About Form 8990, Limitation on Business Interest IRS 2022-2026

Overview of Form 8990: Limitation on Business Interest

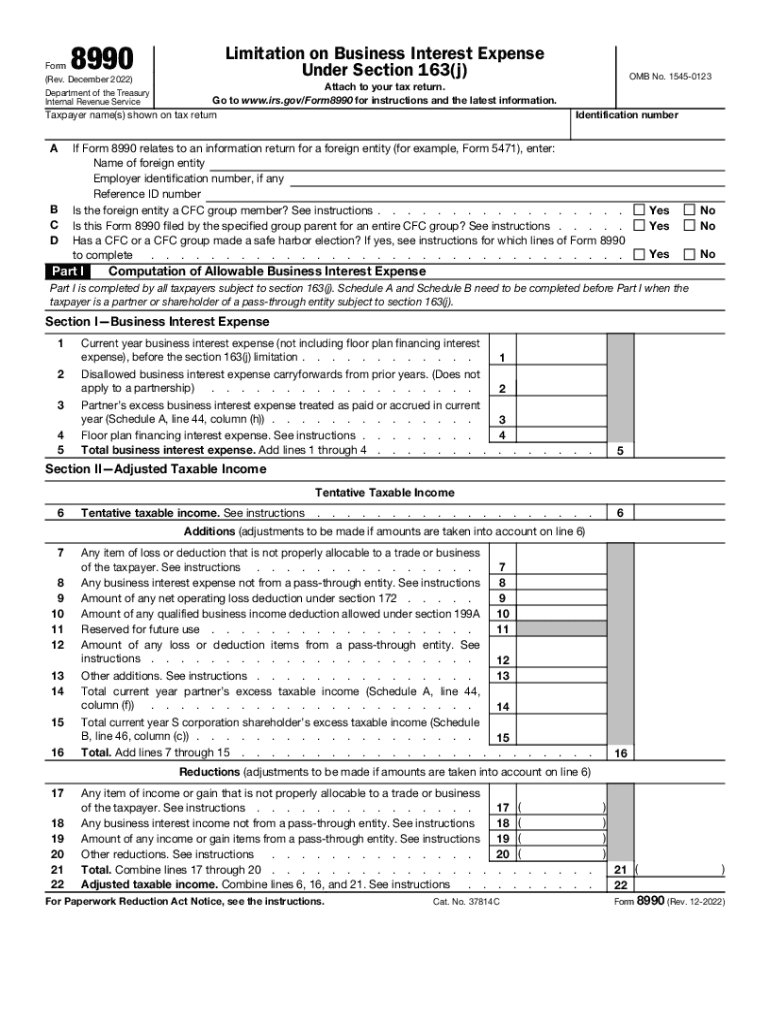

Form 8990 is a crucial document used by businesses to report their interest expense limitations under IRS Section 163(j). This form is essential for entities that have business interest expenses exceeding their allowable limits. It helps ensure compliance with the tax code, particularly for businesses affected by the Tax Cuts and Jobs Act, which introduced new limitations on interest deductions. Understanding this form is vital for accurate tax reporting and for maintaining financial health.

Steps to Complete Form 8990

Completing Form 8990 involves several key steps that require careful attention to detail. First, gather all necessary financial documents, including income statements and expense reports. Next, determine your business's adjusted taxable income, as this figure is critical for calculating the allowable interest expense. Fill out the form by providing your business information, including the entity type and fiscal year. Ensure that you accurately report any business interest income and expenses. Finally, review your calculations and submit the form along with your tax return.

Legal Use of Form 8990

The legal use of Form 8990 is governed by IRS regulations that dictate how businesses must report interest expense limitations. This form must be filed accurately to avoid penalties and ensure compliance with tax laws. It serves as a formal declaration of your business's interest expenses and is subject to review by the IRS. Proper completion and submission of Form 8990 can help protect your business from audits and potential legal issues related to improper tax filings.

Filing Deadlines for Form 8990

Filing deadlines for Form 8990 align with the general tax return deadlines for businesses. For most corporations, the form is due on the fifteenth day of the fourth month following the end of the tax year. Partnerships and S corporations typically have a different deadline, which is the fifteenth day of the third month after the end of their tax year. It is essential to adhere to these deadlines to avoid late fees and penalties associated with non-compliance.

Required Documents for Form 8990

To complete Form 8990, certain documents are necessary to ensure accurate reporting. These include financial statements that detail your business income and expenses, prior year tax returns, and any supporting documentation for interest income and expenses. Additionally, you may need to provide records of any adjustments made to taxable income, as well as documentation supporting the calculation of your business's interest expense limitations under Section 163(j).

Examples of Form 8990 Usage

Form 8990 is used in various scenarios to illustrate how businesses can apply the interest expense limitations. For instance, a corporation with significant debt may find that its interest expenses exceed the allowable limits, necessitating the use of Form 8990 to report these figures accurately. Similarly, a partnership that has recently expanded and incurred additional interest expenses would also need to file this form to ensure compliance with IRS guidelines. These examples highlight the importance of understanding how to utilize Form 8990 effectively within different business contexts.

Quick guide on how to complete about form 8990 limitation on business interest irs

Complete About Form 8990, Limitation On Business Interest IRS effortlessly on any device

Digital document management has become favored by companies and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents swiftly without interruptions. Manage About Form 8990, Limitation On Business Interest IRS on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The simplest way to alter and eSign About Form 8990, Limitation On Business Interest IRS with ease

- Obtain About Form 8990, Limitation On Business Interest IRS and click on Get Form to begin.

- Use the tools provided to finalize your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or errors that require reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choosing. Alter and eSign About Form 8990, Limitation On Business Interest IRS and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about form 8990 limitation on business interest irs

Create this form in 5 minutes!

How to create an eSignature for the about form 8990 limitation on business interest irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 8990 and why is it important?

Form 8990 is a crucial tax form used by businesses to report the amount of interest expense limitations under the Tax Cuts and Jobs Act. It's important because accurate completion of Form 8990 ensures compliance with IRS regulations and maximizes potential tax deductions, impacting your overall tax liabilities.

-

How can airSlate SignNow help with filling out form 8990?

airSlate SignNow streamlines the process of filling out form 8990 by providing users with customizable templates and a user-friendly interface. This allows businesses to efficiently complete and manage their form 8990, saving valuable time and reducing errors in documentation.

-

What features does airSlate SignNow offer for managing form 8990?

Key features of airSlate SignNow for managing form 8990 include collaboration tools, eSignature capabilities, and real-time tracking of document status. These features enhance workflow efficiency and ensure that all stakeholders can contribute to and finalize form 8990 seamlessly.

-

Is there a cost associated with using airSlate SignNow for form 8990?

airSlate SignNow offers competitive pricing plans designed to fit various business needs. Whether you are a small business or a large enterprise, you can access features necessary for managing form 8990 at a price point that suits your budget.

-

Can I integrate airSlate SignNow with other software for form 8990 processing?

Yes, airSlate SignNow offers integrations with popular applications, making it easier to manage form 8990 alongside your existing tools. Whether you use CRM systems, cloud storage, or accounting software, these integrations enhance your workflow and streamline the documentation process.

-

What are the benefits of using airSlate SignNow for form 8990?

Using airSlate SignNow for form 8990 comes with several benefits, including improved accuracy, faster processing times, and enhanced collaboration. By digitizing your form 8990 process, you minimize the risk of errors and ensure that documents are completed and filed on time.

-

How secure is my information when using airSlate SignNow for form 8990?

airSlate SignNow prioritizes security, using industry-standard encryption and compliance with regulations to protect your sensitive information while processing form 8990. You can trust that your documents are safeguarded throughout the signing and filing process.

Get more for About Form 8990, Limitation On Business Interest IRS

Find out other About Form 8990, Limitation On Business Interest IRS

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself