Oklahoma Sales Tax Form Fill Online, Printable, Fillable 2021-2026

Understanding the Oklahoma Sales Tax Form

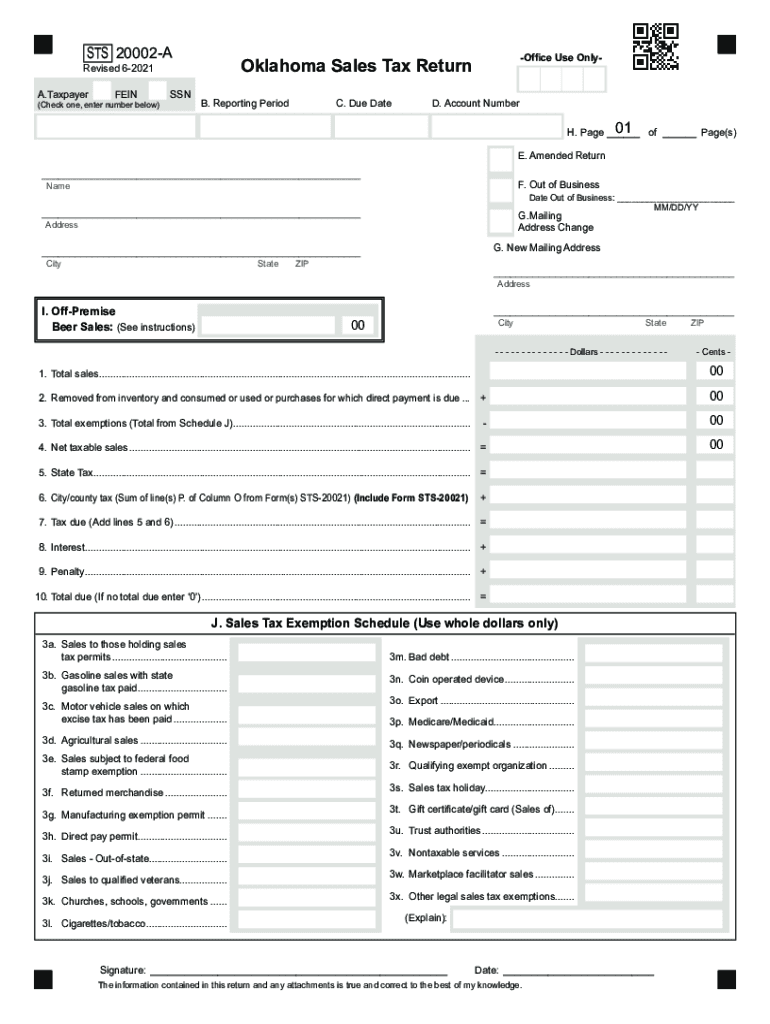

The Oklahoma sales tax form is essential for businesses operating within the state to report and remit sales tax collected from customers. This form is often referred to as the Oklahoma Sales Tax Return, and it is crucial for compliance with state tax regulations. The form can be filled out online or printed for manual completion, making it accessible for all types of businesses, from small enterprises to larger corporations.

Steps to Complete the Oklahoma Sales Tax Form

Completing the Oklahoma sales tax return form involves several key steps to ensure accuracy and compliance:

- Gather all sales records, including invoices and receipts.

- Determine the total sales amount for the reporting period.

- Calculate the sales tax collected based on the applicable tax rate.

- Fill out the Oklahoma sales tax return form with the required information, including business details and sales figures.

- Review the completed form for accuracy before submission.

Legal Use of the Oklahoma Sales Tax Form

The Oklahoma sales tax return form is legally binding when completed correctly. To ensure its validity, businesses must comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). Utilizing a reliable eSignature solution can provide the necessary legal framework to validate the form electronically, ensuring that it meets all legal requirements.

Filing Deadlines and Important Dates

Timely filing of the Oklahoma sales tax return is crucial to avoid penalties. The state typically requires businesses to file monthly, quarterly, or annually, depending on the volume of sales. Specific deadlines may vary, so it is important to check the Oklahoma Tax Commission’s schedule for the exact due dates for your reporting period.

Required Documents for Filing

When filing the Oklahoma sales tax return, businesses should have the following documents ready:

- Sales records for the reporting period.

- Invoices and receipts showing sales tax collected.

- Any relevant exemption certificates for tax-exempt sales.

Form Submission Methods

Businesses can submit the Oklahoma sales tax return form through various methods. Options include:

- Online submission via the Oklahoma Tax Commission’s website.

- Mailing the completed form to the appropriate tax office.

- In-person submission at designated tax offices.

Penalties for Non-Compliance

Failing to file the Oklahoma sales tax return on time can result in significant penalties. These may include fines based on the amount of tax owed and interest on late payments. Businesses should be aware of these potential consequences to maintain compliance and avoid unnecessary financial burdens.

Quick guide on how to complete oklahoma sales tax form fill online printable fillable

Prepare Oklahoma Sales Tax Form Fill Online, Printable, Fillable easily on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides all the necessary tools to create, edit, and eSign your documents quickly without delays. Manage Oklahoma Sales Tax Form Fill Online, Printable, Fillable on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

The simplest way to modify and eSign Oklahoma Sales Tax Form Fill Online, Printable, Fillable effortlessly

- Find Oklahoma Sales Tax Form Fill Online, Printable, Fillable and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, exhausting form searches, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Oklahoma Sales Tax Form Fill Online, Printable, Fillable and ensure superior communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct oklahoma sales tax form fill online printable fillable

Create this form in 5 minutes!

How to create an eSignature for the oklahoma sales tax form fill online printable fillable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Oklahoma sales tax, and how does it apply to businesses?

Oklahoma sales tax is a tax imposed on the sale of goods and services within the state. Businesses in Oklahoma are required to collect this tax from customers and remit it to the state. Understanding how Oklahoma sales tax applies to your transactions can help ensure compliance and avoid penalties.

-

How can airSlate SignNow help with managing Oklahoma sales tax documents?

airSlate SignNow can streamline the process of managing documents related to Oklahoma sales tax, such as invoices and tax returns. With our eSignature capabilities, you can easily send and sign documents, ensuring that all tax-related paperwork is completed efficiently. This helps businesses stay organized and compliant with Oklahoma sales tax regulations.

-

What features does airSlate SignNow offer to assist with Oklahoma sales tax compliance?

airSlate SignNow offers features like customizable templates and secure document storage that can help with Oklahoma sales tax compliance. These features enable businesses to create, send, and track tax documents smoothly. Additionally, integrations with accounting software can facilitate accurate tax reporting.

-

What should I consider when pricing for Oklahoma sales tax applications?

When pricing for applications related to Oklahoma sales tax, consider factors such as the volume of transactions, the complexity of your tax situations, and the features offered by different software solutions. airSlate SignNow provides a cost-effective option without compromising on essential features needed for Oklahoma sales tax management.

-

Can airSlate SignNow integrate with other tools for managing Oklahoma sales tax?

Yes, airSlate SignNow offers integrations with various tools that can assist in managing Oklahoma sales tax, including accounting and tax software. This connectivity ensures that sales tax calculations and records are automatically updated, simplifying your tax compliance process.

-

Are there any benefits of using airSlate SignNow for Oklahoma sales tax management?

Using airSlate SignNow for Oklahoma sales tax management provides several benefits, including increased efficiency and reduced paperwork. Our user-friendly platform allows for quick document handling and ensures that all tax documents are securely stored and easy to access, which is crucial for compliance.

-

How secure is the processing of documents related to Oklahoma sales tax with airSlate SignNow?

AirSlate SignNow takes security seriously, employing advanced encryption and compliance measures to protect your Oklahoma sales tax documents. We are committed to safeguarding sensitive financial information, ensuring that your documents are secure throughout the signing process.

Get more for Oklahoma Sales Tax Form Fill Online, Printable, Fillable

Find out other Oklahoma Sales Tax Form Fill Online, Printable, Fillable

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now