IL 1120 Instructions Illinois Department of Revenue 2022-2026

What is the IL 1120 Instructions?

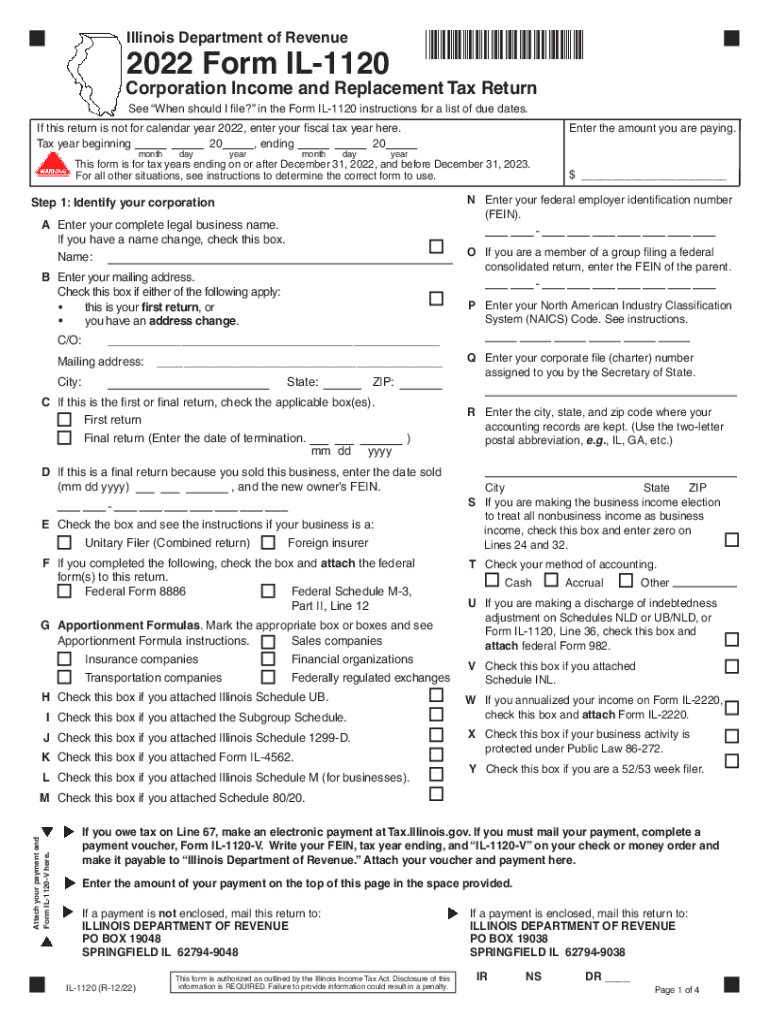

The IL 1120 instructions provide detailed guidance for completing the Illinois Corporation Income Tax Return. This form is essential for corporations operating in Illinois, as it outlines the necessary steps for reporting income, deductions, and credits. The Illinois Department of Revenue issues these instructions to ensure compliance with state tax laws, helping businesses accurately calculate their tax obligations. Understanding these instructions is crucial for any corporation to avoid penalties and ensure timely filing.

Steps to Complete the IL 1120 Instructions

Completing the IL 1120 requires careful attention to detail. Here are the essential steps:

- Gather all necessary financial documents, including income statements and expense records.

- Review the IL 1120 instructions thoroughly to understand the requirements for your specific business type.

- Fill out the form accurately, ensuring all figures are correct and correspond to your financial documents.

- Double-check for any applicable deductions or credits that may apply to your corporation.

- Sign and date the form, ensuring that it is completed by an authorized individual.

Filing Deadlines / Important Dates

Timely filing of the IL 1120 is critical to avoid penalties. The standard deadline for submitting the form is the fifteenth day of the month following the end of your corporation's fiscal year. For corporations operating on a calendar year basis, this means the due date is typically April 15. It is important to keep track of any extensions or changes in deadlines announced by the Illinois Department of Revenue, especially for the 2023 tax year.

Required Documents

To complete the IL 1120, certain documents are necessary. These include:

- Financial statements, including profit and loss statements and balance sheets.

- Records of all income received during the tax year.

- Documentation of any deductions or credits claimed.

- Previous year’s tax return, if applicable, for reference.

Form Submission Methods

The IL 1120 can be submitted in several ways to accommodate different preferences. Corporations can file the form online through the Illinois Department of Revenue's website, which is often the most efficient method. Alternatively, businesses may choose to mail a paper version of the form or submit it in person at designated locations. Each method has specific guidelines, so it is essential to follow the instructions provided for the chosen submission method.

Penalties for Non-Compliance

Failure to comply with the IL 1120 filing requirements can result in significant penalties. These may include late filing fees, interest on unpaid taxes, and potential legal action for persistent non-compliance. It is crucial for corporations to adhere to the filing deadlines and ensure that all information is accurate to avoid these consequences. Understanding the penalties associated with non-compliance can help businesses prioritize their tax obligations effectively.

Quick guide on how to complete 2022 il 1120 instructions illinois department of revenue

Complete IL 1120 Instructions Illinois Department Of Revenue effortlessly on any gadget

Digital document management has become increasingly favored by corporations and individuals alike. It offers an ideal environmentally friendly substitute to conventional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the resources needed to create, alter, and electronically sign your documents rapidly without interruptions. Handle IL 1120 Instructions Illinois Department Of Revenue on any gadget using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

How to modify and electronically sign IL 1120 Instructions Illinois Department Of Revenue with ease

- Locate IL 1120 Instructions Illinois Department Of Revenue and click Get Form to begin.

- Utilize the features we provide to complete your document.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose how you wish to deliver your form: by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searching, or mistakes that necessitate printing new copies of documents. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and electronically sign IL 1120 Instructions Illinois Department Of Revenue and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 il 1120 instructions illinois department of revenue

Create this form in 5 minutes!

How to create an eSignature for the 2022 il 1120 instructions illinois department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key features of airSlate SignNow for completing IL 1120 instructions 2023?

airSlate SignNow offers essential features for completing IL 1120 instructions 2023, such as document eSigning, templates, and real-time collaboration. These tools streamline the filing process and ensure compliance with IRS standards. Plus, users can easily store their documents securely within the platform.

-

How can airSlate SignNow help me with IL 1120 instructions 2023?

With airSlate SignNow, you can efficiently manage your tax filing needs, including IL 1120 instructions 2023. Our user-friendly interface allows for easy editing and signing of documents online, reducing the time spent on paper-based processes. You'll benefit from enhanced organization and quick access to your tax documents.

-

Are there any integration options available for airSlate SignNow when filing IL 1120 instructions 2023?

Yes, airSlate SignNow integrates seamlessly with various accounting software and business applications. This integration is especially beneficial when dealing with IL 1120 instructions 2023, as it helps consolidate your workflow. You can save time and reduce errors by connecting your documents directly to the tools you already use.

-

What is the pricing model for airSlate SignNow when preparing IL 1120 instructions 2023?

airSlate SignNow offers flexible pricing plans suitable for individuals and businesses alike for preparing IL 1120 instructions 2023. With various tiers available, you can choose a plan that fits your budget and needs. Each plan comes with robust features that guarantee effective document management.

-

Is airSlate SignNow secure for submitting IL 1120 instructions 2023?

Absolutely! airSlate SignNow employs top-notch security protocols, ensuring that your IL 1120 instructions 2023 are safe from unauthorized access. Our platform uses encryption and complies with industry standards to keep your sensitive data protected. You can confidently eSign and share documents without worrying about security bsignNowes.

-

Can I access my documents on airSlate SignNow from any device when managing IL 1120 instructions 2023?

Yes, airSlate SignNow offers cloud-based access to your documents, allowing you to manage IL 1120 instructions 2023 from any device with internet access. Whether you're on a computer, tablet, or smartphone, you can quickly access, sign, and send your documents. This flexibility is key for busy professionals.

-

What are the benefits of using airSlate SignNow for IL 1120 instructions 2023 over traditional methods?

Using airSlate SignNow for IL 1120 instructions 2023 provides signNow advantages over traditional paperwork methods. The platform reduces the risk of errors, expedites the signing process, and enhances organization. Additionally, you save on printing and mailing costs, making it a more efficient option for tax filing.

Get more for IL 1120 Instructions Illinois Department Of Revenue

- Ignou control number 13 digit form

- Fsa score chart form

- Wag hotel vaccination requirements form

- Islamic republic of afghanistan passport application form

- Inequality word problems worksheet 7th grade pdf form

- Travel insurance claim202104v1 form

- Confirmation of study letter template form

- In the superior court for the state of alaska at i 790889048 form

Find out other IL 1120 Instructions Illinois Department Of Revenue

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later

- How To Electronic signature Alabama Unlimited Power of Attorney

- Electronic signature Arizona Unlimited Power of Attorney Easy