Prior Authorization Request Form Member OptumRx 2015-2026

Understanding the Optum Rx Appeal Form

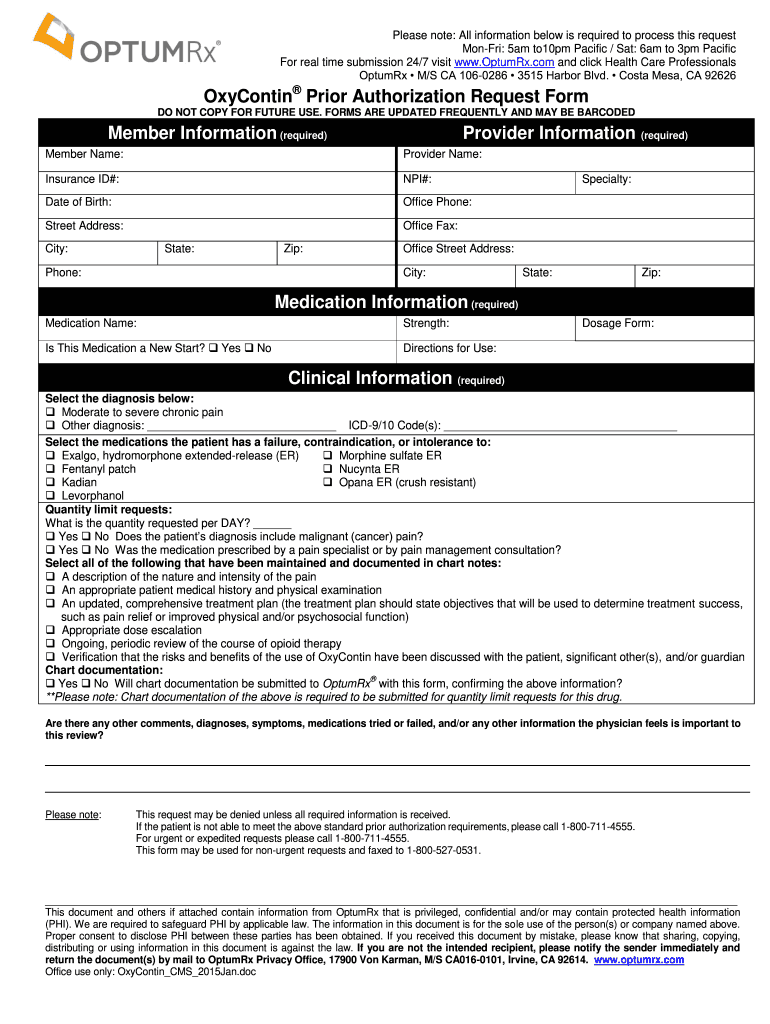

The Optum Rx appeal form is a crucial document for members seeking to contest a decision regarding their medication coverage. This form allows individuals to formally request a review of a prior authorization denial or a formulary exception. Understanding the purpose and use of this form is essential for ensuring that your medication needs are met in a timely manner. The appeal process can help secure necessary medications that may not be covered under standard plans.

Steps to Complete the Optum Rx Appeal Form

Filling out the Optum Rx appeal form involves several key steps to ensure accuracy and compliance. Begin by gathering all relevant information, including your member ID, details about the medication in question, and any supporting documentation from your healthcare provider. Follow these steps:

- Access the Optum Rx appeal form online or request a physical copy.

- Complete all required fields, ensuring that your information is accurate and up to date.

- Attach any necessary documents, such as medical records or letters from your doctor.

- Review the form for completeness before submission.

Legal Use of the Optum Rx Appeal Form

Using the Optum Rx appeal form legally requires adherence to specific regulations and guidelines. The form must be filled out accurately to comply with healthcare laws, including HIPAA, which protects patient information. Submitting the form electronically is permissible, provided that the eSignature used complies with the ESIGN and UETA acts. This ensures that your appeal is legally binding and recognized by Optum Rx.

Key Elements of the Optum Rx Appeal Form

The Optum Rx appeal form contains several key elements that are essential for processing your appeal effectively. These include:

- Member Information: Personal details such as name, address, and member ID.

- Medication Details: The name of the medication, dosage, and the reason for the appeal.

- Healthcare Provider Information: Contact details of your prescribing physician, including their signature if required.

- Supporting Documentation: Any additional documents that support your case, such as medical history or previous treatment plans.

Form Submission Methods

The Optum Rx appeal form can be submitted through various methods, allowing flexibility based on your preferences. You can choose to:

- Submit the form online through the Optum Rx member portal.

- Mail the completed form to the designated address provided on the form.

