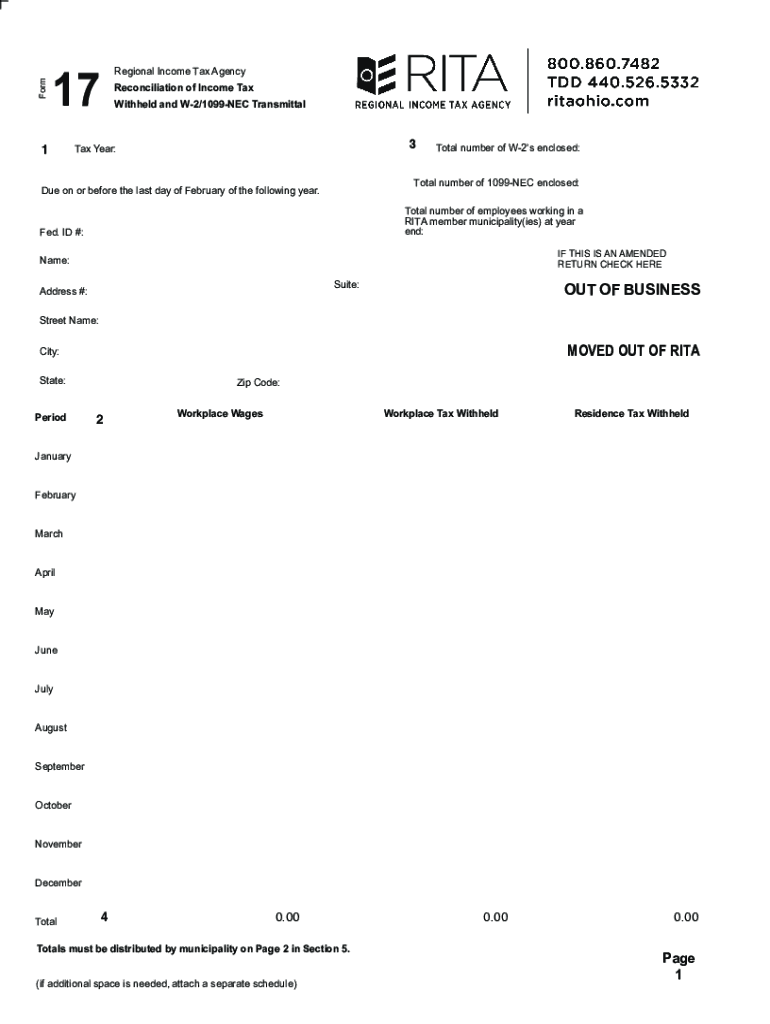

FORM 17RECONCILIATION of INCOME TAX WITHHELD

What is the RITA Form 17: Reconciliation of Income Tax Withheld

The RITA Form 17 is a critical document used for reconciling income tax withheld for employees in Ohio. This form is designed to ensure that the correct amount of regional income tax has been collected and remitted by employers on behalf of their employees. It serves as a reconciliation tool for both employers and the Regional Income Tax Agency (RITA), helping to clarify any discrepancies in tax withholdings throughout the year. Understanding this form is essential for compliance with Ohio tax regulations and maintaining accurate financial records.

Steps to Complete the RITA Form 17

Completing the RITA Form 17 requires careful attention to detail. Here are the essential steps to follow:

- Gather all relevant payroll records for the tax year, including total wages paid and taxes withheld.

- Fill out the employee information section, ensuring accuracy in names, addresses, and Social Security numbers.

- Report the total income tax withheld from each employee’s wages accurately.

- Calculate the total amount of tax due or overpaid by comparing withheld amounts against actual tax liabilities.

- Sign and date the form, certifying that the information provided is accurate and complete.

How to Obtain the RITA Form 17

The RITA Form 17 can be obtained through several convenient methods. Employers can access the form directly from the RITA website, where it is available for download in PDF format. Additionally, employers may request physical copies of the form by contacting RITA’s customer service. It is advisable to ensure you have the most current version of the form to comply with any updates in tax regulations.

Legal Use of the RITA Form 17

The RITA Form 17 is legally binding when completed and submitted according to Ohio tax laws. It is essential for employers to understand that submitting this form accurately is not only a matter of compliance but also a way to avoid potential penalties for incorrect tax reporting. The form must be submitted by the designated deadlines to ensure that all tax obligations are met and to maintain good standing with the RITA.

Filing Deadlines for the RITA Form 17

Filing deadlines for the RITA Form 17 are crucial for compliance. Employers must submit the form by the last day of the month following the end of the tax year. For example, if the tax year ends on December thirty-first, the form must be filed by January thirty-first of the following year. Missing this deadline can result in penalties and interest on any unpaid taxes.

Key Elements of the RITA Form 17

Understanding the key elements of the RITA Form 17 is vital for accurate completion. The form typically includes sections for:

- Employer identification information, including name and address.

- Employee details, such as names and Social Security numbers.

- Total wages paid and taxes withheld for each employee.

- Signature line for the employer or authorized representative.

Each of these components plays a significant role in ensuring the form is filled out correctly and submitted on time.

Quick guide on how to complete form 17reconciliation of income tax withheld

Prepare FORM 17RECONCILIATION OF INCOME TAX WITHHELD easily on any device

Online document management has gained signNow traction among businesses and individuals. It serves as an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents swiftly without delays. Manage FORM 17RECONCILIATION OF INCOME TAX WITHHELD on any platform using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The simplest way to modify and eSign FORM 17RECONCILIATION OF INCOME TAX WITHHELD effortlessly

- Find FORM 17RECONCILIATION OF INCOME TAX WITHHELD and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method to deliver your form: via email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or inaccuracies that require printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Modify and eSign FORM 17RECONCILIATION OF INCOME TAX WITHHELD and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 17reconciliation of income tax withheld

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 'rita tax ohio'?

Rita tax Ohio refers to the municipal income tax collected by the Regional Income Tax Agency (RITA) in Ohio. This tax is imposed on residents and businesses operating within RITA jurisdictions. Understanding how this tax works is crucial for compliance and financial planning.

-

How does airSlate SignNow help with Rita tax Ohio documentation?

AirSlate SignNow simplifies the process of preparing and signing documents related to Rita tax Ohio compliance. With our eSigning features, businesses can ensure that their tax documents are signed and submitted efficiently, avoiding any penalties or delays.

-

What are the pricing options for airSlate SignNow for Rita tax Ohio needs?

AirSlate SignNow offers several pricing plans that cater to different business needs, including users needing to handle Rita tax Ohio documents. Our plans are designed to be cost-effective, making it easy for you to find a solution that fits your budget.

-

Does airSlate SignNow provide templates for Rita tax Ohio forms?

Yes, airSlate SignNow offers customizable templates that can help users prepare Rita tax Ohio forms quickly and accurately. These templates save time and ensure that all necessary information is captured properly.

-

Can airSlate SignNow integrate with other software for Rita tax Ohio management?

Absolutely! AirSlate SignNow integrates seamlessly with various accounting and financial management software, which can enhance your Rita tax Ohio document handling. This integration helps streamline your tax processes and ensures data consistency.

-

What are the key benefits of using airSlate SignNow for Rita tax Ohio?

Using airSlate SignNow for Rita tax Ohio provides numerous benefits, including faster document turnaround times, enhanced security for sensitive tax information, and improved compliance through electronic signatures. Our platform is designed to maximize efficiency for your tax-related tasks.

-

Is airSlate SignNow easy to use for Rita tax Ohio-related documents?

Yes, airSlate SignNow is designed for user-friendly navigation, making it easy even for those unfamiliar with eSigning technology. Users can quickly learn how to send, sign, and manage forms related to Rita tax Ohio without a steep learning curve.

Get more for FORM 17RECONCILIATION OF INCOME TAX WITHHELD

Find out other FORM 17RECONCILIATION OF INCOME TAX WITHHELD

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document