INDIVIDUAL and BUSINESS TAX RETURN CITY of LORAIN 2023-2026

Understanding the Individual and Business Tax Return City of Lorain

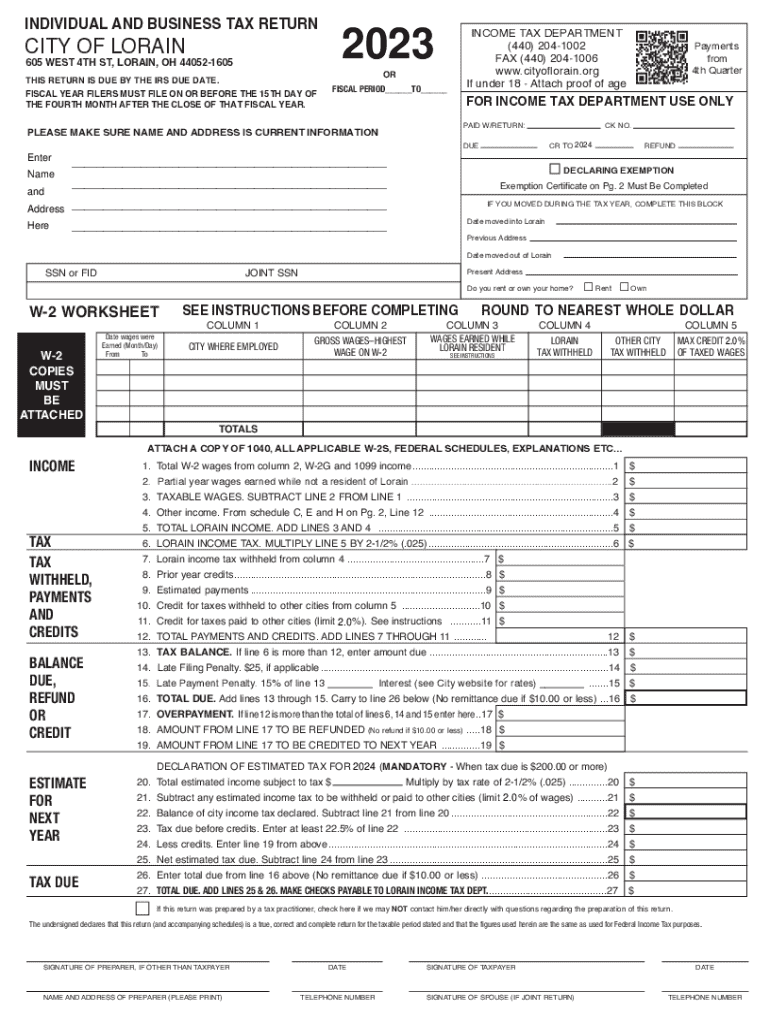

The Individual and Business Tax Return City of Lorain is a crucial document for residents and businesses operating within the city. This form is designed to collect local income taxes, which are essential for funding municipal services. Individuals and businesses must be aware of the specific requirements and regulations that govern this tax return to ensure compliance and avoid penalties.

Steps to Complete the Individual and Business Tax Return City of Lorain

Completing the Individual and Business Tax Return City of Lorain involves several key steps. First, gather all necessary financial documents, including W-2 forms, 1099 forms, and any other relevant income statements. Next, accurately report your income on the form, ensuring that all figures are correct. After filling out the form, review it for any errors or omissions. Finally, submit the completed return by the designated deadline to avoid late fees.

Required Documents for the Individual and Business Tax Return City of Lorain

To successfully file the Individual and Business Tax Return City of Lorain, you will need specific documents. These typically include:

- W-2 forms from employers

- 1099 forms for additional income sources

- Records of any deductions or credits you plan to claim

- Previous tax returns for reference

Having these documents ready will streamline the filing process and help ensure accuracy.

Filing Deadlines and Important Dates

It is essential to be aware of the filing deadlines for the Individual and Business Tax Return City of Lorain. Generally, the tax return is due by April fifteenth of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. Mark your calendar for any important dates related to tax payments or extensions to avoid penalties.

Legal Use of the Individual and Business Tax Return City of Lorain

The Individual and Business Tax Return City of Lorain is legally required for all residents and businesses earning income within the city limits. Failing to file this return can result in penalties, including fines and interest on unpaid taxes. It is important to understand your legal obligations regarding this tax return to maintain compliance with local tax laws.

IRS Guidelines Related to Local Tax Returns

While the Individual and Business Tax Return City of Lorain is a local requirement, it is important to consider how it interacts with federal tax regulations. The IRS provides guidelines that may affect how local taxes are reported on your federal tax return. Taxpayers should ensure they are following both local and federal regulations to avoid discrepancies and potential audits.

Create this form in 5 minutes or less

Find and fill out the correct individual and business tax return city of lorain

Create this form in 5 minutes!

How to create an eSignature for the individual and business tax return city of lorain

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2019 worksheet tax and how can airSlate SignNow help?

The 2019 worksheet tax is a document used to calculate your tax obligations for the year 2019. airSlate SignNow simplifies the process by allowing you to easily fill out, sign, and send your 2019 worksheet tax electronically, ensuring accuracy and compliance.

-

Is airSlate SignNow suitable for filing the 2019 worksheet tax?

Yes, airSlate SignNow is an excellent tool for managing your 2019 worksheet tax. It provides a user-friendly interface that allows you to complete your tax forms efficiently and securely, making the filing process smoother.

-

What features does airSlate SignNow offer for managing the 2019 worksheet tax?

airSlate SignNow offers features such as document templates, eSignature capabilities, and secure cloud storage, all of which are beneficial for managing your 2019 worksheet tax. These features help streamline the preparation and submission of your tax documents.

-

How does airSlate SignNow ensure the security of my 2019 worksheet tax documents?

airSlate SignNow prioritizes security with advanced encryption and compliance with industry standards. Your 2019 worksheet tax documents are stored securely, ensuring that your sensitive information remains protected throughout the signing and submission process.

-

What are the pricing options for using airSlate SignNow for my 2019 worksheet tax?

airSlate SignNow offers various pricing plans to accommodate different needs, including options for individuals and businesses. You can choose a plan that best fits your requirements for managing your 2019 worksheet tax efficiently and cost-effectively.

-

Can I integrate airSlate SignNow with other software for my 2019 worksheet tax?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, enhancing your workflow for the 2019 worksheet tax. This integration allows you to import and export documents easily, saving you time and effort.

-

What benefits does airSlate SignNow provide for small businesses handling the 2019 worksheet tax?

For small businesses, airSlate SignNow offers a cost-effective solution to manage the 2019 worksheet tax. It simplifies document management, reduces the need for physical paperwork, and enhances collaboration among team members, making tax season less stressful.

Get more for INDIVIDUAL AND BUSINESS TAX RETURN CITY OF LORAIN

Find out other INDIVIDUAL AND BUSINESS TAX RETURN CITY OF LORAIN

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe

- How Can I eSign Maryland Non-Profit Credit Memo

- eSign Maryland Non-Profit Separation Agreement Computer

- eSign Legal PDF New Jersey Free

- eSign Non-Profit Document Michigan Safe

- eSign New Mexico Legal Living Will Now

- eSign Minnesota Non-Profit Confidentiality Agreement Fast

- How Do I eSign Montana Non-Profit POA

- eSign Legal Form New York Online

- Can I eSign Nevada Non-Profit LLC Operating Agreement

- eSign Legal Presentation New York Online

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple