pa 41 x amended pa fiduciary income tax schedule pa 41 x formspublications

Complete Schedule PA 41 X Amended PA Fiduciary Income Tax Schedule PA 41 X FormsPublications effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It serves as an excellent sustainable alternative to traditional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents promptly without delays. Manage Schedule PA 41 X Amended PA Fiduciary Income Tax Schedule PA 41 X FormsPublications on any device using the airSlate SignNow Android or iOS applications and enhance any document-focused process today.

How to edit and eSign Schedule PA 41 X Amended PA Fiduciary Income Tax Schedule PA 41 X FormsPublications with ease

- Locate Schedule PA 41 X Amended PA Fiduciary Income Tax Schedule PA 41 X FormsPublications and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or conceal sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which only takes seconds and has the same legal validity as a traditional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form retrieval, or errors necessitating printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Schedule PA 41 X Amended PA Fiduciary Income Tax Schedule PA 41 X FormsPublications and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 schedule pa 41 x amended pa fiduciary income tax schedule pa 41 x formspublications

Create this form in 5 minutes!

How to create an eSignature for the 2022 schedule pa 41 x amended pa fiduciary income tax schedule pa 41 x formspublications

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the airSlate SignNow solution and how does pa 41x relate to it?

The airSlate SignNow solution provides a streamlined platform for sending and eSigning documents efficiently. The term 'pa 41x' is often associated with specific features of our software that enhance user experience, enabling users to execute contracts and agreements swiftly.

-

How does airSlate SignNow pricing work for the pa 41x feature?

airSlate SignNow offers competitive pricing for its services, including the pa 41x feature. Customers can choose between various plans that cater to different business needs, ensuring you only pay for what you require while maximizing productivity.

-

What are the key features of airSlate SignNow related to pa 41x?

The key features of airSlate SignNow include intuitive eSigning processes, templates, and automation, with specific enhancements through pa 41x. This integration allows for improved document management and better compliance, making it an invaluable asset for any business.

-

What benefits do businesses gain from using airSlate SignNow with pa 41x?

By using airSlate SignNow with pa 41x, businesses can experience signNow time savings and increased efficiency. This solution facilitates quicker document processing and enhances overall workflow, allowing teams to focus on core activities rather than administrative tasks.

-

Can airSlate SignNow integrate with other software tools utilizing pa 41x?

Yes, airSlate SignNow supports integrations with a variety of software tools to improve workflows while utilizing pa 41x capabilities. This flexibility allows businesses to connect their existing systems effortlessly, creating a seamless experience in document management and eSigning.

-

Is airSlate SignNow secure for handling sensitive documents with pa 41x?

Absolutely! airSlate SignNow employs advanced security measures to protect sensitive documents, even when utilizing features like pa 41x. With encryption, secure access protocols, and compliance with industry standards, your data is safe within our platform.

-

How can businesses implement airSlate SignNow with pa 41x in their operations?

Implementing airSlate SignNow with pa 41x is straightforward. Businesses can sign up for a plan, access user-friendly onboarding resources, and start incorporating eSigning into their existing workflows, ensuring a smooth transition and quick adoption.

Get more for Schedule PA 41 X Amended PA Fiduciary Income Tax Schedule PA 41 X FormsPublications

Find out other Schedule PA 41 X Amended PA Fiduciary Income Tax Schedule PA 41 X FormsPublications

- eSignature Michigan Internship Contract Computer

- Can I eSignature Nebraska Student Data Sheet

- How To eSignature Michigan Application for University

- eSignature North Carolina Weekly Class Evaluation Now

- eSignature Colorado Medical Power of Attorney Template Fast

- Help Me With eSignature Florida Medical Power of Attorney Template

- eSignature Iowa Medical Power of Attorney Template Safe

- eSignature Nevada Medical Power of Attorney Template Secure

- eSignature Arkansas Nanny Contract Template Secure

- eSignature Wyoming New Patient Registration Mobile

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template