Form R 10606 Supplemental Worksheet for Credit for Taxes 2023

What is the Form R 10606 Supplemental Worksheet For Credit For Taxes

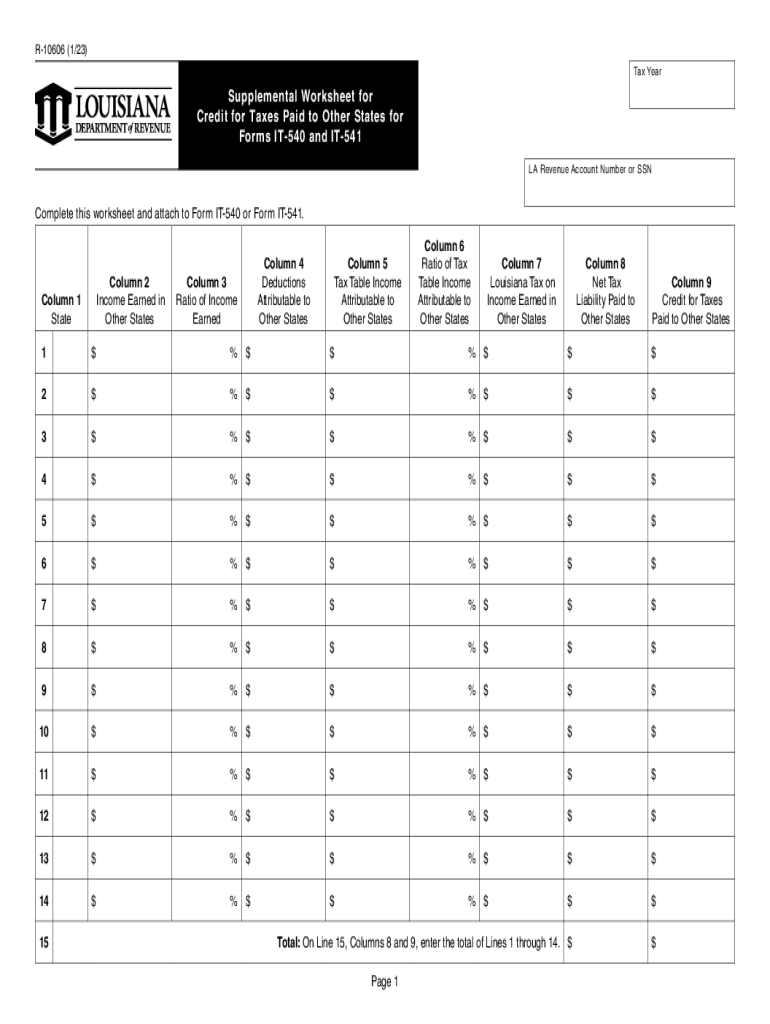

The Form R 10606 Supplemental Worksheet is designed to assist taxpayers in claiming credits for taxes paid to other jurisdictions. This form is particularly relevant for individuals and businesses that have paid taxes to states outside of Louisiana and wish to receive a credit on their Louisiana tax return. The purpose of the form is to ensure that taxpayers do not pay double taxes on the same income and to facilitate the proper calculation of tax credits.

How to use the Form R 10606 Supplemental Worksheet For Credit For Taxes

To effectively use the Form R 10606, taxpayers should first gather all relevant documentation regarding taxes paid to other states. This includes tax returns from those jurisdictions and any supporting documents that confirm the amount of tax paid. Once all information is collected, the taxpayer can fill out the form by entering details such as the amount of tax paid, the state to which it was paid, and any other required information. It is essential to ensure accuracy to avoid delays in processing.

Steps to complete the Form R 10606 Supplemental Worksheet For Credit For Taxes

Completing the Form R 10606 involves several key steps:

- Gather all necessary documents related to taxes paid to other states.

- Fill out personal information, including name, address, and Social Security number.

- Provide details of the tax credits being claimed, including the state and the amount paid.

- Review the form for accuracy and completeness.

- Submit the form along with your Louisiana tax return.

Legal use of the Form R 10606 Supplemental Worksheet For Credit For Taxes

The Form R 10606 is legally recognized as a valid method for claiming tax credits in Louisiana. To ensure compliance, taxpayers must adhere to the guidelines set forth by the Louisiana Department of Revenue. This includes providing accurate information and submitting the form within the designated time frame. Failure to comply with these regulations may result in denied claims or penalties.

Filing Deadlines / Important Dates

Taxpayers should be aware of specific filing deadlines associated with the Form R 10606. Typically, the form must be submitted by the same deadline as the Louisiana state tax return. For individual taxpayers, this is usually April 15. However, extensions may apply, and it is advisable to check the Louisiana Department of Revenue website for the most current information regarding deadlines and any changes that may occur annually.

Eligibility Criteria

To be eligible to use the Form R 10606, taxpayers must have paid taxes to another state on income that is also subject to Louisiana taxation. This form is applicable to both individuals and businesses. It is important to ensure that the taxes paid meet the criteria outlined by the Louisiana Department of Revenue to qualify for the credit. Taxpayers should review their specific situation to determine eligibility before completing the form.

Quick guide on how to complete form r 10606 supplemental worksheet for credit for taxes

Complete Form R 10606 Supplemental Worksheet For Credit For Taxes with ease on any device

Digital document management has become increasingly favored among businesses and individuals. It offers an ideal environmentally friendly option compared to traditional printed and signed documents, as you can locate the correct form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage Form R 10606 Supplemental Worksheet For Credit For Taxes on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and eSign Form R 10606 Supplemental Worksheet For Credit For Taxes effortlessly

- Locate Form R 10606 Supplemental Worksheet For Credit For Taxes and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

No more worries about lost or misfiled documents, tedious form searching, or errors that require printing fresh copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your preference. Edit and eSign Form R 10606 Supplemental Worksheet For Credit For Taxes and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form r 10606 supplemental worksheet for credit for taxes

Create this form in 5 minutes!

How to create an eSignature for the form r 10606 supplemental worksheet for credit for taxes

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the la r10606 feature in airSlate SignNow?

The la r10606 feature in airSlate SignNow allows users to manage document workflows efficiently. It streamlines the process of sending, signing, and storing documents, making it a vital tool for businesses looking to save time and enhance productivity.

-

How much does the airSlate SignNow service cost for la r10606 users?

Pricing for airSlate SignNow varies depending on the plan selected, but it offers a cost-effective solution for users interested in the la r10606 functionalities. You can choose from monthly and annual plans that fit your business needs, ensuring you get the best value for eSigning and document management.

-

What are the key benefits of using la r10606 in airSlate SignNow?

Using la r10606 in airSlate SignNow brings numerous benefits such as improved document turnaround time and enhanced security features. It enables businesses to confidently collect electronic signatures, ensuring compliance and reducing the risk of errors associated with traditional signatures.

-

Can la r10606 integrate with other applications?

Yes, la r10606 in airSlate SignNow seamlessly integrates with various applications such as CRM systems, project management tools, and cloud storage solutions. This integration enhances overall workflow efficiency, allowing you to manage documents and data across platforms effortlessly.

-

Is there a mobile version of airSlate SignNow for la r10606 functionalities?

Absolutely! airSlate SignNow offers a mobile application that supports all la r10606 features. This allows users to send and sign documents on-the-go, making it perfect for busy professionals who need flexibility and convenience.

-

How secure is the la r10606 feature in airSlate SignNow?

The la r10606 feature in airSlate SignNow is designed with top-notch security measures, including encryption and compliance with eSignature regulations. This ensures that all documents and signatures are handled securely, giving businesses peace of mind regarding sensitive information.

-

What types of documents can utilize la r10606 for eSigning?

Many document types can utilize la r10606 for eSigning in airSlate SignNow, including contracts, agreements, and forms. This versatility makes it an ideal choice for various industries looking to streamline their document processes.

Get more for Form R 10606 Supplemental Worksheet For Credit For Taxes

Find out other Form R 10606 Supplemental Worksheet For Credit For Taxes

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile