MI UIA 4101 Form 2022-2026

What is the MI UIA 4101 Form

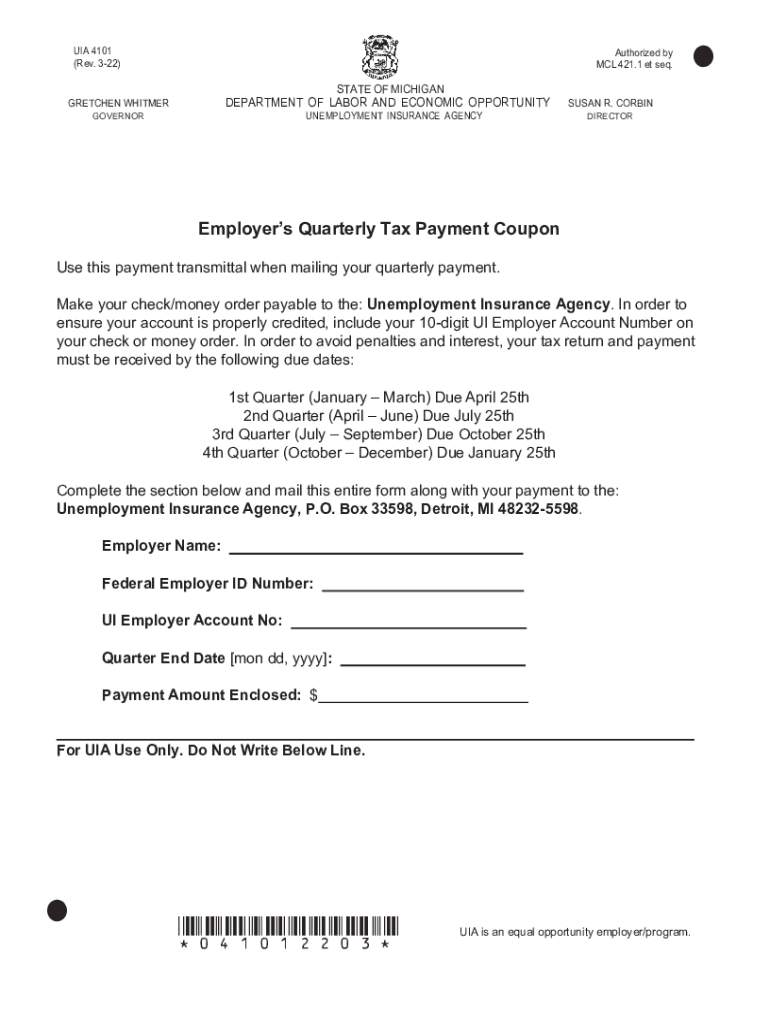

The MI UIA 4101 form, also known as the Michigan Quarterly Payment Form, is a crucial document for individuals and businesses in Michigan who need to report and pay their unemployment insurance taxes. This form is specifically designed for employers who are required to make quarterly payments to the Michigan Unemployment Insurance Agency (UIA). It ensures compliance with state regulations and helps maintain accurate records of payments made towards unemployment insurance.

How to use the MI UIA 4101 Form

To effectively use the MI UIA 4101 form, employers must first ensure they have the correct form version for the applicable quarter. The form should be filled out with accurate information regarding the employer's identification details, the total wages paid, and the corresponding unemployment insurance tax due. Once completed, the form must be submitted along with the payment to the appropriate state agency, ensuring that all deadlines are met to avoid penalties.

Steps to complete the MI UIA 4101 Form

Completing the MI UIA 4101 form involves several key steps:

- Gather necessary information, including your Employer Identification Number (EIN) and total wages paid during the quarter.

- Fill out the form accurately, ensuring all sections are completed, including the calculation of the tax due.

- Review the form for any errors or omissions before submission.

- Submit the form along with the payment by the specified deadline to avoid any late fees.

Legal use of the MI UIA 4101 Form

The legal use of the MI UIA 4101 form is governed by state laws that mandate employers to report and pay unemployment insurance taxes. Proper completion and timely submission of this form are essential for compliance with the Michigan Unemployment Insurance Agency regulations. Failure to adhere to these requirements can result in penalties, including fines and interest on late payments.

Filing Deadlines / Important Dates

Employers must be aware of the filing deadlines associated with the MI UIA 4101 form to ensure compliance. The form is typically due on the last day of the month following the end of each quarter. For example, the deadlines for submission are usually April 30 for the first quarter, July 31 for the second quarter, October 31 for the third quarter, and January 31 for the fourth quarter. Missing these deadlines can lead to penalties and interest charges.

Who Issues the Form

The MI UIA 4101 form is issued by the Michigan Unemployment Insurance Agency. This state agency is responsible for overseeing unemployment insurance programs and ensuring that employers comply with state tax regulations. Employers can obtain the form directly from the agency's website or through authorized state offices.

Quick guide on how to complete mi uia 4101 form

Complete MI UIA 4101 Form effortlessly on any gadget

Online document administration has become widely accepted by businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed files, as you can obtain the necessary form and securely keep it online. airSlate SignNow provides you with all the resources required to create, alter, and eSign your documents quickly without interruptions. Handle MI UIA 4101 Form on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to alter and eSign MI UIA 4101 Form effortlessly

- Obtain MI UIA 4101 Form and then click Get Form to begin.

- Utilize the features we offer to finish your document.

- Emphasize important sections of the documents or redact sensitive details with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form navigation, or errors necessitating new document copies. airSlate SignNow fulfills your needs in document administration in just a few clicks from any device of your selection. Alter and eSign MI UIA 4101 Form and guarantee excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct mi uia 4101 form

Create this form in 5 minutes!

How to create an eSignature for the mi uia 4101 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is uia 4101 and how does it relate to airSlate SignNow?

The uia 4101 is a document form that can be electronically signed using airSlate SignNow. This feature allows users to easily manage and complete uia 4101 forms securely and efficiently. By using airSlate SignNow, you can streamline your document workflows while ensuring compliance with electronic signature laws.

-

How can I use airSlate SignNow to complete a uia 4101 form?

To complete a uia 4101 form using airSlate SignNow, simply upload the document to the platform, specify the fields that need to be filled out, and send it for eSignature. The user-friendly interface makes it easy for anyone to navigate the process. Additionally, you can track the status of your uia 4101 form in real time.

-

What are the pricing plans for airSlate SignNow for uia 4101 electronic signatures?

AirSlate SignNow offers competitive pricing plans that cater to different business needs, starting from a basic plan suitable for occasional users to advanced plans ideal for larger organizations. Each plan includes electronic signature functionality, which can be used for the uia 4101 form and other documents. Detailed pricing information can be found on the airSlate SignNow website.

-

What features does airSlate SignNow provide for uia 4101 document handling?

AirSlate SignNow provides various features for handling uia 4101 documents, including customizable templates, secure cloud storage, and real-time tracking. Users can also integrate with other applications to further automate their workflows. These features enhance the overall efficiency and security of managing uia 4101 documents.

-

Are there any benefits to using airSlate SignNow for uia 4101 forms?

Using airSlate SignNow for uia 4101 forms offers signNow benefits, including reduced processing time and increased accuracy. It eliminates the need for physical signatures and paper, leading to a more environmentally friendly process. Additionally, it enhances document security and helps businesses maintain compliance with regulatory requirements.

-

Which integrations does airSlate SignNow support for processing uia 4101 forms?

AirSlate SignNow supports various integrations with popular applications, including CRMs, project management tools, and cloud storage services. This connectivity allows for seamless workflow automation when processing uia 4101 forms. Major platforms such as Salesforce, Google Drive, and Microsoft Office are compatible, enhancing productivity.

-

Is airSlate SignNow compliant with regulations for uia 4101 electronic signatures?

Yes, airSlate SignNow is compliant with electronic signature regulations, including the ESIGN Act and UETA, ensuring that your uia 4101 forms are legally binding. This compliance provides peace of mind when sending and signing documents electronically. By using airSlate SignNow, you can trust that your signatures are valid and secure.

Get more for MI UIA 4101 Form

Find out other MI UIA 4101 Form

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form