Irs Schedule B 2012-2026

Understanding the IRS Schedule E

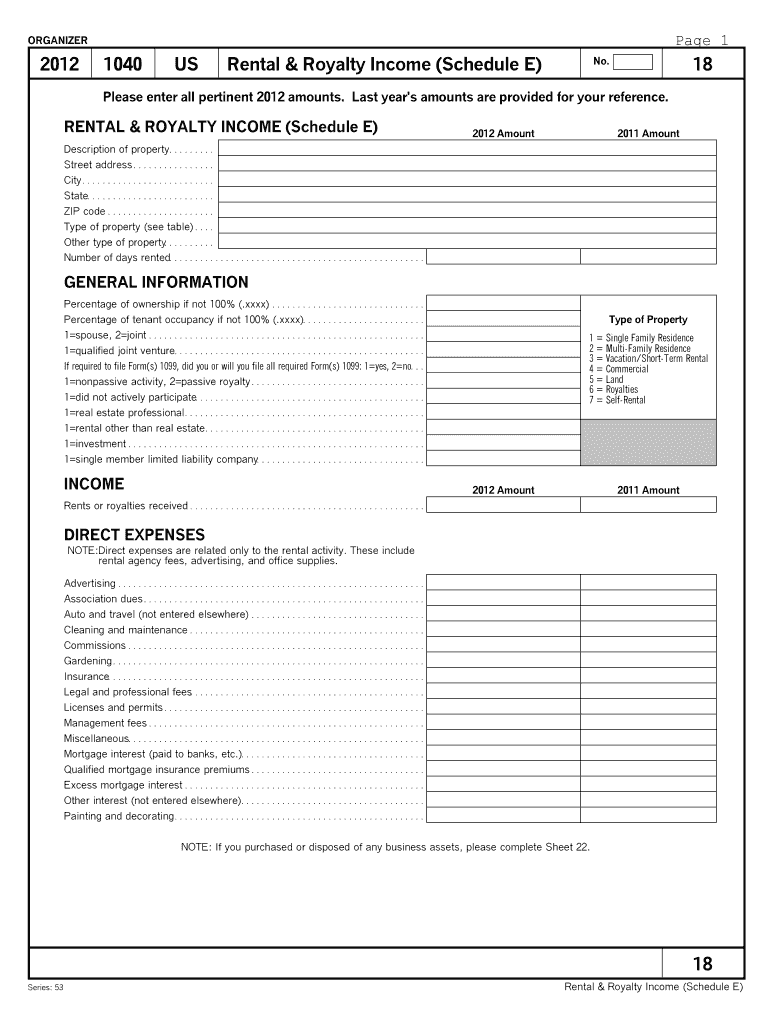

The IRS Schedule E is a tax form used to report income or loss from rental real estate, royalties, partnerships, S corporations, estates, trusts, and residual interests in REMICs. It is essential for individuals who earn income from these sources to accurately complete this form to ensure compliance with federal tax regulations. The information reported on Schedule E is then transferred to Form 1040, which is the standard individual income tax return.

Steps to Complete the IRS Schedule E

Completing the IRS Schedule E involves several steps to ensure accuracy and compliance. First, gather all necessary documents related to your income sources, such as rental agreements and partnership K-1 forms. Next, fill out the form by entering your income, expenses, and any deductions applicable to your situation. Be sure to report each property or business separately, as required. Finally, review the completed form for accuracy before submitting it with your tax return.

Legal Use of the IRS Schedule E

The legal use of the IRS Schedule E is crucial for taxpayers who need to report income from various sources. This form must be filled out accurately to avoid issues with the IRS. Each entry should reflect true and complete information, as any discrepancies can lead to audits or penalties. Understanding the legal implications of the information reported on Schedule E can help taxpayers maintain compliance and avoid potential legal challenges.

Filing Deadlines and Important Dates

Filing deadlines for the IRS Schedule E align with the overall tax return deadlines. Typically, individual tax returns are due on April fifteenth. If you need additional time, you can file for an extension, which usually grants an additional six months. However, any taxes owed must still be paid by the original deadline to avoid penalties and interest. It is essential to keep track of these dates to ensure timely filing and compliance.

Required Documents for IRS Schedule E

To complete the IRS Schedule E accurately, you will need various documents. These include rental agreements, records of income received, receipts for expenses related to property management, and any partnership or S corporation K-1 forms. Having these documents organized and readily available will streamline the process of filling out the form and ensure that all necessary information is reported correctly.

Examples of Using the IRS Schedule E

Examples of using the IRS Schedule E include reporting income from rental properties, such as single-family homes or multi-unit buildings. If you are a partner in a business, you would report your share of the income or loss from that partnership. Additionally, if you receive royalties from intellectual property, those earnings must also be reported on this form. Each scenario requires careful documentation to support the income and expenses claimed.

Quick guide on how to complete us tax forms schedule e

The optimal method to discover and authorize Irs Schedule B

Across the entirety of a corporation, ineffective workflows regarding document approval can consume a signNow amount of working hours. Signing documents such as Irs Schedule B is an inherent element of operations in any enterprise, which is why the efficiency of each agreement’s lifecycle carries considerable weight on the organization’s overall performance. With airSlate SignNow, executing your Irs Schedule B is as straightforward and rapid as possible. This platform provides you with the latest version of nearly any form. Even better, you can sign it instantly without the necessity of downloading external software on your computer or printing hard copies.

Steps to acquire and sign your Irs Schedule B

- Browse our catalog by category or utilize the search box to find the form you require.

- Preview the form by clicking on Learn more to confirm it’s the correct one.

- Press Get form to start editing immediately.

- Fill out your form and include any necessary information using the toolbar.

- When finished, click on the Sign tool to authorize your Irs Schedule B.

- Select the signing method that is most suitable for you: Draw, Create initials, or upload an image of your handwritten signature.

- Click Done to finalize editing and proceed with document-sharing options as required.

With airSlate SignNow, you possess everything necessary to manage your documents effectively. You can search, complete, revise, and even dispatch your Irs Schedule B from a single tab without any inconvenience. Enhance your workflows by utilizing one cohesive, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

What are the main differences between Canadian and US tax systems?

About 72 hours…That is the difference in time it takes me to file taxes. As a dual citizen I have the fun of filling taxes for both Canada and the US each year. Typically the Canadian taxes take me about 30 - 60 minutes for myself and my wife. Most of that time is spent looking up my RRSP information and finding all the tax forms sent by mail. The tax software is unambiguous. The only thing is I don’t bother with the form for deducting my home office, because the time it takes to fill it out and have my boss sign it, is beyond what it is worth for me.For US taxes, my average time is about 3 days. Some years I am much quicker, and some years much slower. In the end I’m never certain if I’ve done everything correctly. However, there are HUGE fines if I get it wrong. For example, $10,000 for each of my Canadian bank accounts I forget to declare, or accidentally supply slightly wrong information for. The tax software does not help much, unless you already know EXACTLY what you need to file. For example, I know I am required to file Schedule B because I have more than $10,000 in foreign bank accounts. I have had years where not only would the tax software not tell me to select schedule B, but once I managed to find a way to fill it out anyway, the software would drop the form from my results.The US tax system is very largely punitive. It is design overly complex deliberately so law enforcement can easily charge anyone on a tax related crime, if they can’t find anything else. The Canadian tax system is more just designed as a way to collect money.Neither is a good tax system. In the end, the government is collecting your money. They have the software that tells them exactly how much you owe, what you owe it on, and to automatically notify you when you make a mistake. Why in the world do I need to spend a week each year filing the information the government already knows? Instead they should just send me a statement, and I should only have to file if I need to supply a correction.I thought maybe it was just because my taxes are more complicated than the average tax payer. But this year I had to file my mother’s taxes for her. She is not a dual citizen, and lives in the US. It only took about 3 hours to file her taxes. But really 3 hours, when she just has social security and two pensions? In the end the tax software still was not right. It would have had her paying a huge amount in state taxes, if I didn’t already know her income was exempt from state taxes. It took me about an hour of fiddling to find the correct way to file with her state tax exemption.To the state’s credit, they actually have a law that says she does not have to file state taxes at all, because there is no money due. But the tax software was not about to tell me that, when they could potentially collect a fee to e-file state taxes. I still filled out the state taxes though, because she needed a copy of her state tax return because it is easier to supply a tax return to government agencies that request one than try and convince them the law didn’t require one to be filed.

-

How do you fill out tax forms?

I strongly recommend purchasing a tax program, Turbo tax, H&R block etc.These programs will ask you questions and they will fill out the forms for you.You just print it out and mail it in. (with a check, if you owe anything)I used to use an accountant but these programs found more deductions.

-

Do I need US EIN taxpayer ID to properly fill out a W8-BEN form?

Since I have asked this question, I believe that I should share the knowledge I have managed to collect in its regard.So, it appears that you should file a SS-4 form to apply for the Employer Identification Number (EIN). To this successfully you will need to have a contract signed with customer in the USA. You will have to show given contract to the US IRA.The downside of this method is that:It requires for you to sign contract with US party prior to the acquiring the EINYou will have to mail originals of your Passport/Natinal ID and contract to the IRA.Instead of going that way, I have decided to register my own "Disregarded entity"-type LLC.If you are also considering going that way, please note that the most popular state for registering such companies (namely, Delaware) is not necessary best for your particular case.AFAICK, tax-wise, there are two top states:Delaware (DE): Sales Tax = 0%, Income Tax = 6.95%Nevada (NV): Sales tax = 7.93%, Income Tax = 0%You will need to find registered agent to register your LLC properly.

-

How do I fill out 2013 tax forms?

I hate when people ask a question, then rather than answer, someone jumps in and tells them they don't need to know--but today, I will be that guy, because this is serious.Why oh why do you think you can do this yourself?Two things to consider:People who get a masters degree in Accounting then go get a CPA then start doing taxes--only then do some of them start specializing in international accounting. I've taught Accounting at the college-level, have taken tax classes beyond that, and wouldn't touch your return.Tax professionals generally either charge by the form or by the hour. Meaning you can sit and do this for 12 hours, or you can pay a CPA by the hour to do it, or you can go to an H&R Block that has flat rates and will do everything but hit Send for free. So why spend 12 hours doing it incorrectly, destined to worry about the IRS putting you in jail, bankrupting you, or deporting you for the next decade when you can get it done professionally for $200-$300?No, just go get it done right.

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

How do I schedule a US visa interview of two people together after filling out a DS160 form?

Here is a link that might help answer your question >> DS-160: Frequently Asked QuestionsFor more information on this and similar matters, please call me direct: 650.424.1902Email: heller@hellerimmigration.comHeller Immigration Law Group | Silicon Valley Immigration Attorneys

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

Create this form in 5 minutes!

How to create an eSignature for the us tax forms schedule e

How to create an eSignature for your Us Tax Forms Schedule E in the online mode

How to make an electronic signature for your Us Tax Forms Schedule E in Chrome

How to create an eSignature for signing the Us Tax Forms Schedule E in Gmail

How to create an eSignature for the Us Tax Forms Schedule E straight from your smartphone

How to create an eSignature for the Us Tax Forms Schedule E on iOS

How to make an eSignature for the Us Tax Forms Schedule E on Android OS

People also ask

-

What is the purpose of the IRS Schedule B?

The IRS Schedule B is used to report interest and ordinary dividends. It is essential for taxpayers who have received more than $1,500 in interest or dividends during the tax year. Accurate completion of the IRS Schedule B ensures compliance with tax regulations and helps avoid penalties.

-

Who needs to file the IRS Schedule B?

You need to file the IRS Schedule B if you have received more than $1,500 in taxable interest or dividends. Additionally, anyone who has certain foreign accounts must also complete this schedule to disclose their holdings. Filing the IRS Schedule B is crucial for taxpayers to report their income accurately.

-

How does airSlate SignNow help with IRS Schedule B forms?

airSlate SignNow simplifies the process of completing and signing IRS Schedule B forms. Our platform allows you to easily upload, fill out, and eSign your documents securely. Using airSlate SignNow, you can ensure that your IRS Schedule B is handled efficiently and accurately.

-

What are the benefits of using airSlate SignNow for IRS Schedule B documents?

Using airSlate SignNow for your IRS Schedule B documents offers several benefits, including ease of use, secure eSigning, and document tracking. Our platform streamlines the process, allowing you to manage your tax documents without the hassle of traditional methods. Enjoy peace of mind knowing your IRS Schedule B is filed accurately and on time.

-

Is there a cost associated with using airSlate SignNow to manage IRS Schedule B?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be cost-effective for businesses of all sizes. Our pricing plans offer various features tailored to your needs, ensuring you have the tools necessary to manage IRS Schedule B and other documents efficiently. Check our website for detailed pricing information.

-

Can I integrate airSlate SignNow with other software for IRS Schedule B management?

Yes, airSlate SignNow offers integrations with various software applications that can help streamline your IRS Schedule B management. Whether you use accounting software or customer relationship management (CRM) tools, our platform can connect seamlessly to enhance your workflow. This ensures that all your documents are organized and easily accessible.

-

What features does airSlate SignNow offer for IRS Schedule B documentation?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document management to assist with IRS Schedule B documentation. These tools help you create, edit, and send your forms efficiently while maintaining compliance with IRS regulations. Our user-friendly interface makes it easy to navigate and complete your IRS Schedule B forms.

Get more for Irs Schedule B

- Contract for deed sellers annual accounting statement tennessee form

- Notice of default for past due payments in connection with contract for deed tennessee form

- Final notice of default for past due payments in connection with contract for deed tennessee form

- Assignment of contract for deed by seller tennessee form

- Notice of assignment of contract for deed tennessee form

- Tn contract form

- Buyers home inspection checklist tennessee form

- Sellers information for appraiser provided to buyer tennessee

Find out other Irs Schedule B

- Sign Indiana Legal Cease And Desist Letter Easy

- Can I Sign Kansas Legal LLC Operating Agreement

- Sign Kansas Legal Cease And Desist Letter Now

- Sign Pennsylvania Insurance Business Plan Template Safe

- Sign Pennsylvania Insurance Contract Safe

- How Do I Sign Louisiana Legal Cease And Desist Letter

- How Can I Sign Kentucky Legal Quitclaim Deed

- Sign Kentucky Legal Cease And Desist Letter Fast

- Sign Maryland Legal Quitclaim Deed Now

- Can I Sign Maine Legal NDA

- How To Sign Maine Legal Warranty Deed

- Sign Maine Legal Last Will And Testament Fast

- How To Sign Maine Legal Quitclaim Deed

- Sign Mississippi Legal Business Plan Template Easy

- How Do I Sign Minnesota Legal Residential Lease Agreement

- Sign South Carolina Insurance Lease Agreement Template Computer

- Sign Missouri Legal Last Will And Testament Online

- Sign Montana Legal Resignation Letter Easy

- How Do I Sign Montana Legal IOU

- How Do I Sign Montana Legal Quitclaim Deed