- Deliver the form in person to a local Optum Rx office, if available.

Examples of Using the Optum Rx Appeal Form

There are several scenarios in which the Optum Rx appeal form may be utilized. Common examples include:

- Requesting coverage for a medication that has been denied due to prior authorization requirements.

- Appealing a formulary exclusion for a necessary drug that is not listed in your plan's covered medications.

- Seeking a tier exception for a higher-cost medication that your healthcare provider deems essential for your treatment.

Quick guide on how to complete prior authorization request form member optumrx

The optimal method to obtain and authenticate Prior Authorization Request Form Member OptumRx

Across your entire organization, ineffective workflows regarding document authorization can take up a signNow amount of working hours. Signing documents like Prior Authorization Request Form Member OptumRx is an inherent aspect of operations in any enterprise, which is why the effectiveness of each agreement’s lifecycle has a considerable impact on the organization’s overall productivity. With airSlate SignNow, signing your Prior Authorization Request Form Member OptumRx is as straightforward and swift as possible. This platform provides you with the latest version of virtually any form available. Even better, you can sign it instantly without needing to install external software on your computer or printing out physical copies.

How to obtain and authenticate your Prior Authorization Request Form Member OptumRx

- Browse our collection by category or use the search bar to locate the document you require.

- Check the form preview by selecting Learn more to confirm it is the correct one.

- Press Get form to begin editing immediately.

- Fill out your form and input any required information using the toolbar.

- Once finished, select the Sign tool to authenticate your Prior Authorization Request Form Member OptumRx.

- Pick the signature method that suits you best: Draw, Create initials, or upload an image of your handwritten signature.

- Press Done to finish editing and move on to document-sharing options if necessary.

With airSlate SignNow, you possess everything necessary to manage your paperwork effectively. You can locate, fill out, modify, and even dispatch your Prior Authorization Request Form Member OptumRx within a single tab effortlessly. Enhance your workflows with a singular, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

Why would a doctor send a prescription to a pharmacy, but not respond to repeated requests from the pharmacy to fill out a faxed prior authorization form?

Filling out a prior authorization is not a requirement of our practice. Most of us do this to help our patients, and it is sometimes taken for granted.Think about it. It is your insurance company that is requesting us to fill out this form, taking time away from actually treating patients, to help you save money on your medications. We understand that, and usually do our best to take care of them, but unless we have a large practice, with someone actually paid to spend all their time doing these PA’s, we have to carve out more time from our day to fill out paperwork.It’s also possible, although not likely, that the pharmacy does not have the correct fax number, the faxes have been misplaced, the doctor has some emergencies and is running behind, went on vacation, and so on.Paperwork and insurance requests have become more and more burdensome on our practices, not due to anything on the part of our patients, but a major hassle none the less.

-

How do I respond to a request for a restraining order? Do I need to fill out a form?

As asked of me specifically;The others are right, you will likely need a lawyer. But to answer your question, there is a response form to respond to a restraining order or order of protection. Worst case the form is available at the courthouse where your hearing is set to be heard in, typically at the appropriate clerk's window, which may vary, so ask any of the clerk's when you get there.You only have so many days to respond, and it will specify in the paperwork.You will also have to appear in court on the date your hearing is scheduled.Most courts have a department that will help you respond to forms at no cost. I figure you are asking because you can't afford an attorney which is completely understandable.The problem is that if you aren't represented and the other person is successful in getting a temporary restraining order made permanent in the hearing you will not be allowed at any of the places the petitioner goes, without risking arrest.I hope this helps.Not given as legal advice-

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

-

Startup I am no longer working with is requesting that I fill out a 2014 w9 form. Is this standard, could someone please provide any insight as to why a startup may be doing this and how would I go about handling it?

It appears that the company may be trying to reclassify you as an independent contractor rather than an employee.Based on the information provided, it appears that such reclassification (a) would be a violation of applicable law by the employer and (b) potentially could be disadvantageous for you (e.g., depriving you of unemployment compensation if you are fired without cause).The most prudent approach would be to retain a lawyer who represents employees in employment matters.In any event, it appears that you would be justified in refusing to complete and sign the W-9, telling the company that there is no business or legal reason for you to do so.Edit: After the foregoing answer was written, the OP added Q details concerning restricted stock repurchase being the reason for the W-9 request. As a result, the foregoing answer appears to be irrelevant. However, I will leave it, for now, in case Q details are changed yet again in a way that reestablishes the answer's relevance.

Create this form in 5 minutes!

How to create an eSignature for the prior authorization request form member optumrx

How to create an eSignature for your Oxycontin Prior Authorization Request Form Member Optumrx online

How to make an eSignature for the Oxycontin Prior Authorization Request Form Member Optumrx in Google Chrome

How to make an electronic signature for signing the Oxycontin Prior Authorization Request Form Member Optumrx in Gmail

How to make an electronic signature for the Oxycontin Prior Authorization Request Form Member Optumrx from your smartphone

How to generate an electronic signature for the Oxycontin Prior Authorization Request Form Member Optumrx on iOS

How to create an eSignature for the Oxycontin Prior Authorization Request Form Member Optumrx on Android OS

People also ask

-

What is the Prior Authorization Request Form Member OptumRx?

The Prior Authorization Request Form Member OptumRx is a crucial document required by members to obtain approval for certain medications. This form ensures that your prescribed treatment is medically necessary and covered by your insurance plan. Using airSlate SignNow, you can easily complete and eSign this form, streamlining the prior authorization process.

-

How does airSlate SignNow help with the Prior Authorization Request Form Member OptumRx?

airSlate SignNow simplifies the process of filling out the Prior Authorization Request Form Member OptumRx by providing an intuitive platform for eSigning and document management. You can quickly complete the form, send it for signatures, and store it securely, all in one place. This efficiency reduces the time spent on paperwork, ensuring that your request is submitted promptly.

-

Is there a cost associated with using airSlate SignNow for the Prior Authorization Request Form Member OptumRx?

Yes, airSlate SignNow offers various pricing plans to meet different business needs, including plans suited for healthcare providers managing the Prior Authorization Request Form Member OptumRx. The cost-effective solutions allow you to choose a plan that fits your budget while still providing powerful eSigning and document management features.

-

Can I integrate airSlate SignNow with other systems for the Prior Authorization Request Form Member OptumRx?

Absolutely! airSlate SignNow integrates seamlessly with various healthcare management systems and electronic health records (EHRs). This integration allows for streamlined data transfer and efficient management of the Prior Authorization Request Form Member OptumRx, enhancing your overall workflow and efficiency.

-

What benefits does airSlate SignNow provide for the Prior Authorization Request Form Member OptumRx?

Using airSlate SignNow for the Prior Authorization Request Form Member OptumRx offers several benefits, including faster turnaround times, reduced paperwork, and enhanced accuracy. The platform's easy-to-use interface ensures that both patients and providers can navigate the form submission process smoothly, minimizing delays in medication access.

-

Is airSlate SignNow secure for handling the Prior Authorization Request Form Member OptumRx?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling sensitive documents like the Prior Authorization Request Form Member OptumRx. The platform employs advanced encryption and security measures to protect your data, ensuring that patient information remains confidential and secure.

-

How can I track the status of my Prior Authorization Request Form Member OptumRx using airSlate SignNow?

With airSlate SignNow, you can easily track the status of your Prior Authorization Request Form Member OptumRx in real-time. The platform provides notifications and updates when the form is viewed, signed, or completed, allowing you to stay informed throughout the authorization process.

Get more for Prior Authorization Request Form Member OptumRx

- Tennessee holder 497326792 form

- Tennessee 14 day form

- Tennessee damage form

- Terminate lease reason form

- 10 day notice to terminate week to week lease for residential from landlord to tenant tennessee form

- Tennessee month to month form

- 10 day notice to terminate week to week lease for residential property from tenant to landlord tennessee form

- Tennessee 30 form

Find out other Prior Authorization Request Form Member OptumRx

- How To eSign Louisiana Joint Venture Agreement Template

- eSign Hawaii Web Hosting Agreement Now

- eSign New Jersey Joint Venture Agreement Template Online

- eSign Missouri Web Hosting Agreement Now

- eSign New Jersey Web Hosting Agreement Now

- eSign Texas Deposit Receipt Template Online

- Help Me With eSign Nebraska Budget Proposal Template

- eSign New Mexico Budget Proposal Template Now

- eSign New York Budget Proposal Template Easy

- eSign Indiana Debt Settlement Agreement Template Later

- eSign New York Financial Funding Proposal Template Now

- eSign Maine Debt Settlement Agreement Template Computer

- eSign Mississippi Debt Settlement Agreement Template Free

- eSign Missouri Debt Settlement Agreement Template Online

- How Do I eSign Montana Debt Settlement Agreement Template

- Help Me With eSign New Mexico Debt Settlement Agreement Template

- eSign North Dakota Debt Settlement Agreement Template Easy

- eSign Utah Share Transfer Agreement Template Fast

- How To eSign California Stock Transfer Form Template

- How Can I eSign Colorado Stock Transfer Form Template