Ad Www pdfFiller Com 2022-2026

IRS Guidelines

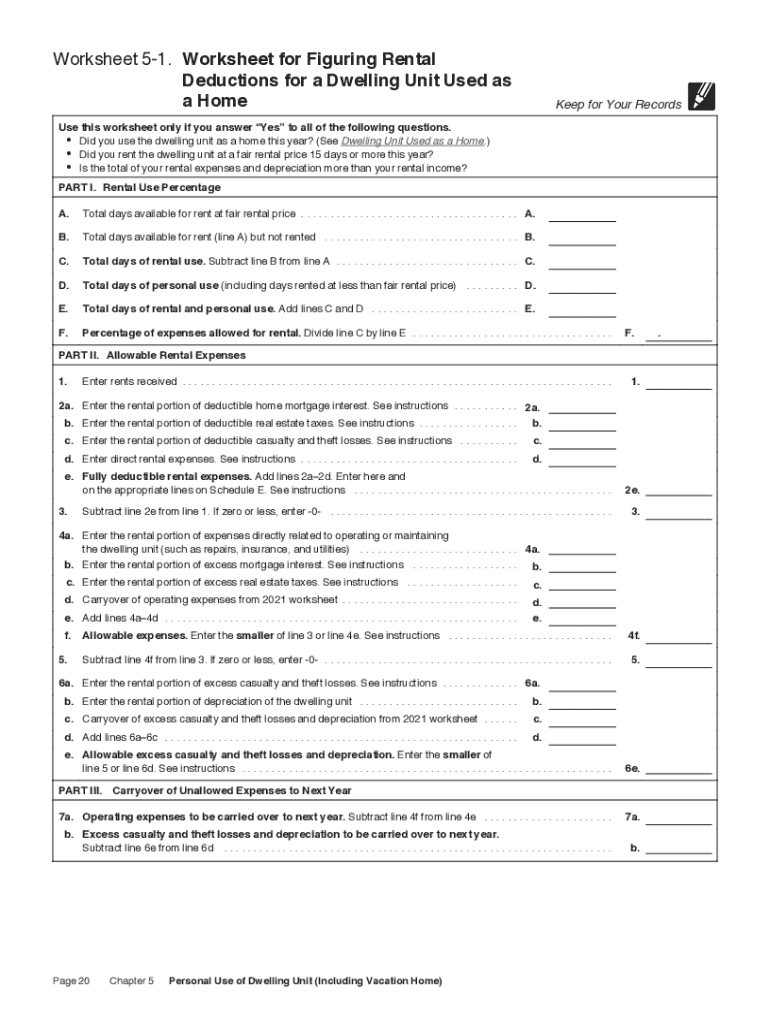

The IRS provides detailed guidelines for completing the publication 527 residential rental property. This document outlines the tax implications and deductions available for individuals who rent out residential properties. Understanding these guidelines is crucial for ensuring compliance with tax regulations and maximizing potential tax benefits. Key areas covered include allowable expenses, depreciation, and reporting rental income. Familiarizing yourself with these guidelines can help you navigate the complexities of residential rental property taxation effectively.

Filing Deadlines / Important Dates

When dealing with the publication 527 residential rental property, it is essential to be aware of filing deadlines and important dates. Typically, individual tax returns, including those reporting rental income, are due by April 15 of the following year. If you require additional time, you can file for an extension, which extends the deadline to October 15. However, any taxes owed must be paid by the original deadline to avoid penalties. Keeping track of these dates ensures that you remain compliant with IRS requirements.

Required Documents

To complete the publication 527 residential rental property accurately, certain documents are necessary. These include records of rental income, receipts for expenses related to the property, and documentation for any improvements made. Additionally, you may need to gather information regarding mortgage interest, property taxes, and insurance costs. Having these documents organized and readily available will facilitate a smoother filing process and help substantiate your claims in case of an audit.

Form Submission Methods (Online / Mail / In-Person)

There are several methods for submitting the publication 527 residential rental property to the IRS. You can file electronically using tax preparation software, which often simplifies the process and reduces errors. Alternatively, you can print the completed form and mail it to the appropriate IRS address. In-person submission is generally not available for this form, as the IRS encourages electronic filing for efficiency. Understanding these submission methods can help you choose the one that best fits your needs.

Penalties for Non-Compliance

Failing to comply with the regulations surrounding the publication 527 residential rental property can result in significant penalties. Common penalties include failure-to-file and failure-to-pay fees, which can accumulate over time. Additionally, inaccuracies in reporting rental income or expenses may lead to audits and further legal implications. Being aware of these penalties emphasizes the importance of accurate and timely filing, ensuring that you remain in good standing with the IRS.

Eligibility Criteria

Eligibility criteria for utilizing the publication 527 residential rental property primarily revolve around the nature of your rental activity. To qualify, you must actively rent out residential properties and report the income generated. The IRS also specifies that the property must be used for rental purposes for at least 15 days during the tax year. Understanding these criteria is vital for determining whether you should complete this publication and what deductions you may be eligible for.

Quick guide on how to complete adwwwpdffillercom

Complete Ad www pdffiller com effortlessly on any device

Digital document management has gained popularity among organizations and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, enabling you to locate the correct form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents promptly without any holdups. Manage Ad www pdffiller com on any platform using airSlate SignNow apps for Android or iOS and streamline any document-related process today.

The easiest way to amend and eSign Ad www pdffiller com with ease

- Obtain Ad www pdffiller com and then click Get Form to begin.

- Take advantage of the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which takes just seconds and carries the same legal validity as a traditional ink signature.

- Review the information and then click on the Done button to save your modifications.

- Select your preferred delivery method for the form: via email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassles of lost or misplaced files, tedious form searches, or mistakes that require new document copies to be printed. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Ad www pdffiller com to ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct adwwwpdffillercom

Create this form in 5 minutes!

How to create an eSignature for the adwwwpdffillercom

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is publication 527 residential rental property?

Publication 527 residential rental property is an IRS guide that provides information on how to report income and expenses from rental properties. It covers topics such as depreciation, repairs, and deductions that landlords can claim to minimize their tax liability. Understanding this publication is essential for anyone managing residential rental properties.

-

How can airSlate SignNow help with managing residential rental properties?

airSlate SignNow offers a streamlined solution for landlords looking to manage their residential rental properties effectively. With features like eSigning, document templates, and secure storage, you can handle leases and tenant agreements conveniently. This flexibility aids in complying with the guidelines outlined in publication 527 residential rental property.

-

Is airSlate SignNow affordable for landlords?

Yes, airSlate SignNow is a cost-effective solution tailored for landlords managing residential rental properties. Our pricing plans are designed to fit various budgets, allowing you to access essential features without overspending. This affordability can help you save resources while ensuring compliance with the financial aspects of publication 527 residential rental property.

-

What benefits does airSlate SignNow offer for document management?

AirSlate SignNow simplifies document management for landlords by ensuring that all rental agreements and documents are easy to send, sign, and store. This efficiency is vital in managing residential rental properties, making it easier to adhere to guidelines set forth in publication 527 residential rental property. Your documents will be organized and accessible, reducing the risk of important documents being misplaced.

-

Can airSlate SignNow integrate with my existing management software?

Absolutely! airSlate SignNow offers seamless integrations with various property management software solutions. This capability enables landlords to efficiently manage their residential rental properties while maintaining compliance with publication 527 residential rental property. You can keep your workflows streamlined without the need for excessive manual entry.

-

How does eSigning enhance the rental agreement process?

ESigning with airSlate SignNow accelerates the rental agreement process for landlords and tenants alike. You no longer need to print, sign, and scan documents, making it far easier to finalize agreements in compliance with publication 527 residential rental property. This expedites the onboarding and leasing processes, thereby enhancing your operational efficiency.

-

What types of documents can I manage with airSlate SignNow?

With airSlate SignNow, you can manage a variety of documents essential for residential rental properties, including leases, rental applications, and termination notices. This comprehensive document management system ensures that all your paperwork complies with the stipulations in publication 527 residential rental property. You can maintain your records securely and efficiently.

Get more for Ad www pdffiller com

- 616 irregular verbs pdf form

- Angle pairs created by parallel lines cut by a transversal form

- Self declaration form for residence certificate goa

- Oklahoma stae treasurer unclaimed property for 496 up form

- Bsnl ecs form

- T1 ovp form

- Hr risk register pdf form

- Product identity label name summit bti briquets section 1 form

Find out other Ad www pdffiller com

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF