Form ST 130 Business Purchaser's Report of Sales and Use Tax Revised 1222

What is the Form ST 130 Business Purchaser's Report Of Sales And Use Tax Revised 1222

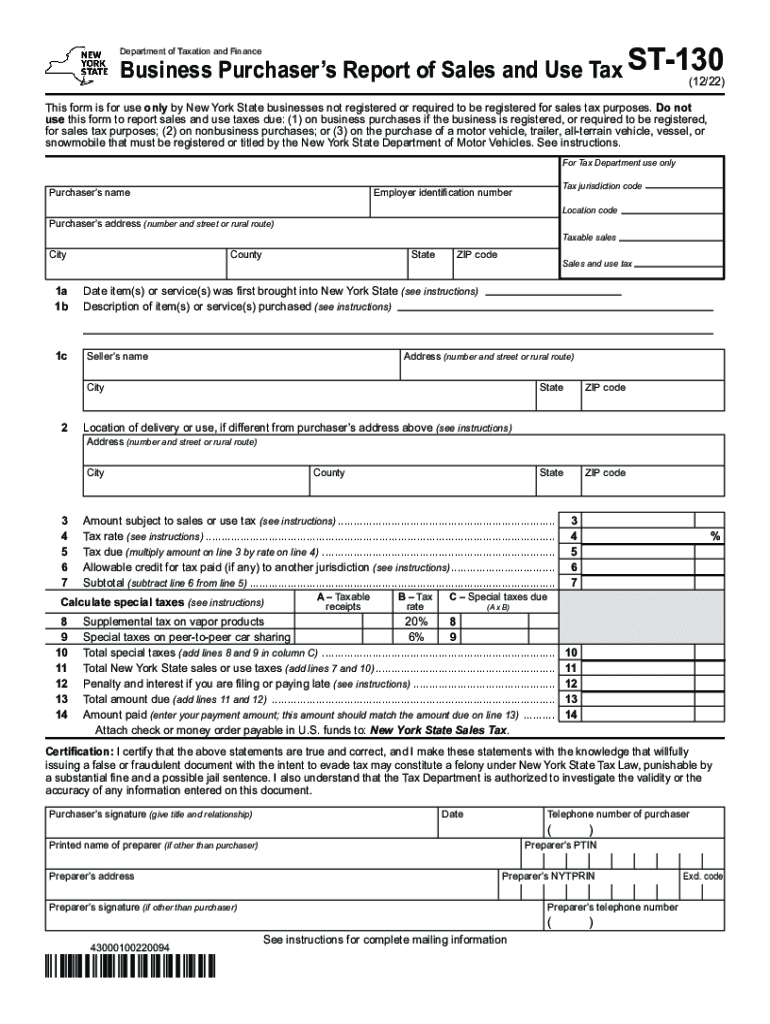

The Form ST 130, also known as the Business Purchaser's Report of Sales and Use Tax, is a crucial document used in New York State for reporting sales tax exemptions. This form is specifically designed for businesses that purchase goods or services that are exempt from sales tax. By completing the ST 130, businesses can provide necessary information to the New York State Department of Taxation and Finance, ensuring compliance with state tax laws. This form is essential for maintaining accurate records and avoiding potential penalties associated with improper tax reporting.

Steps to complete the Form ST 130 Business Purchaser's Report Of Sales And Use Tax Revised 1222

Completing the Form ST 130 involves several important steps to ensure accuracy and compliance. First, gather all necessary information, including your business name, address, and tax identification number. Next, identify the specific purchases that qualify for tax exemption and provide detailed descriptions. Fill out the form by entering the required information in the appropriate sections, ensuring that all data is accurate and complete. After filling out the form, review it thoroughly for any errors before submitting it to the New York State Department of Taxation and Finance.

Key elements of the Form ST 130 Business Purchaser's Report Of Sales And Use Tax Revised 1222

The Form ST 130 consists of several key elements that are vital for proper completion. These include:

- Business Information: This section requires the name, address, and tax identification number of the business.

- Purchase Details: A detailed description of the items purchased, including their cost and the reason for the tax exemption.

- Signature: The form must be signed by an authorized representative of the business, confirming the accuracy of the information provided.

- Certification: A statement certifying that the purchases are exempt from sales tax under applicable laws.

Legal use of the Form ST 130 Business Purchaser's Report Of Sales And Use Tax Revised 1222

The legal use of the Form ST 130 is governed by New York State tax laws. This form is legally binding when completed accurately and submitted in accordance with state regulations. It serves as a declaration that the purchases made by the business are exempt from sales tax, provided that the business meets the eligibility criteria. Misuse or fraudulent completion of the form can lead to penalties, including fines and back taxes owed. Thus, it is essential for businesses to understand the legal implications of using this form correctly.

How to obtain the Form ST 130 Business Purchaser's Report Of Sales And Use Tax Revised 1222

The Form ST 130 can be obtained directly from the New York State Department of Taxation and Finance website. It is available in a downloadable format, allowing businesses to print and complete the form as needed. Additionally, businesses may request physical copies of the form by contacting the department directly. Ensuring that you have the most current version of the form is crucial for compliance, as outdated forms may not be accepted.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Form ST 130 is essential for compliance. Typically, businesses should submit the form at the time of purchase or as soon as possible thereafter. It is important to stay informed about any changes to deadlines, as these can vary based on specific circumstances or updates to tax law. Keeping track of important dates helps businesses avoid penalties and ensures that they remain compliant with state tax regulations.

Quick guide on how to complete form st 130 business purchasers report of sales and use tax revised 1222

Complete Form ST 130 Business Purchaser's Report Of Sales And Use Tax Revised 1222 effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to access the necessary form and securely archive it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents promptly without delays. Manage Form ST 130 Business Purchaser's Report Of Sales And Use Tax Revised 1222 on any platform using the airSlate SignNow Android or iOS applications and enhance any document-centric task today.

How to modify and eSign Form ST 130 Business Purchaser's Report Of Sales And Use Tax Revised 1222 effortlessly

- Locate Form ST 130 Business Purchaser's Report Of Sales And Use Tax Revised 1222 and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information and then click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about missing or lost documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Form ST 130 Business Purchaser's Report Of Sales And Use Tax Revised 1222 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form st 130 business purchasers report of sales and use tax revised 1222

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the pricing structure for airSlate SignNow's services in NY 130?

airSlate SignNow offers flexible pricing plans designed to accommodate businesses of all sizes in NY 130. Our plans include features such as document templates, eSignature, and integrations with third-party applications, all at competitive prices. You can choose a monthly or annual subscription that best fits your budget and business needs.

-

How can airSlate SignNow benefit businesses in NY 130?

airSlate SignNow streamlines document management, enabling businesses in NY 130 to send and eSign documents quickly and securely. The platform enhances efficiency, reduces paper usage, and ensures compliance, making it an essential tool for modern businesses seeking to save time and resources.

-

What features does airSlate SignNow offer for users in NY 130?

In NY 130, airSlate SignNow provides a range of features including customizable document templates, advanced signature security, and real-time tracking of document status. Furthermore, the user-friendly interface ensures that you can easily manage all your eSigning needs without any technical expertise.

-

What integrations are available with airSlate SignNow for businesses in NY 130?

airSlate SignNow seamlessly integrates with many popular applications used by businesses in NY 130, including Google Workspace, Salesforce, and Microsoft Office. These integrations enhance workflow efficiency, allowing users to manage their documents and signatures in one centralized location.

-

Is airSlate SignNow compliant with legal regulations in NY 130?

Yes, airSlate SignNow is compliant with the legal regulations governing electronic signatures in NY 130. Our platform adheres to the U.S. ESIGN Act and the Uniform Electronic Transactions Act (UETA), ensuring that all eSignatures are legally binding and secure.

-

How does airSlate SignNow ensure the security of documents in NY 130?

Security is a top priority for airSlate SignNow, especially for businesses in NY 130 handling sensitive documents. We utilize advanced encryption technology and multi-factor authentication to protect your data and ensure that only authorized individuals can access your documents.

-

Can I access airSlate SignNow on mobile devices in NY 130?

Absolutely! airSlate SignNow is accessible on mobile devices, allowing users in NY 130 to manage and eSign documents on the go. Our mobile app is designed for ease of use, providing functionality similar to our desktop version, ensuring you stay productive wherever you are.

Get more for Form ST 130 Business Purchaser's Report Of Sales And Use Tax Revised 1222

Find out other Form ST 130 Business Purchaser's Report Of Sales And Use Tax Revised 1222

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself