IRS Form 5695 Low Energy Systems

What is the IRS Form 5695 Low Energy Systems

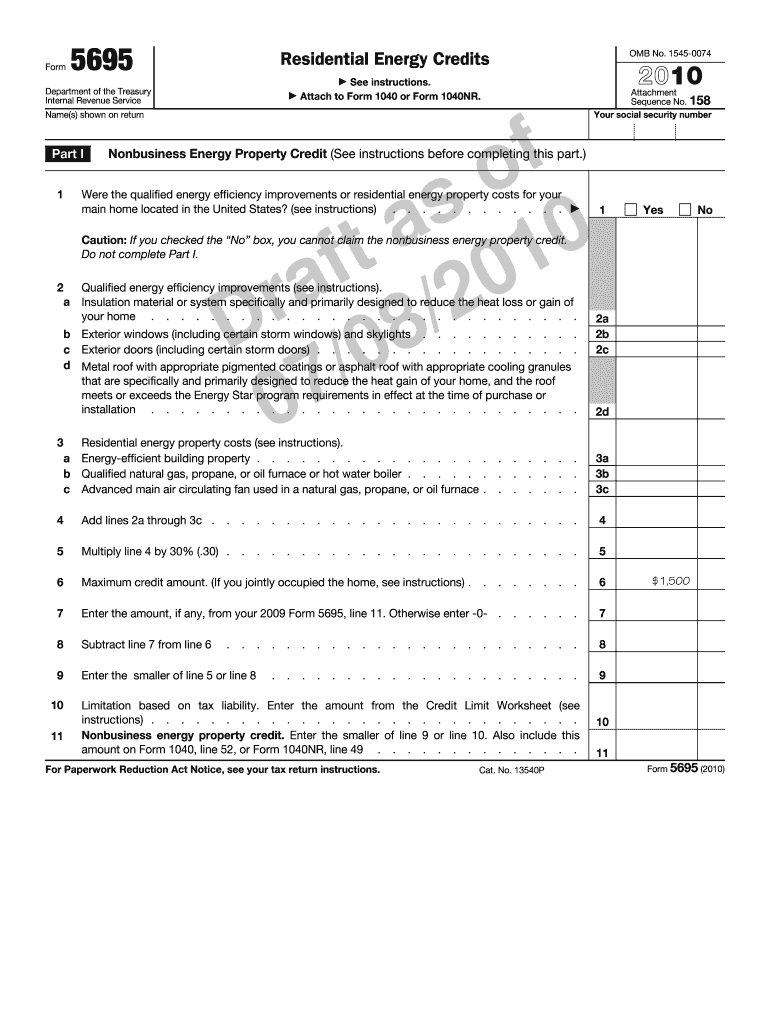

The IRS Form 5695, also known as the Residential Energy Credits form, is utilized by taxpayers in the United States to claim tax credits for certain energy-efficient improvements made to their homes. This form specifically addresses low energy systems, which include solar energy systems, geothermal heat pumps, and other renewable energy technologies. By completing this form, taxpayers can potentially reduce their tax liability while contributing to energy conservation efforts.

How to use the IRS Form 5695 Low Energy Systems

To effectively use the IRS Form 5695, taxpayers should first gather all necessary documentation related to their energy-efficient improvements. This includes receipts, invoices, and any manufacturer certifications that verify the efficiency of the installed systems. Once the documentation is in hand, taxpayers can fill out the form, detailing the specific improvements made and calculating the eligible tax credits. It is crucial to ensure that all information is accurate to avoid delays or issues with the IRS.

Steps to complete the IRS Form 5695 Low Energy Systems

Completing the IRS Form 5695 involves several key steps:

- Gather all relevant documentation, including receipts and certifications for energy-efficient improvements.

- Fill out Part I of the form to claim the Residential Energy Efficient Property Credit, listing the qualifying systems.

- Complete Part II for the Nonbusiness Energy Property Credit, if applicable, detailing any additional improvements.

- Calculate the total credits and ensure all calculations are accurate.

- Attach the completed form to your federal tax return when filing.

Eligibility Criteria for the IRS Form 5695 Low Energy Systems

To be eligible for the credits claimed on IRS Form 5695, taxpayers must meet specific criteria. The improvements must be made to a primary residence located in the United States. Additionally, the systems installed must meet the efficiency standards set by the IRS. Taxpayers should verify that their installations qualify under the current tax year guidelines and ensure they have the necessary documentation to support their claims.

Filing Deadlines / Important Dates

Taxpayers must adhere to specific filing deadlines when submitting the IRS Form 5695. Typically, the deadline aligns with the federal tax return due date, which is usually April 15 of each year. However, if taxpayers file for an extension, they may have additional time to submit their forms. It is essential to keep track of any changes in deadlines, especially if the IRS updates policies or regulations regarding energy credits.

Required Documents for IRS Form 5695 Low Energy Systems

When completing the IRS Form 5695, taxpayers need to provide several key documents to substantiate their claims. Required documents include:

- Receipts or invoices for the purchase and installation of energy-efficient systems.

- Manufacturer certifications that confirm the energy efficiency of the installed systems.

- Any additional documentation that supports the eligibility of the improvements, such as energy audits or performance reports.

Form Submission Methods for IRS Form 5695 Low Energy Systems

Taxpayers have several options for submitting the IRS Form 5695. The form can be filed electronically as part of an e-filed tax return, which is often the fastest method. Alternatively, taxpayers may choose to print the completed form and submit it by mail along with their paper tax return. In-person submission is generally not an option for this form, as it is primarily processed through electronic or mail channels.

Quick guide on how to complete irs form 5695 low energy systems

Prepare [SKS] effortlessly on any device

Online document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed paperwork, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the features required to create, modify, and electronically sign your documents quickly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign [SKS] with ease

- Find [SKS] and click on Get Form to commence.

- Utilize the tools available to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Alter and eSign [SKS] and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to IRS Form 5695 Low Energy Systems

Create this form in 5 minutes!

How to create an eSignature for the irs form 5695 low energy systems

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IRS Form 5695 for Low Energy Systems?

IRS Form 5695 is a tax form used to claim residential energy credits for low energy systems. This form allows homeowners to receive tax benefits for installing energy-efficient systems, helping to reduce overall costs. Understanding how to fill out this form correctly can maximize your savings.

-

How can airSlate SignNow help with IRS Form 5695 for Low Energy Systems?

airSlate SignNow simplifies the process of signing and submitting IRS Form 5695 for Low Energy Systems. Our platform allows you to easily eSign documents and manage your submissions securely. This ensures that your tax credits are claimed efficiently and without hassle.

-

What features does airSlate SignNow offer for managing IRS Form 5695?

airSlate SignNow offers features such as document templates, secure eSigning, and real-time tracking for IRS Form 5695 submissions. These tools streamline the process, making it easier for users to manage their energy credit claims. Additionally, our user-friendly interface enhances the overall experience.

-

Is there a cost associated with using airSlate SignNow for IRS Form 5695?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs when managing IRS Form 5695. Our plans are designed to be cost-effective, ensuring that you get the best value for your investment. You can choose a plan that fits your budget and requirements.

-

What are the benefits of using airSlate SignNow for IRS Form 5695?

Using airSlate SignNow for IRS Form 5695 provides numerous benefits, including increased efficiency and reduced paperwork. Our platform allows for quick eSigning and document management, saving you time and effort. Additionally, you can ensure compliance with IRS regulations easily.

-

Can I integrate airSlate SignNow with other software for IRS Form 5695?

Yes, airSlate SignNow offers integrations with various software solutions to enhance your experience with IRS Form 5695. This allows you to connect with accounting software, CRM systems, and more, streamlining your workflow. Integrations help you manage your documents and data seamlessly.

-

How secure is airSlate SignNow when handling IRS Form 5695?

airSlate SignNow prioritizes security, ensuring that your IRS Form 5695 and other documents are protected. We use advanced encryption and secure storage solutions to safeguard your information. You can trust that your sensitive data is handled with the utmost care.

Get more for IRS Form 5695 Low Energy Systems

- Civ 010fl 935 application for appointment of guardian ad litem civil and family law judicial council forms

- Name address and telephone number sfsuperiorcourt form

- De 350 petition for appointment ofguardian ad litemprobate judicial council forms

- Fw 015 info information sheet on waiver of appellate court fees supreme court court of appeal appellate division judicial

- Withholding faqs maryland department of human services form

- For your protection and privacy press the clear t form

- Form packetsgun violence restraining order

- Cr 251 order for transfer judicial council forms

Find out other IRS Form 5695 Low Energy Systems

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation