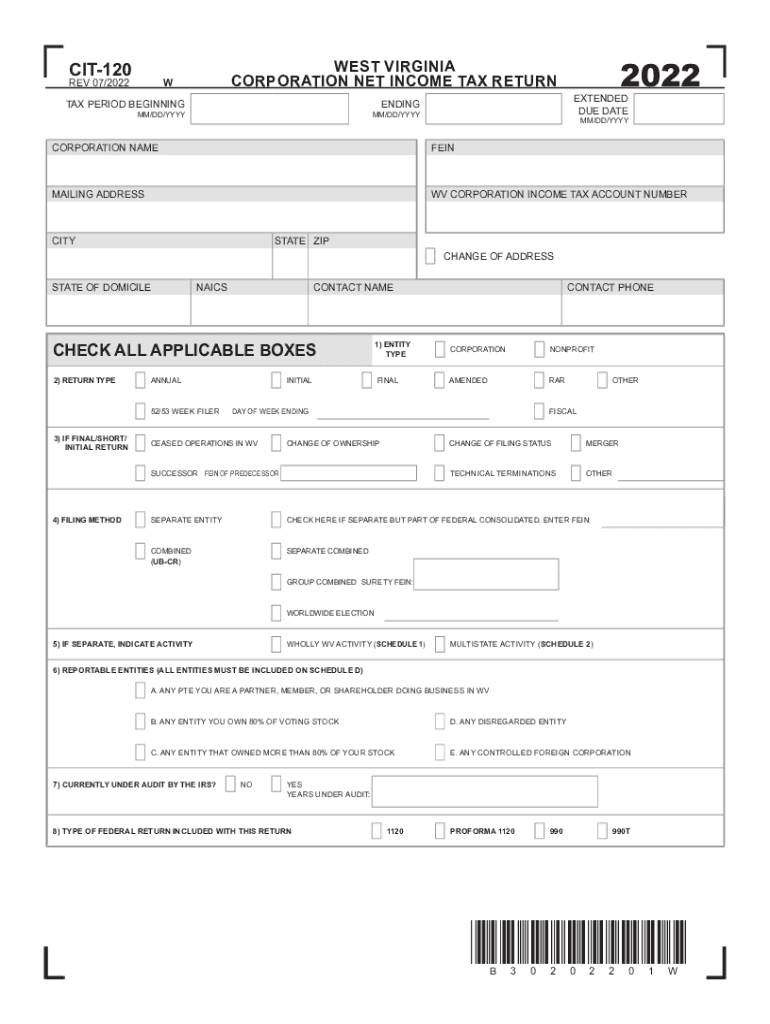

West VirginiaInternal Revenue Service Form

Understanding the West Virginia CNF120 Tax Form

The West Virginia CNF120 tax form, commonly referred to as the WV 120 tax form, is essential for businesses operating in West Virginia. This form is used to report income and calculate tax liabilities for corporations and other business entities. Filing this form accurately is crucial for compliance with state tax laws, ensuring that businesses meet their financial obligations while avoiding potential penalties.

Steps to Complete the WV 120 Tax Form

Completing the WV 120 tax form involves several key steps:

- Gather Required Documents: Collect financial statements, income records, and any other relevant documentation needed to accurately report your income.

- Fill Out the Form: Carefully enter your business information, including income, deductions, and credits. Ensure that all figures are accurate.

- Review for Accuracy: Double-check all entries to avoid errors that could lead to delays or penalties.

- Submit the Form: Choose your preferred submission method, whether online, by mail, or in person, and ensure it is sent by the deadline.

Legal Use of the WV 120 Tax Form

The WV 120 tax form is legally binding when completed and submitted according to West Virginia state laws. To ensure its legal validity, it is important to follow the specific instructions provided by the West Virginia Department of Revenue. Utilizing digital tools for e-signatures can enhance the security and authenticity of the submission, provided that these tools comply with relevant eSignature laws.

Filing Deadlines and Important Dates

Timely filing of the WV 120 tax form is crucial to avoid penalties. The standard deadline for submitting this form is typically the fifteenth day of the fourth month following the end of your fiscal year. Businesses should mark their calendars for this date and consider filing early to ensure compliance.

Form Submission Methods

The WV 120 tax form can be submitted through various methods:

- Online: Many businesses prefer to file electronically for convenience and speed.

- By Mail: Physical copies can be mailed to the appropriate tax office, ensuring they are postmarked by the deadline.

- In Person: Businesses can also deliver their forms directly to local tax offices for immediate processing.

Penalties for Non-Compliance

Failure to file the WV 120 tax form on time can result in significant penalties. These may include late fees, interest on unpaid taxes, and potential legal action. Understanding these consequences emphasizes the importance of timely and accurate filing.

Quick guide on how to complete west virginiainternal revenue service

Effortlessly prepare West VirginiaInternal Revenue Service on any device

Managing documents online has surged in popularity among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without any delays. Manage West VirginiaInternal Revenue Service on any platform with the airSlate SignNow Android or iOS applications and simplify your document-related tasks today.

How to modify and eSign West VirginiaInternal Revenue Service with ease

- Find West VirginiaInternal Revenue Service and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or redact sensitive details using tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to preserve your changes.

- Select your preferred delivery method for your form, whether by email, SMS, invite link, or download it to your computer.

Put aside the worry of lost or misplaced files, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Edit and eSign West VirginiaInternal Revenue Service while ensuring excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the west virginiainternal revenue service

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the WV 120 tax form and who needs to file it?

The WV 120 tax form is a state income tax return form for West Virginia residents. Individuals or businesses with taxable income in West Virginia need to file this form. Using airSlate SignNow can simplify the eSigning process of your WV 120 tax form, making it easier to manage your tax obligations.

-

How can airSlate SignNow help with the WV 120 tax form?

airSlate SignNow provides a seamless platform for businesses to send and eSign documents, including the WV 120 tax form. By using SignNow, you can ensure that all signatures are collected quickly and securely, speeding up your filing process and reducing paperwork hassle.

-

Is airSlate SignNow cost-effective for filing the WV 120 tax form?

Yes, airSlate SignNow offers a cost-effective solution for handling documents like the WV 120 tax form. With various pricing plans available, you can choose one that best fits your business needs while enjoying a valuable set of features to streamline your signing process.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow offers features such as customizable templates, real-time tracking, and an intuitive dashboard for managing your documents. These features are particularly useful for preparing and processing the WV 120 tax form, ensuring all steps are efficient and organized.

-

Can I integrate airSlate SignNow with my existing software for tax filing?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to connect your existing systems seamlessly. This means you can easily incorporate the WV 120 tax form into your current workflow without disrupting your established processes.

-

Is it secure to use airSlate SignNow for sensitive documents like the WV 120 tax form?

Yes, airSlate SignNow prioritizes security to protect sensitive documents, including the WV 120 tax form. The platform uses encryption and complies with industry standards to ensure that your documents are securely stored and shared, maintaining your confidentiality.

-

How do I get started with airSlate SignNow to handle the WV 120 tax form?

Getting started with airSlate SignNow is easy! Simply create an account, choose a plan that works for you, and start uploading your documents, including the WV 120 tax form. The user-friendly interface makes it a breeze to send, sign, and manage your forms efficiently.

Get more for West VirginiaInternal Revenue Service

- Military id card creator app form

- Shopfirstlinebenefits com catalog 2022 form

- Engineering drawing n3 study guide pdf form

- Half marathon training plan pdf form

- Mri mra cpt coding chart form

- Prioritizing tasks worksheet form

- New patient registration form welcome aspire2health pa

- New event horse test entry form

Find out other West VirginiaInternal Revenue Service

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors