MEASURE O SENIOR CITIZEN EXCEMPTION CLAIM 2023

What is the MEASURE O SENIOR CITIZEN EXCEMPTION CLAIM

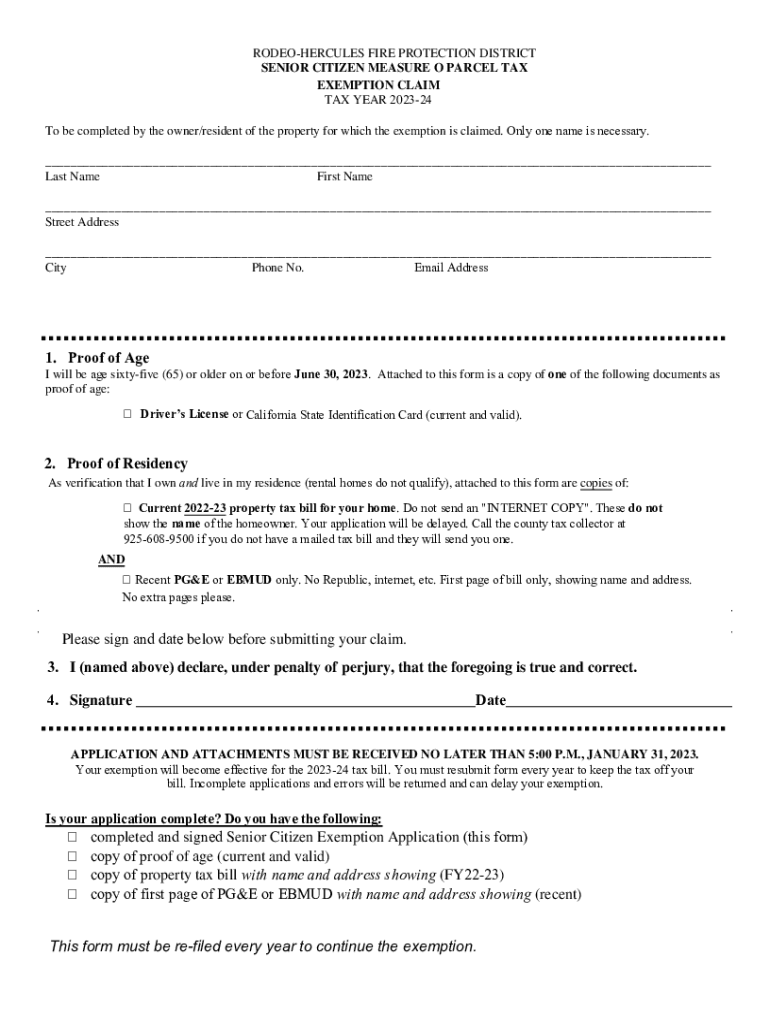

The Measure O Senior Citizen Exemption Claim is a form designed to provide property tax relief to eligible senior citizens in specific jurisdictions. This exemption allows qualifying seniors to reduce their property tax burden, making homeownership more affordable. The form typically requires the applicant to provide personal information, including age, income, and property details, to establish eligibility for the exemption.

Eligibility Criteria

To qualify for the Measure O Senior Citizen Exemption Claim, applicants generally must meet certain criteria, which may include:

- Age: Applicants must typically be at least sixty-five years old.

- Residency: The property must be the applicant's primary residence.

- Income Limits: There may be income restrictions that determine eligibility for the exemption.

It is essential to verify specific requirements with local authorities, as they may vary by location.

Steps to Complete the MEASURE O SENIOR CITIZEN EXCEMPTION CLAIM

Completing the Measure O Senior Citizen Exemption Claim involves several straightforward steps:

- Gather necessary documents, including proof of age and income.

- Obtain the claim form from the appropriate local government office or website.

- Fill out the form carefully, ensuring all information is accurate.

- Submit the completed form along with any required documentation by the specified deadline.

Following these steps can help ensure a smooth application process.

How to Obtain the MEASURE O SENIOR CITIZEN EXCEMPTION CLAIM

The Measure O Senior Citizen Exemption Claim can typically be obtained through local government offices, such as the county assessor's office. Many jurisdictions also provide the form online, allowing for easy access and download. It is advisable to check the official website of the local tax authority for the most current version of the form and any specific instructions related to its completion.

Form Submission Methods

Submitting the Measure O Senior Citizen Exemption Claim can usually be done through various methods:

- Online: Many jurisdictions offer an online submission option through their official websites.

- Mail: Applicants can print the completed form and send it via postal mail to the appropriate office.

- In-Person: Submissions can often be made in person at local government offices during business hours.

Choosing the right submission method can depend on personal preference and local regulations.

Legal Use of the MEASURE O SENIOR CITIZEN EXCEMPTION CLAIM

The Measure O Senior Citizen Exemption Claim is legally binding once properly completed and submitted. It is crucial to ensure that all information provided is accurate and truthful, as any discrepancies may lead to penalties or denial of the exemption. Understanding the legal implications of the claim can help applicants navigate the process more effectively and ensure compliance with local tax laws.

Quick guide on how to complete measure o senior citizen excemption claim

Effortlessly Prepare MEASURE O SENIOR CITIZEN EXCEMPTION CLAIM on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent environmentally friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the resources you require to create, modify, and electronically sign your documents swiftly without any delays. Manage MEASURE O SENIOR CITIZEN EXCEMPTION CLAIM on any device with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to Modify and eSign MEASURE O SENIOR CITIZEN EXCEMPTION CLAIM with Ease

- Obtain MEASURE O SENIOR CITIZEN EXCEMPTION CLAIM and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or conceal sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes only seconds and holds the same legal significance as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Decide how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device of your choice. Modify and eSign MEASURE O SENIOR CITIZEN EXCEMPTION CLAIM and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct measure o senior citizen excemption claim

Create this form in 5 minutes!

How to create an eSignature for the measure o senior citizen excemption claim

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the MEASURE O SENIOR CITIZEN EXEMPTION CLAIM?

The MEASURE O SENIOR CITIZEN EXEMPTION CLAIM is a financial relief program designed to help senior citizens reduce their property taxes. By applying for this exemption, seniors can potentially save signNow amounts in annual property taxes, making it easier to manage their financial obligations.

-

How can airSlate SignNow assist with the MEASURE O SENIOR CITIZEN EXEMPTION CLAIM process?

airSlate SignNow simplifies the MEASURE O SENIOR CITIZEN EXEMPTION CLAIM application process by allowing you to electronically sign and share your documents effortlessly. You can prepare, send, and receive signed documents quickly, ensuring your claim is submitted on time.

-

What are the costs associated with using airSlate SignNow for filing the MEASURE O SENIOR CITIZEN EXEMPTION CLAIM?

Using airSlate SignNow is cost-effective with flexible pricing plans that fit various budgets. Depending on the plan you choose, you can manage all your document signing needs, including those related to the MEASURE O SENIOR CITIZEN EXEMPTION CLAIM, without breaking the bank.

-

Are there any specific features of airSlate SignNow that aid in the MEASURE O SENIOR CITIZEN EXEMPTION CLAIM?

Yes, airSlate SignNow offers features like templates, document tracking, and real-time notifications which are particularly helpful for the MEASURE O SENIOR CITIZEN EXEMPTION CLAIM. These features streamline the process, allowing you to stay organized and on top of your submissions.

-

Is airSlate SignNow secure for processing the MEASURE O SENIOR CITIZEN EXEMPTION CLAIM?

Absolutely, airSlate SignNow prioritizes security with encryption and compliance measures in place to protect sensitive information related to the MEASURE O SENIOR CITIZEN EXEMPTION CLAIM. You can trust that your documents are safe from unauthorized access.

-

How does airSlate SignNow integrate with other platforms for the MEASURE O SENIOR CITIZEN EXEMPTION CLAIM?

airSlate SignNow integrates seamlessly with various platforms, enhancing your efficiency when filing the MEASURE O SENIOR CITIZEN EXEMPTION CLAIM. Whether connecting with CRM tools, cloud storage, or other software, these integrations save you time and effort.

-

Can I get assistance with filling out the MEASURE O SENIOR CITIZEN EXEMPTION CLAIM through airSlate SignNow?

While airSlate SignNow provides tools for document management, it does not offer direct assistance for filling out forms. However, you can utilize our templates to understand the requirements better and ensure that your MEASURE O SENIOR CITIZEN EXEMPTION CLAIM is accurate.

Get more for MEASURE O SENIOR CITIZEN EXCEMPTION CLAIM

- Mentoring log template form

- Cobb county sports physical form

- Obligation request sample form

- Anti money laundering declaration form

- Pmc good standing certificate form

- Neuron reimbursement form 62734095

- Dv 520 info s judicial council forms

- Superior court of california county of riverside 731169337 form

Find out other MEASURE O SENIOR CITIZEN EXCEMPTION CLAIM

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will