RCT 132 B11 21 PA Department of Revenue 2021-2026

What is the RCT 132 B11 21 PA Department of Revenue

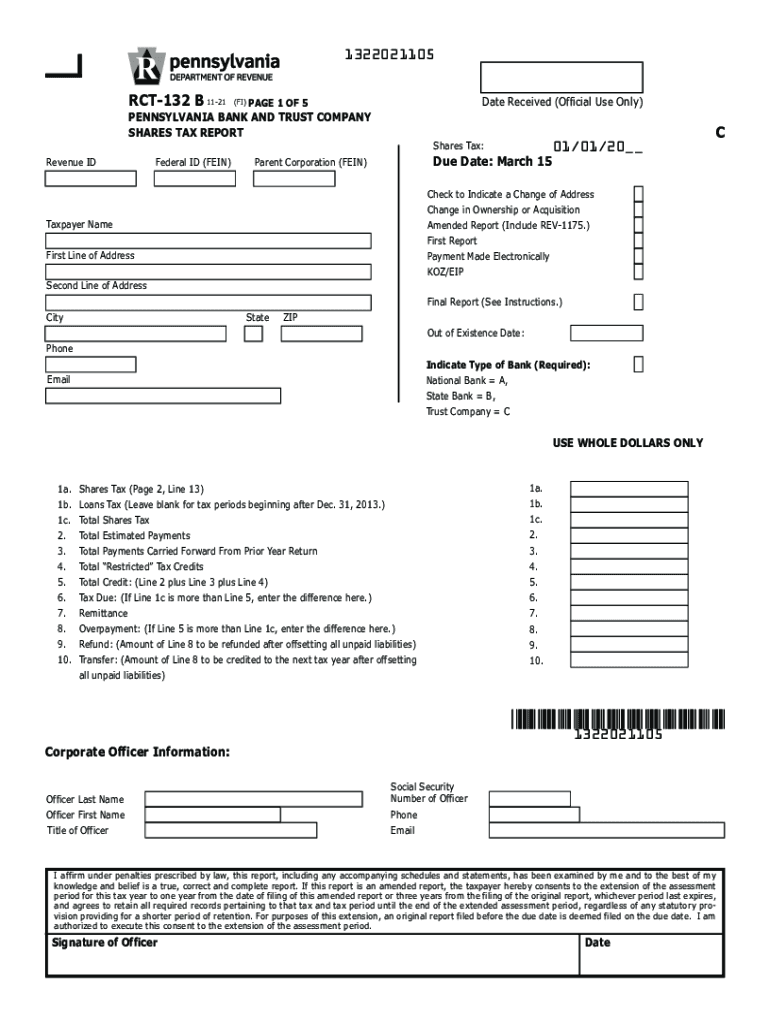

The RCT 132 B11 21 is a specific form issued by the Pennsylvania Department of Revenue. This form is primarily used for reporting and remitting taxes related to certain business activities within the state. It plays a crucial role in ensuring compliance with state tax regulations and helps businesses accurately report their financial activities. Understanding this form is essential for business owners to maintain good standing with the state and avoid potential penalties.

How to use the RCT 132 B11 21 PA Department of Revenue

Using the RCT 132 B11 21 involves several steps to ensure accurate completion and submission. First, gather all necessary financial records and documentation related to your business activities. Next, fill out the form with accurate information, ensuring that all required fields are completed. After filling out the form, review it for any errors or omissions. Finally, submit the form as per the guidelines provided by the Pennsylvania Department of Revenue, either electronically or via mail.

Steps to complete the RCT 132 B11 21 PA Department of Revenue

Completing the RCT 132 B11 21 requires careful attention to detail. Here are the steps to follow:

- Gather necessary financial documents, including income statements and expense reports.

- Download the RCT 132 B11 21 form from the Pennsylvania Department of Revenue website.

- Fill in the required information, including business details and tax calculations.

- Double-check all entries for accuracy and completeness.

- Submit the form by the specified deadline, either online or by mail.

Legal use of the RCT 132 B11 21 PA Department of Revenue

The RCT 132 B11 21 form is legally binding when completed and submitted in accordance with Pennsylvania tax laws. It is essential that businesses adhere to the legal requirements outlined by the state to ensure the form is valid. This includes providing accurate information and submitting the form by the designated deadlines. Failure to comply with these regulations can result in penalties or legal repercussions.

