Form ST 809 New York State and Local Sales and Use Tax Return for Part Quarterly Monthly Filers Revised 123

Understanding the ST 809 Form for New York State Sales Tax

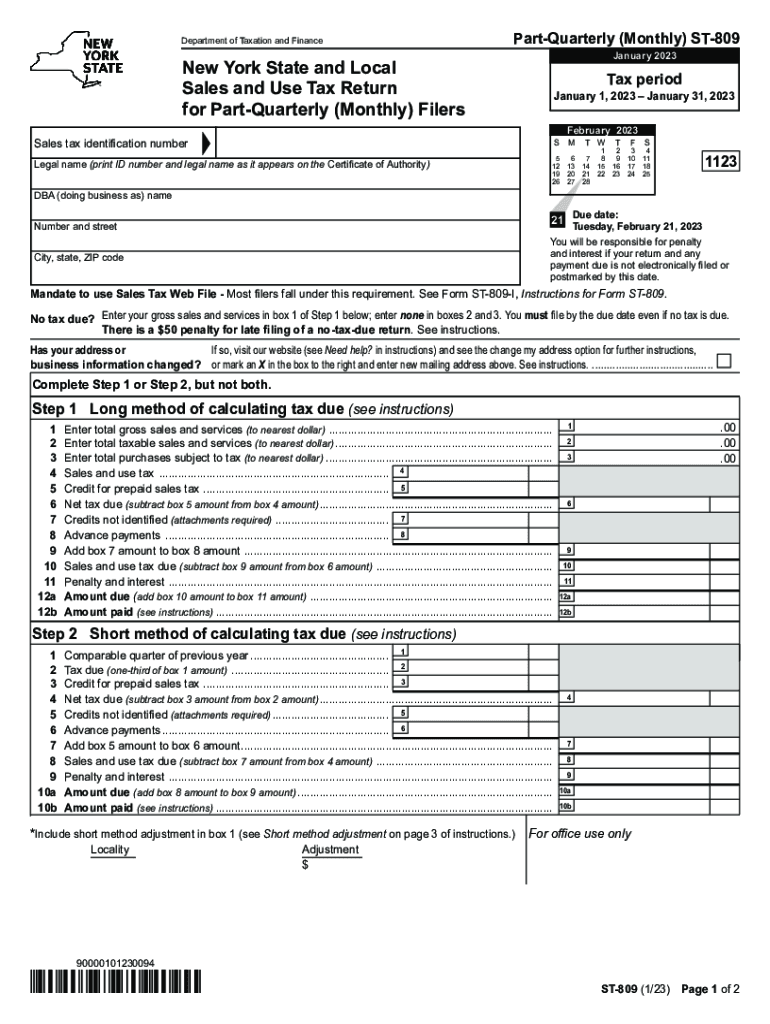

The ST 809 form is the New York State and Local Sales and Use Tax Return designed for businesses that file on a monthly or quarterly basis. This form is essential for reporting sales tax collected from customers and remitting it to the state. It is specifically tailored for those who need to comply with New York's sales tax regulations. The form includes sections for reporting taxable sales, exempt sales, and the total sales tax due. Understanding the structure of the ST 809 is crucial for accurate and timely filing.

Steps to Complete the ST 809 Form

Completing the ST 809 form involves several key steps to ensure accuracy and compliance. First, gather all necessary sales records for the reporting period. This includes total sales, exempt sales, and any deductions. Next, fill out the form by entering the total sales amount and calculating the sales tax owed based on the applicable rates. Be sure to double-check each entry for accuracy. Once completed, sign and date the form before submitting it to the New York State Department of Taxation and Finance.

Legal Use of the ST 809 Form

The ST 809 form must be used in accordance with New York State tax laws. It serves as a legal document for reporting sales tax obligations. Filing this form accurately is essential to avoid penalties and ensure compliance with state regulations. Businesses should maintain records of their sales and the submitted forms for at least three years in case of audits or inquiries from tax authorities.

Filing Deadlines for the ST 809 Form

Filing deadlines for the ST 809 form vary depending on whether a business files monthly or quarterly. Monthly filers are generally required to submit their forms by the 20th of the following month. Quarterly filers must submit their returns by the 20th of the month following the end of the quarter. It is important to adhere to these deadlines to avoid late fees and interest on unpaid taxes.

Key Elements of the ST 809 Form

The ST 809 form includes several key elements that are critical for accurate reporting. These elements consist of sections for reporting total sales, exempt sales, and the calculation of sales tax due. Additionally, filers must provide their business identification information, including the sales tax identification number. Understanding these components helps ensure that all necessary information is included and accurately reported.

Obtaining the ST 809 Form

The ST 809 form can be obtained directly from the New York State Department of Taxation and Finance website. It is available in both digital and printable formats, allowing businesses to choose the method that best suits their needs. Additionally, many tax preparation software programs include the ST 809 form, simplifying the filing process for users.

Quick guide on how to complete form st 809 new york state and local sales and use tax return for part quarterly monthly filers revised 123

Complete Form ST 809 New York State And Local Sales And Use Tax Return For Part Quarterly Monthly Filers Revised 123 effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can easily find the necessary form and securely save it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents quickly and without interruptions. Manage Form ST 809 New York State And Local Sales And Use Tax Return For Part Quarterly Monthly Filers Revised 123 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Form ST 809 New York State And Local Sales And Use Tax Return For Part Quarterly Monthly Filers Revised 123 with ease

- Locate Form ST 809 New York State And Local Sales And Use Tax Return For Part Quarterly Monthly Filers Revised 123 and click Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Highlight pertinent sections of the documents or redact sensitive content with the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just moments and holds the same legal validity as a traditional wet ink signature.

- Review all the information and then click the Done button to save your changes.

- Select how you wish to deliver your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tiresome form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Form ST 809 New York State And Local Sales And Use Tax Return For Part Quarterly Monthly Filers Revised 123 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form st 809 new york state and local sales and use tax return for part quarterly monthly filers revised 123

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to ny tax monthly?

airSlate SignNow is a digital signing solution that enables businesses to send and electronically sign documents. For those managing ny tax monthly obligations, this tool streamlines document preparation and signing processes, ensuring compliance and efficiency.

-

How much does airSlate SignNow cost for businesses handling ny tax monthly?

Pricing for airSlate SignNow varies depending on the plan you choose, but it remains an affordable option for organizations dealing with ny tax monthly. With options ranging from basic to advanced features, businesses can select a plan that best fits their needs and budget.

-

What features of airSlate SignNow help with managing ny tax monthly documents?

airSlate SignNow includes features such as custom templates, automated workflows, and real-time tracking, all of which can be beneficial for managing ny tax monthly documents. These features allow users to save time and reduce errors associated with tax documentation.

-

Can airSlate SignNow integrate with other tools for managing ny tax monthly tasks?

Yes, airSlate SignNow offers seamless integrations with various software platforms, including accounting and tax preparation tools. These integrations facilitate smoother operations, especially for professionals handling ny tax monthly activities.

-

How does airSlate SignNow ensure the security of documents related to ny tax monthly?

airSlate SignNow employs top-notch security measures, including encryption and secure storage to protect documents. This is especially critical for sensitive information, such as that involved in ny tax monthly, ensuring your data remains safe from unauthorized access.

-

What benefits do businesses gain from using airSlate SignNow for ny tax monthly processes?

Using airSlate SignNow for ny tax monthly processes enhances efficiency and accuracy in document management. By minimizing paperwork and streamlining the signing process, businesses can focus on core activities while ensuring timely compliance with tax regulations.

-

Is airSlate SignNow user-friendly for those managing ny tax monthly?

Absolutely! airSlate SignNow is designed with an intuitive interface that makes it easy for users of all skill levels. This user-friendliness is particularly beneficial for those who regularly handle ny tax monthly tasks and prefer a straightforward solution.

Get more for Form ST 809 New York State And Local Sales And Use Tax Return For Part Quarterly Monthly Filers Revised 123

Find out other Form ST 809 New York State And Local Sales And Use Tax Return For Part Quarterly Monthly Filers Revised 123

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage

- Electronic signature West Virginia Sales Receipt Template Free

- Electronic signature Colorado Sales Invoice Template Computer

- Electronic signature New Hampshire Sales Invoice Template Computer

- Electronic signature Tennessee Introduction Letter Free

- How To eSignature Michigan Disclosure Notice

- How To Electronic signature Ohio Product Defect Notice

- Electronic signature California Customer Complaint Form Online

- Electronic signature Alaska Refund Request Form Later

- How Can I Electronic signature Texas Customer Return Report

- How Do I Electronic signature Florida Reseller Agreement

- Electronic signature Indiana Sponsorship Agreement Free