State of South Carolina Department of Revenue 2022-2026

What is the State of South Carolina Department of Revenue?

The South Carolina Department of Revenue (SCDOR) is the state agency responsible for administering and enforcing tax laws in South Carolina. It oversees the collection of various taxes, including income, sales, and property taxes. The department also manages tax compliance and provides resources to help taxpayers understand their obligations. Additionally, SCDOR plays a crucial role in the distribution of state funds, ensuring that revenue is allocated appropriately to support public services and infrastructure.

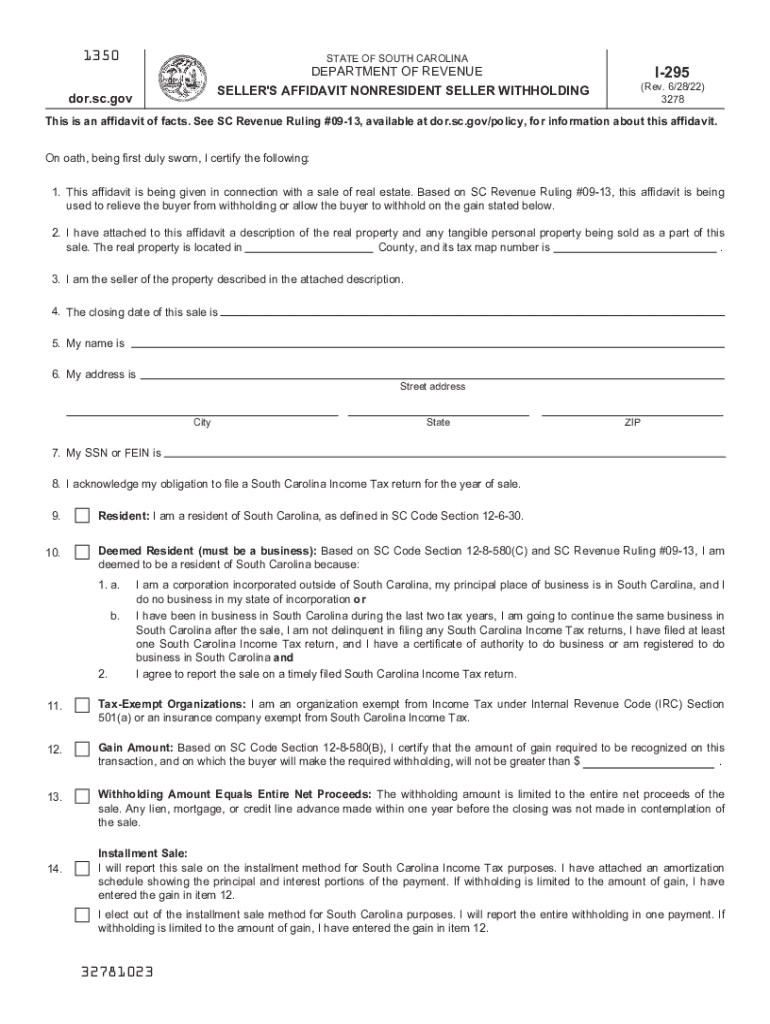

Steps to Complete the South Carolina Seller Form

Completing the South Carolina seller form, often referred to as the SC form I 295, involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information, including your personal details and any relevant business information. Next, fill out the form carefully, paying close attention to each section. It is essential to provide accurate information to avoid delays or penalties. Once completed, review the form for any errors or omissions before submitting it. Finally, choose your preferred submission method, whether online, by mail, or in person, to finalize the process.

Legal Use of the South Carolina Seller Form

The legal use of the South Carolina seller form is crucial for ensuring compliance with state tax regulations. This form is used to report sales tax and other relevant information to the SCDOR. To be legally binding, the form must be filled out accurately and submitted within the specified deadlines. Failure to comply with these requirements can result in penalties or legal repercussions. It is advisable to consult with a tax professional if you have questions about the legal implications of using this form.

Required Documents for the South Carolina Seller Form

When completing the South Carolina seller form, certain documents are typically required to support your submission. These may include proof of identity, such as a driver's license or Social Security number, as well as any relevant business licenses or permits. Additionally, you may need to provide financial records that demonstrate your sales activities. Having these documents ready can streamline the process and help ensure that your form is processed without delays.

Form Submission Methods

The South Carolina seller form can be submitted through various methods, providing flexibility for taxpayers. You can choose to submit the form online via the SCDOR website, which is often the quickest option. Alternatively, you may opt to mail the completed form to the appropriate address or deliver it in person to a local SCDOR office. Each method has its own processing times, so it is important to consider your timeline when deciding how to submit your form.

Penalties for Non-Compliance

Non-compliance with the requirements associated with the South Carolina seller form can lead to significant penalties. These may include fines, interest on unpaid taxes, and even legal action in severe cases. It is essential to adhere to all filing deadlines and ensure that the information provided is accurate. By staying informed about your obligations and submitting your form correctly, you can avoid the potential consequences of non-compliance.

Eligibility Criteria for the South Carolina Seller Form

To be eligible to complete the South Carolina seller form, individuals or businesses must meet specific criteria established by the SCDOR. Generally, this includes having a valid business license and being registered for sales tax collection in South Carolina. Additionally, sellers must engage in taxable sales activities within the state. Understanding these eligibility requirements is important for ensuring that you can successfully complete and submit the form.

Quick guide on how to complete state of south carolina department of revenue

Effortlessly Prepare State Of South Carolina Department Of Revenue on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed paperwork, as you can easily access the appropriate form and securely save it online. airSlate SignNow supplies you with all the necessary tools to create, modify, and eSign your documents quickly and without delays. Manage State Of South Carolina Department Of Revenue on any device using airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

The simplest way to modify and eSign State Of South Carolina Department Of Revenue with ease

- Find State Of South Carolina Department Of Revenue and click Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize important sections of your documents or conceal sensitive information with tools specifically provided by airSlate SignNow.

- Create your signature using the Sign tool, which takes moments and holds the same legal validity as a traditional ink signature.

- Review all the details and press the Done button to save your changes.

- Choose how you wish to send your form, be it via email, text message (SMS), a shared link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing additional document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign State Of South Carolina Department Of Revenue and ensure seamless communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct state of south carolina department of revenue

Create this form in 5 minutes!

How to create an eSignature for the state of south carolina department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the benefits of using airSlate SignNow for a South Carolina seller?

For a South Carolina seller, airSlate SignNow provides a streamlined way to send and eSign documents quickly, which can accelerate the closing process. The platform is user-friendly and ensures that all transactions are legally binding and compliant. Additionally, sellers can manage their documents from anywhere, increasing efficiency and allowing for better customer service.

-

How does pricing for airSlate SignNow work for South Carolina sellers?

airSlate SignNow offers competitive pricing plans suitable for South Carolina sellers, including options for individual users and businesses. The plans are designed to cater to various usage levels, ensuring that everyone finds a suitable option. Moreover, there's a free trial available that allows sellers to test the platform before committing financially.

-

What features does airSlate SignNow offer for South Carolina sellers?

South Carolina sellers can take advantage of features like customizable templates, bulk sending, and real-time tracking of document status with airSlate SignNow. The platform also supports multi-party signing, which is essential for complex transactions. These features enhance seller efficiency and create a smooth transaction experience for all parties involved.

-

Is airSlate SignNow secure for South Carolina sellers?

Yes, airSlate SignNow prioritizes security, making it a reliable choice for South Carolina sellers. The platform employs advanced encryption and complies with various data protection regulations to safeguard sensitive information. Sellers can feel confident that their documents are stored securely and are protected from unauthorized access.

-

Can South Carolina sellers integrate airSlate SignNow with other tools?

Absolutely! South Carolina sellers can easily integrate airSlate SignNow with other applications they already use, such as CRM systems and accounting software. This integration capability helps streamline workflows, minimizing the manual work involved in keeping documents and transactions up to date. Sellers can maximize productivity by using airSlate SignNow alongside their existing tools.

-

How easy is it for South Carolina sellers to adopt airSlate SignNow?

South Carolina sellers will find it very easy to adopt airSlate SignNow thanks to its intuitive interface and user-focused design. The platform includes helpful tutorials and customer support to assist users during the onboarding process. Even those who are not tech-savvy can quickly learn how to send and eSign documents efficiently.

-

What kind of customer support does airSlate SignNow provide for South Carolina sellers?

South Carolina sellers can access comprehensive customer support through airSlate SignNow. The platform offers multiple support channels, including live chat, email, and a dedicated help center with resources and FAQs. This ensures that sellers receive timely assistance whenever they encounter any issues or have questions.

Get more for State Of South Carolina Department Of Revenue

Find out other State Of South Carolina Department Of Revenue

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile

- Can I Sign Alabama Healthcare / Medical Quitclaim Deed

- Sign Utah Government Month To Month Lease Myself

- Can I Sign Texas Government Limited Power Of Attorney

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later

- Sign California Healthcare / Medical Arbitration Agreement Free

- Help Me With Sign California Healthcare / Medical Lease Agreement Form

- Sign Connecticut Healthcare / Medical Business Plan Template Free

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile

- Sign Wyoming Government Quitclaim Deed Free

- How To Sign Nebraska Healthcare / Medical Living Will