Key elements of the RCT 132 B11 21 PA Department of Revenue

Several key elements must be included when completing the RCT 132 B11 21. These elements typically include:

- Business name and address

- Tax identification number

- Details of business activities

- Accurate financial figures, including revenue and expenses

- Signature of the authorized person

Filing Deadlines / Important Dates

Filing deadlines for the RCT 132 B11 21 are crucial for compliance. Typically, the form must be submitted annually or quarterly, depending on the specific business tax obligations. It is important to check the Pennsylvania Department of Revenue's official calendar for the exact dates to avoid late fees or penalties. Keeping track of these deadlines ensures that businesses remain compliant with state tax laws.

Quick guide on how to complete rct 132 b11 21 pa department of revenue

Complete RCT 132 B11 21 PA Department Of Revenue effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It serves as a perfectly eco-friendly alternative to traditional printed and signed papers, allowing you to locate the right form and securely store it in the cloud. airSlate SignNow provides all the features necessary to create, edit, and electronically sign your documents quickly and efficiently. Handle RCT 132 B11 21 PA Department Of Revenue on any device using airSlate SignNow’s Android or iOS applications and streamline any document-related procedure today.

The easiest way to edit and electronically sign RCT 132 B11 21 PA Department Of Revenue without stress

- Obtain RCT 132 B11 21 PA Department Of Revenue and click Get Form to begin.

- Use the tools provided to fill out your document.

- Emphasize important sections of the documents or conceal sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal weight as a conventional handwritten signature.

- Verify all the details and click the Done button to save your changes.

- Choose how you want to send your form, whether by email, SMS, or a shareable link, or download it to your computer.

Eliminate concerns about missing or lost documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow meets your needs in document management with just a few clicks from your preferred device. Edit and electronically sign RCT 132 B11 21 PA Department Of Revenue and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct rct 132 b11 21 pa department of revenue

Create this form in 5 minutes!

How to create an eSignature for the rct 132 b11 21 pa department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is RCT 132 and how does it relate to airSlate SignNow?

RCT 132 is a regulatory compliance standard that airSlate SignNow aligns with to ensure secure and valid electronic signatures. By following this standard, airSlate SignNow provides businesses with a reliable solution to eSign documents while maintaining compliance with legal requirements.

-

What are the key features of airSlate SignNow regarding RCT 132 compliance?

AirSlate SignNow offers robust features that support RCT 132 compliance, including digital signatures, audit trails, and secure document storage. These features help businesses ensure that their electronic signatures are legally binding and fully compliant with regulations.

-

How does airSlate SignNow help with document management under RCT 132?

With airSlate SignNow, businesses can effectively manage their documents in accordance with RCT 132 by using templates, tracked changes, and real-time collaboration tools. This ensures that all documentation is comprehensive and compliant with industry standards.

-

What pricing plans are available for airSlate SignNow users focused on RCT 132 compliance?

AirSlate SignNow offers tiered pricing plans to accommodate businesses looking to comply with RCT 132. Users can choose from basic to advanced plans depending on their needs, each offering essential features for managing documents securely and efficiently.

-

What benefits does airSlate SignNow offer to businesses aiming for RCT 132 adherence?

By utilizing airSlate SignNow, businesses can enjoy streamlined workflows, reduced paper costs, and enhanced security—all crucial for adhering to RCT 132. Additionally, the platform simplifies the eSigning process, allowing for quicker transactions and improved customer satisfaction.

-

Can airSlate SignNow integrate with other systems while maintaining RCT 132 compliance?

Yes, airSlate SignNow can seamlessly integrate with various CRM and document management systems while ensuring compliance with RCT 132. These integrations enhance your existing business processes and maintain the integrity of your document workflows.

-

Is training available for businesses using airSlate SignNow for RCT 132 functions?

Absolutely! AirSlate SignNow provides comprehensive training resources that help users understand how to leverage the platform effectively for RCT 132 compliance. This ensures that your team is well-equipped to use the features for efficient eSigning and document management.

Get more for RCT 132 B11 21 PA Department Of Revenue

Find out other RCT 132 B11 21 PA Department Of Revenue

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe