CA ACR 521 Form 2022-2026

What is the CA ACR 521 Form

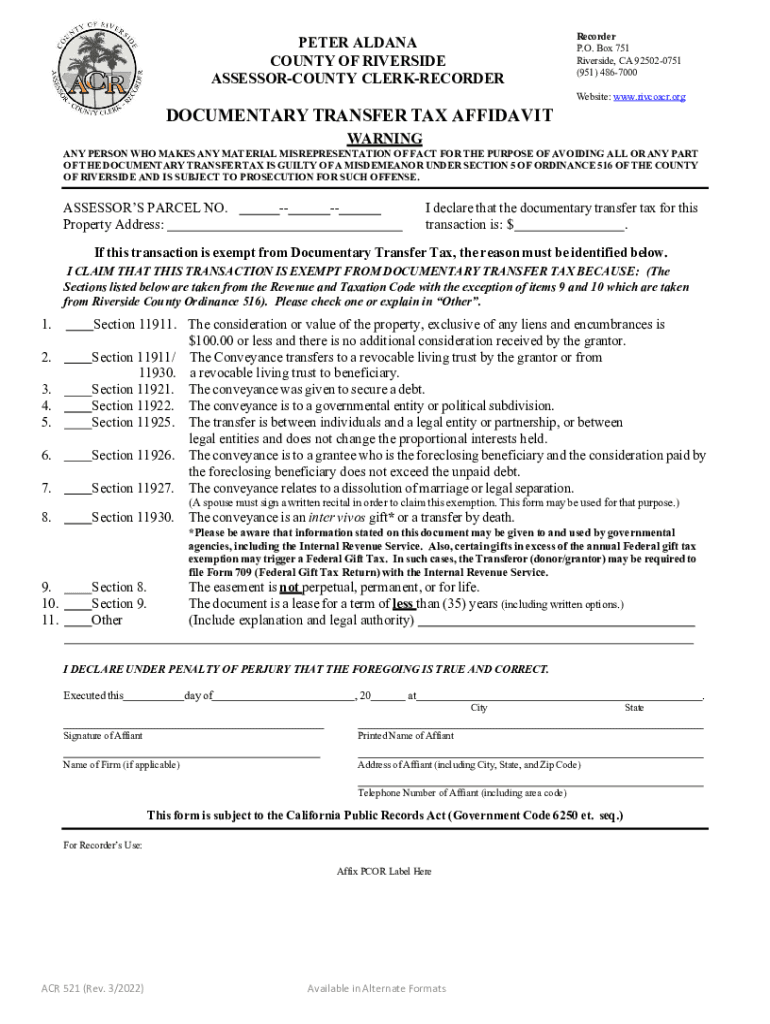

The CA ACR 521 Form, also known as the transfer affidavit form, is a crucial document used in California for reporting the transfer of real property. This form is often required when property ownership changes hands, ensuring that the transaction is documented for tax and legal purposes. The form helps local tax authorities assess any applicable transfer taxes and ensures compliance with state regulations.

How to use the CA ACR 521 Form

To effectively use the CA ACR 521 Form, individuals must first gather all relevant information regarding the property transfer, including the names of the buyer and seller, the property's legal description, and the sale price. Once this information is collected, the form can be filled out accurately. It is essential to ensure that all fields are completed, as incomplete forms may lead to delays or issues with the transfer process.

Steps to complete the CA ACR 521 Form

Completing the CA ACR 521 Form involves several key steps:

- Gather necessary information about the property and parties involved.

- Fill out the form with accurate details, including names, addresses, and legal descriptions.

- Review the completed form for any errors or omissions.

- Sign and date the form as required.

- Submit the form to the appropriate county recorder's office.

Legal use of the CA ACR 521 Form

The CA ACR 521 Form serves a legal purpose by providing a documented record of property transfers. This documentation is vital for tax assessment and compliance with California state laws. When properly filled out and submitted, the form ensures that both the buyer and seller fulfill their legal obligations regarding the transfer of property.

Required Documents

When submitting the CA ACR 521 Form, it is important to have the following documents ready:

- The completed CA ACR 521 Form.

- A copy of the grant deed or other transfer documents.

- Identification for both the buyer and seller, if necessary.

- Any additional documentation required by the county recorder's office.

Who Issues the Form

The CA ACR 521 Form is issued by the California State Government, specifically through the county recorder's office where the property is located. Each county may have specific requirements or additional forms that need to be submitted alongside the ACR 521, so it is advisable to check with the local office for any particular instructions.

Quick guide on how to complete ca acr 521 form

Complete CA ACR 521 Form effortlessly on any device

Online document management has become increasingly popular among companies and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents quickly and without interruptions. Handle CA ACR 521 Form on any device with the airSlate SignNow apps for Android or iOS, and enhance any document-centric process today.

How to adjust and eSign CA ACR 521 Form with ease

- Find CA ACR 521 Form and click Get Form to begin.

- Make use of the tools we offer to fill out your document.

- Emphasize relevant sections of your documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes only seconds and holds the same legal authority as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose your preferred method to send your form, via email, SMS, or invite link, or download it to your computer.

No more worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign CA ACR 521 Form and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ca acr 521 form

Create this form in 5 minutes!

How to create an eSignature for the ca acr 521 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Santa Clara County grant deed?

A Santa Clara County grant deed is a legal document used to transfer property ownership. It provides a guarantee that the property is being transferred free of any claims or liens, making it an essential document for real estate transactions in Santa Clara County. Understanding how a grant deed works will help you navigate property transfers more effectively.

-

How can airSlate SignNow assist with Santa Clara County grant deeds?

airSlate SignNow streamlines the process of creating, sending, and signing grant deeds. With our user-friendly platform, you can easily manage your Santa Clara County grant deed documents, ensuring all parties can review and sign them quickly and securely. This efficiency saves time and reduces the risk of errors.

-

What are the pricing options for using airSlate SignNow for Santa Clara County grant deeds?

airSlate SignNow offers flexible pricing plans tailored to individual needs, making it affordable for anyone dealing with Santa Clara County grant deeds. You can choose from various subscription options that provide access to comprehensive eSigning features, allowing you to select a plan that suits your budget and requirements.

-

Are there any integrations available with airSlate SignNow when handling Santa Clara County grant deeds?

Yes, airSlate SignNow offers several integrations that enhance your ability to manage Santa Clara County grant deeds. You can integrate with popular platforms such as Google Drive, Microsoft Office, and Dropbox, enabling seamless document storage and sharing. These integrations help automate and simplify your workflow.

-

What are the benefits of using airSlate SignNow for my Santa Clara County grant deed?

Using airSlate SignNow for your Santa Clara County grant deed provides many advantages, including improved efficiency, security, and compliance. Our platform ensures that your documents are securely stored and legally binding. Additionally, electronic signatures help expedite the transaction process, making it smoother for all parties involved.

-

Is airSlate SignNow legally compliant for Santa Clara County grant deeds?

Absolutely! airSlate SignNow complies with eSignature laws, including the ESIGN Act and UETA, ensuring that your Santa Clara County grant deeds are legally binding. Our platform employs top-notch security measures to safeguard your documents at every stage, giving you peace of mind during your real estate transactions.

-

Can I customize my Santa Clara County grant deed documents using airSlate SignNow?

Yes, airSlate SignNow allows you to customize your Santa Clara County grant deed documents to meet your specific needs. You can add fields for signatures, dates, and other necessary information, ensuring that your documents are tailored to your transaction. This flexibility helps you create professional and accurate grant deeds every time.

Get more for CA ACR 521 Form

- South african domestic worker payslip template form

- Bpi supplementary card form

- Forced choice menu form

- Intec college matric rewrite 2022 form

- Traineeship certificate international tum de form

- Social security name change in south carolina form

- Compassionate release petition form

- Computer repair service contract template form

Find out other CA ACR 521 Form

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter