Form 540NR California Nonresident or Part Year Resident Income Tax Return 2024-2026

What is the Form 540NR California Nonresident Or Part Year Resident Income Tax Return

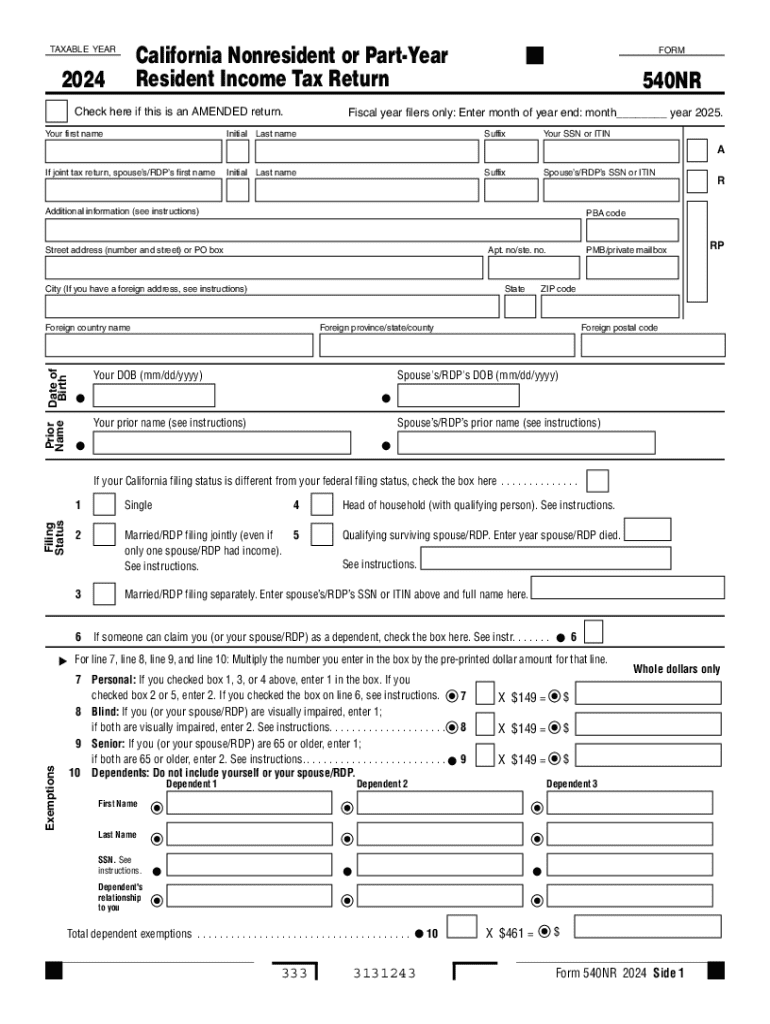

The Form 540NR is designed for individuals who are nonresidents or part-year residents of California. This income tax return allows these taxpayers to report their California source income and claim any applicable deductions or credits. It is essential for ensuring compliance with California tax laws while accurately reflecting the taxpayer's residency status and income earned within the state.

How to use the Form 540NR California Nonresident Or Part Year Resident Income Tax Return

Using the Form 540NR involves several steps to ensure accurate reporting. Taxpayers must first gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, the form should be filled out with personal information, including residency status, income details, and any deductions. It is important to follow the instructions carefully to avoid errors that could lead to delays or penalties.

Steps to complete the Form 540NR California Nonresident Or Part Year Resident Income Tax Return

Completing the Form 540NR requires a systematic approach:

- Gather all relevant income documents and tax statements.

- Fill out personal information, including your name, address, and Social Security number.

- Report your California source income accurately in the designated sections.

- Claim deductions and credits applicable to your situation.

- Review the completed form for accuracy before submission.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the Form 540NR. Generally, the form is due on April 15 for the tax year ending December 31. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is crucial to file on time to avoid penalties and interest on any taxes owed.

Required Documents

When preparing to file the Form 540NR, certain documents are essential:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Records of any other income received.

- Documentation for deductions, such as mortgage interest statements or property tax receipts.

- Identification documents, including Social Security numbers for all dependents.

Eligibility Criteria

To file the Form 540NR, individuals must meet specific eligibility criteria. Taxpayers must be classified as nonresidents or part-year residents of California. They should have earned income from California sources during the tax year and must not have been a full-year resident of the state. Understanding these criteria is vital to ensure proper filing and compliance with state tax regulations.

Create this form in 5 minutes or less

Find and fill out the correct form 540nr california nonresident or part year resident income tax return

Create this form in 5 minutes!

How to create an eSignature for the form 540nr california nonresident or part year resident income tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 540NR California Nonresident Or Part Year Resident Income Tax Return?

The Form 540NR California Nonresident Or Part Year Resident Income Tax Return is a tax form used by individuals who are nonresidents or part-year residents of California to report their income and calculate their tax liability. This form is essential for ensuring compliance with California tax laws and accurately reporting income earned within the state.

-

How can airSlate SignNow help with the Form 540NR California Nonresident Or Part Year Resident Income Tax Return?

airSlate SignNow provides a streamlined platform for electronically signing and sending the Form 540NR California Nonresident Or Part Year Resident Income Tax Return. With our user-friendly interface, you can easily manage your tax documents, ensuring they are signed and submitted on time.

-

What are the pricing options for using airSlate SignNow for tax forms?

airSlate SignNow offers flexible pricing plans that cater to different needs, including options for individuals and businesses. Our cost-effective solution allows you to manage the Form 540NR California Nonresident Or Part Year Resident Income Tax Return without breaking the bank, ensuring you get the best value for your eSigning needs.

-

Are there any features specifically designed for tax document management?

Yes, airSlate SignNow includes features tailored for tax document management, such as templates for the Form 540NR California Nonresident Or Part Year Resident Income Tax Return, automated reminders, and secure storage. These features help you stay organized and ensure that your tax documents are always accessible when needed.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with various tax preparation software, allowing you to streamline your workflow when handling the Form 540NR California Nonresident Or Part Year Resident Income Tax Return. This integration enhances efficiency and ensures that all your documents are in one place.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your Form 540NR California Nonresident Or Part Year Resident Income Tax Return and other sensitive documents are protected. We use advanced encryption and security protocols to safeguard your information throughout the signing process.

-

What benefits does airSlate SignNow offer for eSigning tax documents?

Using airSlate SignNow for eSigning tax documents like the Form 540NR California Nonresident Or Part Year Resident Income Tax Return offers numerous benefits, including faster turnaround times, reduced paper usage, and enhanced tracking capabilities. This efficiency allows you to focus on other important aspects of your tax preparation.

Get more for Form 540NR California Nonresident Or Part Year Resident Income Tax Return

Find out other Form 540NR California Nonresident Or Part Year Resident Income Tax Return

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter